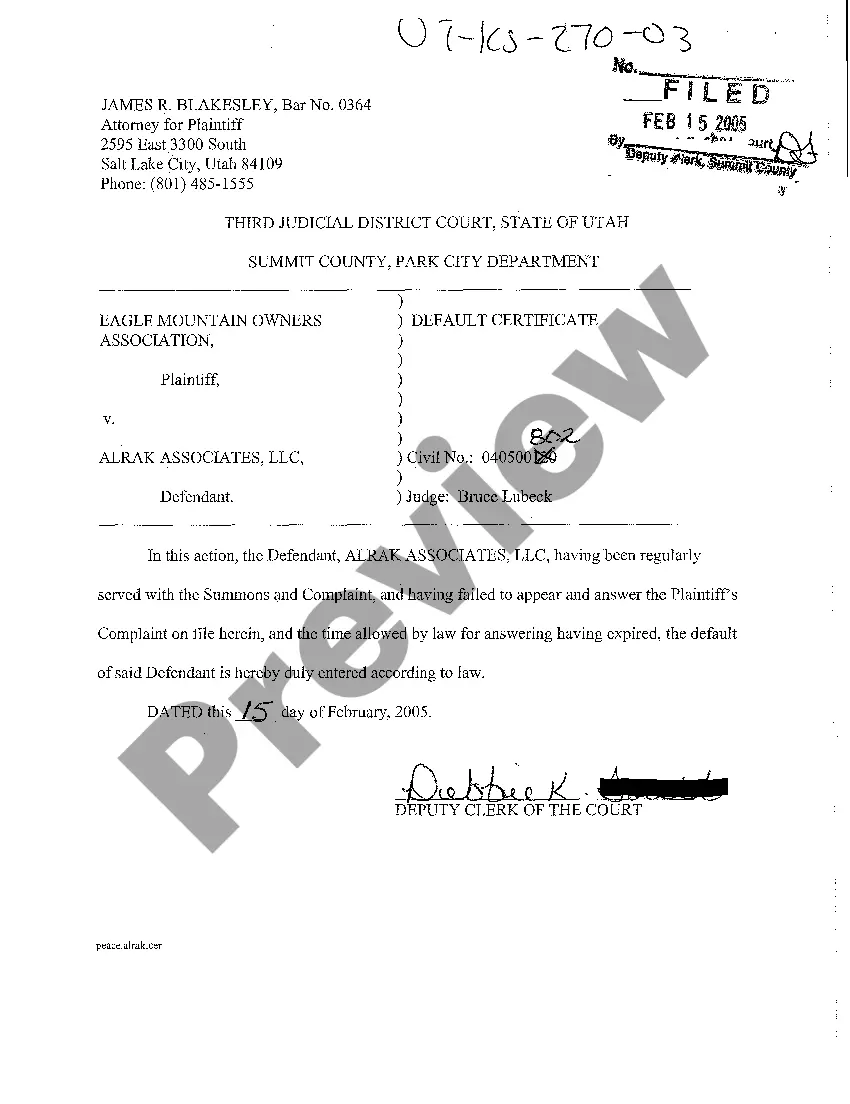

The West Valley City Utah Default Certificate is an essential legal document issued by the government of West Valley City, Utah, which declares that an individual or entity has defaulted on their financial obligations. This certificate serves as proof of default and is typically issued by the local government in order to inform creditors, potential lenders, and interested parties about the debtor's failure to fulfill their payment obligations. There are several types of West Valley City Utah Default Certificates, each designed to address specific financial defaults: 1. Mortgage Default Certificate: This certificate is issued when an individual or entity fails to make timely payments towards their mortgage loan in West Valley City, Utah. 2. Tax Default Certificate: This certificate is issued when an individual or entity fails to pay their property or income taxes to the West Valley City government. 3. Loan Default Certificate: This certificate is issued when an individual or entity fails to repay a loan, such as a personal loan or business loan, to a West Valley City-based lender. 4. Utility Default Certificate: This certificate is issued when an individual or entity fails to pay their utility bills, such as water, electricity, or gas bills, to the West Valley City Utility Department. 5. Fines Default Certificate: This certificate is issued when an individual or entity accumulates unpaid fines related to traffic violations, parking tickets, or other related offenses within West Valley City. The West Valley City Utah Default Certificate includes crucial information such as the debtor's name, address, account number, the specific type of default, the outstanding amount, and the due date. It also outlines the consequences of default, such as legal action, credit score decrease, or potential seizure of assets. It is essential for creditors and potential lenders to be aware of these default certificates as they provide valuable information about an individual or entity's financial history and responsibility. Additionally, these certificates enable the government and creditors to take appropriate measures to recover the outstanding debts or enforce legal actions to rectify the defaults.

West Valley City Utah Default Certificate

Description

How to fill out West Valley City Utah Default Certificate?

We always want to reduce or avoid legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for legal services that, as a rule, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to an attorney. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the West Valley City Utah Default Certificate or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the West Valley City Utah Default Certificate adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the West Valley City Utah Default Certificate is proper for you, you can pick the subscription option and make a payment.

- Then you can download the form in any suitable format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!