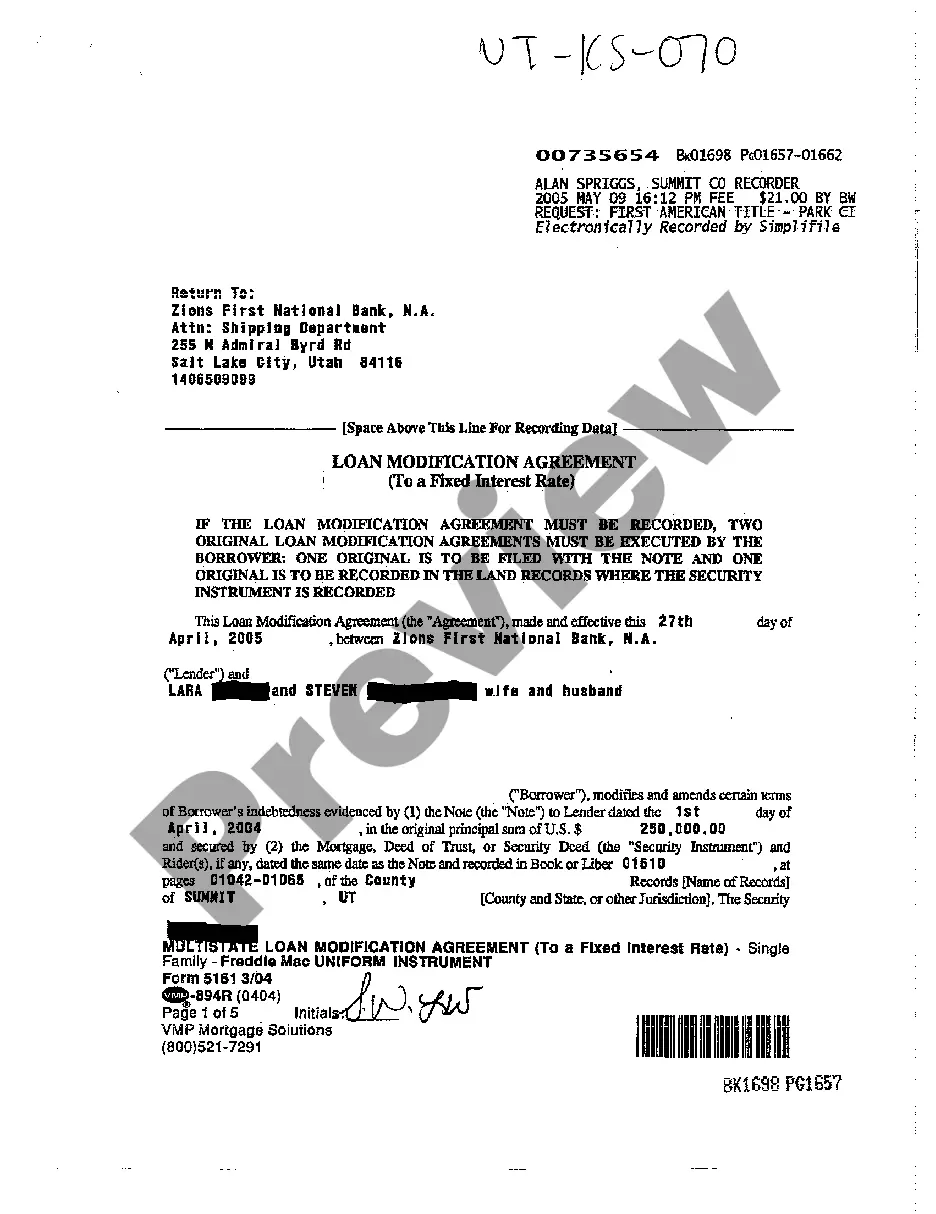

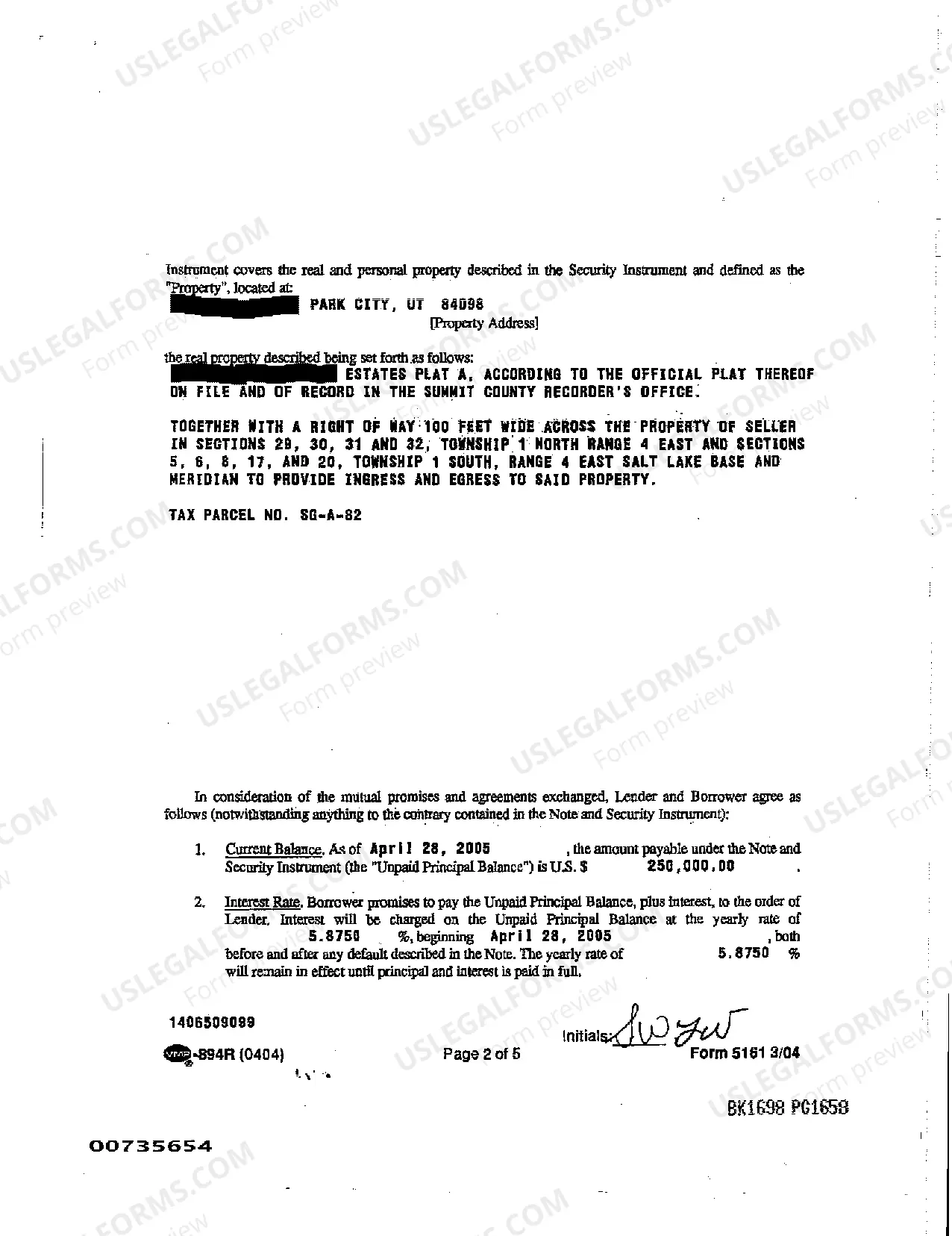

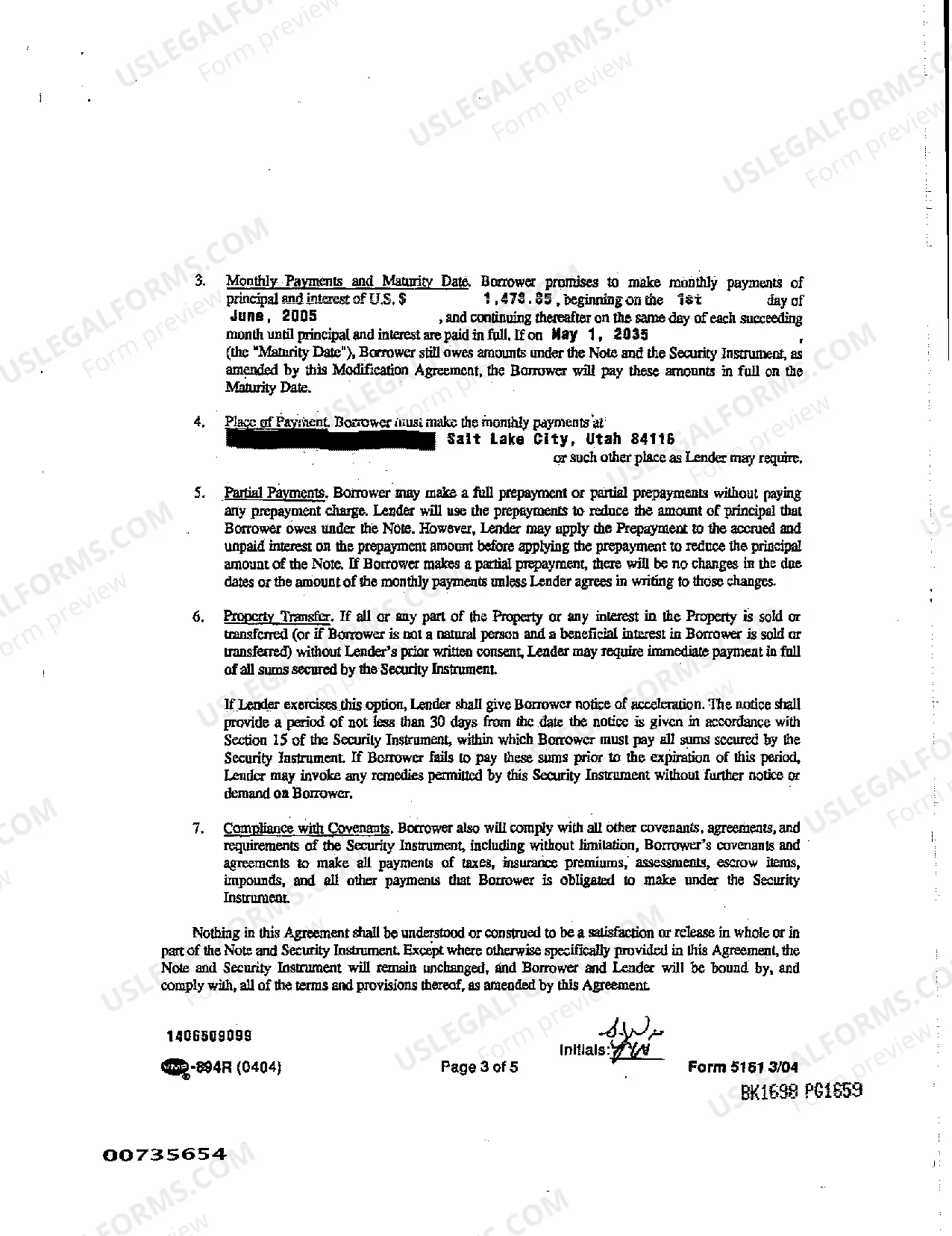

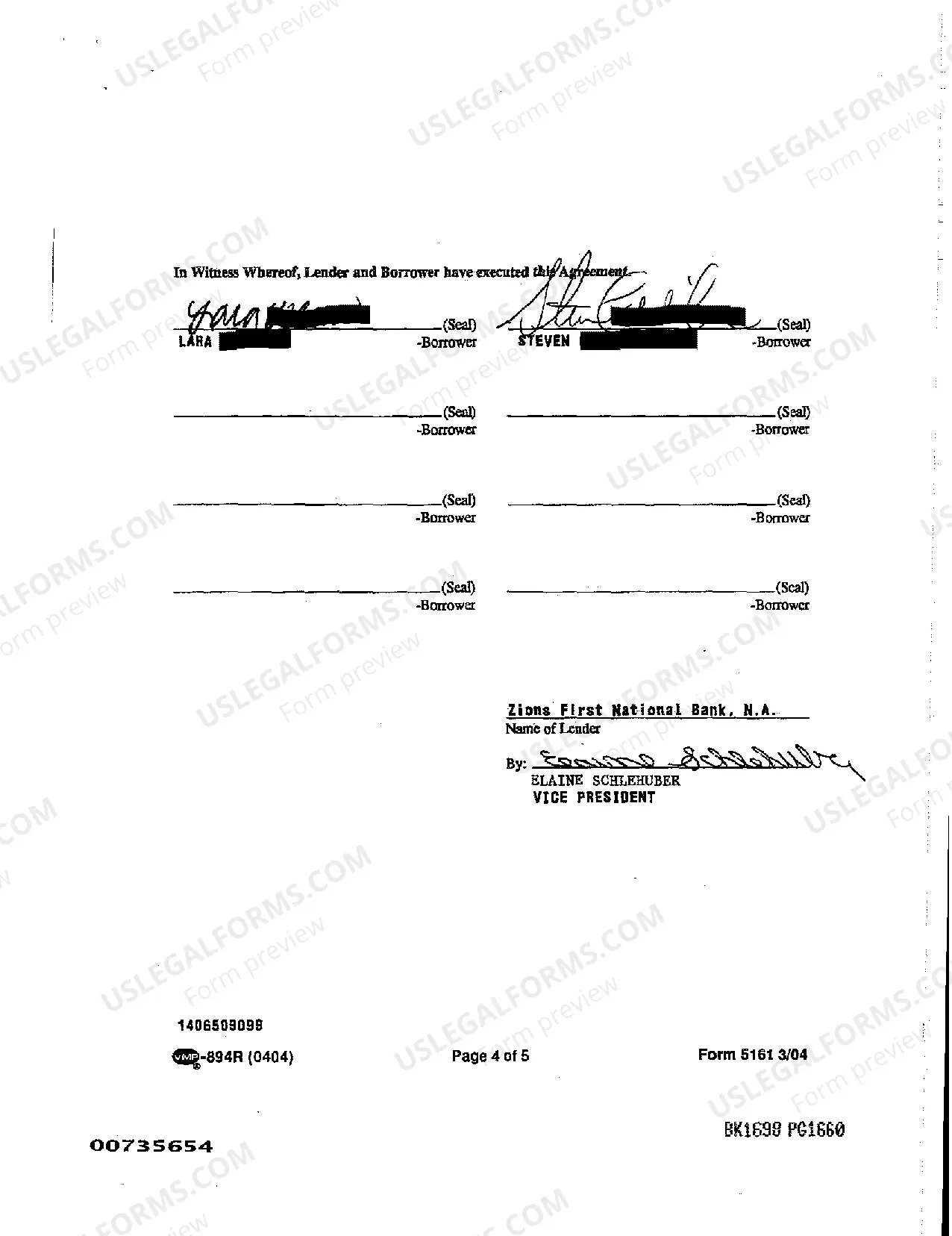

A West Jordan Utah Loan Modification Agreement — To a Fixed Interest Rate is a legal and financial agreement between a borrower and a lender that aims to modify the terms of an existing loan. The purpose of this agreement is to change the interest rate from a variable or adjustable rate to a fixed rate, providing stability and predictability to the borrower's monthly payments. By opting for a loan modification agreement with a fixed interest rate in West Jordan Utah, borrowers can protect themselves from future interest rate fluctuations that could result in higher monthly payments. This type of agreement is particularly beneficial for homeowners who have adjustable-rate mortgages (ARM's) and wish to secure a more stable financial situation. The West Jordan Utah Loan Modification Agreement — To a Fixed Interest Rate offers various advantages for borrowers. First and foremost, it provides peace of mind, as homeowners can plan their monthly budgets without worrying about sudden spikes in mortgage payments. Additionally, this agreement can lead to long-term savings, especially if the fixed interest rate is lower than the original adjustable rate. There are different types of West Jordan Utah Loan Modification Agreements — To a Fixed Interest Rate available to borrowers, depending on their specific circumstances and needs. Some common variations include: 1. Standard Fixed-Rate Modification: This agreement replaces the existing loan terms with a new fixed interest rate, typically lower than the original adjustable rate, providing stability and potential savings for the borrower. 2. Temporary Fixed-Rate Modification: In some cases, lenders may offer a temporary fixed-rate modification, which applies for a specific period, such as one to three years. After this period, the interest rate may revert to an adjustable rate or undergo another modification. 3. Streamlined Fixed-Rate Modification: This type of loan modification agreement is typically available to borrowers who are current on their mortgage payments but facing financial hardship. It aims to simplify the modification process by requiring less documentation and paperwork. It is important for borrowers who are considering a West Jordan Utah Loan Modification Agreement — To a Fixed Interest Rate to carefully evaluate the terms and conditions of the agreement before signing. Consulting with a qualified loan modification attorney or financial advisor can provide valuable insights and ensure all legal aspects are understood and accounted for. In conclusion, a West Jordan Utah Loan Modification Agreement — To a Fixed Interest Rate offers homeowners the opportunity to convert an adjustable-rate mortgage into a more stable and predictable fixed-rate mortgage. This agreement provides financial security, potential cost savings, and peace of mind for borrowers in West Jordan, Utah.

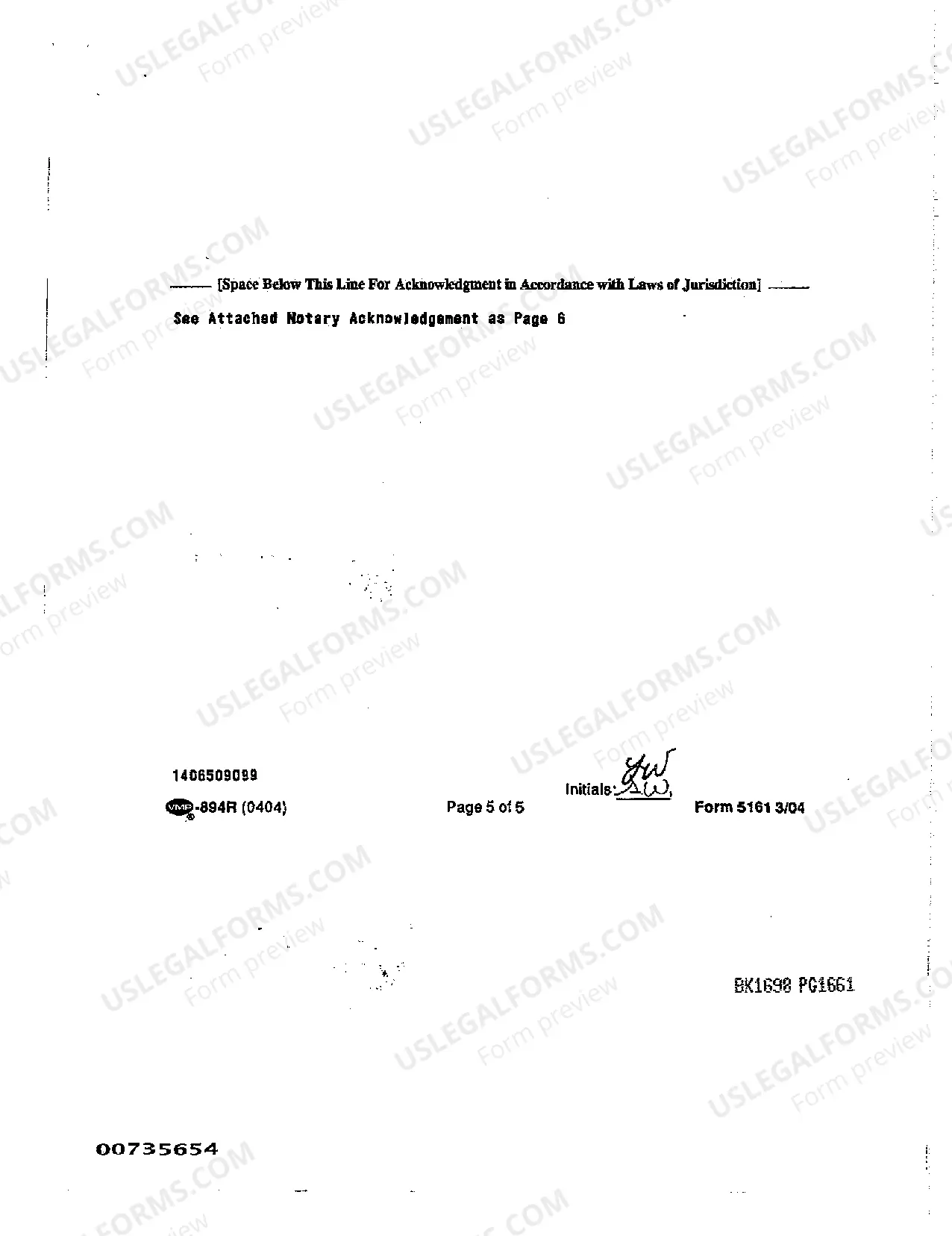

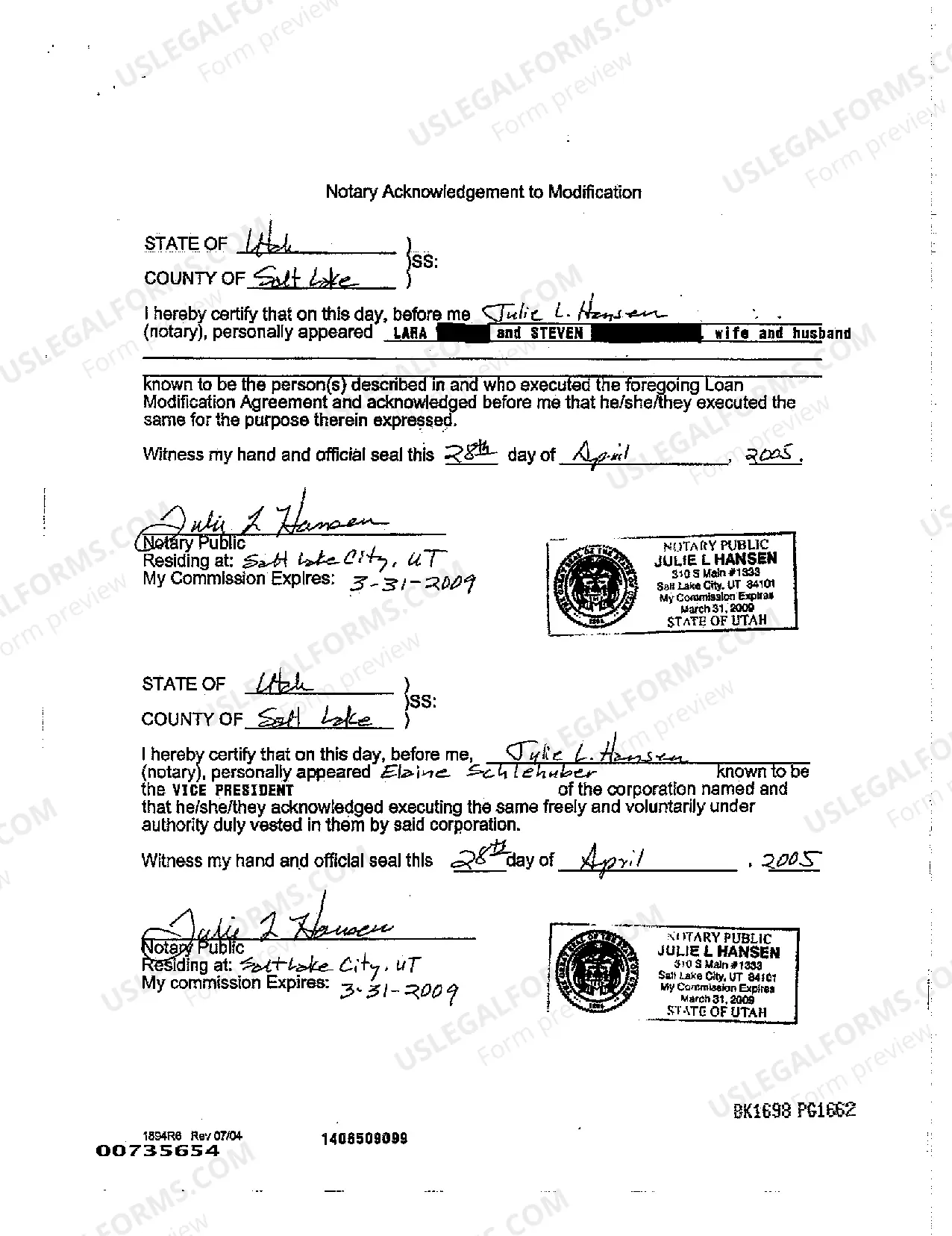

West Jordan Utah Loan Modification Agreement - To a Fixed Interest Rate

Description

How to fill out West Jordan Utah Loan Modification Agreement - To A Fixed Interest Rate?

Make use of the US Legal Forms and obtain immediate access to any form template you require. Our useful website with thousands of documents makes it easy to find and get almost any document sample you want. You can export, complete, and certify the West Jordan Utah Loan Modification Agreement - To a Fixed Interest Rate in just a few minutes instead of surfing the Net for several hours searching for an appropriate template.

Utilizing our library is a wonderful strategy to increase the safety of your form submissions. Our experienced legal professionals on a regular basis review all the records to ensure that the templates are relevant for a particular region and compliant with new laws and regulations.

How do you get the West Jordan Utah Loan Modification Agreement - To a Fixed Interest Rate? If you already have a profile, just log in to the account. The Download option will be enabled on all the samples you view. Furthermore, you can find all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, stick to the tips below:

- Find the template you need. Ensure that it is the form you were hoping to find: check its headline and description, and make use of the Preview feature if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the downloading procedure. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Save the document. Indicate the format to get the West Jordan Utah Loan Modification Agreement - To a Fixed Interest Rate and revise and complete, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy form libraries on the web. Our company is always ready to assist you in virtually any legal procedure, even if it is just downloading the West Jordan Utah Loan Modification Agreement - To a Fixed Interest Rate.

Feel free to take full advantage of our service and make your document experience as convenient as possible!

Form popularity

FAQ

Some loan modifications are a debt settlement, and it can affect your credit depending on your the type of program in which you enroll. Debt settlement will hurt your credit score, even if there is an agreement with the lender.

Modifications Could be Reported as Debt Settlement Many lenders will report modifications to the credit bureaus as debt settlement, or adjustment to the terms of your loan. This could show as a failure to stick to the original terms, which will, in the short term, would harm your score.

A modification involves one or more of the following: Extending the term of the mortgage (e.g., from a 30-year term to a 40-year term) Reducing the interest rate. Adding any past-due amounts, such as interest and escrow, to the unpaid principal balance, which is then reamortized over the new term.

Most other negative information, including foreclosures, short sales, and loan modifications (if they're reported negatively), will remain on your credit report for seven years.

The disadvantages of a loan modification include the possibility that you will end up paying more over time to repay the loan. The total you owe may even be more than your house is worth in some cases. In addition, you may pay extra fees to modify a loan or incur tax liability.

Loan modifications are a long-term mortgage relief option for borrowers experiencing financial hardship, such as loss of income due to illness. A modification typically changes the loan's rate or term (or both) to make monthly payments more affordable.

Obtaining a loan modification can also hurt your credit. It will show up on your credit report, and it may lower your credit score, which can affect your ability to get another loan in the future. Loan modifications are also complex, time-consuming, and carry the risk of scams.

A modification involves one or more of the following: Extending the term of the mortgage (e.g., from a 30-year term to a 40-year term) Reducing the interest rate. Adding any past-due amounts, such as interest and escrow, to the unpaid principal balance, which is then reamortized over the new term.

A loan modification can change the principal of the loan, the interest rate, and other terms to make the loan more affordable. However, a lender must agree to the loan modification, which means borrowers must negotiate with them.