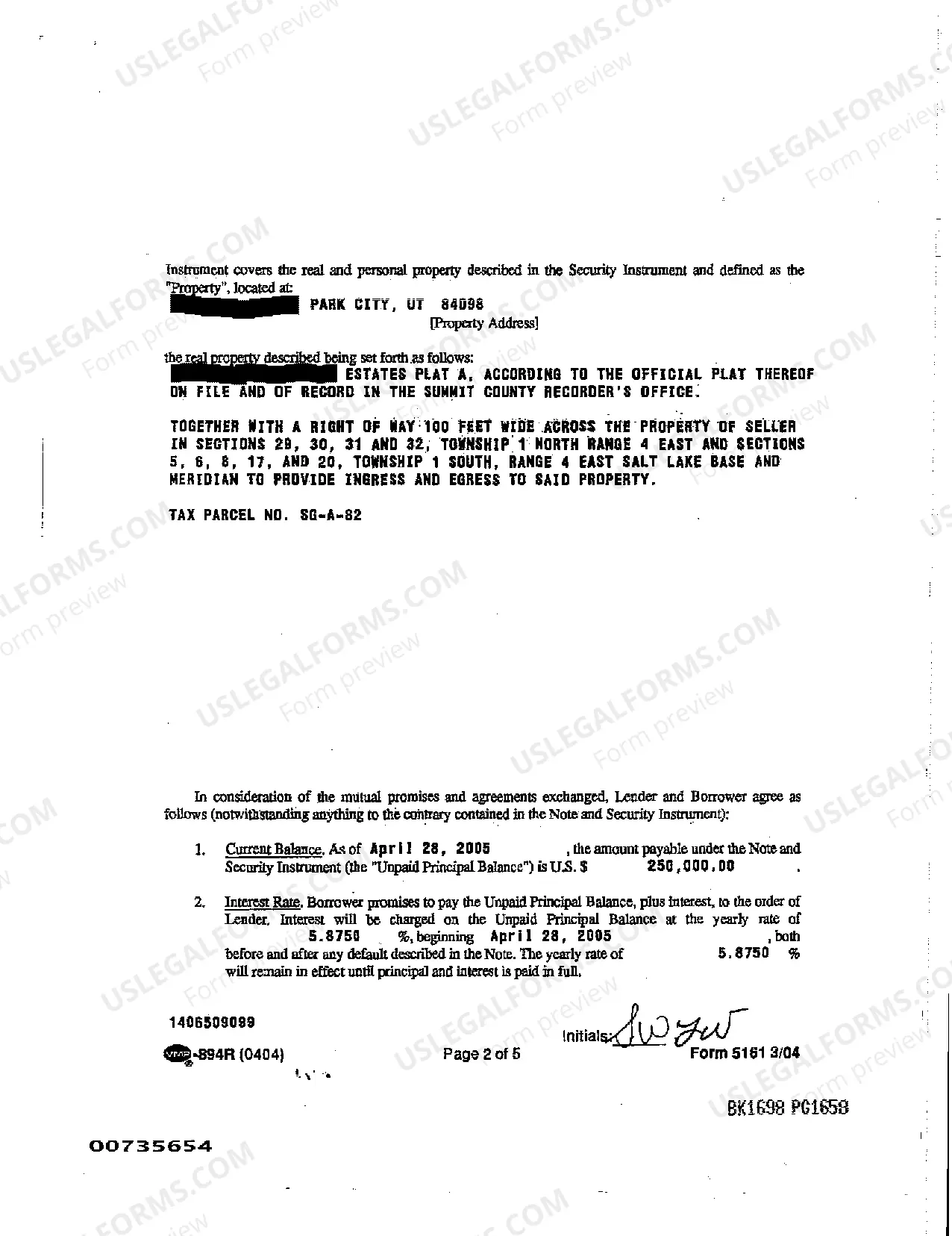

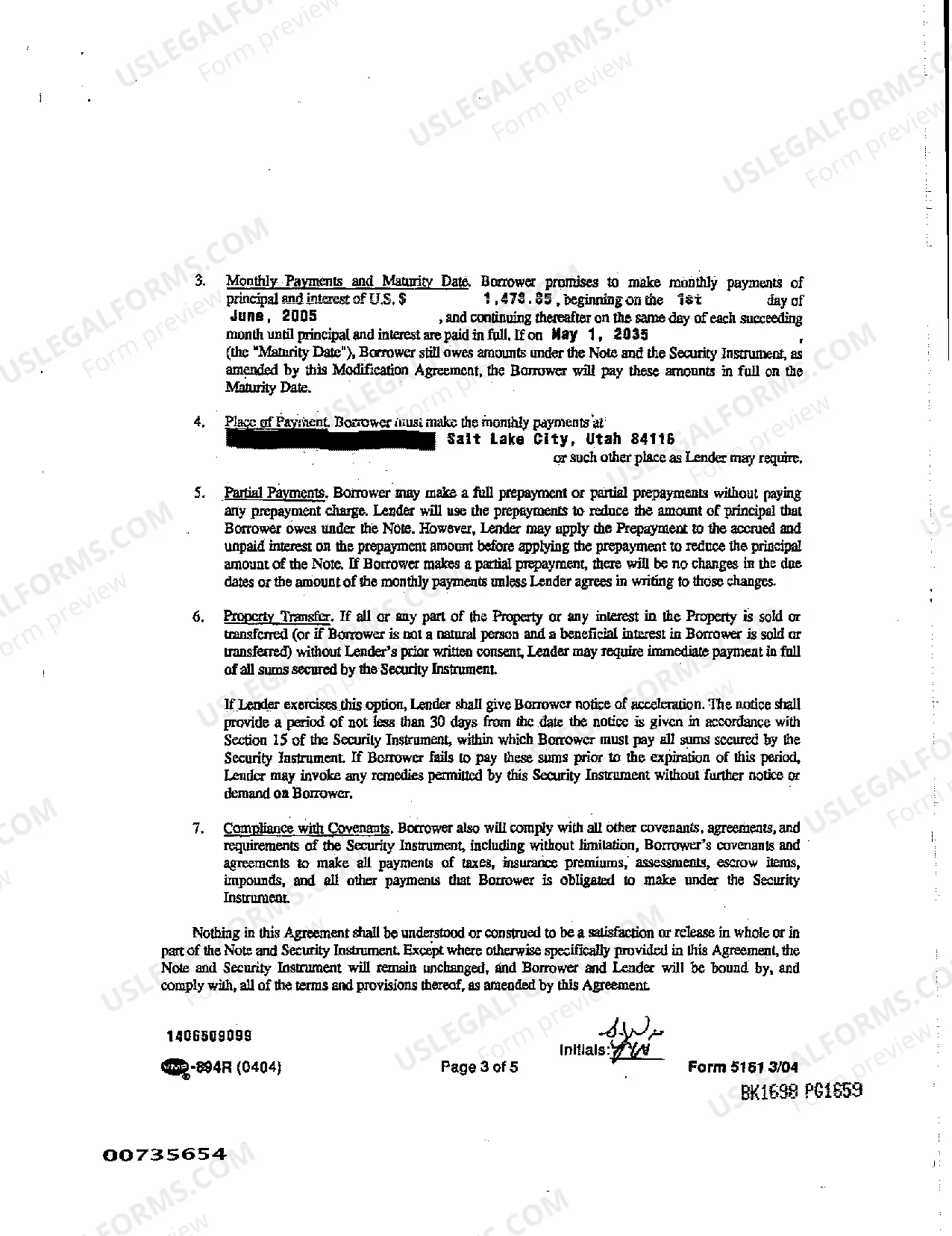

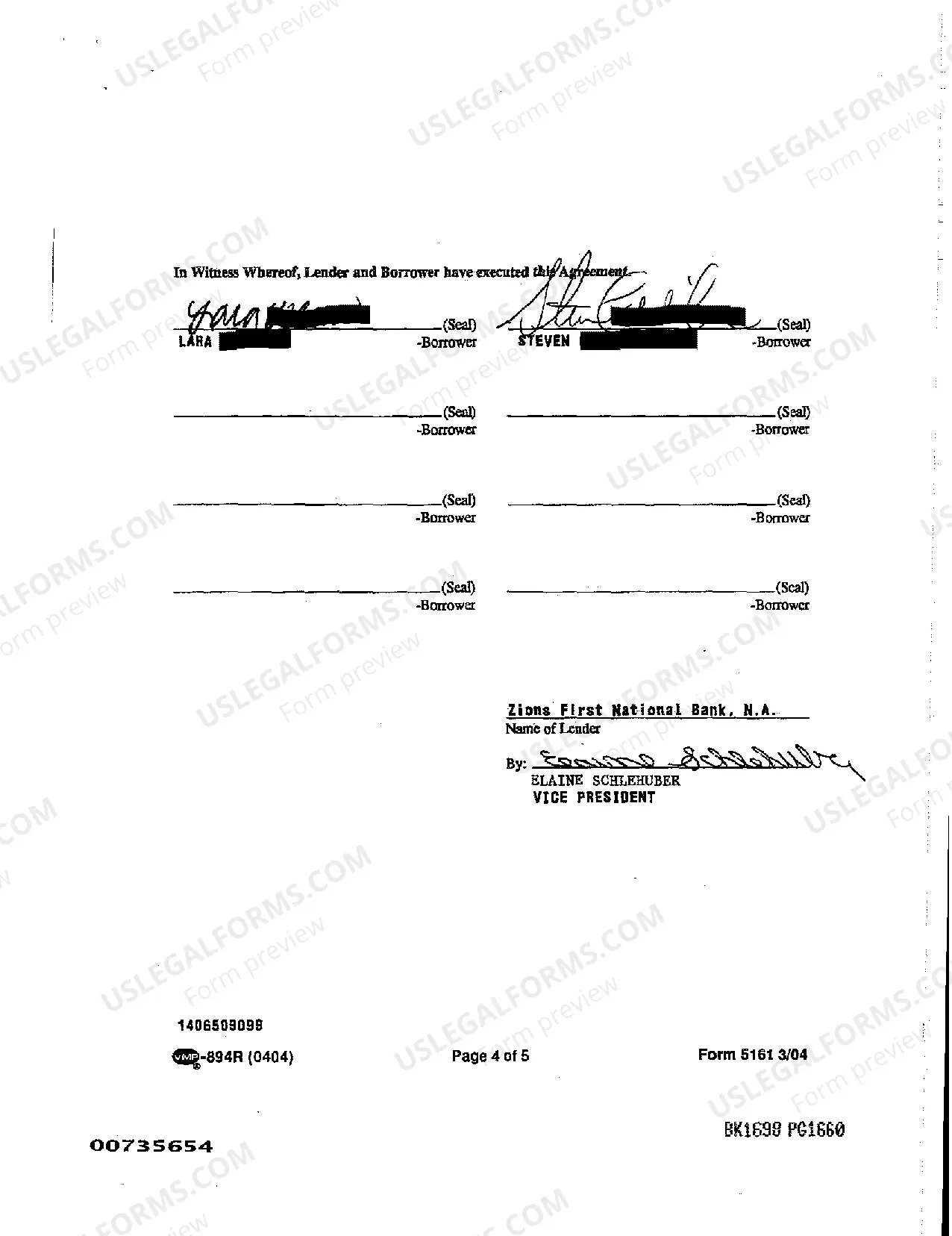

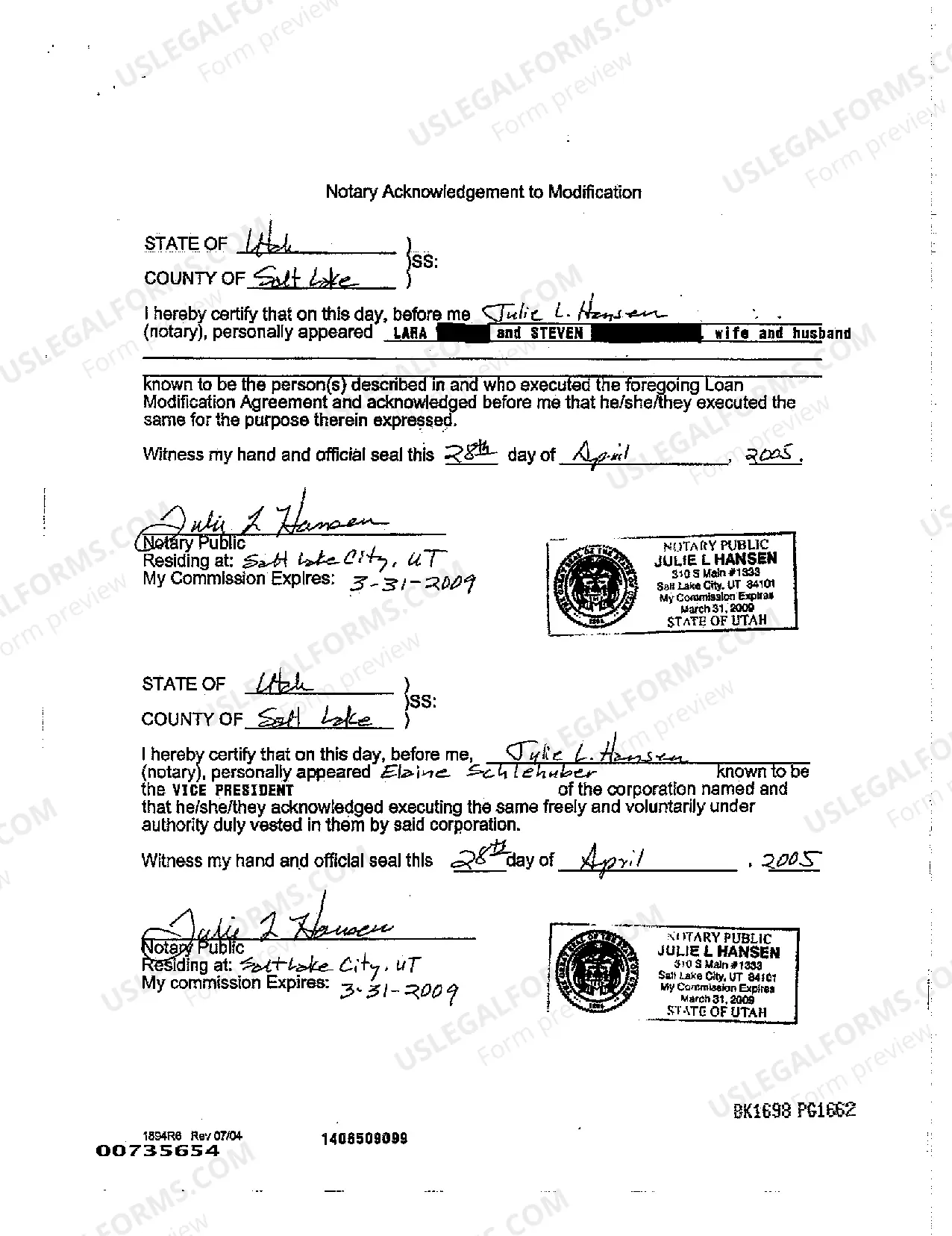

Salt Lake City Utah Loan Modification Agreement — To a Fixed Interest Rate serves as a financial tool that allows homeowners in Salt Lake City, Utah, to renegotiate the terms of their mortgage and convert it to a fixed interest rate. This type of loan modification aims to make monthly mortgage payments more affordable and stable for homeowners while ensuring long-term financial security. By switching from an adjustable or variable interest rate to a fixed rate, borrowers can benefit from predictable payment amounts over the life of the loan. Different types of Salt Lake City Utah Loan Modification Agreements — To a Fixed Interest Rate may include options tailored to the specific needs of homeowners. These variations could involve various terms, such as: 1. Traditional Fixed-Rate Loan Modification: This option offers homeowners the opportunity to convert their existing mortgage, which may have a fluctuating interest rate, to a fixed rate. By locking in a stable interest rate, borrowers can have peace of mind knowing their mortgage payments will remain consistent throughout the loan term. 2. Adjustable to Fixed-Rate Conversion: Homeowners who currently hold an adjustable-rate mortgage (ARM) can convert their loan to a fixed-rate mortgage through this loan modification agreement. This conversion eliminates the uncertainty of future interest rate hikes and provides stability in monthly payments. 3. Temporary Fixed-Rate Agreement: Sometimes, homeowners who are facing financial hardships may qualify for a temporary fixed-rate agreement. This modification offers a fixed interest rate for a limited period, providing temporary relief for struggling borrowers. Once the agreed-upon period expires, the terms may revert to the original loan agreement or be subject to further negotiation. 4. Government Loan Modification Programs: The Salt Lake City, Utah area may also offer loan modification programs initiated by government organizations or agencies. These programs might provide additional assistance to homeowners through modification agreements that aim to fix interest rates or provide more sustainable payment options. 5. Mortgage Refinancing with a Fixed Interest Rate: Although not strictly considered a loan modification agreement, homeowners in Salt Lake City, Utah, may choose to refinance their mortgage to obtain a fixed interest rate. Refinancing involves paying off the existing loan and obtaining a new one with different terms, including a fixed interest rate. This option allows borrowers to secure a lower interest rate and potentially reduce their monthly payments. In conclusion, a Salt Lake City Utah Loan Modification Agreement — To a Fixed Interest Rate assists homeowners in modifying their mortgage terms, primarily by converting to a fixed interest rate. By selecting from various types of loan modification agreements, borrowers can find a solution that meets their unique financial needs and ensures more manageable and predictable monthly mortgage payments.

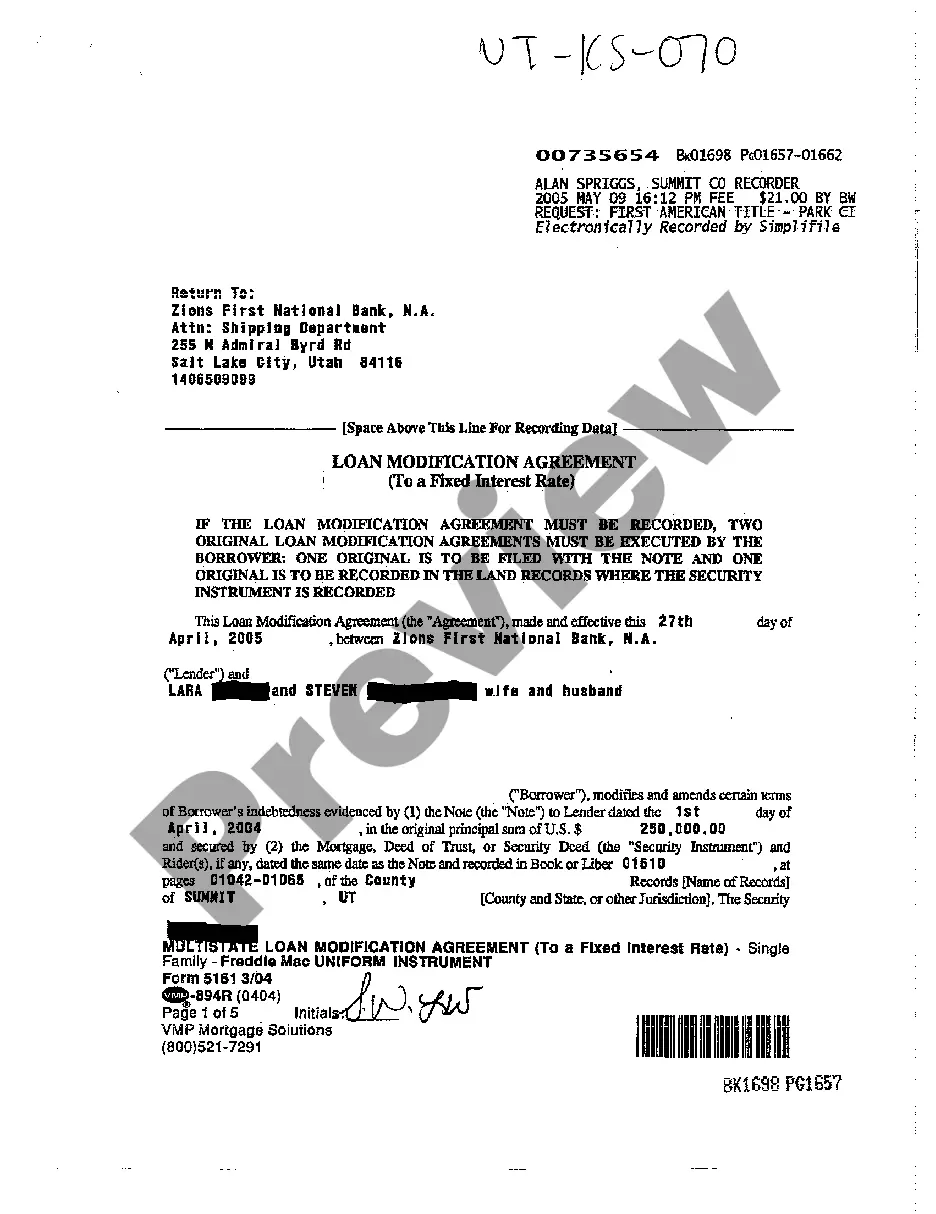

Salt Lake City Utah Loan Modification Agreement - To a Fixed Interest Rate

Description

How to fill out Salt Lake City Utah Loan Modification Agreement - To A Fixed Interest Rate?

Do you need a reliable and inexpensive legal forms provider to buy the Salt Lake City Utah Loan Modification Agreement - To a Fixed Interest Rate? US Legal Forms is your go-to choice.

Whether you need a simple agreement to set regulations for cohabitating with your partner or a set of forms to advance your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and frameworked based on the requirements of specific state and county.

To download the form, you need to log in account, find the needed template, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Salt Lake City Utah Loan Modification Agreement - To a Fixed Interest Rate conforms to the laws of your state and local area.

- Go through the form’s description (if available) to learn who and what the form is good for.

- Start the search over if the template isn’t suitable for your legal scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Salt Lake City Utah Loan Modification Agreement - To a Fixed Interest Rate in any available file format. You can return to the website at any time and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending hours researching legal papers online for good.