Salt Lake Utah Canceled Order of Sale Return refers to the process in which a foreclosure sale that was scheduled in Salt Lake City, Utah, is canceled or reversed. This cancellation may occur due to various reasons, such as the homeowner's successful negotiations with the lender, filing for bankruptcy, or the discovery of a legal error in the foreclosure proceedings. When a Salt Lake Utah Canceled Order of Sale Return occurs, it means that the homeowner retains ownership of the property, and the foreclosure process is halted. This can be a significant relief for homeowners who are at risk of losing their homes. There are different types of situations that may lead to a Salt Lake Utah Canceled Order of Sale Return: 1. Loan Modification: In some cases, homeowners in Salt Lake City, Utah, may be able to negotiate a loan modification with their lender. This process involves making changes to the existing loan terms, such as lowering the interest rate or extending the repayment period. If a loan modification is approved, the foreclosure sale may be canceled. 2. Bankruptcy Proceedings: Filing for bankruptcy can provide homeowners with temporary relief from foreclosure. When a homeowner files for bankruptcy, an automatic stay is implemented, which halts all collection efforts, including foreclosure proceedings. If the bankruptcy court decides to dismiss the foreclosure case, the order of sale may be canceled. 3. Legal Errors: Occasionally, mistakes or legal errors occur during the foreclosure process. These errors can range from improper notice to flaws in the documentation. If such errors are discovered, homeowners can challenge the foreclosure in court and request a cancellation of the order of sale. 4. Loss Mitigation Options: Homeowners in Salt Lake City, Utah, have access to various loss mitigation options provided by their lenders. This may include programs such as loan forbearance, short sale, or deed in lieu of foreclosure. If the homeowner successfully qualifies for one of these options, the order of sale can be canceled. It is important for homeowners facing foreclosure in Salt Lake City, Utah, to seek legal guidance and assistance to explore these options and determine if a canceled order of sale return is possible in their particular situation. By understanding their rights and available alternatives, homeowners can potentially avoid foreclosure and find a favorable resolution to their mortgage difficulties.

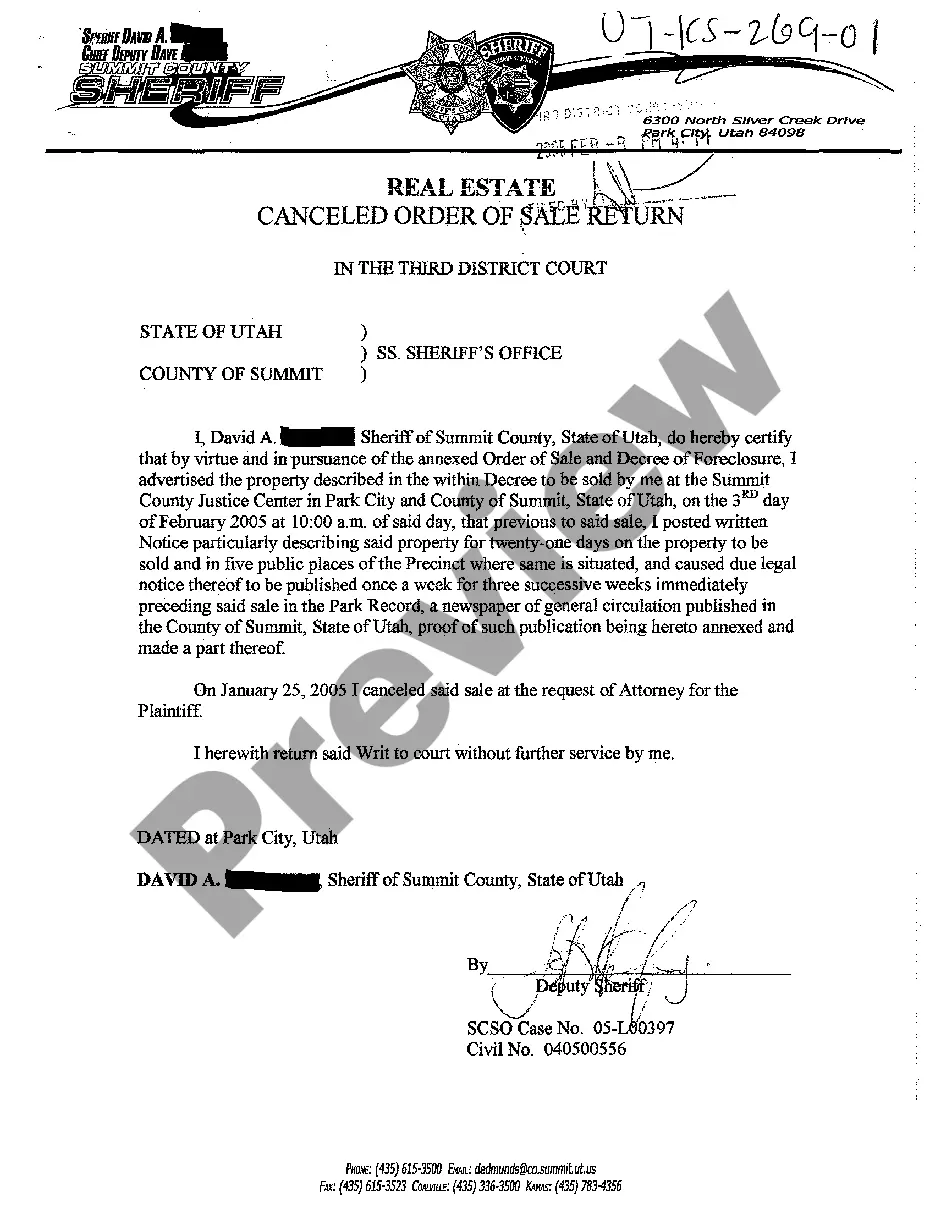

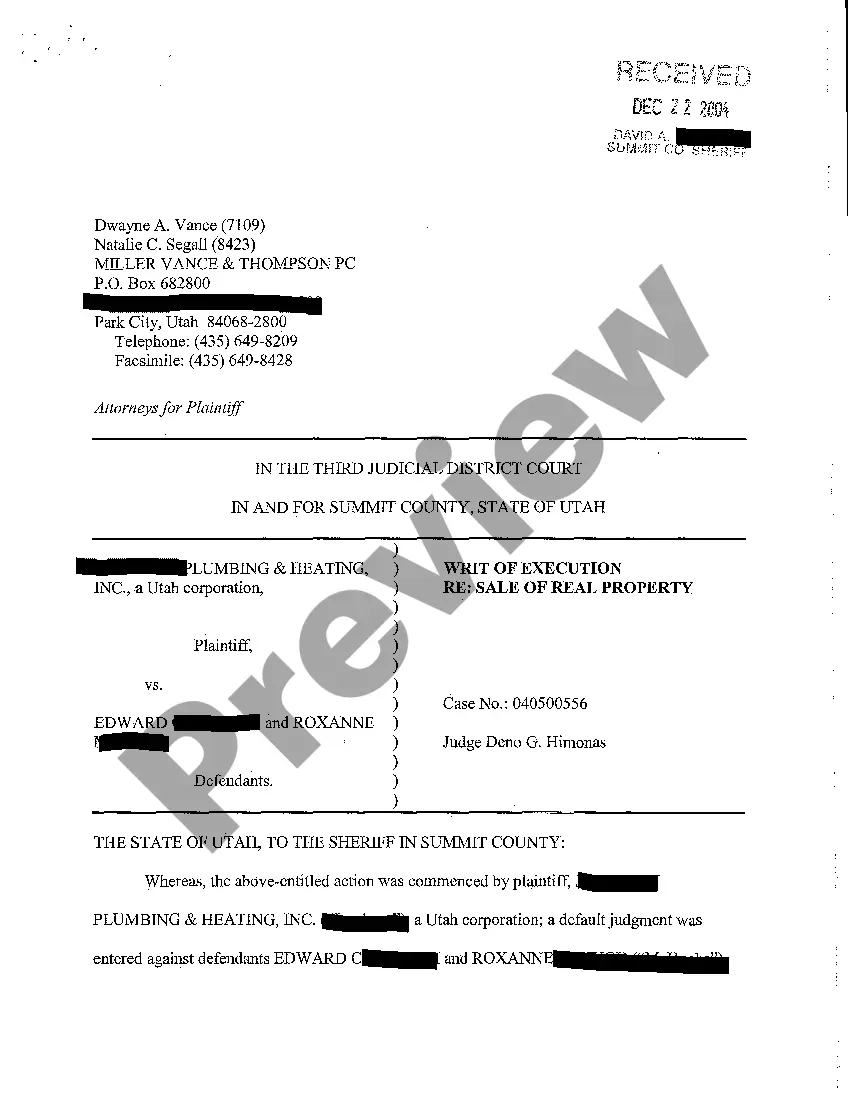

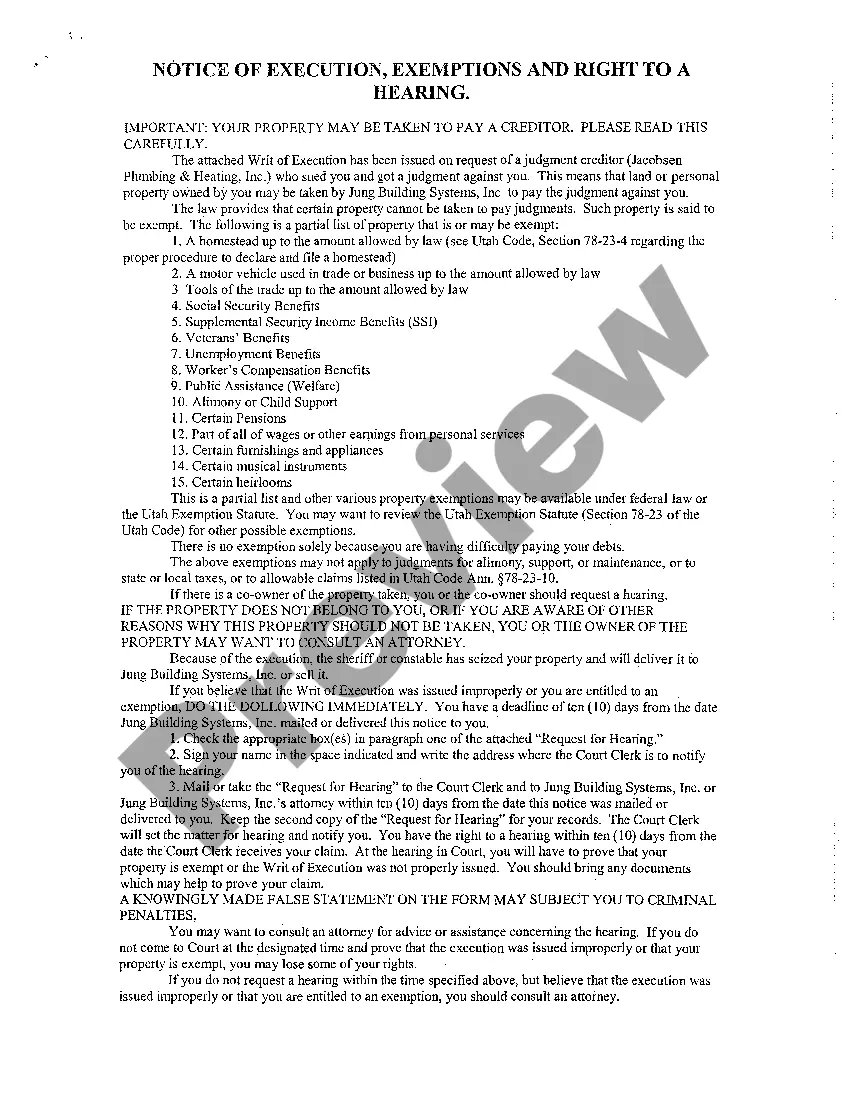

Salt Lake Utah Canceled Order of Sale Return

Description

How to fill out Salt Lake Utah Canceled Order Of Sale Return?

We always want to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal solutions that, as a rule, are very costly. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to legal counsel. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Salt Lake Utah Canceled Order of Sale Return or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Salt Lake Utah Canceled Order of Sale Return complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Salt Lake Utah Canceled Order of Sale Return would work for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!