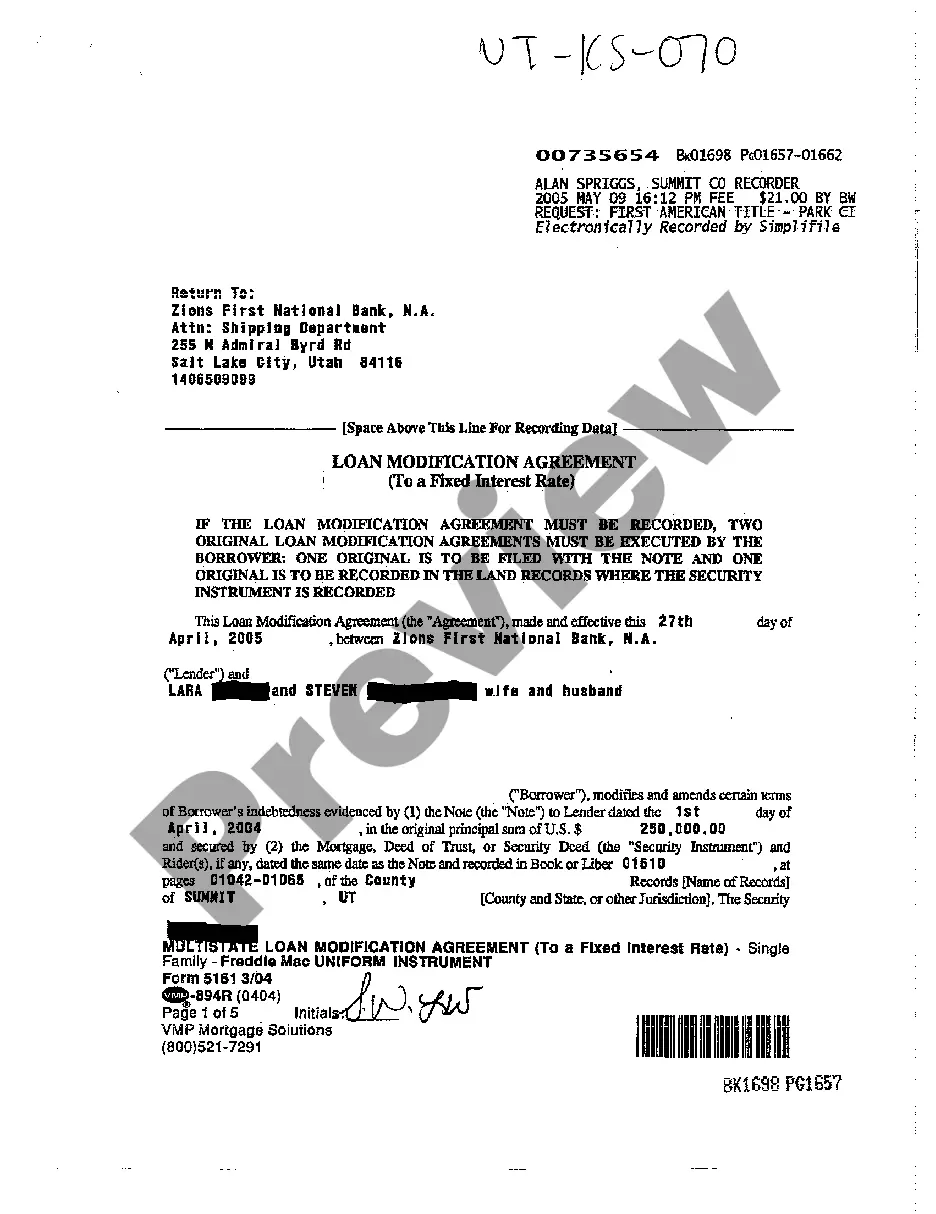

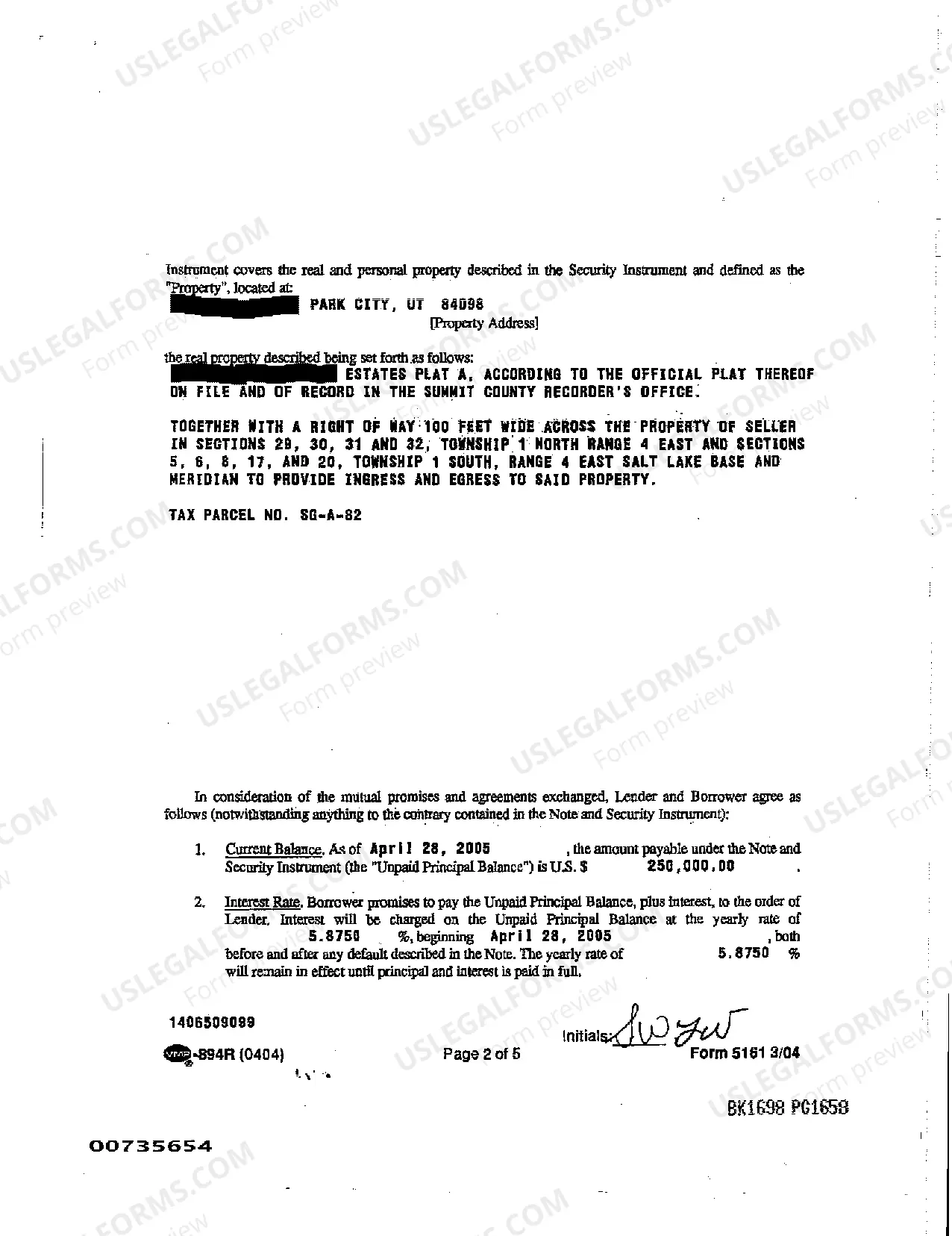

Provo Utah Loan Modification Agreement — To a Fixed Interest Rate: A Comprehensive Guide Introduction: A Provo Utah Loan Modification Agreement — To a Fixed Interest Rate refers to a legally binding agreement between a borrower and a lender to modify the terms of an existing loan, with the goal of converting it to a fixed interest rate structure. This agreement provides borrowers with the opportunity to secure a stable interest rate over the course of their loan term and could potentially lead to a more affordable and predictable repayment plan. By entering into this agreement, borrowers can safeguard themselves from the potential risk of fluctuating interest rates, ultimately helping them achieve their financial goals. Key Features: 1. Conversion to Fixed Interest Rate: The primary purpose of this agreement is to convert the existing adjustable interest rate on the loan to a fixed interest rate. The fixed interest rate remains constant throughout the agreed-upon loan term, providing borrowers with stability and predictability when it comes to their monthly payments. 2. Potentially Lower Interest Rates: In some cases, a Provo Utah Loan Modification Agreement may offer borrowers an opportunity to secure a lower fixed interest rate compared to their current adjustable rate. This can result in significant savings over the life of the loan, making monthly repayments more manageable and affordable. 3. Avoiding Interest Rate Volatility: By opting for a fixed interest rate through loan modification, borrowers can insulate themselves against potential interest rate hikes. This protection can be particularly valuable in times of economic uncertainty or rising interest rates, as it allows borrowers to plan their finances without worrying about unexpected increases in their monthly payment obligations. 4. Long-term Affordability: This type of loan modification aims to provide borrowers with a repayment plan that enables long-term financial stability. By eliminating the uncertainty associated with adjustable interest rates, borrowers can better forecast their monthly mortgage payments and budget accordingly. This can help prevent financial strain and enable borrowers to meet other financial goals. Types of Provo Utah Loan Modification Agreement — To a Fixed Interest Rate: 1. Rate Reduction Modification: This type of modification involves negotiating a lower fixed interest rate compared to the existing adjustable rate. Borrowers can benefit from reduced monthly payments and overall interest costs. 2. Rate Stability Modification: This agreement focuses on maintaining a fixed interest rate that remains unchanged throughout the loan term. It provides borrowers with peace of mind and allows for better financial planning. 3. Term Extension Modification: In some cases, borrowers may choose to extend the loan term through this agreement, while securing a fixed interest rate. This modification can help reduce monthly payments by spreading them out over a longer period. Conclusion: A Provo Utah Loan Modification Agreement — To a Fixed Interest Rate is a valuable tool for borrowers looking to secure financial stability and avoid the uncertainty associated with adjustable interest rates. By converting to a fixed interest rate, borrowers can benefit from lower rates, predictable monthly payments, and the ability to plan their finances more effectively. Whether it involves rate reduction, rate stability, or term extension, this agreement aims to provide borrowers with a feasible and sustainable repayment plan conducive to their financial objectives. It is essential to consult with a qualified professional or lender to assess individual circumstances and explore available options for loan modification.

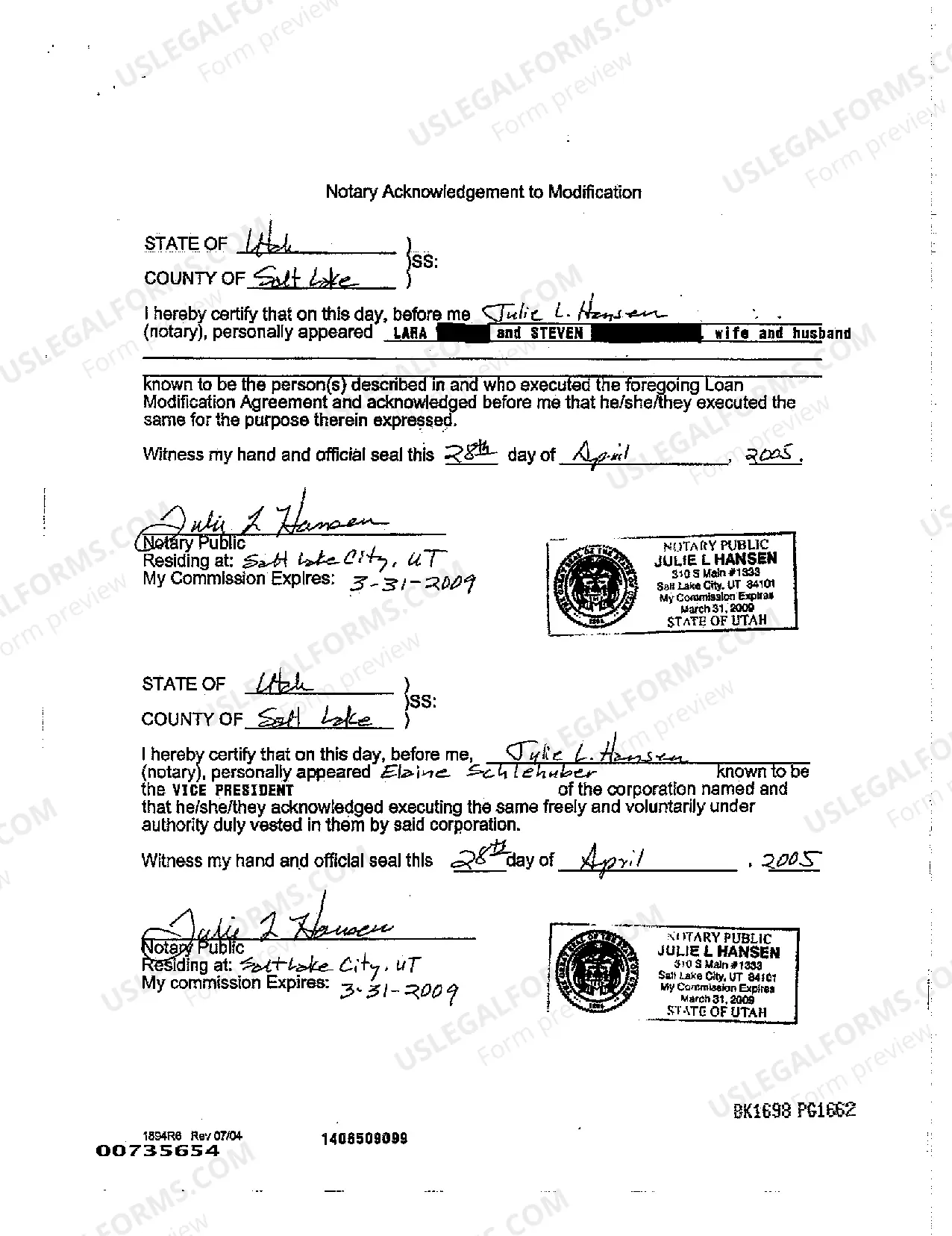

Provo Utah Loan Modification Agreement - To a Fixed Interest Rate

Description

How to fill out Provo Utah Loan Modification Agreement - To A Fixed Interest Rate?

Benefit from the US Legal Forms and obtain immediate access to any form template you need. Our helpful platform with a large number of documents makes it easy to find and obtain almost any document sample you want. You are able to export, fill, and certify the Provo Utah Loan Modification Agreement - To a Fixed Interest Rate in just a few minutes instead of surfing the Net for many hours attempting to find the right template.

Using our library is a great strategy to increase the safety of your record filing. Our professional legal professionals regularly review all the documents to ensure that the forms are relevant for a particular state and compliant with new acts and polices.

How can you obtain the Provo Utah Loan Modification Agreement - To a Fixed Interest Rate? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you view. In addition, you can get all the previously saved files in the My Forms menu.

If you don’t have a profile yet, stick to the tips listed below:

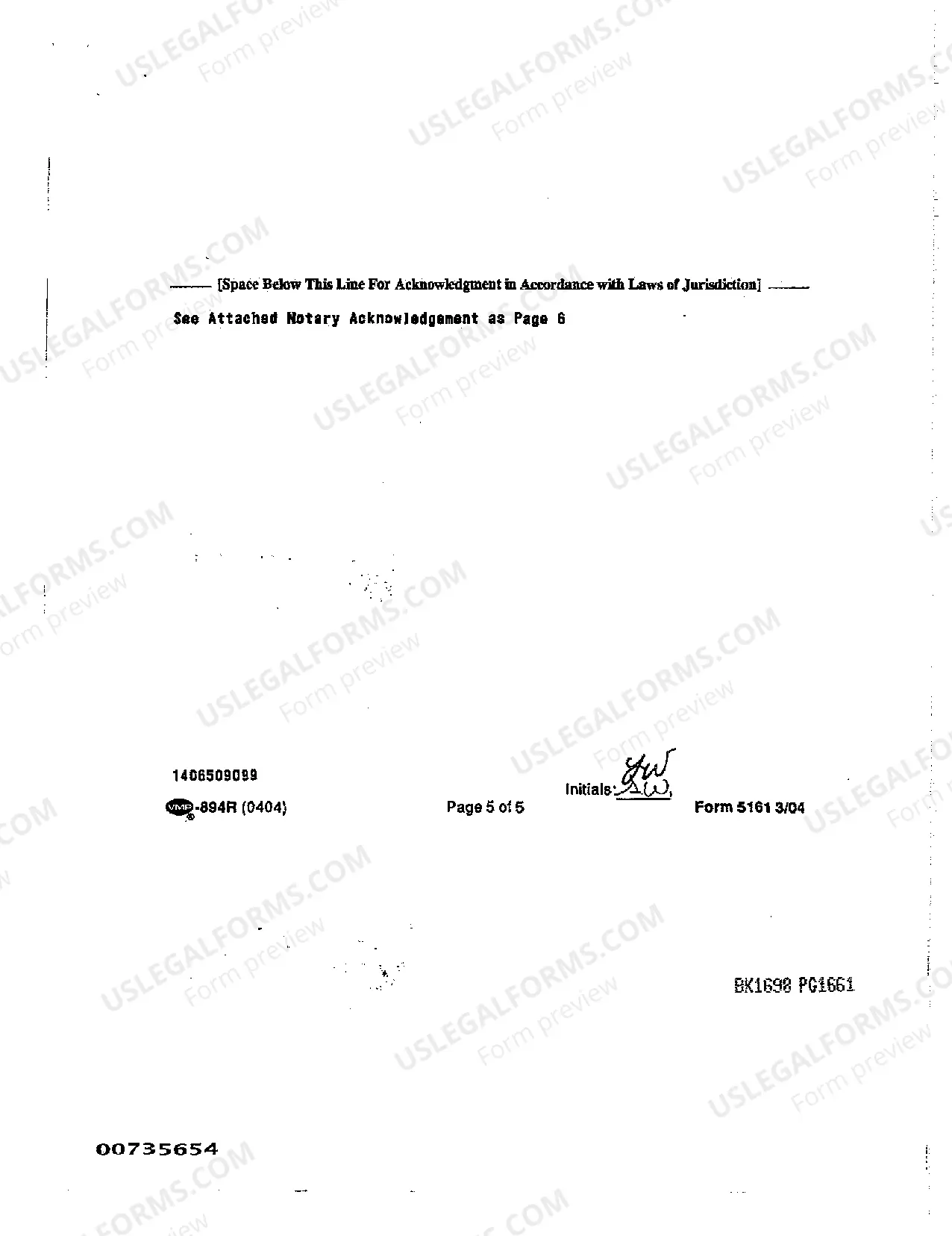

- Open the page with the template you require. Ensure that it is the template you were seeking: examine its name and description, and use the Preview function when it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Start the downloading process. Click Buy Now and choose the pricing plan you like. Then, create an account and process your order utilizing a credit card or PayPal.

- Download the document. Select the format to obtain the Provo Utah Loan Modification Agreement - To a Fixed Interest Rate and modify and fill, or sign it according to your requirements.

US Legal Forms is probably the most extensive and reliable document libraries on the internet. We are always ready to help you in virtually any legal procedure, even if it is just downloading the Provo Utah Loan Modification Agreement - To a Fixed Interest Rate.

Feel free to make the most of our service and make your document experience as convenient as possible!