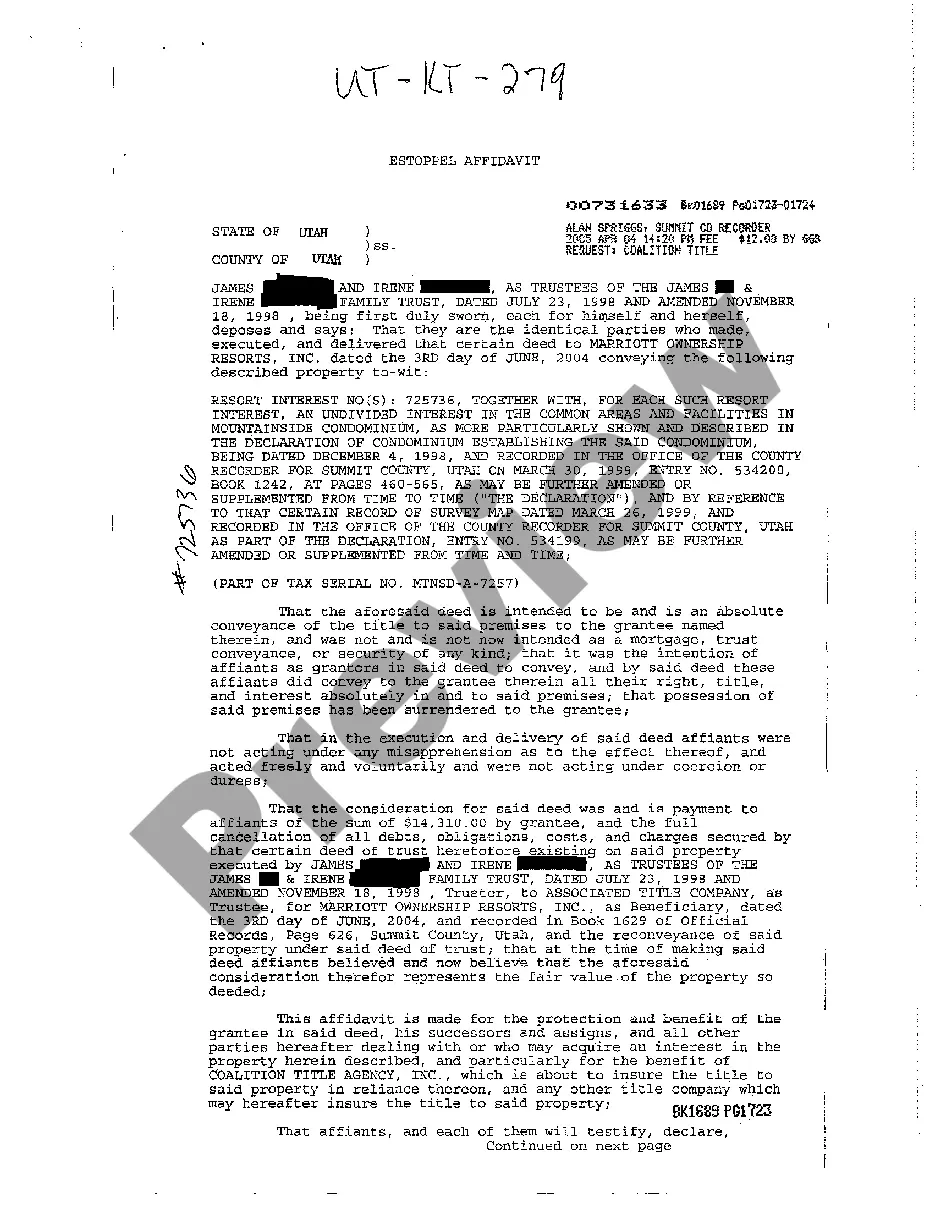

A Salt Lake Utah Estoppel Affidavit regarding Trust Property Deed is a legal document used in real estate transactions to establish and confirm the rights and interests of parties involved in a trust property. This affidavit serves as an official statement, sworn under oath, providing an outline of the property's ownership details, outstanding debts or liens, and any other pertinent information related to the property's title and ownership. In Salt Lake Utah, there are different types of Estoppel Affidavits regarding Trust Property Deed, including: 1. General Trust Property Deed Estoppel Affidavit: This type of affidavit covers all trust property deeds and provides a comprehensive overview of the property's history, details, and any encumbrances. 2. Mortgage Estoppel Affidavit: Specifically used when there is a mortgage involved, this type of affidavit ensures that all parties, including the lender, borrower, and trustee, acknowledge the terms and conditions of the mortgage agreement as they pertain to the trust property deed. 3. Lien holder Estoppel Affidavit: If there are any existing liens or debts against the trust property, this affidavit identifies and confirms the lender or lien holder's rights and interests in the property. It outlines the outstanding debts owed to the lien holder, including the amount, terms, and conditions. 4. Partial Estoppel Affidavit: In certain situations, a partial estoppel affidavit may be required to address specific concerns related to a particular section or portion of the trust property deed. This affidavit focuses on a limited area of the property or a specific issue that needs clarification. When preparing a Salt Lake Utah Estoppel Affidavit regarding Trust Property Deed, it is essential to incorporate relevant keywords such as Salt Lake Utah, Estoppel Affidavit, Trust Property Deed, property ownership, liens, debts, encumbrances, mortgage, and specific types of affidavits mentioned above. Ensure that the affidavit accurately reflects the legal status of the property, providing a thorough and detailed description of its history, title, and any pertinent information necessary for the transaction.

Salt Lake Utah Estoppels Affidavit regarding Trust Property Deed

Description

How to fill out Salt Lake Utah Estoppels Affidavit Regarding Trust Property Deed?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we apply for attorney solutions that, as a rule, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to legal counsel. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Salt Lake Utah Estoppels Affidavit regarding Trust Property Deed or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Salt Lake Utah Estoppels Affidavit regarding Trust Property Deed complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Salt Lake Utah Estoppels Affidavit regarding Trust Property Deed would work for you, you can choose the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!