The Provo Utah Application for Assessment and Taxation of Agriculture Land is a crucial process for farmers and landowners within the Provo, Utah area. This application is designed to accurately assess and determine the taxation on agricultural land within the region, considering its specific use for farming and agriculture. To complete the application, landowners need to provide detailed information about their agricultural land, including its size, location, soil conditions, water sources, crops or livestock being raised, and any other relevant factors that contribute to its agricultural productivity. This comprehensive information ensures that the assessment accurately reflects the land's market value and its intended use. The Provo Utah Application for Assessment and Taxation of Agriculture Land is necessary to establish fair and equitable taxation for farmers and maintain the agricultural land's productivity. By accurately assessing the value of agricultural land, property taxes can be levied in a way that supports the local farming community and ensures the sustainability of agricultural practices in Provo. Keyword: Provo Utah, Application for Assessment and Taxation, Agriculture Land, farmers, landowners, taxation, agricultural land, Provo, Utah area, assess, determine, accurate, soil conditions, water sources, crops, livestock, productivity, market value, intended use, fair and equitable taxation, farming community, sustainable agriculture, Provo. Different types of Provo Utah Application for Assessment and Taxation of Agriculture Land include: 1. Initial Assessment Application: This type of application is for farmers or landowners who are seeking to have their agricultural land assessed for the first time. It involves providing all the necessary information and documentation required to establish the land's value and determine its taxation. 2. Renewal Application: A renewal application is for farmers or landowners who have previously applied for assessment and taxation and are now seeking to renew the process. This type of application requires updating any changes or improvements made to the agricultural land and ensuring the continued accuracy of the assessment. 3. Exemption Application: In certain cases, there may be exemptions available for agricultural land that meets specific criteria. The exemption application allows farmers or landowners to apply for tax exemptions if their land meets the requirements set by the local authorities. 4. Appeal Application: If a farmer or landowner disagrees with the assessment and taxation determined by the authorities, they can submit an appeal application. This application provides an opportunity to challenge the initial assessment and present additional evidence or information to support a different valuation of the agricultural land. Keywords: Initial Assessment Application, Renewal Application, Exemption Application, Appeal Application, farmers, landowners, assessed, taxation, documentation, value, renew, changes, improvements, accuracy, exemptions, criteria, appeal, authorities, evidence, valuation.

Provo Utah Application for Assessment and Taxation of Agriculture Land

Description

How to fill out Provo Utah Application For Assessment And Taxation Of Agriculture Land?

Utilize US Legal Forms and gain immediate access to any form sample you desire.

Our helpful website, containing a vast array of templates, streamlines the process of locating and acquiring nearly any document sample you require.

You can download, complete, and sign the Provo Utah Application for Assessment and Taxation of Agriculture Land in just a few minutes rather than spending hours online searching for a suitable template.

Using our catalog is an excellent method to enhance the security of your document submission.

If you do not have an account yet, follow the steps outlined below.

Locate the form you need. Ensure it is the template you are seeking: verify its title and description, and utilize the Preview function if available. If not, employ the Search box to find the correct one.

- Our experienced attorneys routinely evaluate all documents to ensure that the templates are pertinent to a specific region and compliant with current laws and regulations.

- How can you obtain the Provo Utah Application for Assessment and Taxation of Agriculture Land.

- If you possess an account, simply Log In to your profile.

- The Download feature will be activated for all documents you view.

- Moreover, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

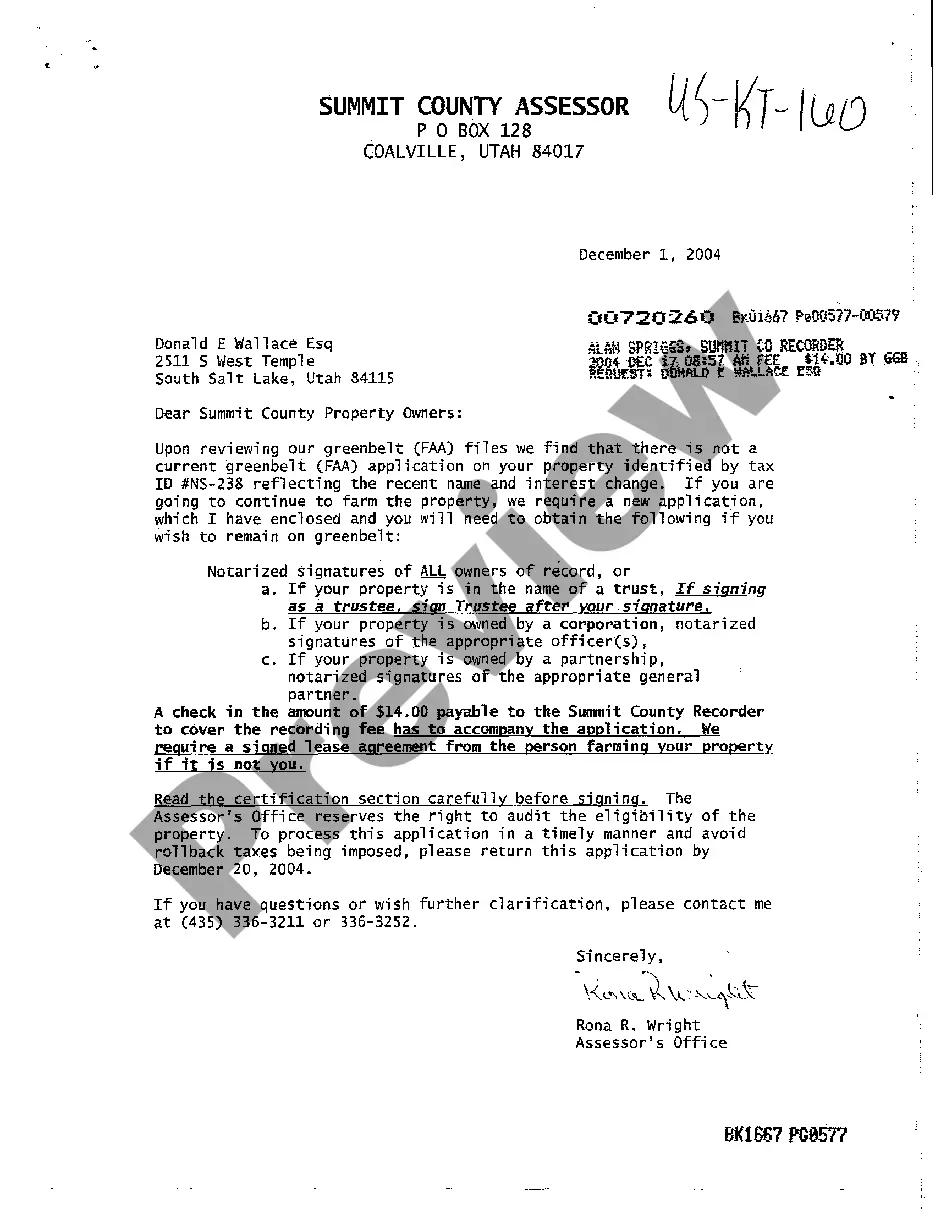

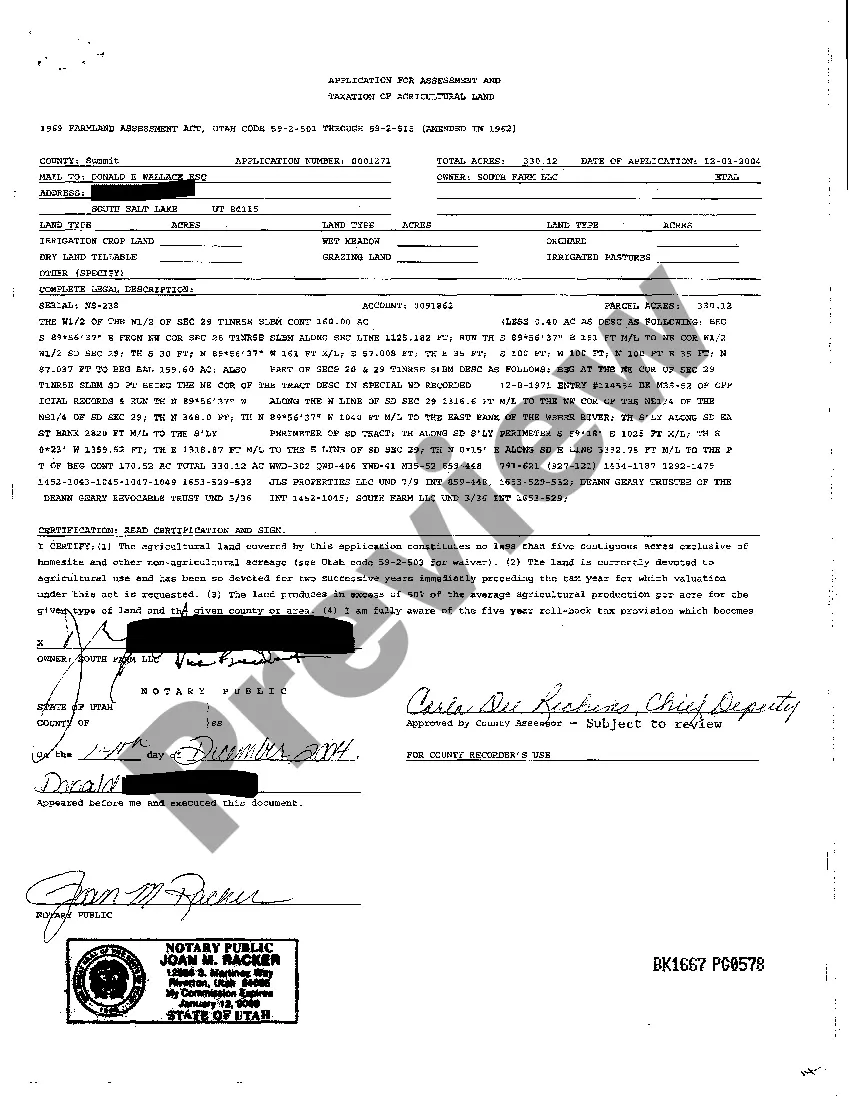

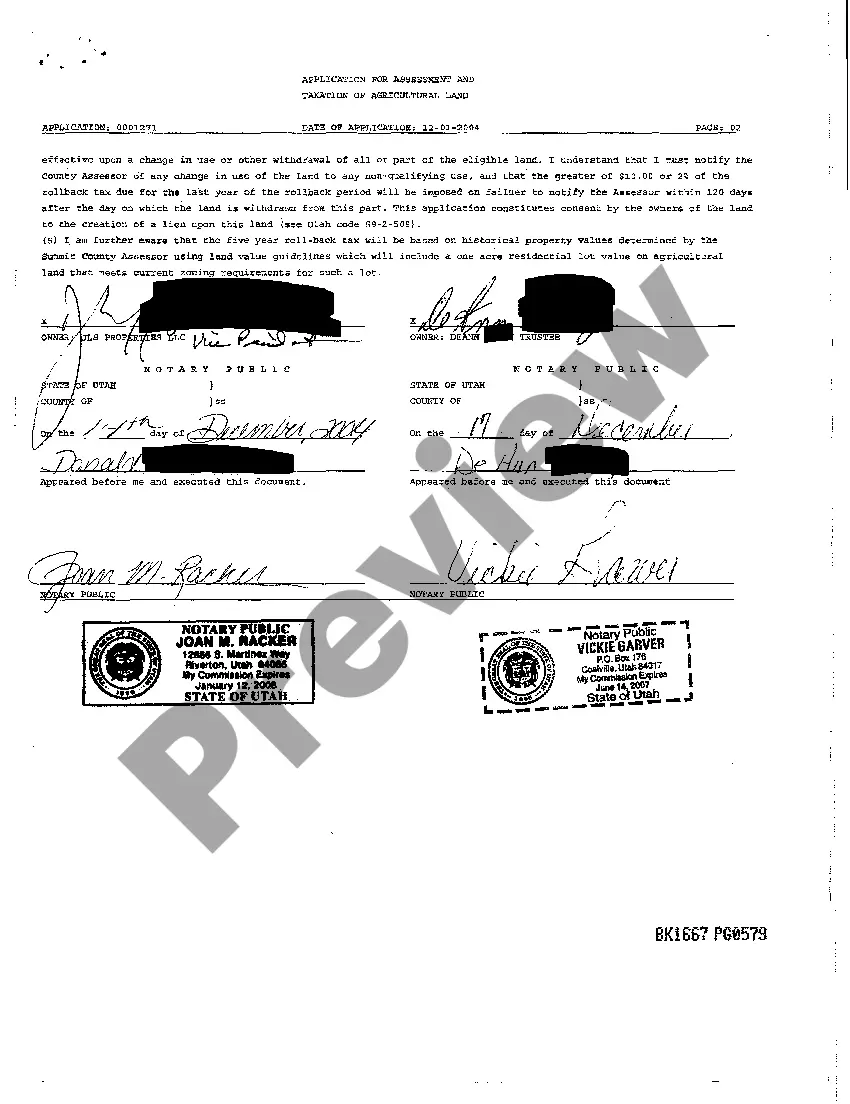

In Utah, the requirements for a greenbelt designation include using your land primarily for agricultural production. You must submit the Provo Utah Application for Assessment and Taxation of Agriculture Land to apply for this designation. Additionally, your land must meet specific criteria, such as size and type of agricultural activity. Securing a greenbelt can significantly lower your property taxes, thereby making it vital for landowners interested in agricultural preservation.

The Utah Farmland Assessment Act provides guidelines for assessing agricultural land for tax purposes, ensuring fair treatment for farmers. This act enables landowners to apply for reduced tax assessments through the Provo Utah Application for Assessment and Taxation of Agriculture Land. By meeting specific criteria, farmers can benefit from lower property taxes while preserving their land for agricultural use. Understanding this act can greatly assist in financial planning for landowners.

To claim land as a farm on your taxes, you need to file the Provo Utah Application for Assessment and Taxation of Agriculture Land. This process allows you to benefit from a lower property tax rate applicable to agricultural lands. Ensure you provide all necessary documentation, including proof of agricultural activity and land use. Consulting with a tax professional can also help you navigate the application process more smoothly.

The Farmland Protection Policy Act aims to protect farmland from being converted to non-agricultural uses. This policy supports agricultural viability by promoting local farming interests and maintaining open spaces. If you are pursuing the Provo Utah Application for Assessment and Taxation of Agriculture Land, understanding this act can help you appreciate the importance of preserving agricultural land.

The Right to Farm Act in Utah protects farmers from nuisance lawsuits related to agricultural operations. This legislation ensures that farmers can continue their essential work without undue interference from urban development. For those completing the Provo Utah Application for Assessment and Taxation of Agriculture Land, this act provides necessary legal protections and promotes agricultural sustainability.

Building a house on greenbelt land in Utah can be challenging due to zoning laws and regulations surrounding agricultural land. Typically, greenbelt designation focuses on preserving agricultural use, which may restrict residential development. If you're considering the Provo Utah Application for Assessment and Taxation of Agriculture Land, it's wise to check local regulations to understand what is permitted on your land while ensuring compliance with any requirements.