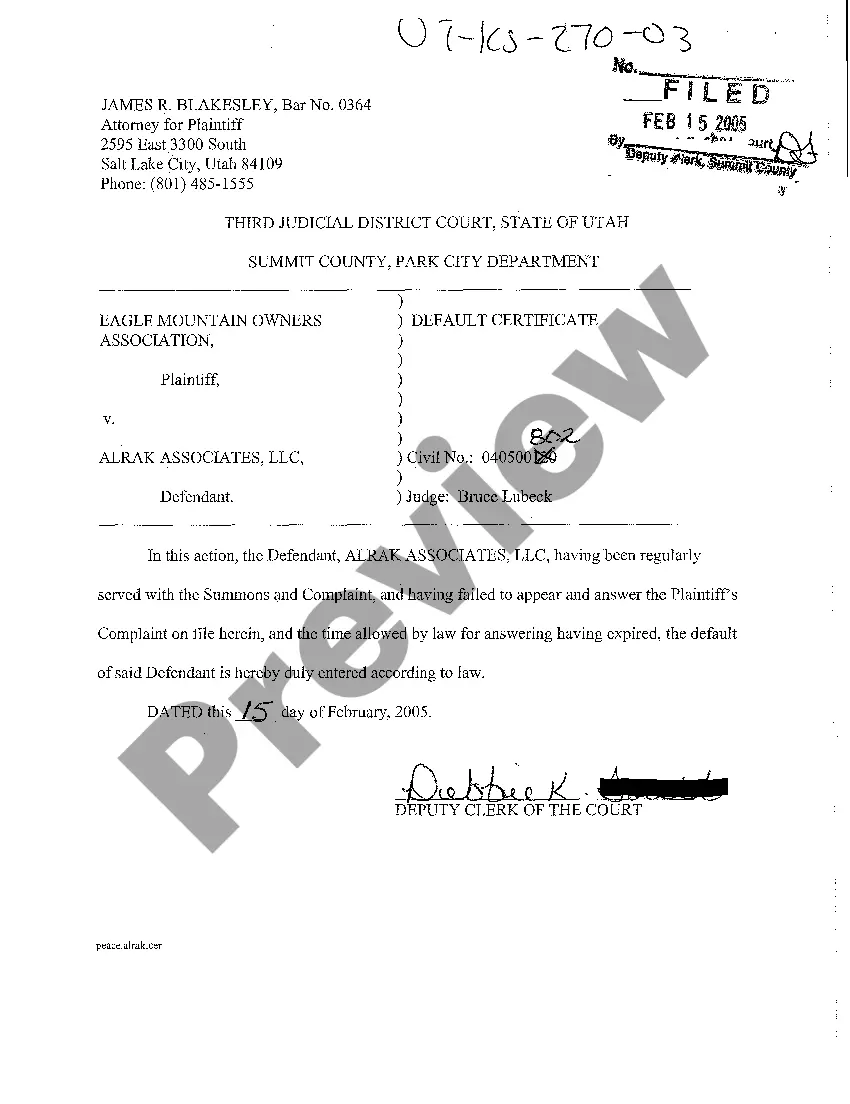

West Jordan Utah Default Certificate is a legal document issued by the West Jordan City Clerk's Office in the state of Utah. This certificate is typically issued as a result of a property owner's failure to meet their financial obligations, specifically mortgage payments, property taxes, or homeowners' association dues. The West Jordan Utah Default Certificate serves as a formal notification to the property owner that they are in default and notifies them of the potential consequences of their default, such as the initiation of foreclosure proceedings. It acts as an official record of the default status and helps protect the rights of the creditor or lien holder. Different types of West Jordan Utah Default Certificates may include: 1. Mortgage Default Certificate: This type of certificate is issued when an individual fails to make timely mortgage payments to their lender. It serves as a warning and allows the lender to initiate foreclosure proceedings if the default is not rectified within a specified period. 2. Property Tax Default Certificate: Property owners who fail to pay their property taxes can receive a default certificate. This certificate is typically issued by the city or county treasurer's office and provides notice of the outstanding taxes, penalties, and potential consequences, such as tax lien sales or foreclosure. 3. Homeowners' Association Default Certificate: In cases where a property owner fails to pay their homeowners' association dues, a default certificate may be issued. This certificate informs the property owner about their delinquency and the potential consequences, such as legal action or the imposition of liens on the property. It is important to note that each type of West Jordan Utah Default Certificate carries different implications and consequences for the property owner. These certificates are intended to protect the rights of creditors and ensure that financial obligations are met. In conclusion, a West Jordan Utah Default Certificate is a legal document issued in situations where a property owner fails to meet their financial obligations, such as mortgage payments, property taxes, or homeowners' association dues. It serves as official notification of the default and can lead to consequences such as foreclosure or the imposition of liens. The different types of certificates include mortgage default certificates, property tax default certificates, and homeowners' association default certificates.

West Jordan Utah Default Certificate

Description

How to fill out West Jordan Utah Default Certificate?

We always strive to reduce or avoid legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for legal services that, usually, are very expensive. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of an attorney. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the West Jordan Utah Default Certificate or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the West Jordan Utah Default Certificate adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the West Jordan Utah Default Certificate is proper for your case, you can choose the subscription plan and make a payment.

- Then you can download the form in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!