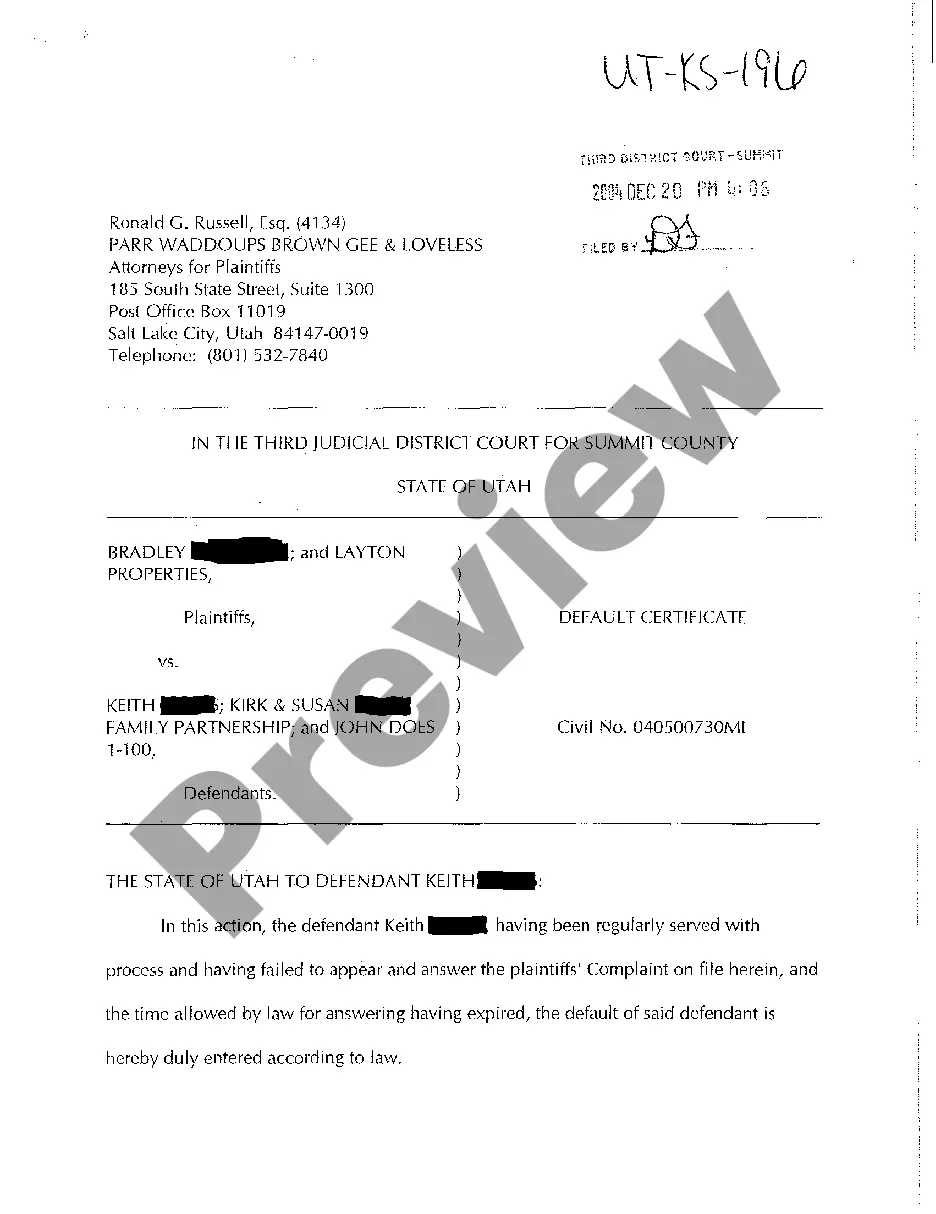

The West Jordan Utah Default Certificate is a legal document issued by the city of West Jordan, Utah, to indicate that a property or parcel of land has fallen into default on its tax payments. This certificate is typically issued after a property owner fails to pay their property taxes for a certain period of time. The purpose of the West Jordan Utah Default Certificate is to protect the local government's interest in collecting unpaid property taxes and to ensure that the property owner fulfills their obligations as a taxpayer. By issuing this certificate, the city has the authority to place a lien on the property, giving them the right to eventually sell it to recover the unpaid taxes. There are different types of West Jordan Utah Default Certificates, depending on the specific circumstances of the default. For instance, there may be a partial default certificate, which indicates that only a portion of the property taxes have gone unpaid. Alternatively, a full default certificate is issued when the property owner has failed to pay the entirety of their tax obligations. The West Jordan Utah Default Certificate is an important tool for the city in its efforts to maintain consistent revenue streams and ensure compliance with taxation laws. It serves as a warning to property owners who have neglected their tax responsibilities and alerts potential buyers or investors about the property's financial status. In summary, the West Jordan Utah Default Certificate is a legal document that signifies the default on property tax payments in West Jordan, Utah. It is issued to protect the city's interests, may come in both partial and full default variations, and ultimately enables the city to place a lien on the property for the purpose of recovering the unpaid taxes.

West Jordan Utah Default Certificate

Description

How to fill out West Jordan Utah Default Certificate?

If you are searching for a relevant form template, it’s impossible to find a more convenient service than the US Legal Forms website – one of the most considerable libraries on the internet. With this library, you can find a large number of form samples for organization and individual purposes by types and states, or key phrases. Using our high-quality search function, finding the most up-to-date West Jordan Utah Default Certificate is as elementary as 1-2-3. Moreover, the relevance of every file is proved by a group of expert lawyers that regularly review the templates on our platform and revise them according to the latest state and county laws.

If you already know about our platform and have a registered account, all you need to get the West Jordan Utah Default Certificate is to log in to your account and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have chosen the form you want. Look at its information and use the Preview function to check its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to find the appropriate file.

- Affirm your decision. Choose the Buy now option. After that, select the preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Receive the form. Choose the file format and download it on your device.

- Make changes. Fill out, revise, print, and sign the obtained West Jordan Utah Default Certificate.

Every form you save in your account has no expiration date and is yours forever. It is possible to access them via the My Forms menu, so if you need to receive an extra copy for editing or printing, feel free to come back and save it once again anytime.

Take advantage of the US Legal Forms professional collection to gain access to the West Jordan Utah Default Certificate you were seeking and a large number of other professional and state-specific templates on one website!