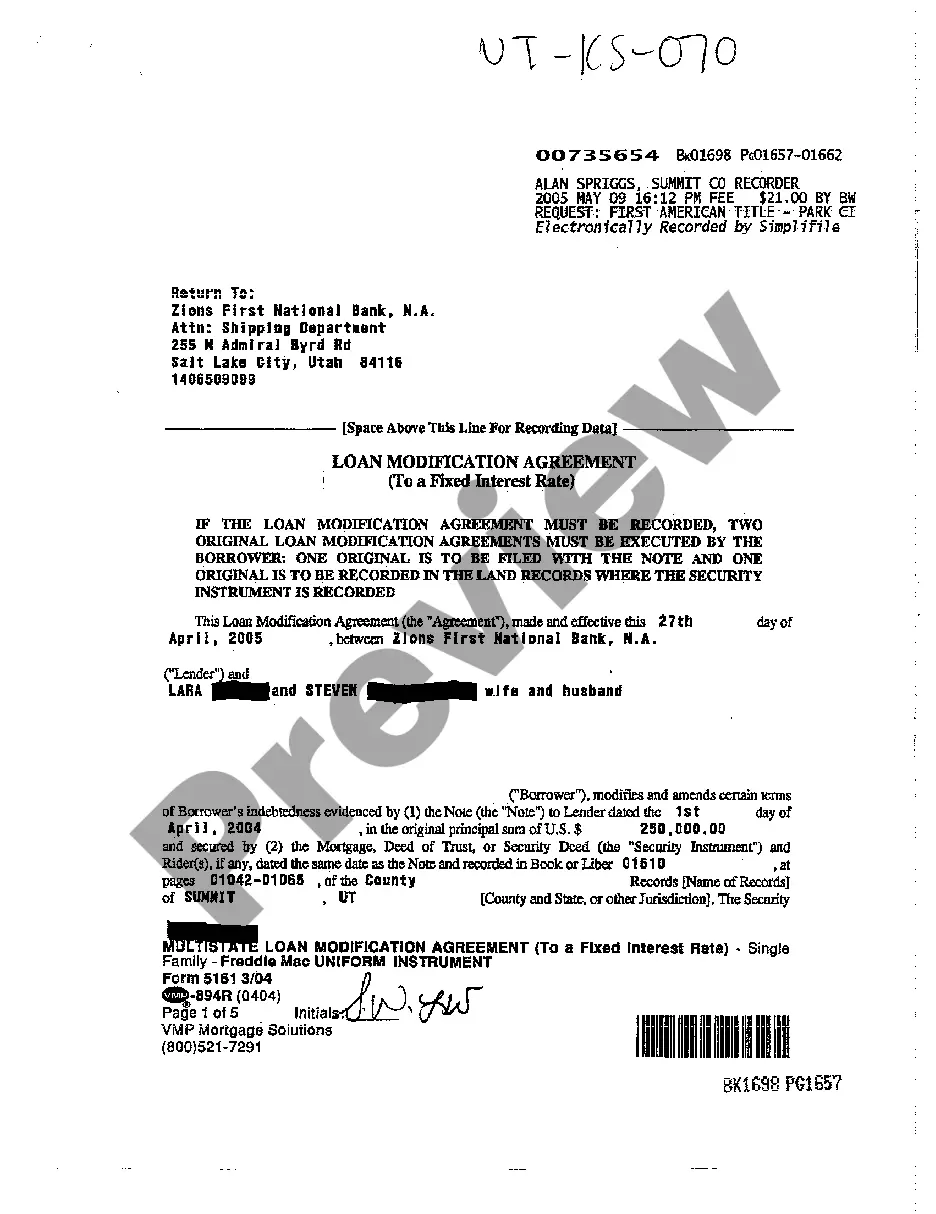

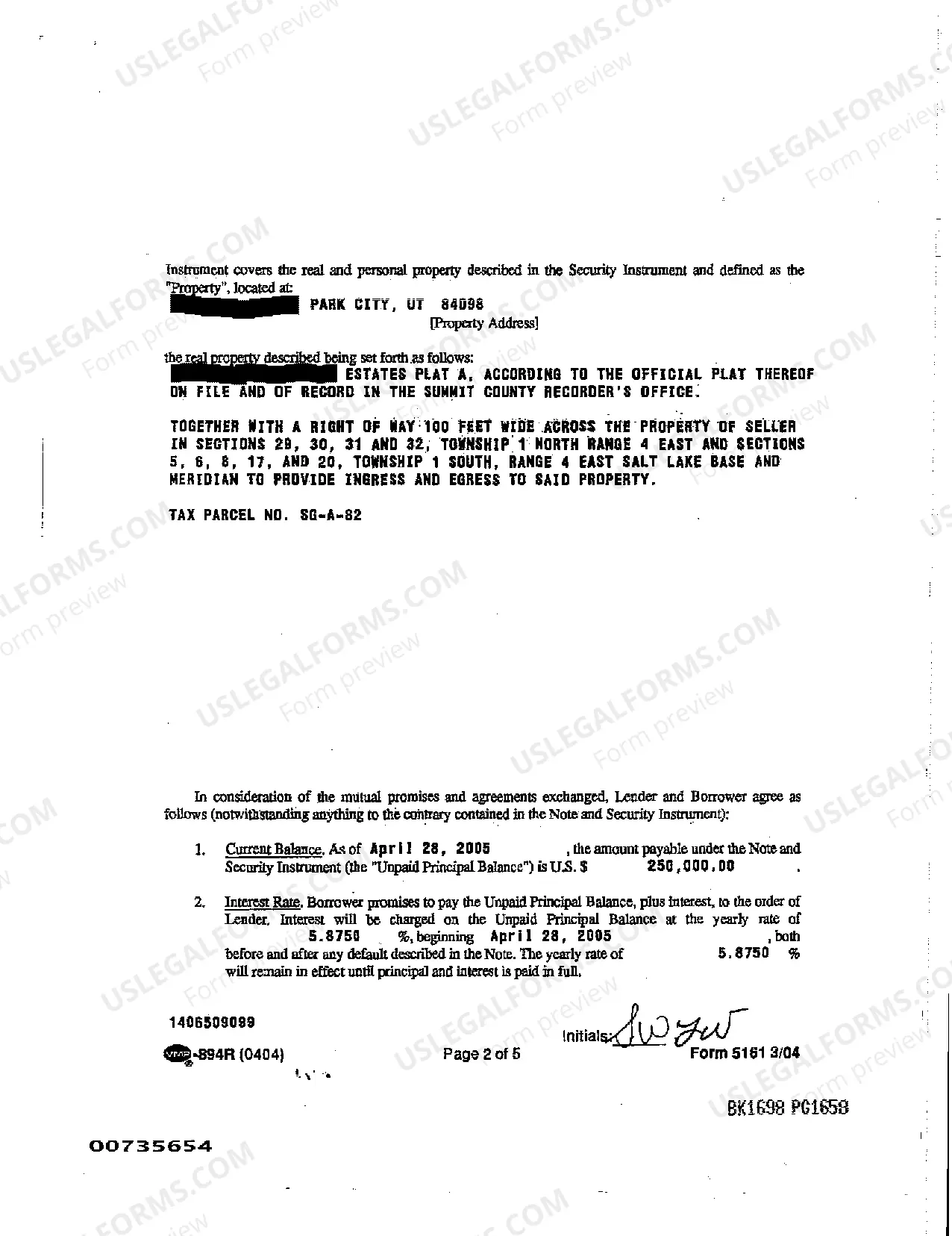

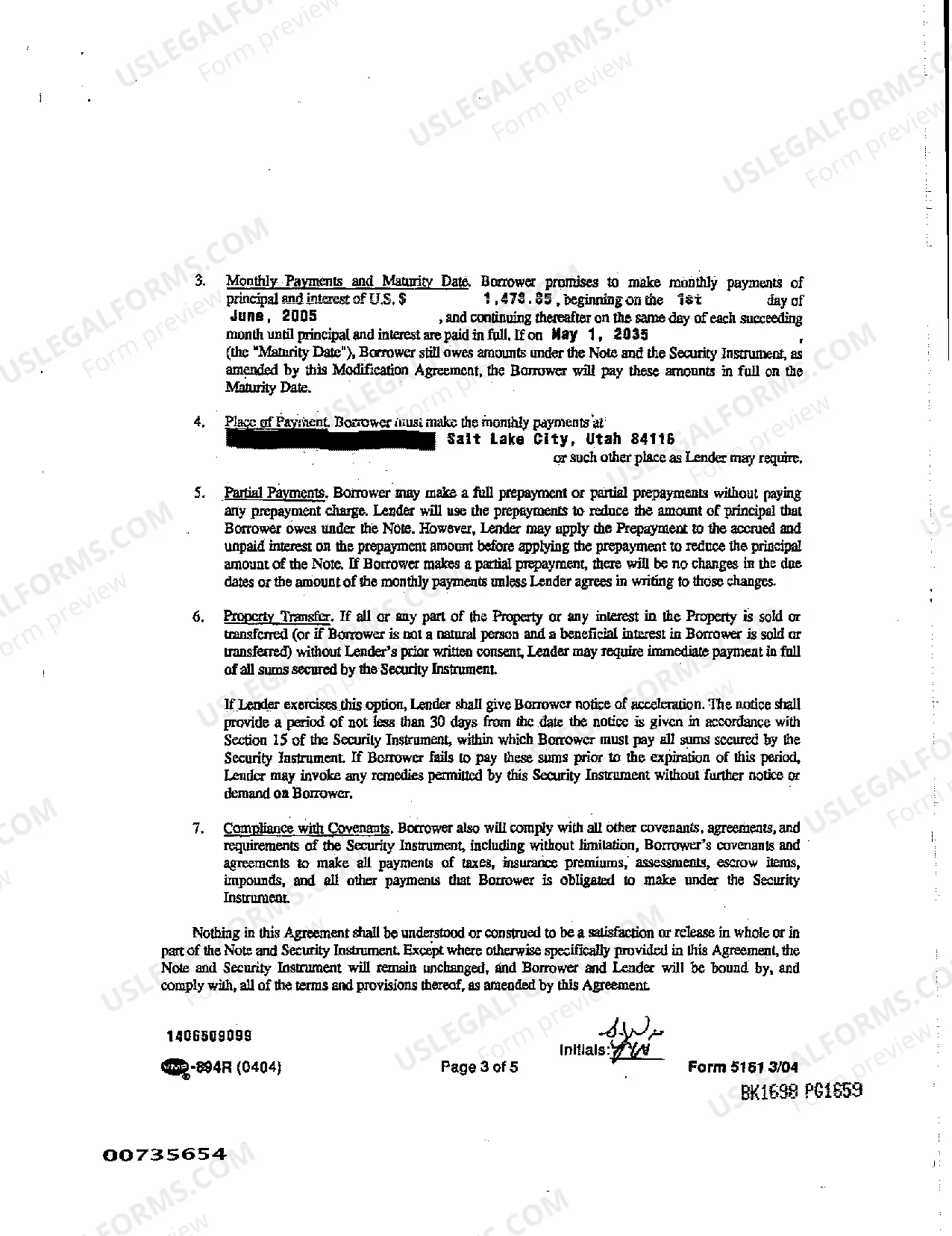

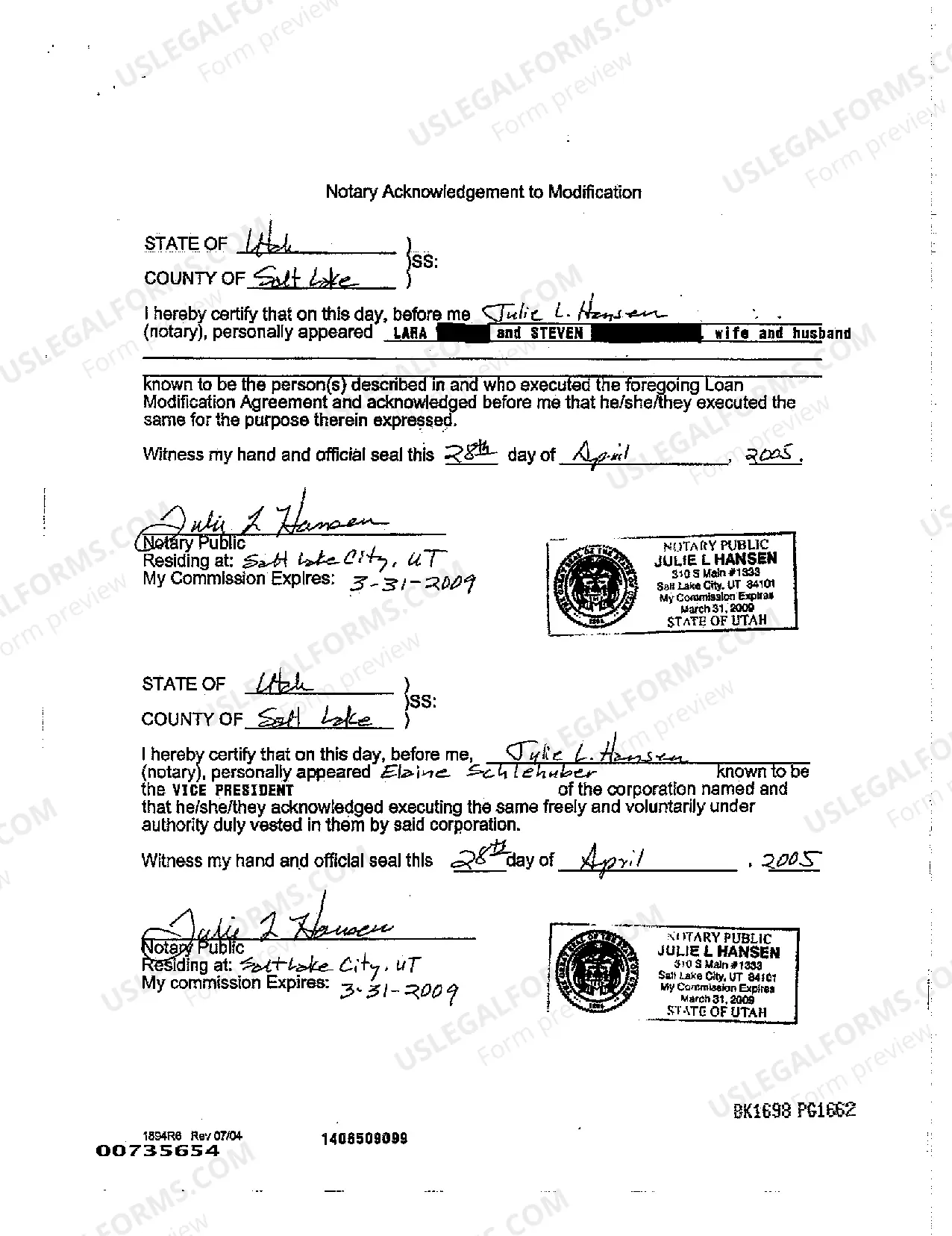

A Salt Lake Utah Loan Modification Agreement — To a Fixed Interest Rate refers to a legally binding contract between a borrower and a lender in Salt Lake, Utah, that allows the borrower to modify the terms of their existing loan agreement to convert it to a fixed interest rate structure. In Salt Lake, Utah, Loan Modification Agreements are commonly used by borrowers who are looking to stabilize their mortgage payments and avoid future uncertainties associated with adjustable interest rates. By converting their loan to a fixed interest rate, borrowers can ensure a consistent monthly payment through the life of the loan. Several types of Salt Lake Utah Loan Modification Agreements can be considered based on the borrower's needs and financial situation. These may include: 1. Standard Fixed-Rate Modification: This type of agreement allows the borrower to negotiate a new fixed interest rate for the remaining loan term. The interest rate remains constant over the agreed-upon period, typically reducing financial uncertainty for the borrower. 2. Term Extension Modification: Sometimes, borrowers struggle to make their monthly payments due to financial hardships. In such cases, the lender may offer a Loan Modification Agreement that extends the loan term in addition to fixing the interest rate. This extension helps to reduce the monthly payment obligation by spreading it over a longer period. 3. Principal Reduction Modification: In situations where the borrower owes more than the current value of the property, a Loan Modification Agreement may be reached that involves reducing the principal balance of the loan. This reduction helps borrowers overcome negative equity and can be combined with a fixed interest rate for added stability. 4. Recast Modification: A recast modification is an option for borrowers who have made significant lump-sum payments towards their mortgage but wish to maintain the original loan term. In this case, the Loan Modification Agreement adjusts the monthly payments and fixes the interest rate to reflect the reduced loan balance. Salt Lake Utah Loan Modification Agreements — To a Fixed Interest Rate provide borrowers with the opportunity to achieve financial stability while avoiding potential hardships associated with adjustable interest rates. It is essential for borrowers to carefully review and understand the terms of the agreement, seeking legal advice if needed, to ensure they are making an informed decision that aligns with their current and future financial goals.

Salt Lake Utah Loan Modification Agreement - To a Fixed Interest Rate

Description

How to fill out Salt Lake Utah Loan Modification Agreement - To A Fixed Interest Rate?

If you are looking for a relevant form template, it’s extremely hard to find a more convenient platform than the US Legal Forms site – probably the most comprehensive libraries on the internet. With this library, you can find a large number of document samples for business and individual purposes by types and regions, or key phrases. Using our advanced search function, getting the most up-to-date Salt Lake Utah Loan Modification Agreement - To a Fixed Interest Rate is as elementary as 1-2-3. In addition, the relevance of each file is verified by a group of professional lawyers that regularly review the templates on our website and revise them in accordance with the newest state and county demands.

If you already know about our system and have an account, all you need to get the Salt Lake Utah Loan Modification Agreement - To a Fixed Interest Rate is to log in to your profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the instructions below:

- Make sure you have discovered the sample you require. Check its description and use the Preview feature to explore its content. If it doesn’t meet your needs, use the Search field near the top of the screen to discover the proper record.

- Confirm your choice. Select the Buy now option. After that, choose your preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Pick the file format and save it on your device.

- Make modifications. Fill out, edit, print, and sign the acquired Salt Lake Utah Loan Modification Agreement - To a Fixed Interest Rate.

Every template you save in your profile does not have an expiration date and is yours permanently. You always have the ability to access them via the My Forms menu, so if you want to have an additional duplicate for modifying or printing, feel free to return and save it once more at any moment.

Make use of the US Legal Forms extensive catalogue to gain access to the Salt Lake Utah Loan Modification Agreement - To a Fixed Interest Rate you were seeking and a large number of other professional and state-specific templates on one platform!