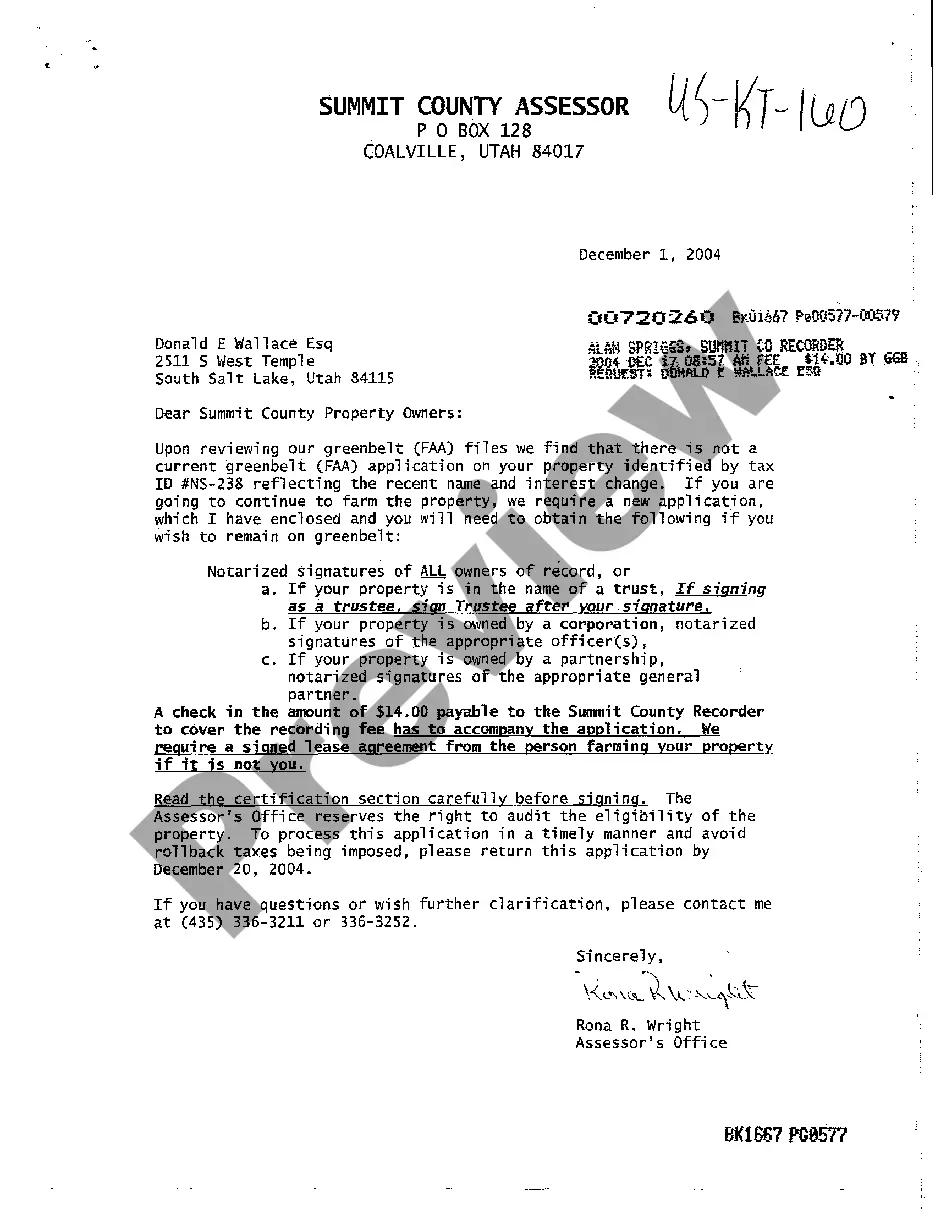

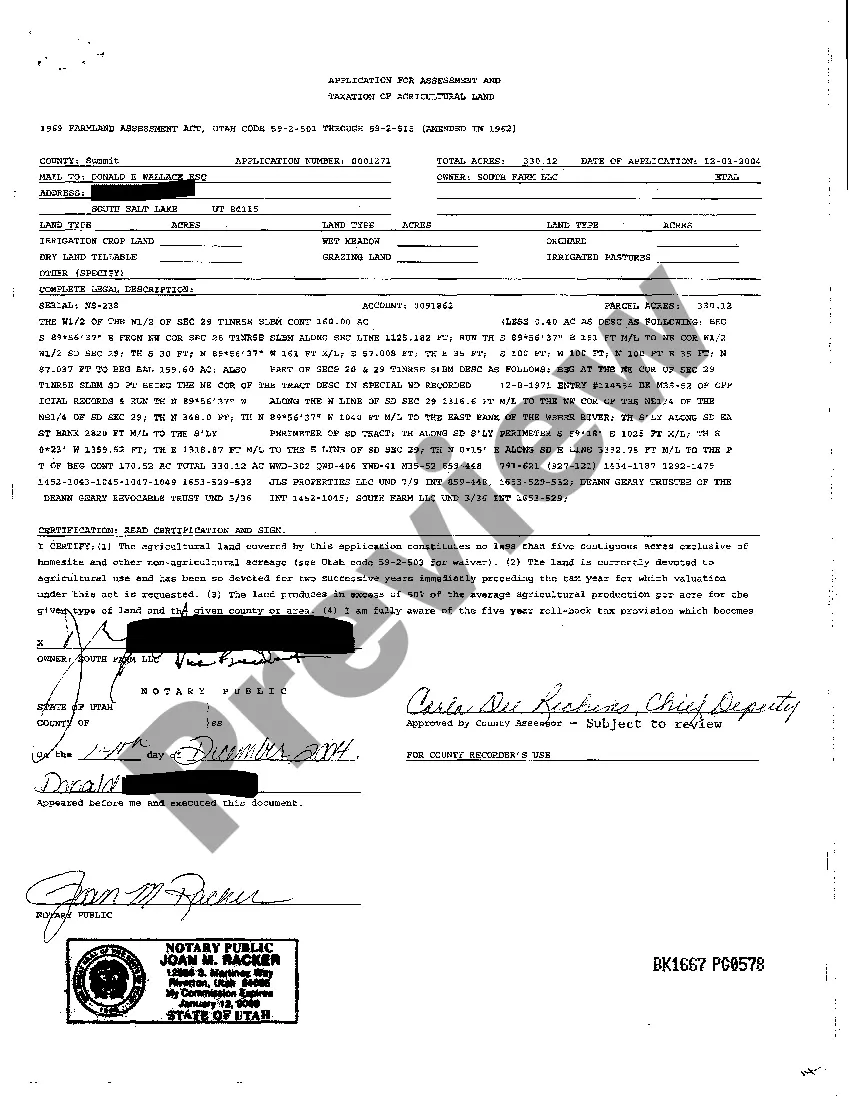

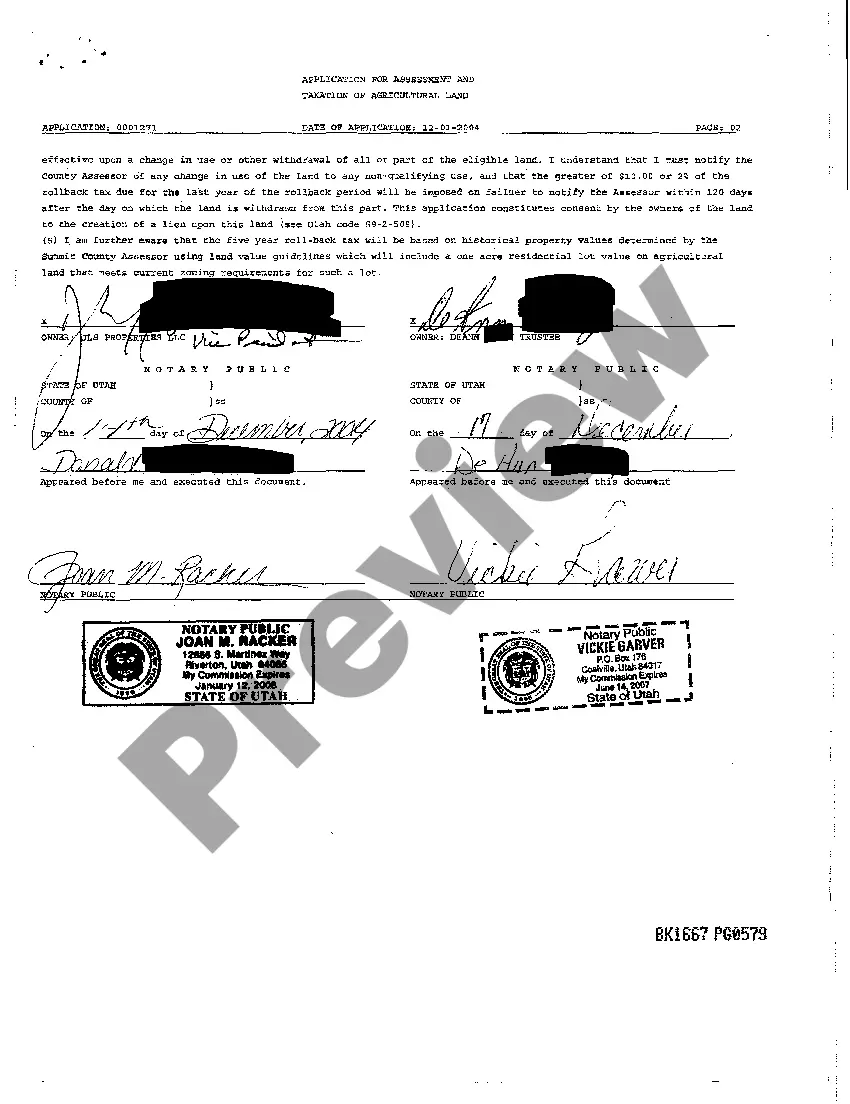

Title: Salt Lake City Utah Application for Assessment and Taxation of Agriculture Land: A Comprehensive Guide Introduction: The Salt Lake City Utah Application for Assessment and Taxation of Agriculture Land is a vital process used to assess and tax agricultural properties located within the city. This detailed description will provide key insights into this application, its significance, and various types of applications catering to specific agricultural land types. Keywords: Salt Lake City, Utah, Application, Assessment, Taxation, Agriculture Land 1. Understanding the Purpose and Significance: The Salt Lake City Utah Application for Assessment and Taxation of Agriculture Land serves as a critical tool to determine the proper assessment and taxation of agricultural properties within the city limits. This process ensures that agriculture landowners are fairly taxed based on their land's specific characteristics and usage, thereby promoting accurate tax assessments and equitable tax rates. 2. Types of Salt Lake City Utah Applications for Assessment and Taxation of Agriculture Land: a) General Agricultural Land Application: This application is designed for assessing and taxing agricultural lands used for typical farming activities, including crop cultivation, livestock raising, orchards, and other similar agricultural operations. It caters to a wide range of farm types and requires detailed information on land acreage, crops, irrigation systems, livestock, and any additional features or structures. b) Specialty Crop Production Application: This specific application is intended for assessing and taxing specialized agricultural lands engaged in growing high-value crops such as nursery plants, greenhouse production, horticulture, or vineyards. It may require additional information related to irrigation techniques, greenhouse facilities, specialized equipment, or crop-specific details. c) Agroforestry and Forestry Application: For agricultural lands where forestry practices or agroforestry techniques are predominantly employed, this particular application is utilized. Landowners are required to provide data on tree species, forest management plans, timber production activities, agroforestry practices, or forest ecosystem services. Such information helps assessors to accurately evaluate and tax these properties. d) Livestock Production Application: Specifically designed for agricultural lands primarily used for livestock production such as cattle ranches, horse farms, or dairy operations. This application seeks details on animal types, population, grazing areas, facilities, and any additional factors relevant to the livestock industry to ensure proper assessment and taxation. e) Organic Farming and Sustainable Agriculture Application: This application is tailored to evaluate agricultural lands engaged in organic farming or sustainable agricultural practices. Information related to organic certification, soil improvement methods, water conservation, renewable energy utilization, and other sustainable practices are crucial for accurate assessment and taxation purposes. Conclusion: The Salt Lake City Utah Application for Assessment and Taxation of Agriculture Land provides a structured and comprehensive approach to assess and tax agricultural properties within the city. By offering separate applications based on land uses, such as general farming, specialty crop production, agroforestry, livestock production, and sustainable agriculture, the process ensures fairness, accuracy, and equity in taxation.

Salt Lake City Utah Application for Assessment and Taxation of Agriculture Land

Description

How to fill out Salt Lake City Utah Application For Assessment And Taxation Of Agriculture Land?

If you are searching for a valid form, it’s impossible to choose a more convenient service than the US Legal Forms website – one of the most extensive libraries on the web. Here you can find a large number of form samples for company and individual purposes by types and states, or keywords. Using our high-quality search function, discovering the latest Salt Lake City Utah Application for Assessment and Taxation of Agriculture Land is as easy as 1-2-3. Additionally, the relevance of every record is verified by a group of expert lawyers that on a regular basis review the templates on our website and update them in accordance with the latest state and county laws.

If you already know about our system and have a registered account, all you should do to receive the Salt Lake City Utah Application for Assessment and Taxation of Agriculture Land is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have discovered the form you require. Look at its description and utilize the Preview feature (if available) to explore its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to get the proper record.

- Confirm your selection. Choose the Buy now option. After that, pick your preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Receive the template. Indicate the format and download it to your system.

- Make adjustments. Fill out, revise, print, and sign the obtained Salt Lake City Utah Application for Assessment and Taxation of Agriculture Land.

Each template you add to your account does not have an expiration date and is yours forever. You always have the ability to gain access to them using the My Forms menu, so if you need to get an additional copy for editing or printing, feel free to return and export it once more anytime.

Take advantage of the US Legal Forms extensive catalogue to get access to the Salt Lake City Utah Application for Assessment and Taxation of Agriculture Land you were looking for and a large number of other professional and state-specific templates on a single website!