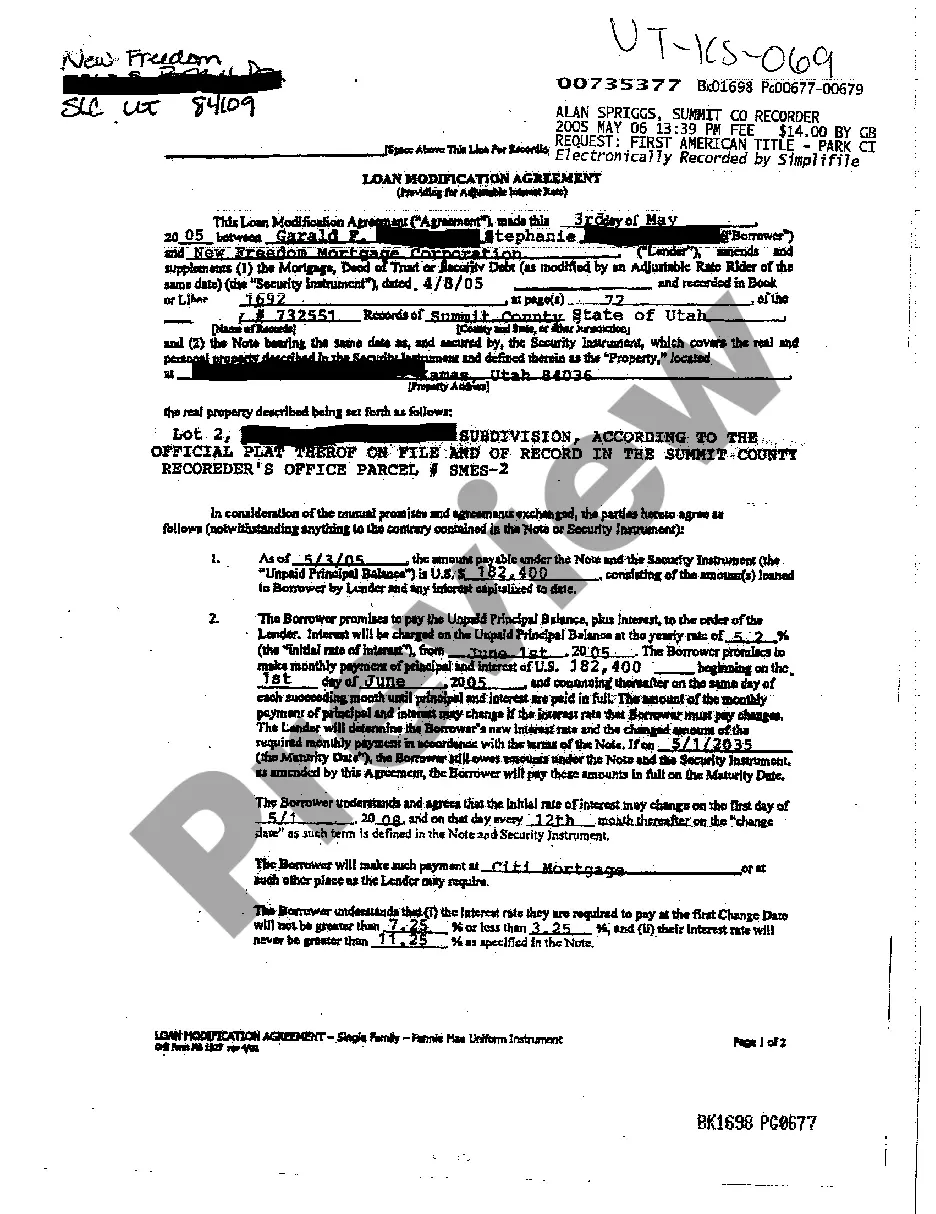

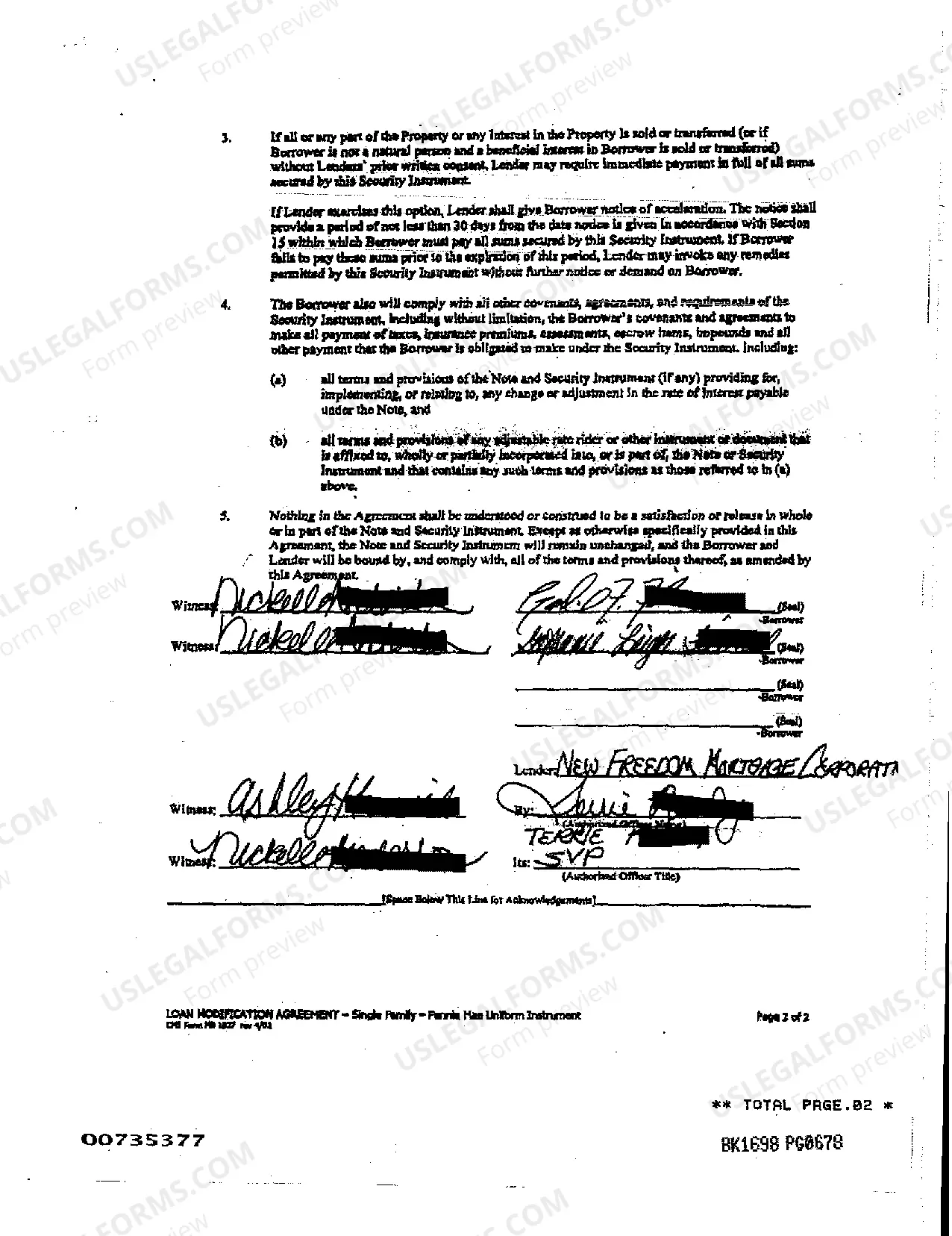

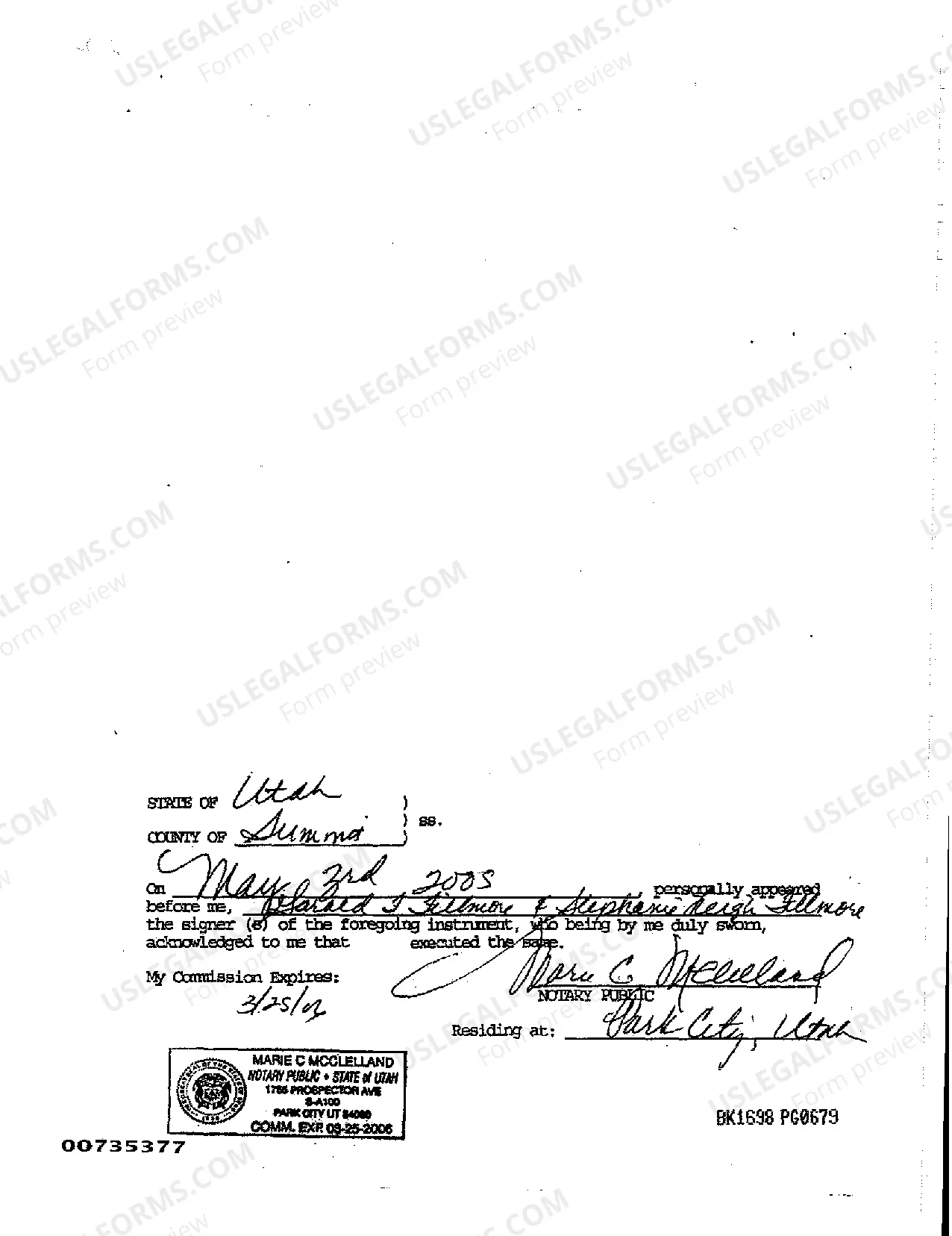

West Jordan Utah Loan Modification Agreement is a legal document that allows borrowers in West Jordan, Utah to modify the terms of their existing loans. This agreement is typically entered into between lenders and borrowers who are experiencing financial hardship, aiming to help them avoid foreclosure and make their mortgage payments more affordable. The West Jordan Utah Loan Modification Agreement outlines the specific changes being made to the original loan terms, such as interest rate reduction, extension of loan term, principal forgiveness, or a combination of these modifications. It is important to note that the terms and conditions of these agreements may vary depending on the lender and the borrower's financial situation. Different types of Loan Modification Agreements in West Jordan, Utah may include: 1. Interest Rate Reduction: This type of modification lowers the interest rate of the loan, resulting in decreased monthly mortgage payments for the borrower. It helps to ease the financial burden and make the loan more affordable. 2. Loan Term Extension: In some cases, lenders may extend the loan term, allowing borrowers to pay off the loan over a longer period. This modification can reduce the monthly payment amounts, providing the borrower with more flexibility to meet their financial obligations. 3. Principal Forgiveness: In certain situations, lenders may agree to forgive a portion of the outstanding loan principal. This reduction in the overall loan balance can significantly lower monthly payment amounts, making it easier for homeowners to repay their loans. 4. Combination Modifications: Borrowers may also benefit from a combination of modifications, such as a reduced interest rate, an extended loan term, and principal forgiveness. These combined modifications aim to create a sustainable payment plan for borrowers who are struggling financially. It is crucial for borrowers in West Jordan, Utah, to thoroughly review and understand the terms and conditions of their Loan Modification Agreement before signing. Seeking legal advice or assistance from a loan modification specialist can help borrowers navigate the process and ensure that their best interests are protected.

West Jordan Utah Loan Modification Agreement

Description

How to fill out West Jordan Utah Loan Modification Agreement?

Do you need a trustworthy and affordable legal forms supplier to get the West Jordan Utah Loan Modification Agreement? US Legal Forms is your go-to solution.

Whether you need a simple agreement to set regulations for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed based on the requirements of specific state and county.

To download the document, you need to log in account, locate the required form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the West Jordan Utah Loan Modification Agreement conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to learn who and what the document is good for.

- Restart the search if the form isn’t suitable for your specific situation.

Now you can create your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the West Jordan Utah Loan Modification Agreement in any provided file format. You can return to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal paperwork online once and for all.