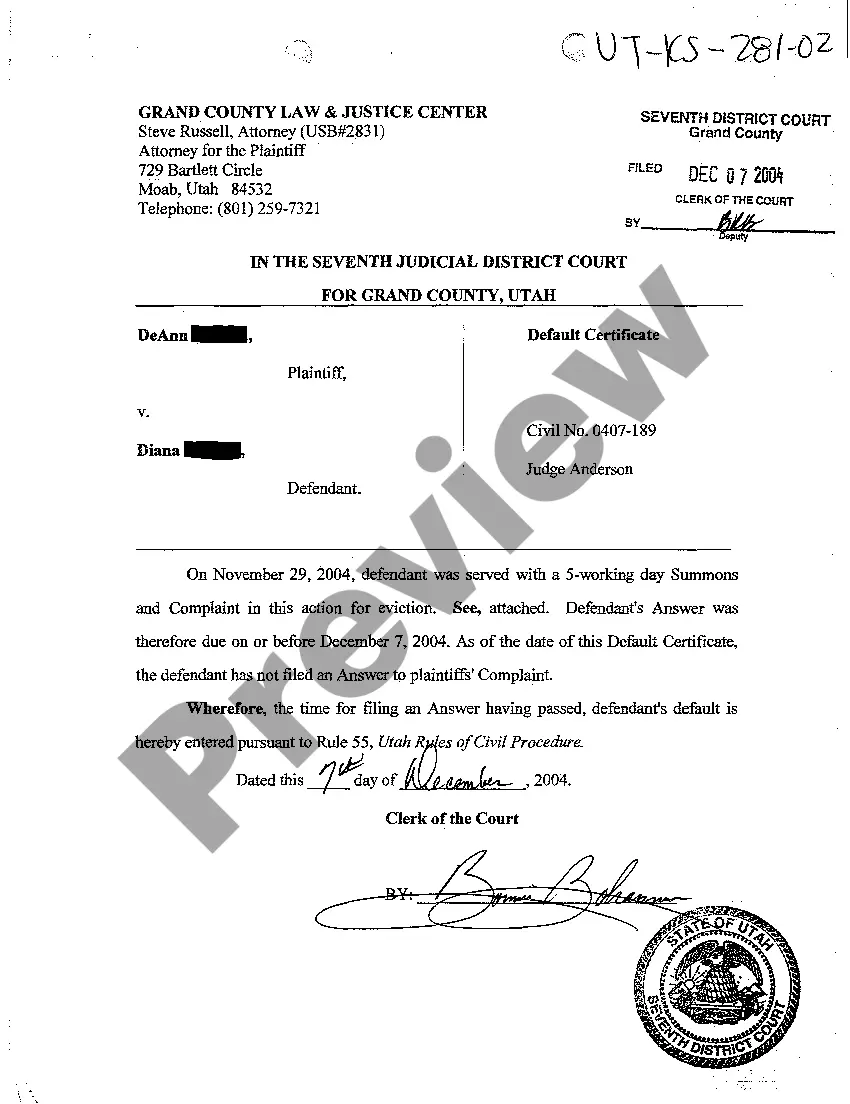

West Jordan Utah Default Certificate is a legal document that acknowledges a borrower's failure to meet their financial obligations in relation to a loan or debt. It is a significant document used in the foreclosure process in West Jordan, Utah. The default certificate is filed by the lender or the lien holder as evidence that the borrower is in default of their repayment terms. The West Jordan Utah Default Certificate serves as a formal notice, outlining specific details related to the outstanding debt, such as the loan amount, interest rates, due dates, and any additional charges or fees. It also provides a timeline for the borrower to rectify the default and bring the debt up to date. Failure to comply with the terms outlined in the default certificate can lead to the initiation of foreclosure proceedings. Different types of West Jordan Utah Default Certificates may include: 1. Mortgage Default Certificate: This type of default certificate is typically associated with a mortgage loan, showcasing a borrower's inability to meet their mortgage payments as agreed upon in the initial contract. 2. Auto Loan Default Certificate: When a borrower defaults on an auto loan in West Jordan, Utah, the lender can file an auto loan default certificate as a way to initiate repossession and recover the outstanding debt. 3. Credit Card Default Certificate: In cases where individuals fail to make timely credit card payments, the credit card issuer may issue a default certificate to alert the borrower about their default and potential consequences such as increased interest rates or collection actions. 4. Student Loan Default Certificate: This type of default certificate is specific to student loans, which highlights the borrower's failure to repay student loans, potentially resulting in wage garnishment, credit damage, and legal actions. In conclusion, the West Jordan Utah Default Certificate is a crucial legal document used to notify borrowers about their default on various types of loans, such as mortgages, auto loans, credit card debt, and student loans. It serves as a formal notice to encourage borrowers to rectify their default and become current on their outstanding debts to avoid further legal actions and financial repercussions.

West Jordan Utah Default Certificate

Description

How to fill out West Jordan Utah Default Certificate?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person without any law background to create such paperwork cfrom the ground up, mostly due to the convoluted terminology and legal nuances they entail. This is where US Legal Forms can save the day. Our platform provides a huge collection with more than 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also is a great resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you require the West Jordan Utah Default Certificate or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the West Jordan Utah Default Certificate quickly employing our trustworthy platform. In case you are presently an existing customer, you can proceed to log in to your account to get the appropriate form.

However, in case you are new to our platform, ensure that you follow these steps prior to downloading the West Jordan Utah Default Certificate:

- Ensure the form you have found is specific to your location considering that the rules of one state or county do not work for another state or county.

- Review the form and read a short outline (if available) of cases the document can be used for.

- If the form you selected doesn’t meet your requirements, you can start over and search for the necessary form.

- Click Buy now and pick the subscription plan you prefer the best.

- Access an account {using your credentials or register for one from scratch.

- Choose the payment method and proceed to download the West Jordan Utah Default Certificate as soon as the payment is done.

You’re good to go! Now you can proceed to print out the form or complete it online. In case you have any problems locating your purchased documents, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

A default judgment can have serious consequences as it often leads to a loss of rights, such as the inability to dispute claims or defend oneself in court. The judgment can impact credit ratings and result in financial penalties, creating long-term ramifications for the affected party. If you are concerned about the implications of a default judgment, utilizing resources like the West Jordan Utah Default Certificate can help mitigate risks and provide needed information.

After filing a Motion for default, the court reviews the motion to confirm that the legal conditions for a default have been met. If the motion is granted, the court will issue a default judgment against the non-responsive party. This process is fundamental in maintaining the efficiency of legal proceedings, and having a West Jordan Utah Default Certificate can aid in navigating these steps effectively.

Rule 55 of the Utah Rules of Civil Procedure outlines the process for obtaining a default judgment when a party does not respond to the legal complaint. It specifies how a plaintiff can seek relief, including the necessary steps for notifying the defaulting party. For those dealing with defaults in West Jordan, the West Jordan Utah Default Certificate is essential for ensuring compliance with local procedures.

A judgment is a court's final decision on a legal dispute after both parties present their cases. In contrast, a default judgment is a ruling issued when one party fails to appear or respond, often leaving the court without a defense. Understanding this distinction can help clarify legal options; for matters related to default judgments, the West Jordan Utah Default Certificate is an important document to consider.

Yes, a default judgment typically acts as a final judgment when the court has determined that one party has not participated in the proceedings. Once entered, it represents a decision on the merits of the case, often favoring the plaintiff. If you are involved in a case related to default judgments, you may want to explore the West Jordan Utah Default Certificate for further guidance.

A default is not necessarily a final judgment. It occurs when a party fails to respond to a legal action, resulting in a judgment against them. However, this judgment may be set aside in certain circumstances, allowing the party another chance to present their case. To better understand defaults and their implications, especially concerning the West Jordan Utah Default Certificate, consulting legal resources is beneficial.

Filing a default judgment in federal court involves completing specific forms and following particular procedures. You will generally need to file a motion for default judgment along with supporting documentation that shows the defendant did not respond. Utilizing resources like US Legal Forms can guide you through this process, ensuring you correctly prepare and submit your paperwork.

The entry of default, often filed in the court clerk's office, marks the official acknowledgment of a defendant's failure to respond. In West Jordan, Utah, this important legal document can expedite your case by allowing you to request a default judgment. Once this entry is made, you are one step closer to resolving your legal situation.

An entry of default is a formal action taken by the court to declare that a defendant has not responded to a legal complaint. In West Jordan, Utah, this entry serves as a prerequisite for obtaining a default judgment. It is essential because it allows the plaintiff to seek a judgment without needing to prove their case in full detail.

To enter default is to officially record that a defendant has not responded to a legal claim. In West Jordan, Utah, this step is crucial for moving forward with a default judgment. This recording signals the court that you can proceed without the defendant’s participation, paving the way for your case to advance.