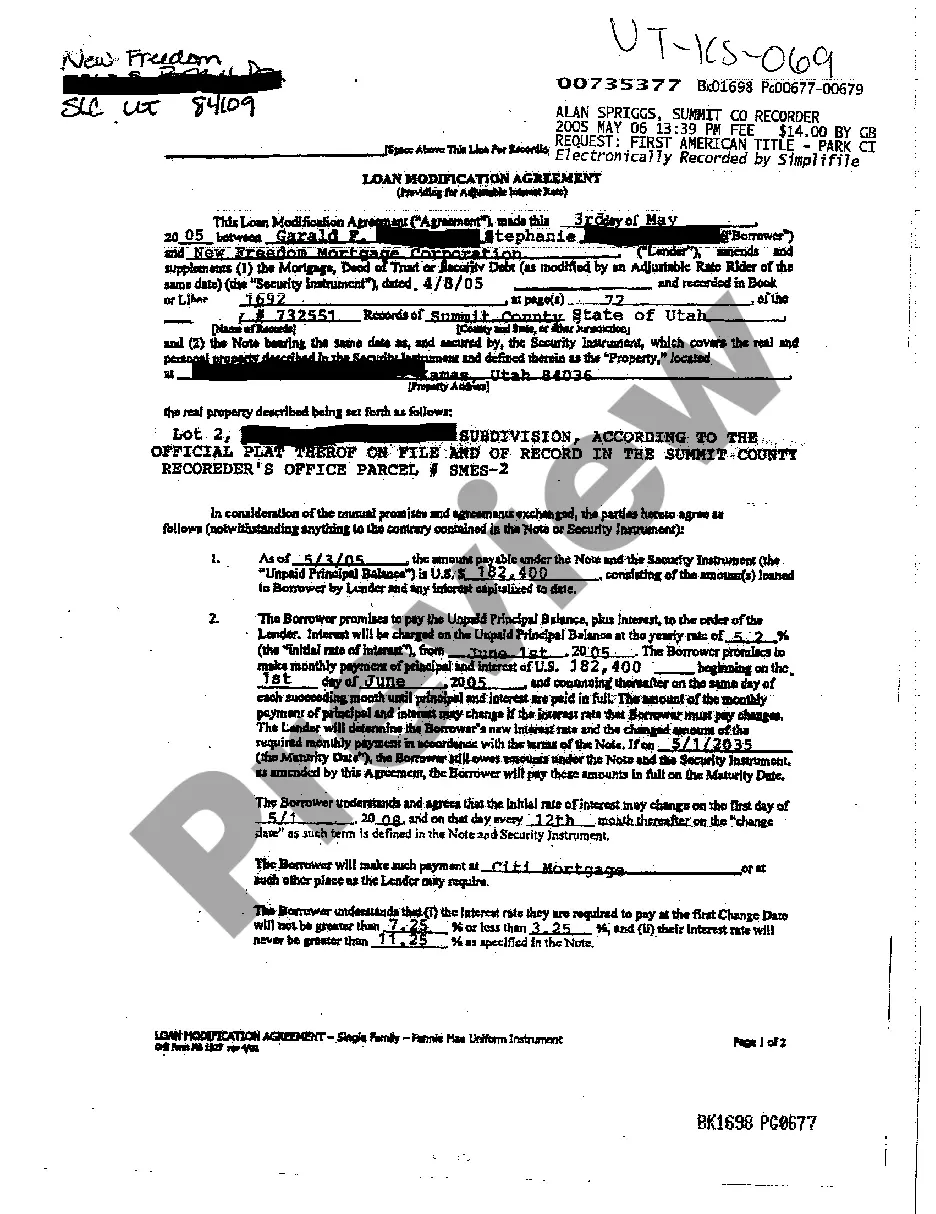

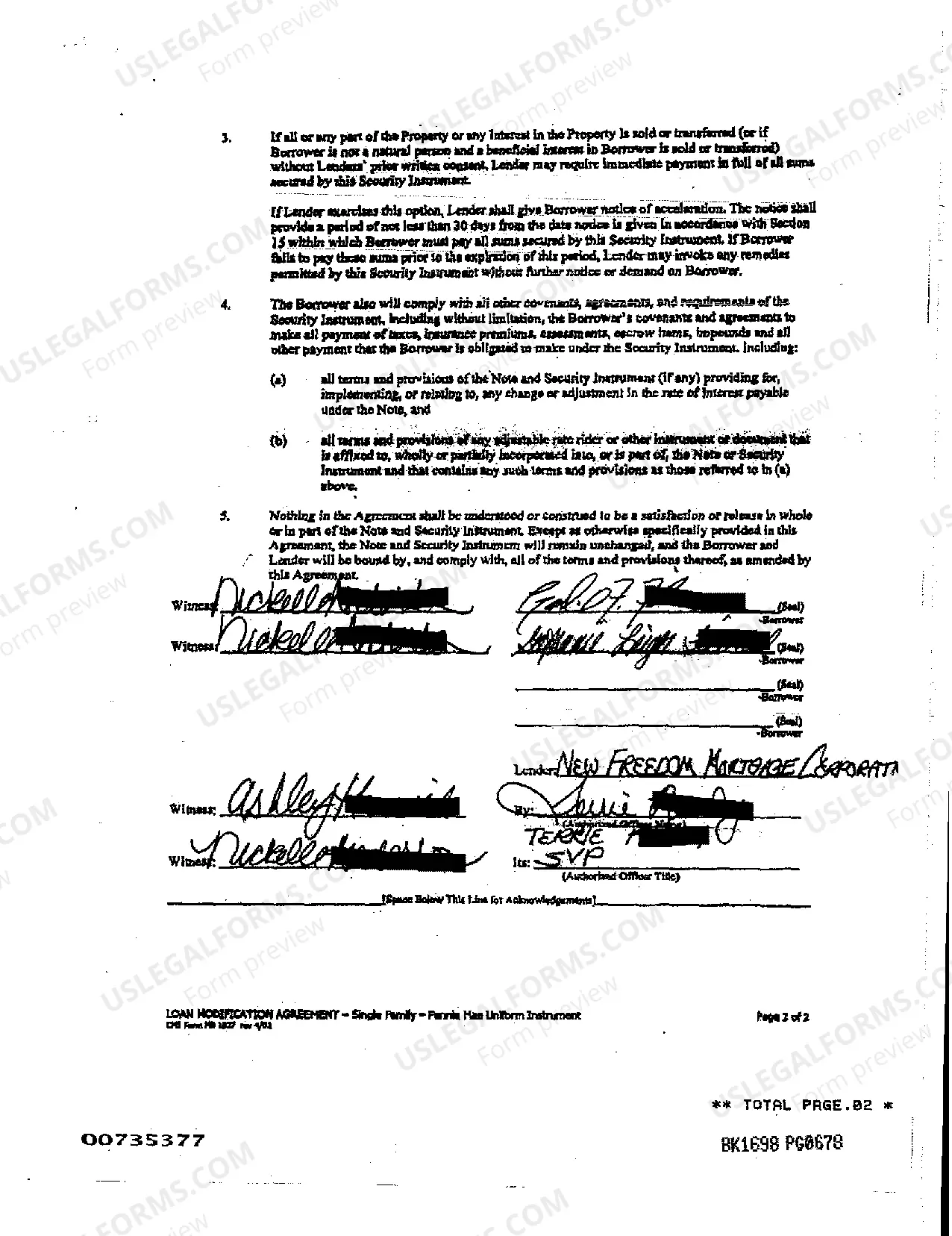

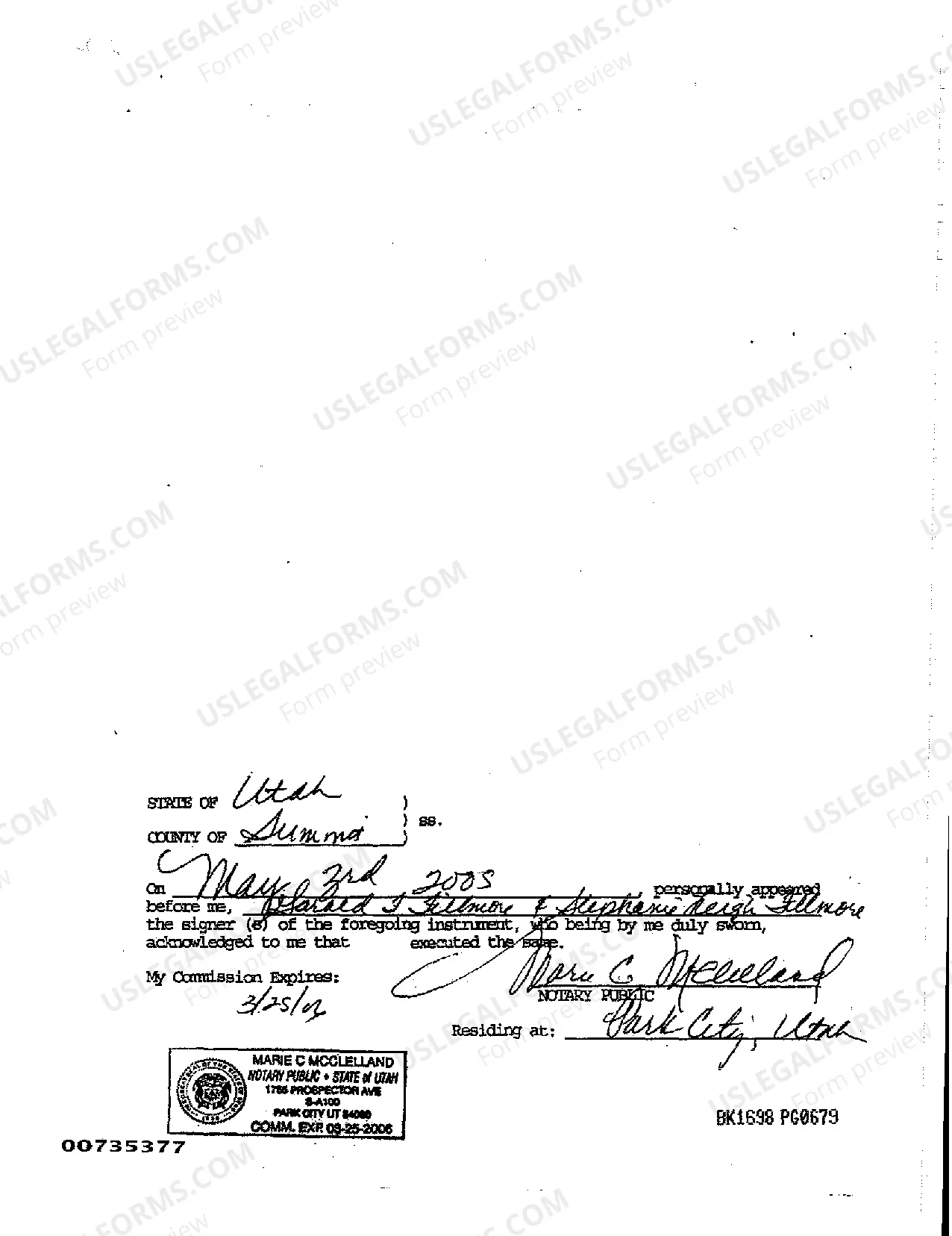

Salt Lake City Utah Loan Modification Agreement is a legally binding document that outlines the terms and conditions of modifying a loan in the Salt Lake City area. This agreement is designed to help borrowers in financial distress by providing them with an alternative repayment plan that better suits their current financial situation. The key purpose of a Salt Lake City Utah Loan Modification Agreement is to prevent foreclosure and allow homeowners to keep their properties while making affordable monthly payments. This agreement is typically entered into between the borrower and the lender or mortgage service, and it can be a lifeline for individuals struggling to meet their loan obligations. Some keywords related to Salt Lake City Utah Loan Modification Agreement include: 1. Loan modification: This refers to the process of changing the original terms of a loan to make it more manageable for the borrower. 2. Foreclosure prevention: This describes the aim of the agreement to help borrowers avoid losing their homes through foreclosure proceedings. 3. Affordable repayment plan: This highlights the focus on creating a new payment structure that is affordable for the borrower based on their current financial circumstances. 4. Financial distress: This term signifies the borrower's inability to meet their loan obligations due to financial hardship. 5. Mortgage service: This is the entity responsible for collecting loan payments on behalf of the lender. 6. Borrower: This is the individual or party who has taken out the loan and is seeking a modification agreement to ease their financial burden. 7. Lender: This refers to the financial institution or entity that initially provided the loan. 8. Terms and conditions: This refers to the specific details and provisions outlined in the agreement, including interest rate changes, loan term extensions, or principal reductions. 9. Debt renegotiation: This indicates the renegotiation of the debt terms to make them more favorable for the borrower. Additionally, there may be specific types of Salt Lake City Utah Loan Modification Agreements like: 1. Interest rate reduction modification: This modification focuses on reducing the interest rate charged on the loan, which can lead to lower monthly payments for the borrower. 2. Loan term extension modification: This modification extends the loan repayment period, resulting in smaller monthly payments but potentially increasing the overall cost of the loan. 3. Principal reduction modification: This type of modification involves reducing the outstanding balance of the loan, effectively reducing the loan amount and often resulting in a more affordable monthly payment. 4. Combination modification: In some cases, multiple modifications may be made to the loan terms simultaneously, such as a combination of interest rate reduction, loan term extension, and principal reduction. It is important for borrowers to carefully review and understand the terms of the Salt Lake City Utah Loan Modification Agreement before signing. Seeking professional advice from a lawyer or housing counselor is recommended to ensure the agreement is in their best interest and aligns with their long-term financial goals.

Salt Lake City Utah Loan Modification Agreement

Description

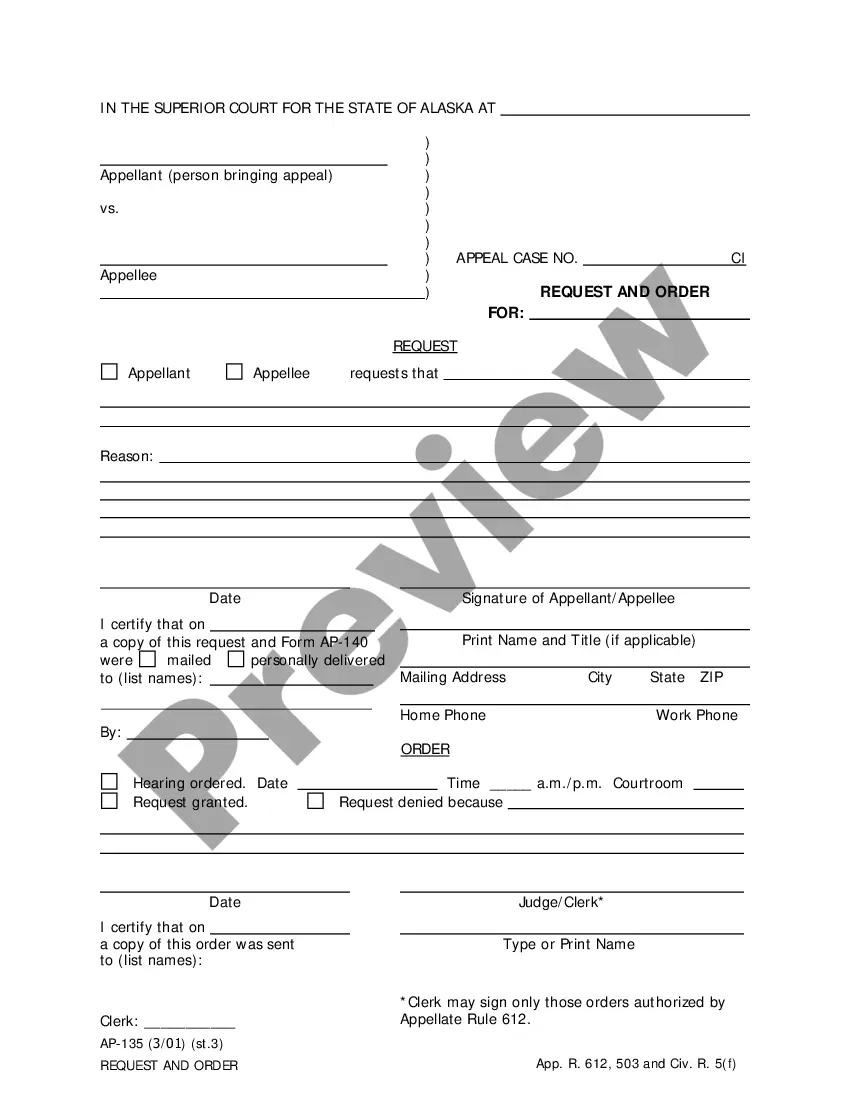

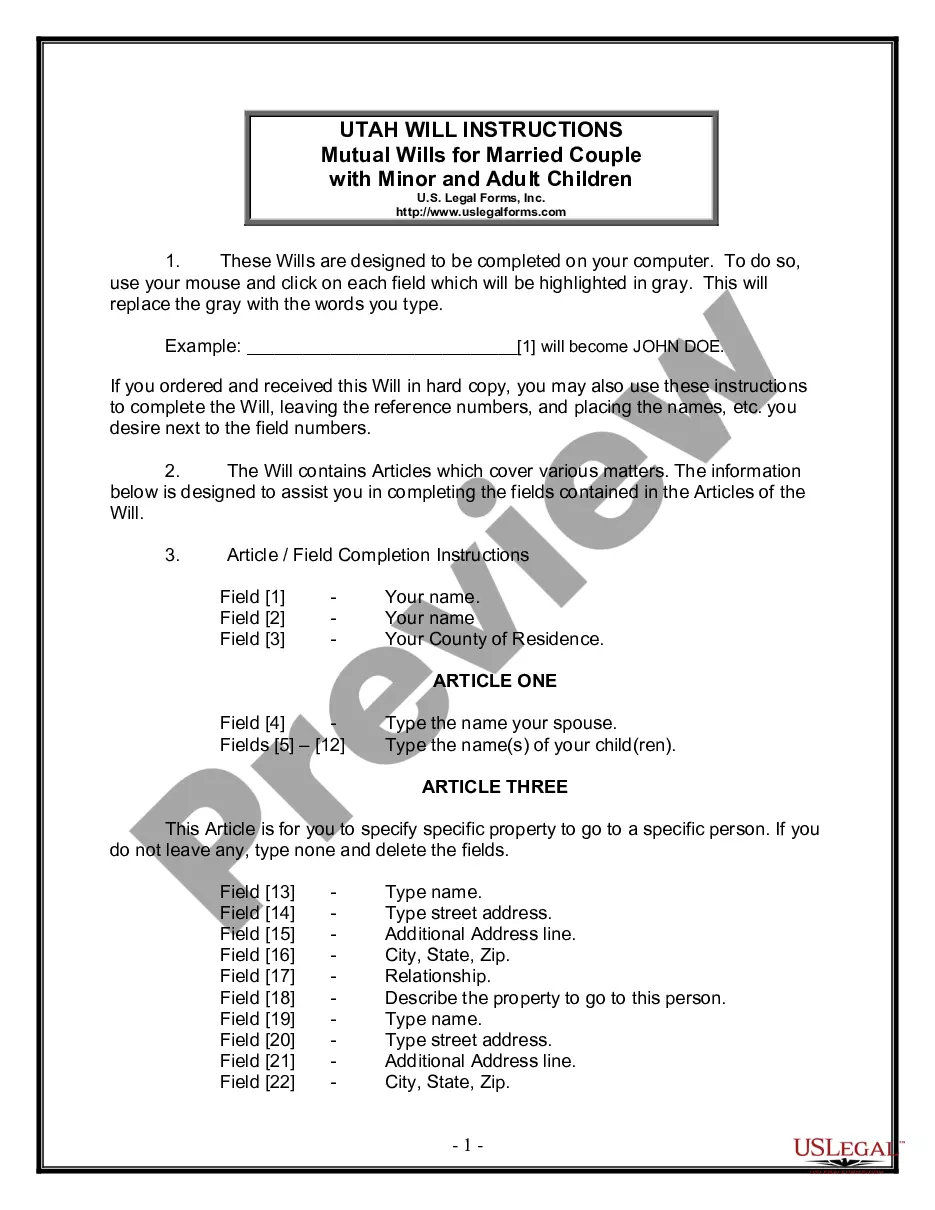

How to fill out Salt Lake City Utah Loan Modification Agreement?

Regardless of social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person with no legal background to draft this sort of paperwork cfrom the ground up, mostly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms can save the day. Our platform offers a huge library with over 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you want the Salt Lake City Utah Loan Modification Agreement or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Salt Lake City Utah Loan Modification Agreement in minutes using our trustworthy platform. If you are presently an existing customer, you can proceed to log in to your account to download the needed form.

However, if you are unfamiliar with our platform, make sure to follow these steps before downloading the Salt Lake City Utah Loan Modification Agreement:

- Ensure the form you have chosen is suitable for your area since the rules of one state or area do not work for another state or area.

- Review the document and read a brief description (if provided) of scenarios the paper can be used for.

- If the one you chosen doesn’t meet your needs, you can start over and search for the needed form.

- Click Buy now and pick the subscription plan that suits you the best.

- utilizing your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Salt Lake City Utah Loan Modification Agreement once the payment is completed.

You’re good to go! Now you can proceed to print the document or fill it out online. If you have any issues locating your purchased forms, you can easily find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.