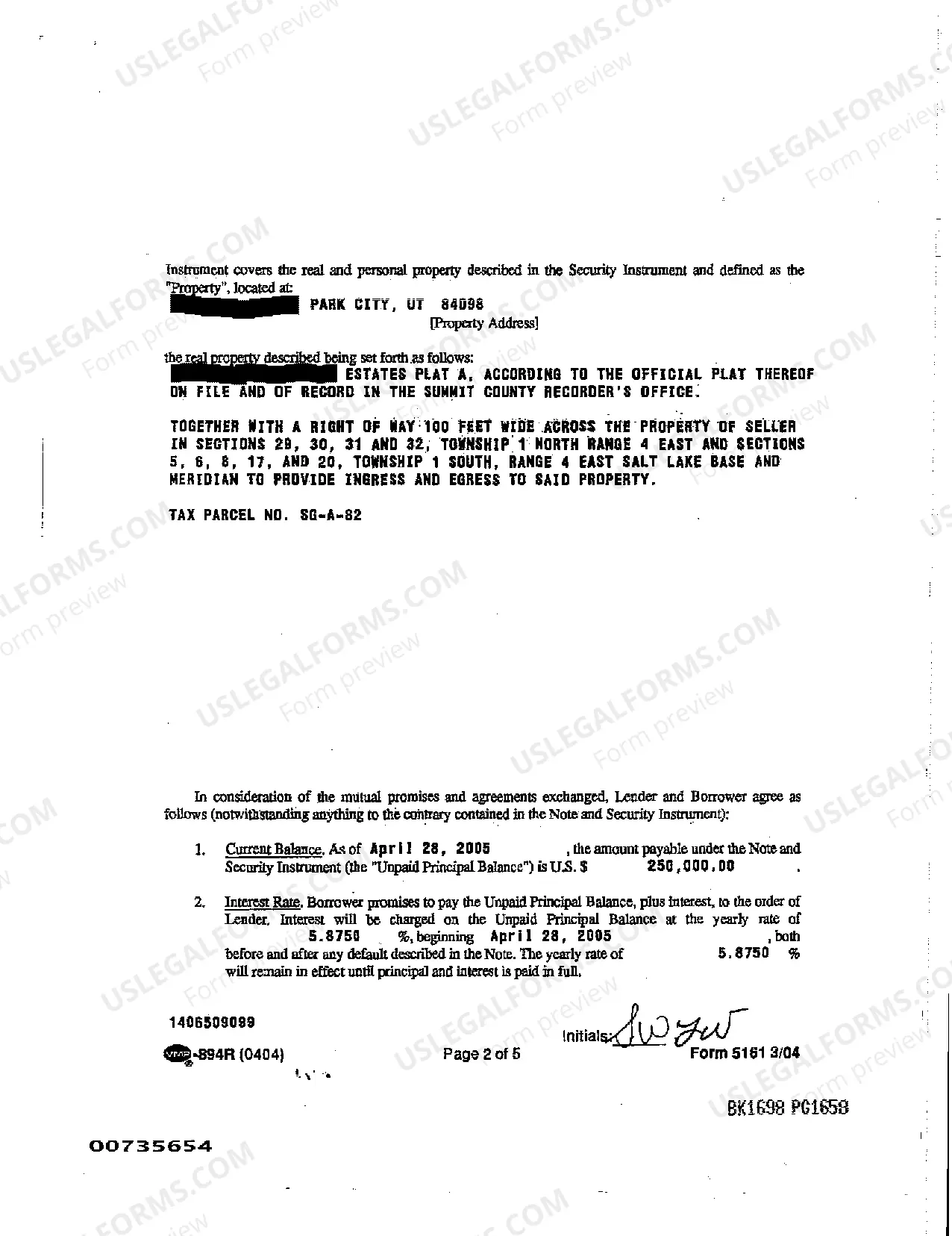

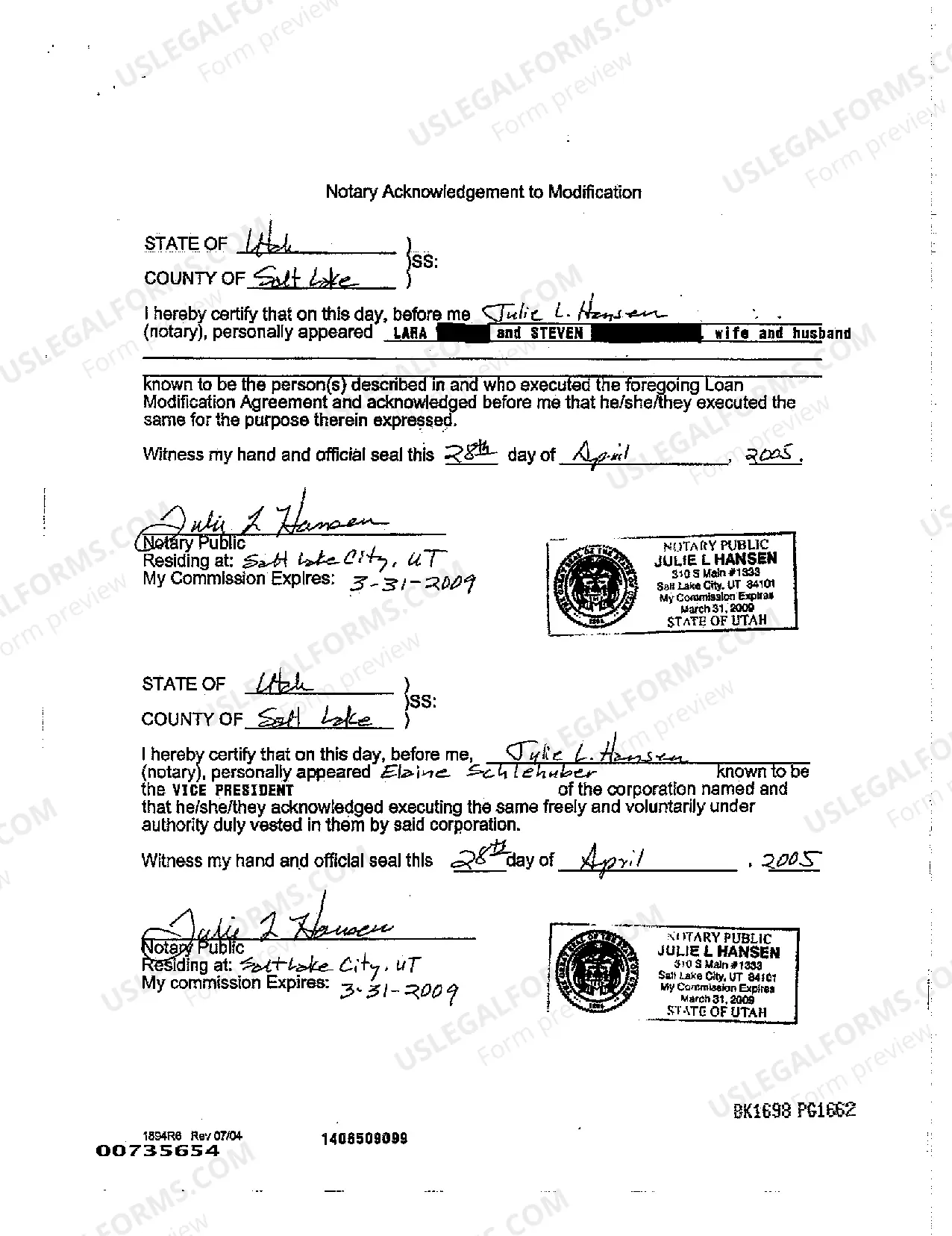

A West Valley City Utah Loan Modification Agreement — To a Fixed Interest Rate refers to a legal contract that allows borrowers in West Valley City, Utah, to change the terms of their existing mortgage loans in order to secure a fixed interest rate. Loan modifications are typically sought by borrowers who are struggling to make their monthly mortgage payments or facing other financial hardships. By entering into this agreement, borrowers can negotiate with their lenders to alter the terms of their mortgage loans, specifically focusing on transitioning from an adjustable interest rate to a fixed interest rate. This provides borrowers with the advantage of having a predictable and consistent monthly payment amount throughout the loan term, rather than risking potential fluctuations in interest rates. The West Valley City Utah Loan Modification Agreement — To a Fixed Interest Rate may involve various types depending on the specific circumstances and needs of the borrower. Some common types include: 1. Standard Fixed-Rate Modification: This type of loan modification involves changing the existing adjustable interest rate to a fixed interest rate for the entire remaining loan term. Borrowers benefit from having a stable interest rate, knowing exactly how much their monthly mortgage payment will be. 2. Rate and Term Modification: In this type, borrowers negotiate with their lender to not only secure a fixed interest rate but also adjust other terms of their loan, such as the repayment period or loan balance. The main aim is to make the loan more affordable by fitting it better within the borrower's financial capacity. 3. Trial Loan Modification: This type of modification is typically offered as a temporary solution to borrowers who are struggling to meet their mortgage payments. The lender approves a trial period with modified terms, which may include a fixed interest rate, allowing the borrower to demonstrate their ability to make regular payments. If successful, the trial modification can be converted into a permanent agreement. Ultimately, a West Valley City Utah Loan Modification Agreement — To a Fixed Interest Rate can provide homeowners with the opportunity to alleviate financial burdens and establish a more sustainable mortgage plan. It is essential for borrowers to carefully review and understand the terms and conditions of any loan modification agreement before signing to ensure it aligns with their specific needs and circumstances.

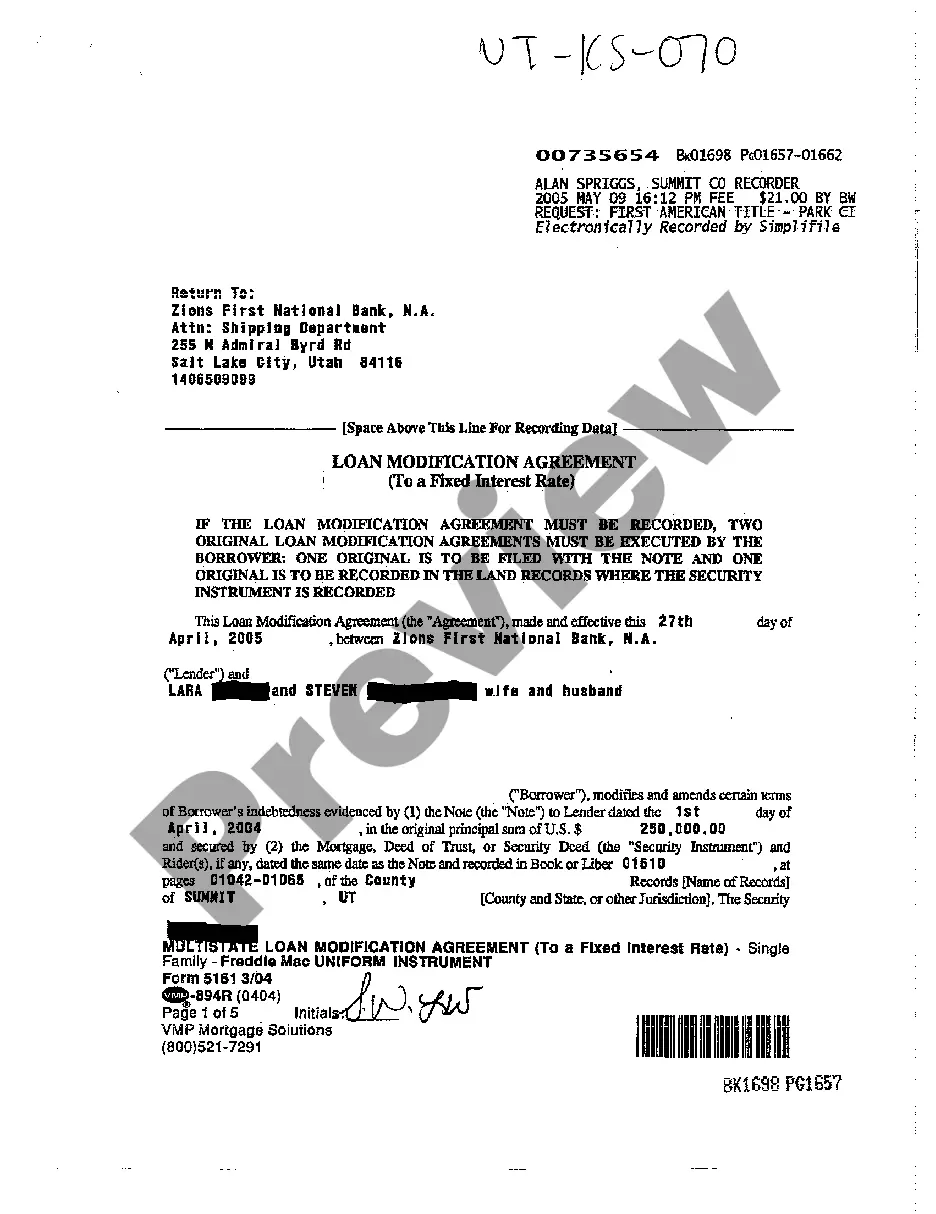

West Valley City Utah Loan Modification Agreement - To a Fixed Interest Rate

Description

How to fill out West Valley City Utah Loan Modification Agreement - To A Fixed Interest Rate?

If you are looking for a valid form template, it’s difficult to find a better place than the US Legal Forms website – one of the most extensive online libraries. Here you can find thousands of form samples for company and personal purposes by categories and states, or key phrases. Using our high-quality search function, finding the most up-to-date West Valley City Utah Loan Modification Agreement - To a Fixed Interest Rate is as elementary as 1-2-3. In addition, the relevance of each and every file is verified by a team of professional attorneys that on a regular basis review the templates on our website and update them according to the latest state and county regulations.

If you already know about our system and have an account, all you need to get the West Valley City Utah Loan Modification Agreement - To a Fixed Interest Rate is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have chosen the sample you require. Check its description and utilize the Preview function to explore its content. If it doesn’t suit your needs, use the Search option near the top of the screen to find the appropriate document.

- Affirm your selection. Select the Buy now option. Next, select your preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Make use of your credit card or PayPal account to finish the registration procedure.

- Get the form. Choose the format and download it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained West Valley City Utah Loan Modification Agreement - To a Fixed Interest Rate.

Each form you save in your profile does not have an expiry date and is yours forever. You can easily access them via the My Forms menu, so if you need to get an additional version for editing or printing, you can come back and save it once again anytime.

Make use of the US Legal Forms professional catalogue to gain access to the West Valley City Utah Loan Modification Agreement - To a Fixed Interest Rate you were looking for and thousands of other professional and state-specific templates in a single place!