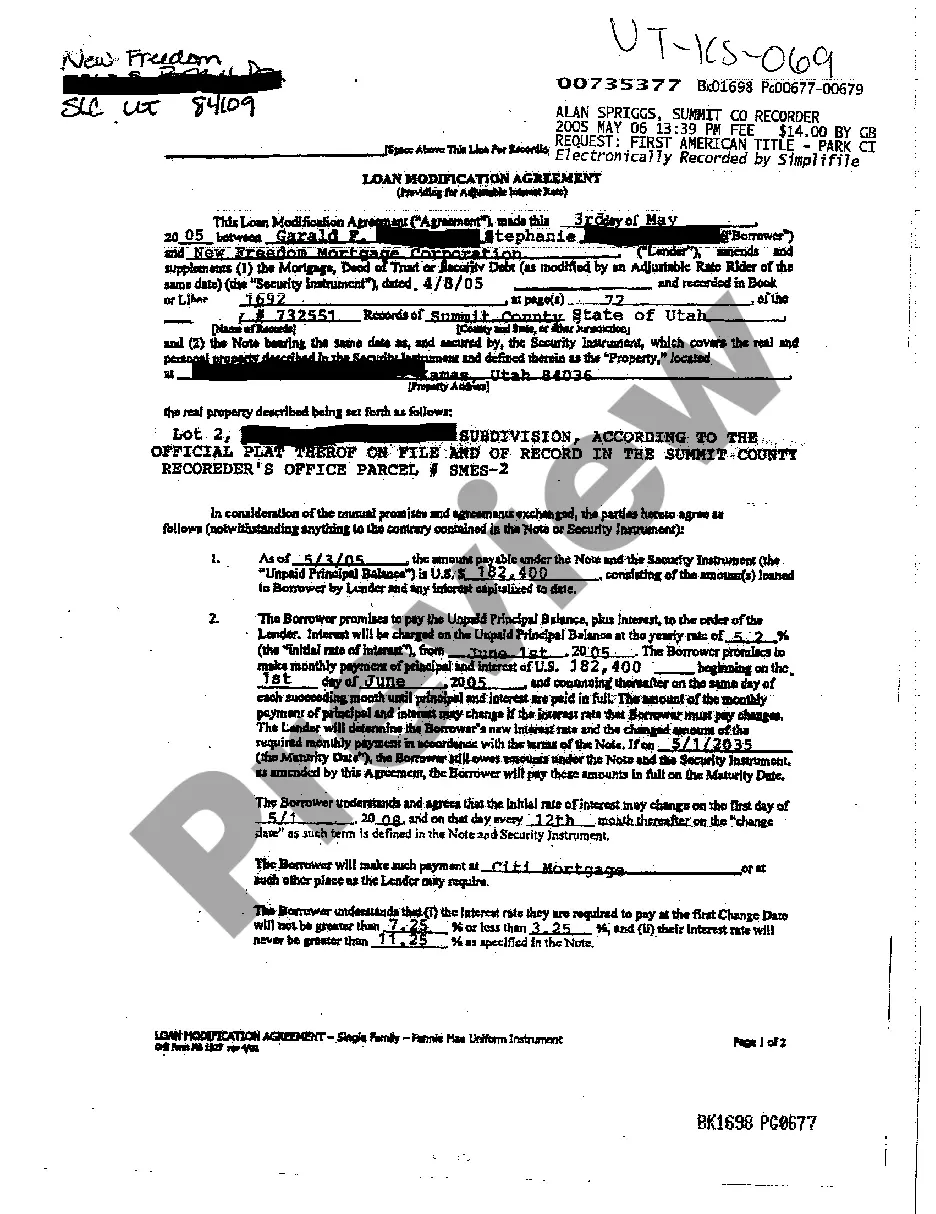

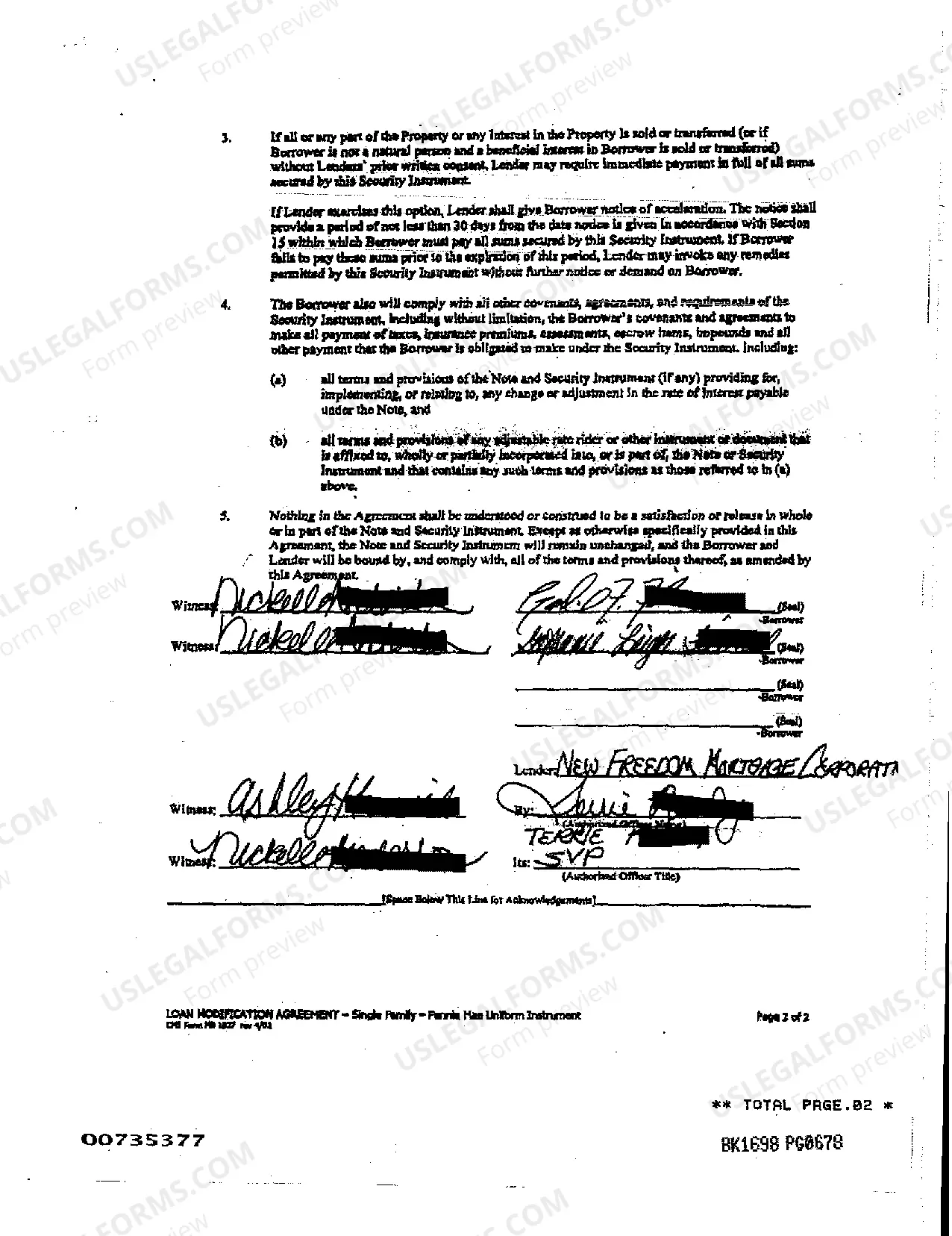

A West Valley City Utah Loan Modification Agreement is a legal agreement between a borrower and a lender to modify the terms of an existing loan in order to make it more affordable or to address financial hardships. This agreement allows borrowers to renegotiate terms such as interest rates, loan duration, monthly payments, and sometimes even the principal balance. In West Valley City Utah, there are several types of loan modification agreements that borrowers can consider depending on their specific financial situations: 1. Interest Rate Reduction: This type of loan modification agreement involves reducing the interest rate applicable to the loan. Lowering the interest rate can significantly reduce the monthly payment burden for the borrower. 2. Loan Term Extension: In this agreement, the lender extends the duration of the loan, resulting in lower monthly payments. Extending the loan term may help borrowers who are struggling financially by spreading their payments over a longer period. 3. Principal Forbearance: Principal forbearance involves temporarily suspending a portion of the loan's principal balance, which is then repaid at a later date. This type of modification can provide short-term relief to borrowers facing financial difficulties. 4. Temporary Payment Reduction: This agreement allows borrowers to make reduced payments for a specific period, typically for a few months. It is a temporary solution to assist borrowers during financial hardships, after which the regular payments are resumed. 5. Loan Repayment Plan: A loan repayment plan is a structured agreement that allows borrowers to catch up on missed payments by adding the arrears to the existing loan balance and spreading the repayment over an agreed-upon period. 6. Partial Claim: Available for Federal Housing Administration (FHA) loans, a partial claim modifies the loan by creating a separate interest-free loan to bring the delinquent mortgage payments current. West Valley City Utah Loan Modification Agreements are designed to provide options for borrowers facing economic challenges, enabling them to stay in their homes and avoid foreclosure. However, it is essential to note that each agreement's terms and eligibility criteria may vary depending on individual circumstances, lender policies, and loan types. Prospective borrowers should consult with their lenders or seek legal advice to determine the most suitable loan modification agreement for their specific needs.

West Valley City Utah Loan Modification Agreement

State:

Utah

City:

West Valley City

Control #:

UT-KS-069

Format:

PDF

Instant download

This form is available by subscription

Description

Loan Modification Agreement

A West Valley City Utah Loan Modification Agreement is a legal agreement between a borrower and a lender to modify the terms of an existing loan in order to make it more affordable or to address financial hardships. This agreement allows borrowers to renegotiate terms such as interest rates, loan duration, monthly payments, and sometimes even the principal balance. In West Valley City Utah, there are several types of loan modification agreements that borrowers can consider depending on their specific financial situations: 1. Interest Rate Reduction: This type of loan modification agreement involves reducing the interest rate applicable to the loan. Lowering the interest rate can significantly reduce the monthly payment burden for the borrower. 2. Loan Term Extension: In this agreement, the lender extends the duration of the loan, resulting in lower monthly payments. Extending the loan term may help borrowers who are struggling financially by spreading their payments over a longer period. 3. Principal Forbearance: Principal forbearance involves temporarily suspending a portion of the loan's principal balance, which is then repaid at a later date. This type of modification can provide short-term relief to borrowers facing financial difficulties. 4. Temporary Payment Reduction: This agreement allows borrowers to make reduced payments for a specific period, typically for a few months. It is a temporary solution to assist borrowers during financial hardships, after which the regular payments are resumed. 5. Loan Repayment Plan: A loan repayment plan is a structured agreement that allows borrowers to catch up on missed payments by adding the arrears to the existing loan balance and spreading the repayment over an agreed-upon period. 6. Partial Claim: Available for Federal Housing Administration (FHA) loans, a partial claim modifies the loan by creating a separate interest-free loan to bring the delinquent mortgage payments current. West Valley City Utah Loan Modification Agreements are designed to provide options for borrowers facing economic challenges, enabling them to stay in their homes and avoid foreclosure. However, it is essential to note that each agreement's terms and eligibility criteria may vary depending on individual circumstances, lender policies, and loan types. Prospective borrowers should consult with their lenders or seek legal advice to determine the most suitable loan modification agreement for their specific needs.

Free preview

How to fill out West Valley City Utah Loan Modification Agreement?

If you’ve already used our service before, log in to your account and save the West Valley City Utah Loan Modification Agreement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your West Valley City Utah Loan Modification Agreement. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!