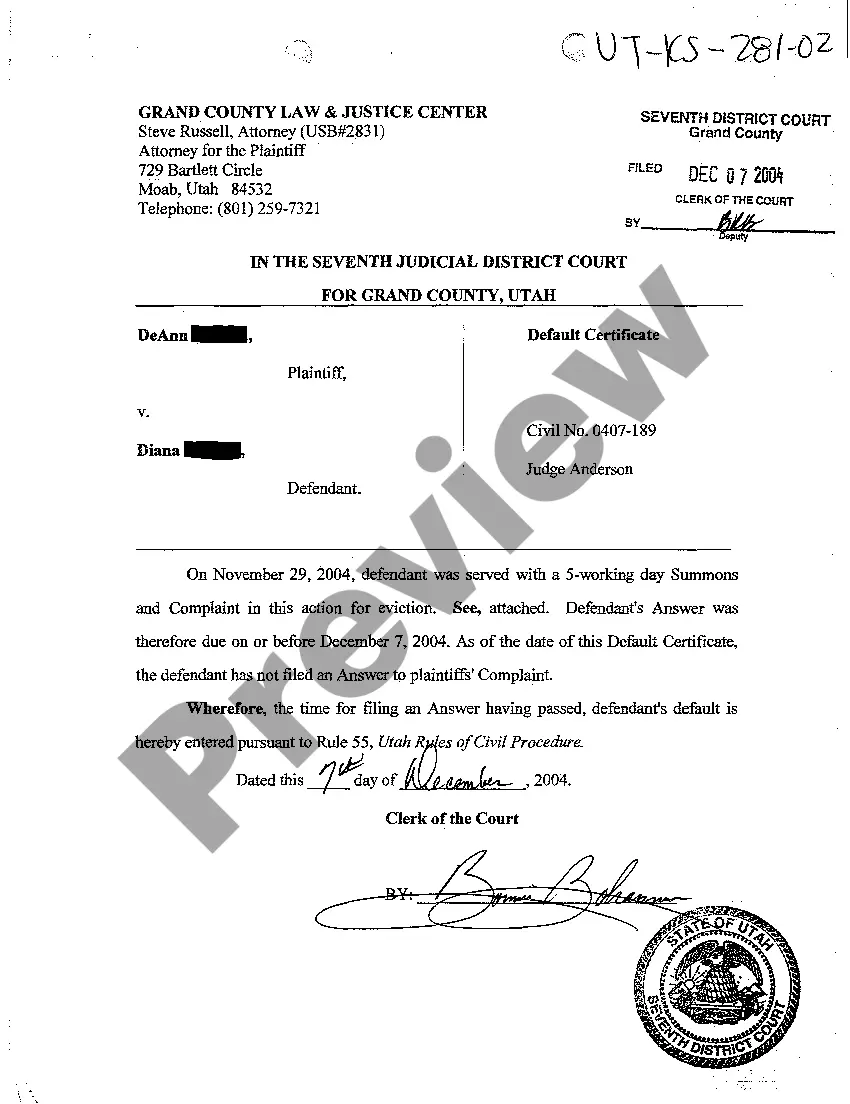

Salt Lake City Utah Default Certificate is a legal document issued in Salt Lake City, Utah, that signifies a default on certain financial obligations. It serves as an official record of a default or failure to meet the terms and conditions of a loan, mortgage, or financial agreement. The Salt Lake City Utah Default Certificate is typically issued by a financial institution or creditor when the borrower fails to make timely payments or breaches the terms of the loan agreement. It is an important legal document that outlines the specifics of the default, including the outstanding amount, the due date of payments, and any penalties or fees incurred. There are different types of Salt Lake City Utah Default Certificate, depending on the nature of the financial obligation. Some common types include: 1. Mortgage Default Certificate: This certificate is issued by a mortgage lender when a borrower defaults on their mortgage payments. It outlines the outstanding mortgage balance, any missed payments, and the actions that may be taken, such as foreclosure. 2. Loan Default Certificate: This type of certificate is issued when a borrower defaults on a personal or business loan. It includes details about the amount owed, missed payments, and the steps the lender may take to recover the debt. 3. Credit Card Default Certificate: When a credit cardholder defaults on their credit card payments, the credit card company may issue a default certificate. It outlines the outstanding balance, missed payments, and any actions the company may take, such as reporting to credit bureaus or pursuing legal action. 4. Student Loan Default Certificate: When a borrower fails to repay their student loans, the lending institution may issue a default certificate. It contains information about the outstanding loan balance, missed payments, and possible consequences such as wage garnishment or loss of eligibility for future financial aid. Receiving a Salt Lake City Utah Default Certificate can have serious implications for the borrower. It can adversely affect their credit score, make it difficult to secure future loans, and may result in legal actions to recover the outstanding debt. It is crucial for individuals who receive a default certificate to seek professional advice and take appropriate measures to address the default and rectify the financial situation.

Salt Lake City Utah Default Certificate

State:

Utah

City:

Salt Lake City

Control #:

UT-KS-281-02

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Default Certificate

Salt Lake City Utah Default Certificate is a legal document issued in Salt Lake City, Utah, that signifies a default on certain financial obligations. It serves as an official record of a default or failure to meet the terms and conditions of a loan, mortgage, or financial agreement. The Salt Lake City Utah Default Certificate is typically issued by a financial institution or creditor when the borrower fails to make timely payments or breaches the terms of the loan agreement. It is an important legal document that outlines the specifics of the default, including the outstanding amount, the due date of payments, and any penalties or fees incurred. There are different types of Salt Lake City Utah Default Certificate, depending on the nature of the financial obligation. Some common types include: 1. Mortgage Default Certificate: This certificate is issued by a mortgage lender when a borrower defaults on their mortgage payments. It outlines the outstanding mortgage balance, any missed payments, and the actions that may be taken, such as foreclosure. 2. Loan Default Certificate: This type of certificate is issued when a borrower defaults on a personal or business loan. It includes details about the amount owed, missed payments, and the steps the lender may take to recover the debt. 3. Credit Card Default Certificate: When a credit cardholder defaults on their credit card payments, the credit card company may issue a default certificate. It outlines the outstanding balance, missed payments, and any actions the company may take, such as reporting to credit bureaus or pursuing legal action. 4. Student Loan Default Certificate: When a borrower fails to repay their student loans, the lending institution may issue a default certificate. It contains information about the outstanding loan balance, missed payments, and possible consequences such as wage garnishment or loss of eligibility for future financial aid. Receiving a Salt Lake City Utah Default Certificate can have serious implications for the borrower. It can adversely affect their credit score, make it difficult to secure future loans, and may result in legal actions to recover the outstanding debt. It is crucial for individuals who receive a default certificate to seek professional advice and take appropriate measures to address the default and rectify the financial situation.

How to fill out Salt Lake City Utah Default Certificate?

If you’ve already used our service before, log in to your account and save the Salt Lake City Utah Default Certificate on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make certain you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Salt Lake City Utah Default Certificate. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!