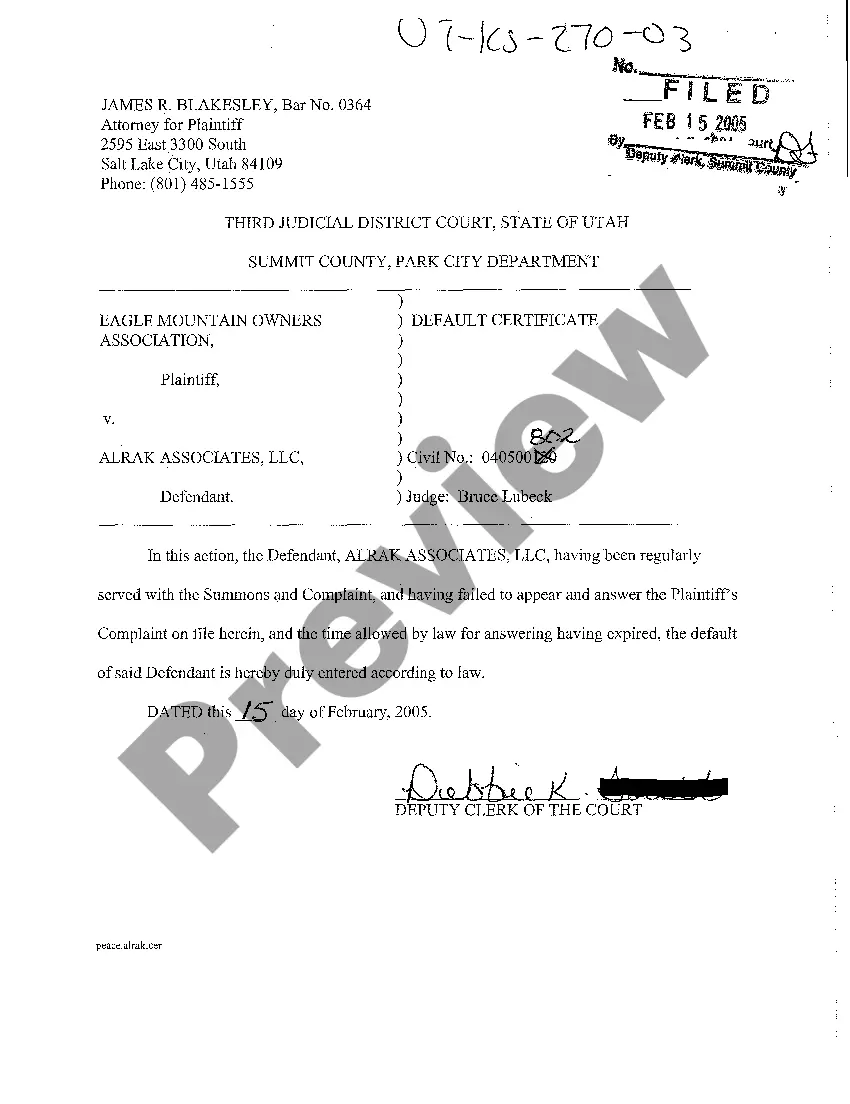

Salt Lake City Utah Default Certificate is a legal document that pertains to the default status of a property in Salt Lake City, Utah. It is issued when a borrower fails to fulfill their obligations on a loan or mortgage, resulting in a default situation. This certificate serves as an official notice of default and is typically issued by the lender or the county's designated authority. The Salt Lake City Utah Default Certificate contains essential information regarding the defaulted property, including its address, legal description, and the borrower's details. It also includes the outstanding amount owed, the default date, and the specific terms of the loan or mortgage agreement that were violated. Additionally, it serves as evidence that the borrower has failed to make timely payments or comply with other contractual obligations. This certificate aims to protect the rights and interests of lenders and helps to initiate foreclosure proceedings. It is an important legal document for both the lender and potential buyers, as it provides necessary information about the property's default status. Moreover, it ensures transparency in real estate transactions and helps potential buyers make informed decisions. In Salt Lake City, Utah, there are various types of Default Certificates, each serving a specific purpose: 1. Pre-Foreclosure Default Certificate: This type of certificate is issued during the initial stages of default, signaling the borrower's failure to meet their loan obligations. It alerts the borrower, the lender, and interested parties about the potential foreclosure of the property. 2. Notice of Default Certificate: This certificate serves as an official notification to the borrower that they are in default. It outlines the specific terms and conditions that have been breached, along with the consequences and possible actions that may be taken by the lender. 3. Notice of Sale Default Certificate: This certificate is issued when the lender initiates the formal foreclosure process and schedules a sale of the defaulted property. It provides information regarding the upcoming auction, such as the date, time, and location. The Salt Lake City Utah Default Certificate plays a crucial role in the foreclosure process, ensuring transparency and providing important legal information for all parties involved. It serves as a valuable resource for lenders, potential buyers, and interested parties seeking detailed information about a defaulted property in Salt Lake City, Utah.

Salt Lake City Utah Default Certificate

Description

How to fill out Salt Lake City Utah Default Certificate?

Benefit from the US Legal Forms and obtain immediate access to any form you want. Our useful website with thousands of document templates makes it simple to find and obtain almost any document sample you want. You can download, fill, and certify the Salt Lake City Utah Default Certificate in a couple of minutes instead of surfing the Net for hours looking for a proper template.

Using our catalog is an excellent way to improve the safety of your record filing. Our professional attorneys regularly check all the documents to make sure that the forms are appropriate for a particular state and compliant with new acts and polices.

How do you get the Salt Lake City Utah Default Certificate? If you have a subscription, just log in to the account. The Download button will be enabled on all the documents you look at. Additionally, you can get all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction listed below:

- Open the page with the template you need. Make certain that it is the template you were seeking: examine its name and description, and take take advantage of the Preview option if it is available. Otherwise, make use of the Search field to look for the needed one.

- Launch the saving process. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Export the document. Indicate the format to get the Salt Lake City Utah Default Certificate and edit and fill, or sign it according to your requirements.

US Legal Forms is probably the most extensive and trustworthy template libraries on the web. We are always ready to assist you in virtually any legal case, even if it is just downloading the Salt Lake City Utah Default Certificate.

Feel free to take advantage of our service and make your document experience as efficient as possible!