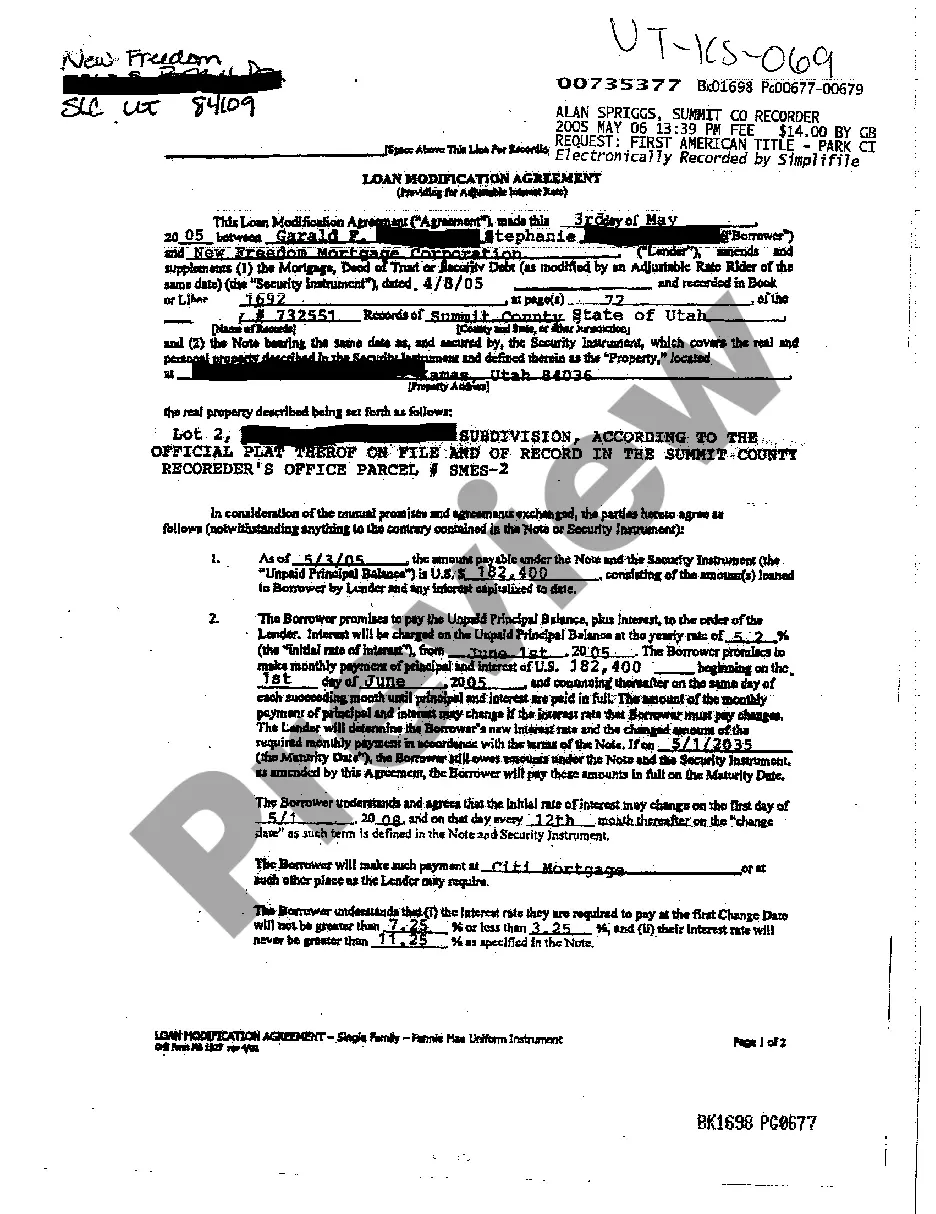

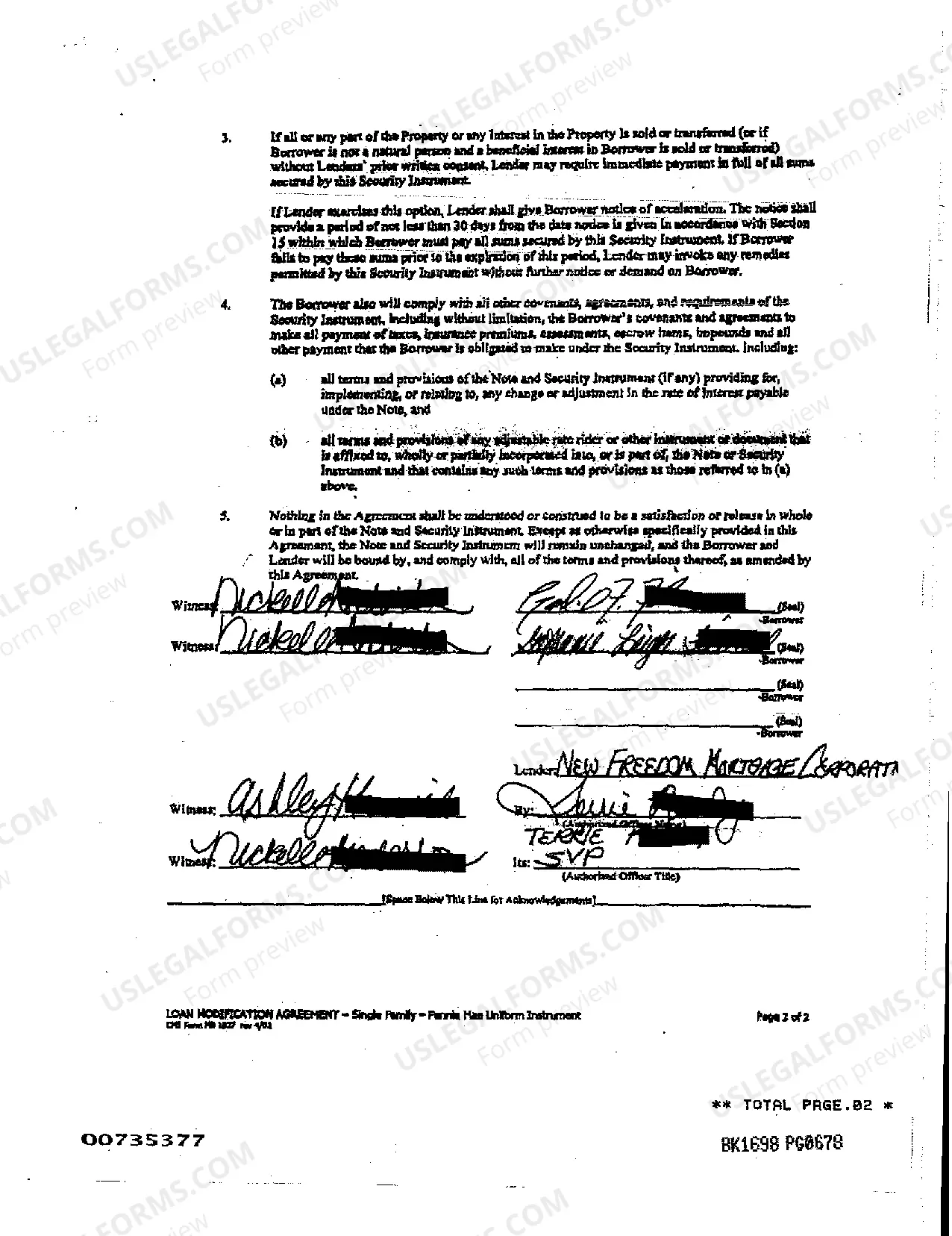

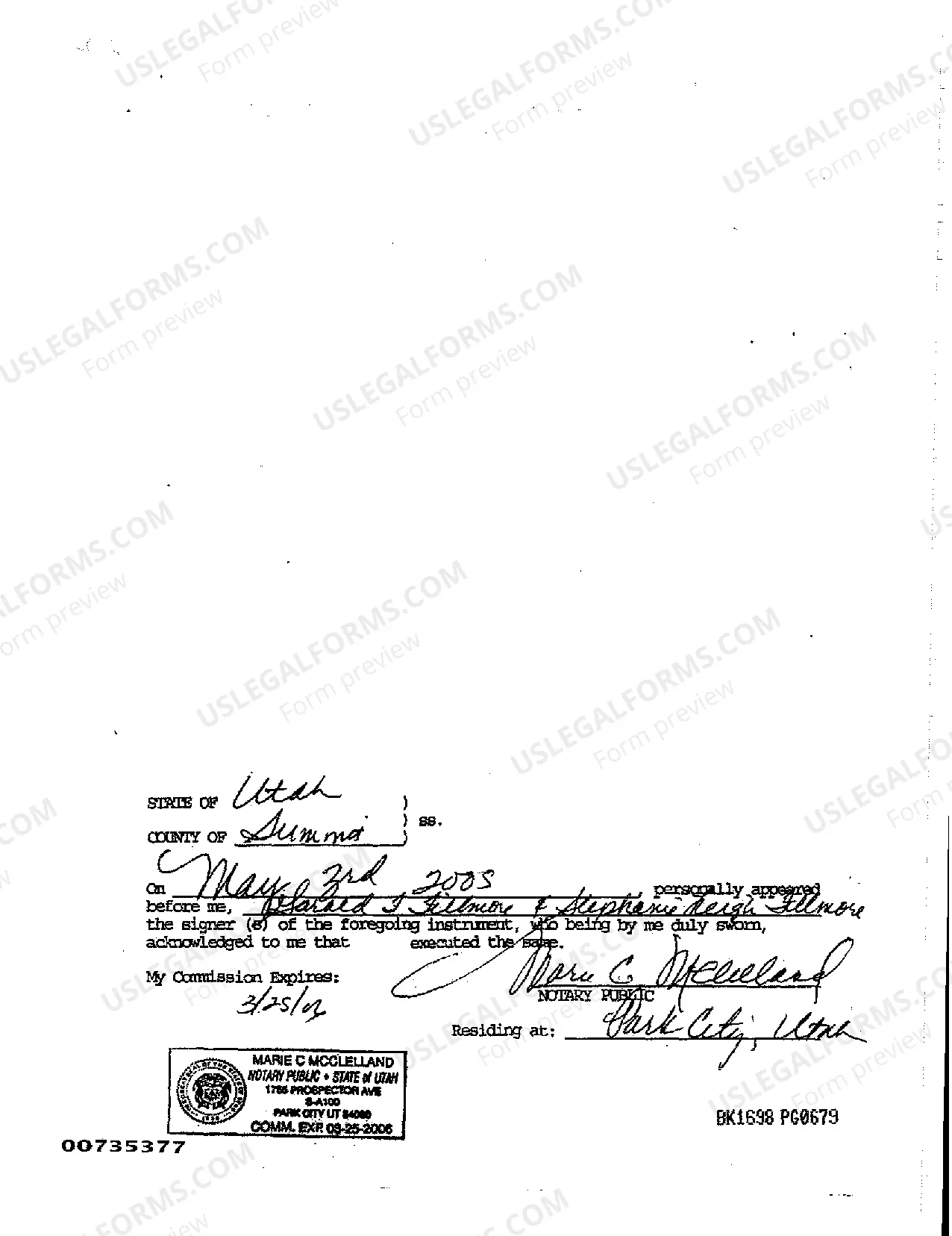

Salt Lake Utah Loan Modification Agreement

Description

How to fill out Utah Loan Modification Agreement?

We consistently aim to reduce or avert legal complications when handling intricate law-related or financial issues. To achieve this, we engage attorney services that are typically quite costly.

Nevertheless, not all legal concerns are equally intricate. Many can be resolved independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions. Our platform empowers you to manage your affairs without relying on legal services.

We provide access to legal document templates that are not always accessible to the public. Our templates are specific to states and regions, greatly simplifying the search process.

Ensure to verify that the Salt Lake Utah Loan Modification Agreement complies with the laws and regulations of your state and locality. Additionally, it’s vital to review the form’s description (if available), and if you find any inconsistencies with your original requirements, look for an alternative form. Once you’ve confirmed that the Salt Lake Utah Loan Modification Agreement is suitable for you, you may choose a subscription plan and proceed with payment. Then, you can download the document in any preferred file format. For over 24 years, we have assisted millions by providing ready-to-customize and current legal documents. Utilize US Legal Forms now to conserve time and resources!

- Take advantage of US Legal Forms whenever you need to locate and download the Salt Lake Utah Loan Modification Agreement or any other document with ease and safety.

- Just Log In to your account and click the Get button adjacent to it.

- If you happen to misplace the document, you can always download it again in the My documents section.

- The procedure is equally simple if you’re new to the platform! You can create your account in a matter of minutes.

Form popularity

FAQ

There are many reasons a lender might deny an application for a loan modification or claim you don't qualify for one, including but not limited to: An incomplete or untimely loan modification application. Insufficient finances to afford a modified payment.

Who is eligible for a loan modification? To qualify for a loan modification, a borrower usually must have missed at least three mortgage payments and be in default. ?Sometimes, a borrower who has experienced financial setbacks, which makes a default imminent, can qualify for a loan modification.

Once approved for a modification, your lender will usually require you to go through a Trial Payment Plan (TPP) before they complete the modification. A TPP requires you to make a mortgage payment for a fixed number of months prior to fully modifying the loan.

Who qualifies for a loan modification? Not everyone struggling to make a mortgage payment can qualify for a loan modification. In general, homeowners must either be delinquent or facing imminent default, meaning they're not delinquent yet, but there's a high probability they will be.

To qualify for a loan modification under federal laws, the borrower's surplus income must total at least $300 and must constitute at least 15 percent of his or her monthly income.

No matter how focused your attention to detail, your credit score almost certainly will take a hit with a home loan modification. Often, a homeowner won't get approved for a loan modification unless there is evidence of one or several missed payments.

What Is A Loan Modification? A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.

You could receive your mortgage loan modification in as little as 30 days. Or you could be left waiting upwards of 90 days for everything to go through. It really comes down to the individual lender and their ability to quickly process mortgage modifications.

You never completed the required loan modification package. You don't make enough money to support a loan modification. You don't have clear title to your property. You don't have a valid financial hardship reason.

There are many reasons a lender might deny an application for a loan modification or claim you don't qualify for one, including but not limited to: An incomplete or untimely loan modification application. Insufficient finances to afford a modified payment.