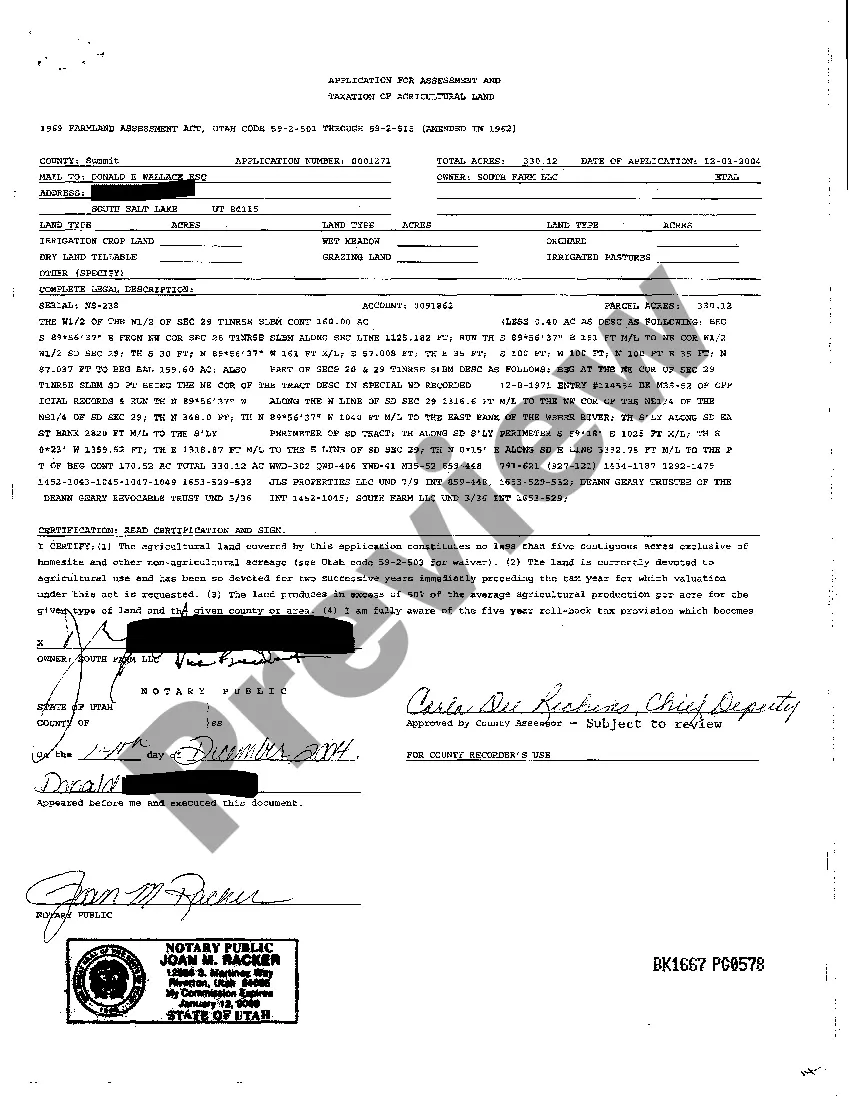

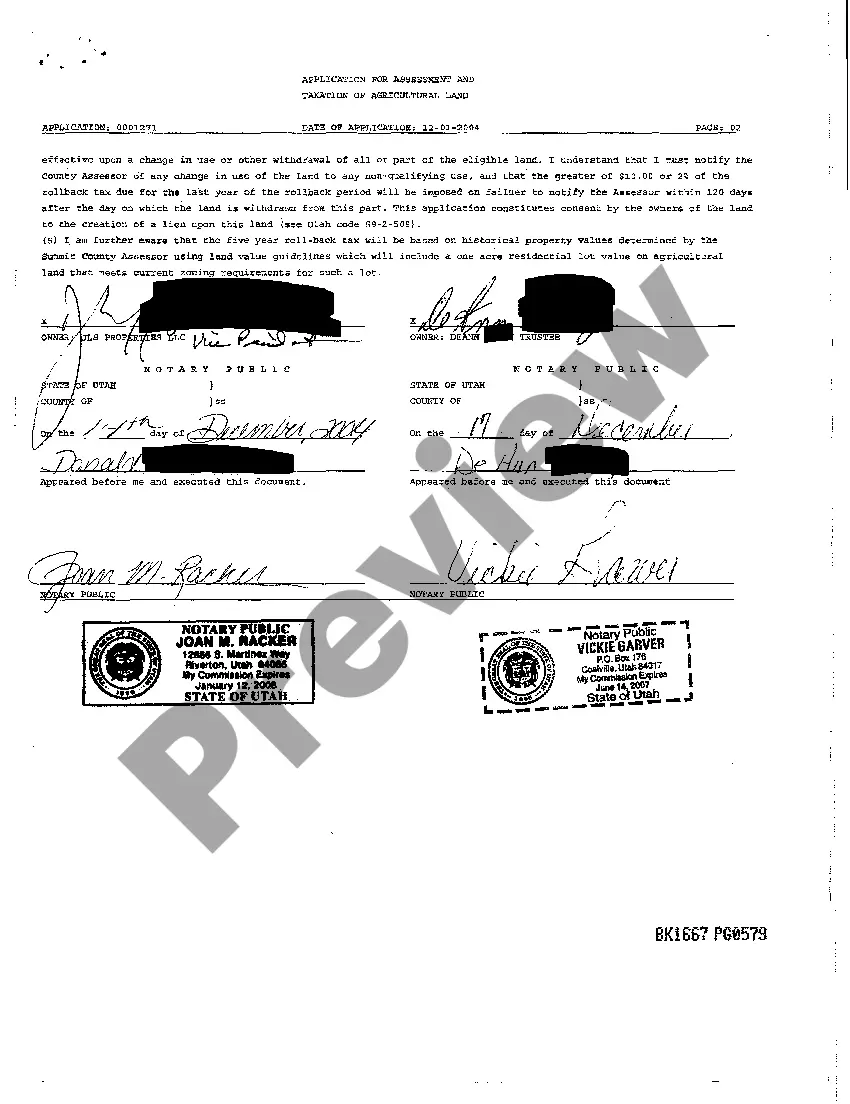

The West Jordan Utah Application for Assessment and Taxation of Agriculture Land is a crucial tool designed to provide assistance and support to farmers and agricultural landowners in West Jordan, Utah. This application serves as a means to accurately assess and determine the taxation rates applicable to agricultural properties, ensuring fair taxation practices and promoting the growth of the local agricultural sector. Keywords: West Jordan Utah, Application for Assessment and Taxation, Agriculture Land, farmers, agricultural landowners, taxation rates, fair taxation practices, local agricultural sector. By utilizing the West Jordan Utah Application for Assessment and Taxation of Agriculture Land, farmers and agricultural landowners can effectively evaluate and determine the appropriate taxation rates on their properties. This application helps in maintaining fairness in the property assessment process and ensures that agricultural landowners are not overburdened with excessive tax obligations. The West Jordan Utah Application for Assessment and Taxation of Agriculture Land provides a streamlined process for farmers to submit essential details and documentation related to their agricultural properties. This information includes specific aspects such as the size of the land, the crops or livestock being raised, irrigation systems, and any other relevant details. By providing accurate information through this application, farmers can receive a more precise assessment of their properties and, subsequently, fair taxation rates. This application helps the local tax authorities in West Jordan, Utah, to meticulously evaluate the agricultural land's productivity, the land's potential agricultural value, and other essential factors. By examining these aspects, the authorities can better understand the agricultural land's contribution to the local economy and make informed decisions regarding taxation. Furthermore, the West Jordan Utah Application for Assessment and Taxation of Agriculture Land may have additional variations or types to cater to different agricultural classifications within the area. Some possible variations of this application may include: 1. Application for Assessment and Taxation of Crop Farming Land: This particular variation is tailored specifically for farmers who primarily engage in crop cultivation. It may require additional details such as the types of crops grown, crop rotation practices, and soil fertility assessment. 2. Application for Assessment and Taxation of Livestock Farming Land: This variation is designed for farmers involved primarily in livestock breeding and animal husbandry. It may require information on the number and types of livestock reared, available grazing areas, and the sustainability of the livestock operation. 3. Application for Assessment and Taxation of Vineyards and Orchards: This variation caters specifically to farmers engaged in vineyard cultivation or orchard management. It may require details such as specific grape varieties or fruit tree species grown, acreage, and productivity metrics. In conclusion, the West Jordan Utah Application for Assessment and Taxation of Agriculture Land is an essential tool for farmers and agricultural landowners in West Jordan, Utah. By utilizing this application, farmers can ensure fair taxation practices and contribute to the growth and sustainability of the local agricultural sector.

West Jordan Utah Application for Assessment and Taxation of Agriculture Land

Description

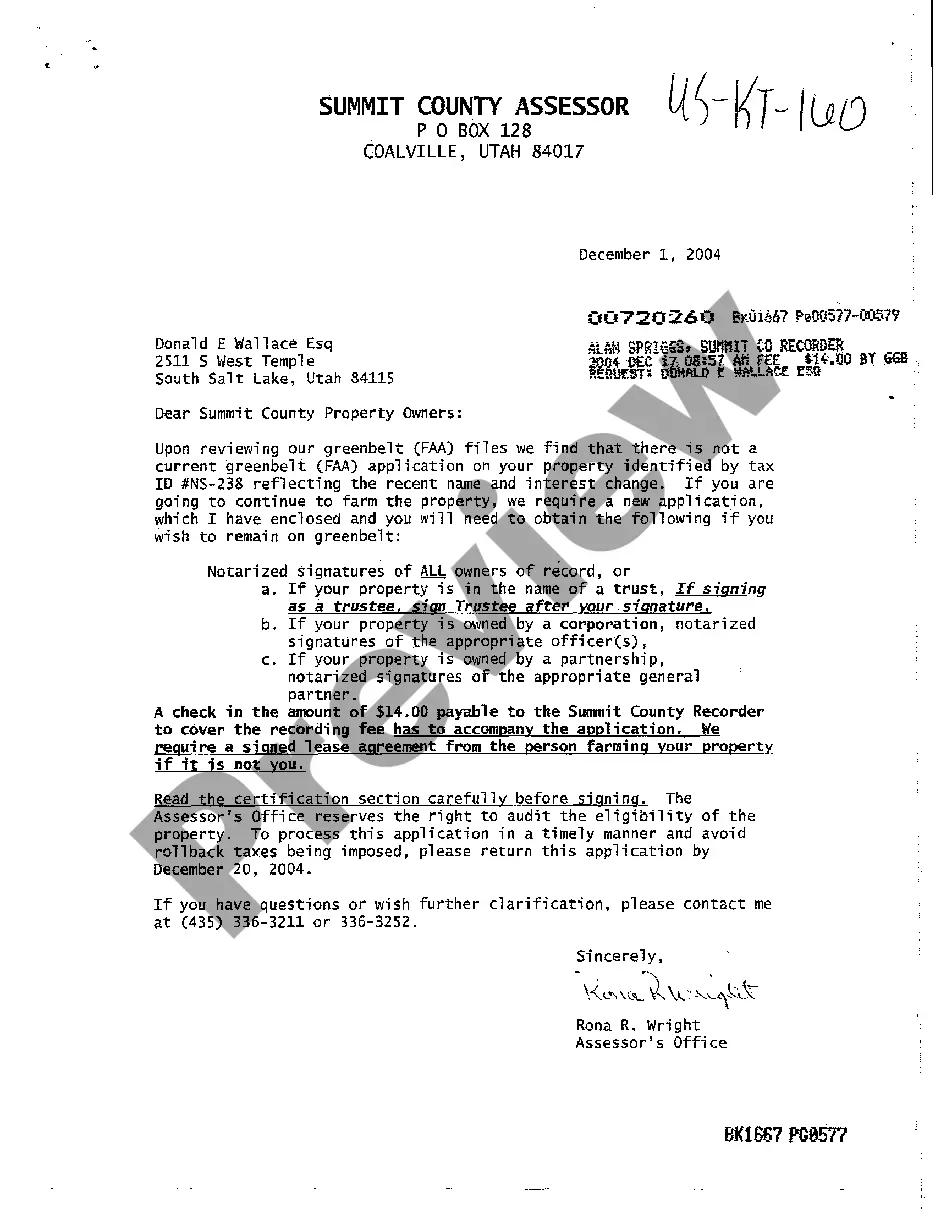

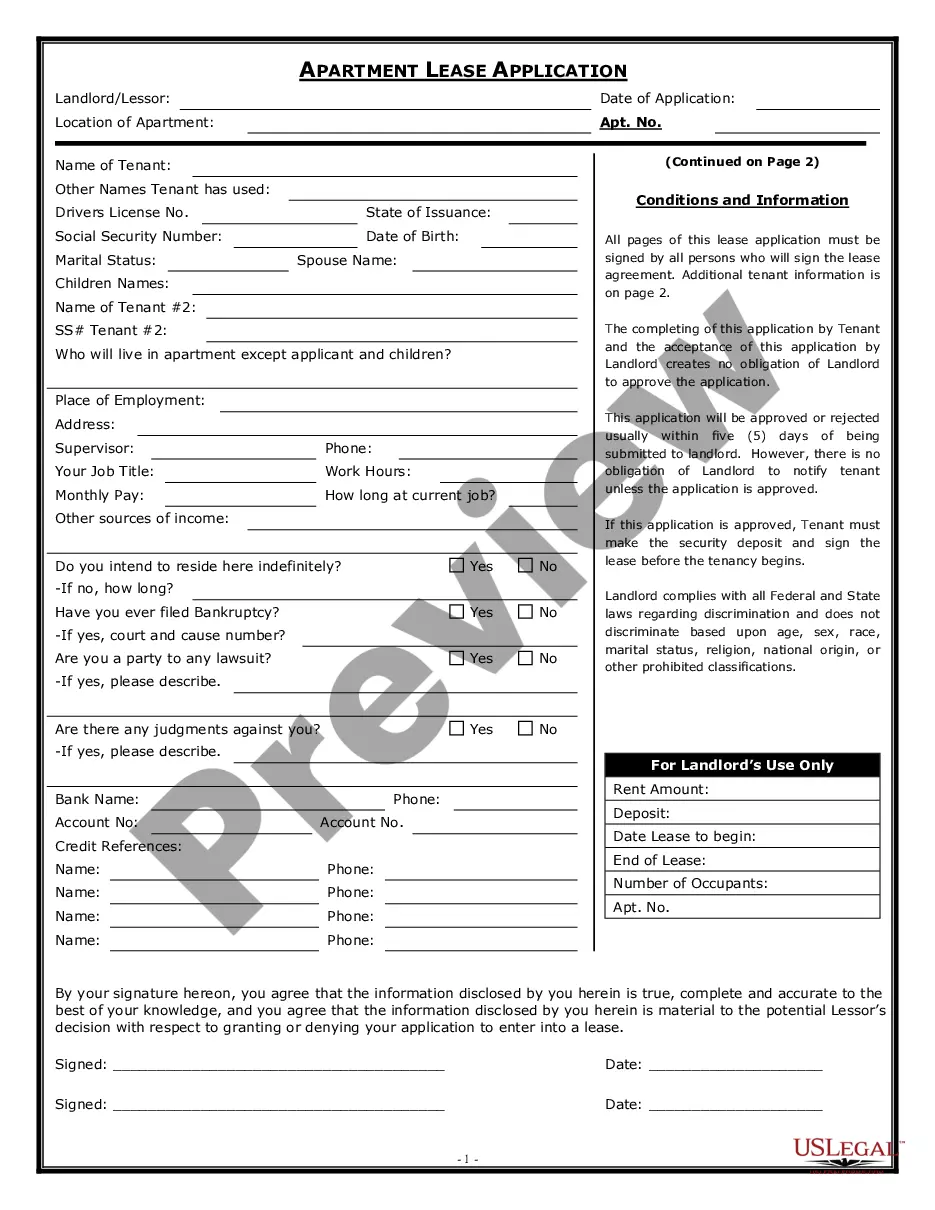

How to fill out West Jordan Utah Application For Assessment And Taxation Of Agriculture Land?

Make use of the US Legal Forms and get immediate access to any form you want. Our beneficial website with a large number of templates makes it easy to find and obtain virtually any document sample you want. You can export, fill, and certify the West Jordan Utah Application for Assessment and Taxation of Agriculture Land in a couple of minutes instead of browsing the web for several hours attempting to find an appropriate template.

Utilizing our catalog is a superb strategy to improve the safety of your form filing. Our experienced attorneys regularly review all the documents to ensure that the forms are relevant for a particular state and compliant with new laws and polices.

How do you obtain the West Jordan Utah Application for Assessment and Taxation of Agriculture Land? If you already have a subscription, just log in to the account. The Download button will be enabled on all the samples you look at. In addition, you can find all the earlier saved documents in the My Forms menu.

If you don’t have an account yet, stick to the instruction below:

- Open the page with the form you require. Make certain that it is the template you were looking for: examine its headline and description, and use the Preview option when it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the downloading procedure. Click Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Save the document. Select the format to obtain the West Jordan Utah Application for Assessment and Taxation of Agriculture Land and edit and fill, or sign it according to your requirements.

US Legal Forms is probably the most considerable and trustworthy document libraries on the web. Our company is always ready to assist you in virtually any legal procedure, even if it is just downloading the West Jordan Utah Application for Assessment and Taxation of Agriculture Land.

Feel free to benefit from our service and make your document experience as efficient as possible!

Form popularity

FAQ

Determining farmland value involves analyzing several factors, including the land's current use, potential income, and recent sales of similar properties. It may also require consultation with local appraisal professionals to obtain accurate valuations. The West Jordan Utah Application for Assessment and Taxation of Agriculture Land provides useful resources to assist you in understanding and determining the value of your agricultural land.

Farmland is appraised by assessing its value based on various criteria, including soil type, agricultural productivity, and market trends. Appraisal may also consider comparable sales of similar properties. The West Jordan Utah Application for Assessment and Taxation of Agriculture Land can facilitate this appraisal process, ensuring you follow local requirements.

The Utah Farmland Assessment Act provides guidelines for the fair taxation of agricultural land in the state. It aims to encourage agricultural production by establishing a more equitable assessment method based on the land's potential use. Understanding this act is essential, and referencing the West Jordan Utah Application for Assessment and Taxation of Agriculture Land can clarify your responsibilities.

When evaluating farmland, focus on soil health, water resources, and climate conditions. Additionally, research any existing zoning regulations or land use restrictions that may affect your investment. Using the West Jordan Utah Application for Assessment and Taxation of Agriculture Land can help you identify these key factors thoroughly.

Assessing farmland involves analyzing both physical characteristics and economic factors. Start by examining the land’s topography, soil conditions, and access to irrigation. Utilizing the West Jordan Utah Application for Assessment and Taxation of Agriculture Land can provide you with necessary tools and forms to streamline the assessment process.

To assess farmland effectively, you need to consider soil quality, water availability, and crop history. Additionally, evaluating the local market conditions and surrounding land use is crucial. The West Jordan Utah Application for Assessment and Taxation of Agriculture Land can help guide you through these considerations, ensuring your assessment aligns with state guidelines.

Yes, you can write off chickens on your taxes if you use them for agricultural purposes and can provide proof of expenses related to their care and maintenance. This includes costs for feed, shelter, and healthcare. Using the West Jordan Utah Application for Assessment and Taxation of Agriculture Land can help you organize your deductions and ensure you comply with local tax laws.

In Utah, greenbelt status requires that the land be actively used for agricultural purposes, accompanied by a minimum acreage requirement. The landowner must also submit an application and demonstrate that the property produces income through farming activities. The West Jordan Utah Application for Assessment and Taxation of Agriculture Land can guide you through this process and ensure your application meets the necessary criteria.

Yes, owning land can involve tax write-offs, particularly if the land is used for agricultural purposes. Deductions may be available for various expenses related to maintaining the property. To take advantage of these benefits, consider the West Jordan Utah Application for Assessment and Taxation of Agriculture Land, which provides valuable information on eligibility requirements.

To claim land as a farm on your taxes, you need to provide evidence that you are actively farming and that your land produces income. This includes submitting the appropriate forms and documentation to your tax authority. The West Jordan Utah Application for Assessment and Taxation of Agriculture Land can facilitate this process by giving you the tools to establish your land's agricultural classification.