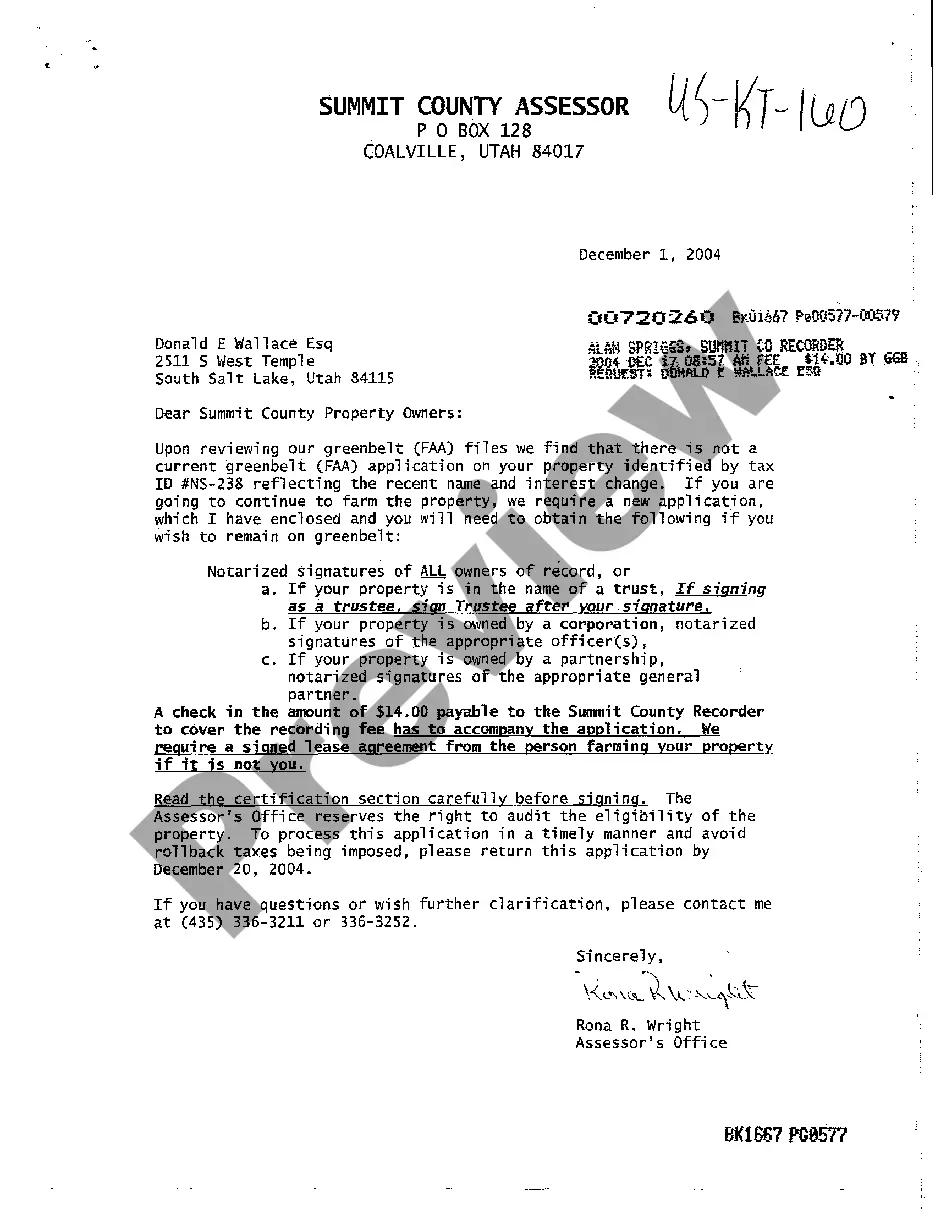

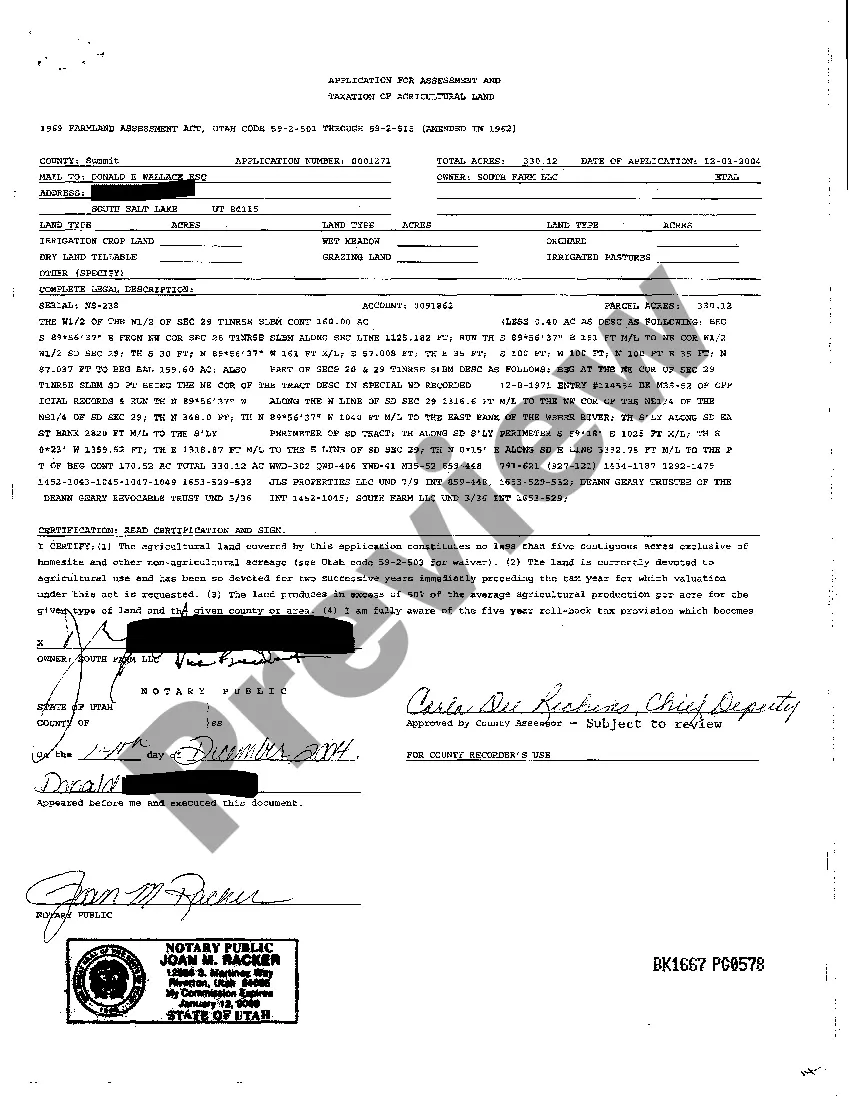

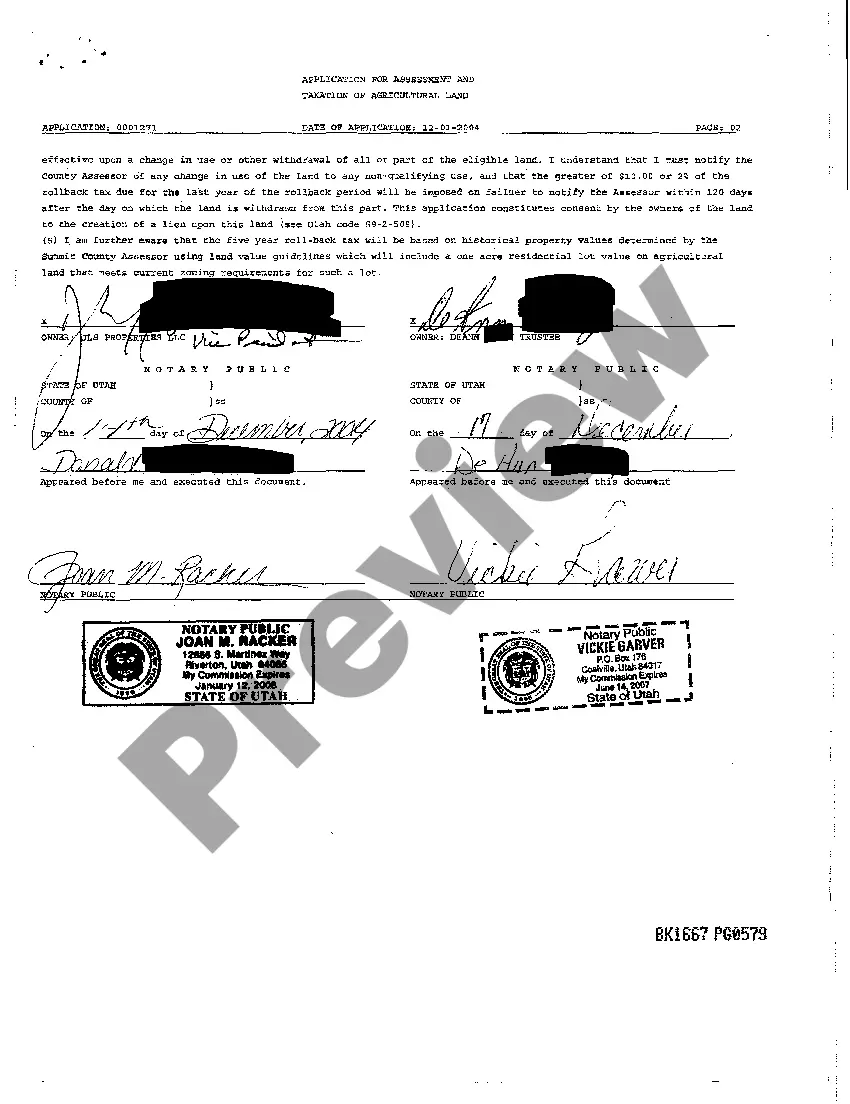

The Salt Lake Utah Application for Assessment and Taxation of Agriculture Land is a crucial process aimed at determining the appropriate assessment and taxation rates for agricultural properties in Salt Lake, Utah. This application is designed to provide fair and accurate valuation methods for different types of agricultural land, ensuring that property owners are taxed appropriately based on their land's agricultural use. The Salt Lake Utah Application for Assessment and Taxation of Agriculture Land takes into account various factors such as land productivity, irrigation systems, crop yields, and overall agricultural value. By considering these factors, the application helps determine the assessed value of the agricultural land for taxation purposes. Different types of Salt Lake Utah Applications for Assessment and Taxation of Agriculture Land may include: 1. Crop Land Application: This type of application involves assessing and taxing agricultural land primarily used for crop production. It takes into account factors such as soil quality, crop yields, and irrigation systems to accurately value the land. 2. Livestock Application: This type of application focuses on assessing and taxing agricultural land primarily used for raising livestock. Factors such as the number and type of livestock, available grazing areas, and animal husbandry practices are considered to determine the land's assessed value. 3. Orchard and Vineyard Application: This application is specific to agricultural land used for orchard or vineyard purposes. Factors such as the type of crops, fruit yield, quality of the trees or vines, and irrigation methods employed are considered to assess and tax the land accurately. 4. Greenhouse Application: For agricultural land utilized for greenhouse farming, this application considers factors such as the size and number of greenhouses, plant productivity, and crop types grown. This assessment helps determine the appropriate taxation rates for greenhouse farmers. It is important for property owners engaged in agricultural activities in Salt Lake, Utah to complete the Salt Lake Utah Application for Assessment and Taxation of Agriculture Land accurately and submit it within the designated timeframe. By doing so, landowners can ensure a fair assessment and taxation process that reflects the agricultural value of their land.

Salt Lake Utah Application for Assessment and Taxation of Agriculture Land

Description

How to fill out Salt Lake Utah Application For Assessment And Taxation Of Agriculture Land?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Salt Lake Utah Application for Assessment and Taxation of Agriculture Land becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Salt Lake Utah Application for Assessment and Taxation of Agriculture Land takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve chosen the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Salt Lake Utah Application for Assessment and Taxation of Agriculture Land. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!