Salt Lake City, Utah Complaint for Foreclosure: A Comprehensive Overview In Salt Lake City, Utah, a Complaint for Foreclosure is a legal document filed by a mortgage lender or service when a homeowner defaults on their mortgage payments. This detailed description aims to provide relevant information about Salt Lake City's Complaint for Foreclosure, its process, and potential types or variations of such complaints. Keywords: Salt Lake City, Utah, Complaint for Foreclosure, mortgage lender, homeowner, foreclosure process. 1. Overview of Foreclosure in Salt Lake City, Utah: Foreclosure is a legal process initiated by the lender when a homeowner defaults on their mortgage payments, leading to the sale of the property to recover the outstanding debt. In Salt Lake City, Utah, foreclosure is typically governed by state laws and may involve various legal proceedings. 2. The Complaint for Foreclosure: The Complaint for Foreclosure is a crucial document filed by the lender to commence the foreclosure process. It is a formal legal notice that notifies the homeowner of the lender's intention to foreclose on the property due to defaulting on their mortgage payments. 3. Required Contents of a Complaint for Foreclosure: A Complaint for Foreclosure in Salt Lake City, Utah generally includes: — Identification of the lendeserviceer filing the complaint — Identification of the homeowner(s) named as defendants — Clear description of the property subject to foreclosure — Comprehensive details regarding the defaulted mortgage loan — Specifics of the default, such as missed payments and the amount owed — Declaration of the lender's right to foreclose based on the mortgage agreement — Request for the court to order the foreclosure and sale of the property 4. Types of Salt Lake City, Utah Complaints for Foreclosure: Although there can be multiple variations of foreclosure complaints, the following are commonly observed types in Salt Lake City, Utah: a) Judicial Foreclosure Complaint: A Judicial Foreclosure Complaint is filed when the mortgage contract includes a "power of sale" clause allowing the lender to foreclose through the court system. This type of complaint initiates a judicial foreclosure process wherein the court supervises the foreclosure proceedings. b) Non-Judicial Foreclosure Complaint: In Utah, a Non-Judicial Foreclosure Complaint is filed when the mortgage agreement includes a "power of sale" clause, granting the lender the authority to foreclose without court intervention. This type of complaint initiates a non-judicial foreclosure process, usually overseen by a trustee. 5. Process after Filing the Complaint: After filing the Complaint for Foreclosure, the lender must serve a copy of the complaint to the homeowner, who then has a specified period to respond or contest the foreclosure. If the homeowner fails to respond, the court may grant a judgment in favor of the lender, allowing them to proceed with the foreclosure. It is important to note that foreclosure laws and processes can vary, so homeowners and lenders in Salt Lake City, Utah should consult with legal professionals to understand their specific rights and obligations. Overall, understanding the Complaint for Foreclosure process provides key insights into the legal actions initiated by mortgage lenders when homeowners default on their mortgage payments in Salt Lake City, Utah.

Salt Lake City Utah Complaint for Foreclosure

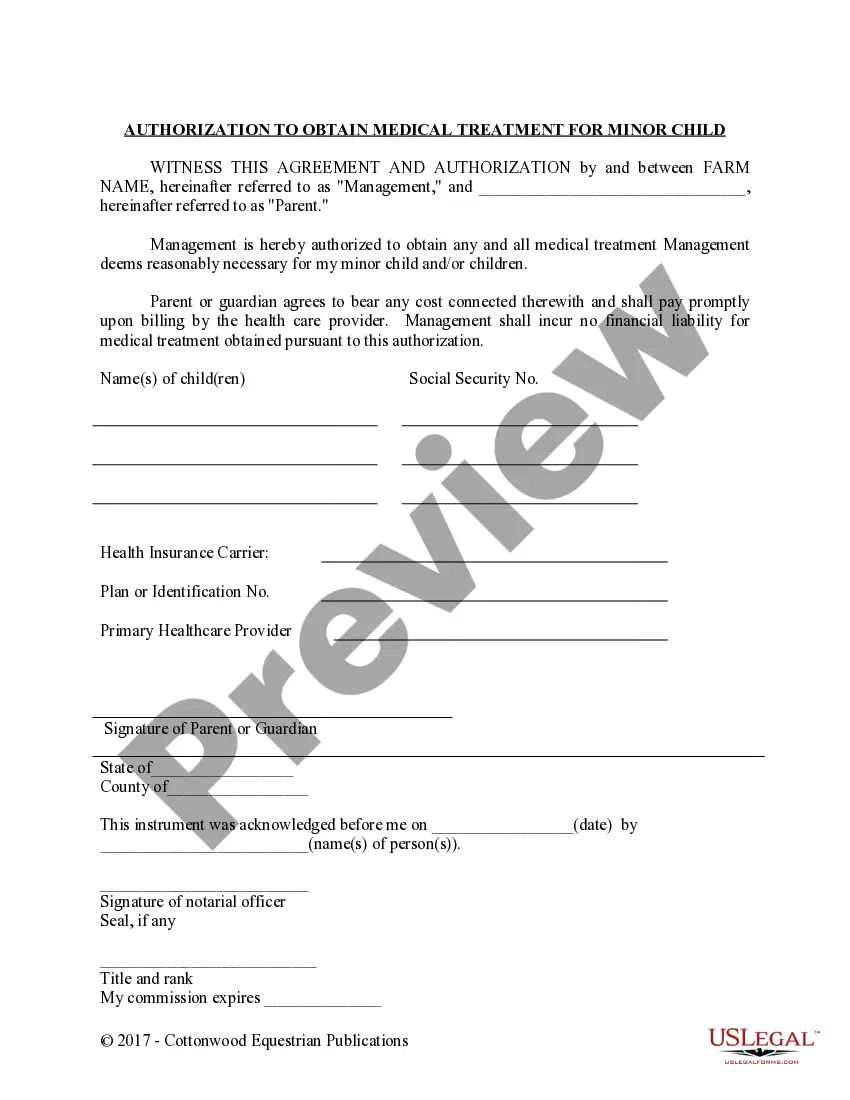

Description

How to fill out Salt Lake City Utah Complaint For Foreclosure?

We always want to minimize or avoid legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for legal services that, as a rule, are extremely costly. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to an attorney. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Salt Lake City Utah Complaint for Foreclosure or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Salt Lake City Utah Complaint for Foreclosure complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Salt Lake City Utah Complaint for Foreclosure is proper for you, you can choose the subscription option and make a payment.

- Then you can download the form in any available format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!