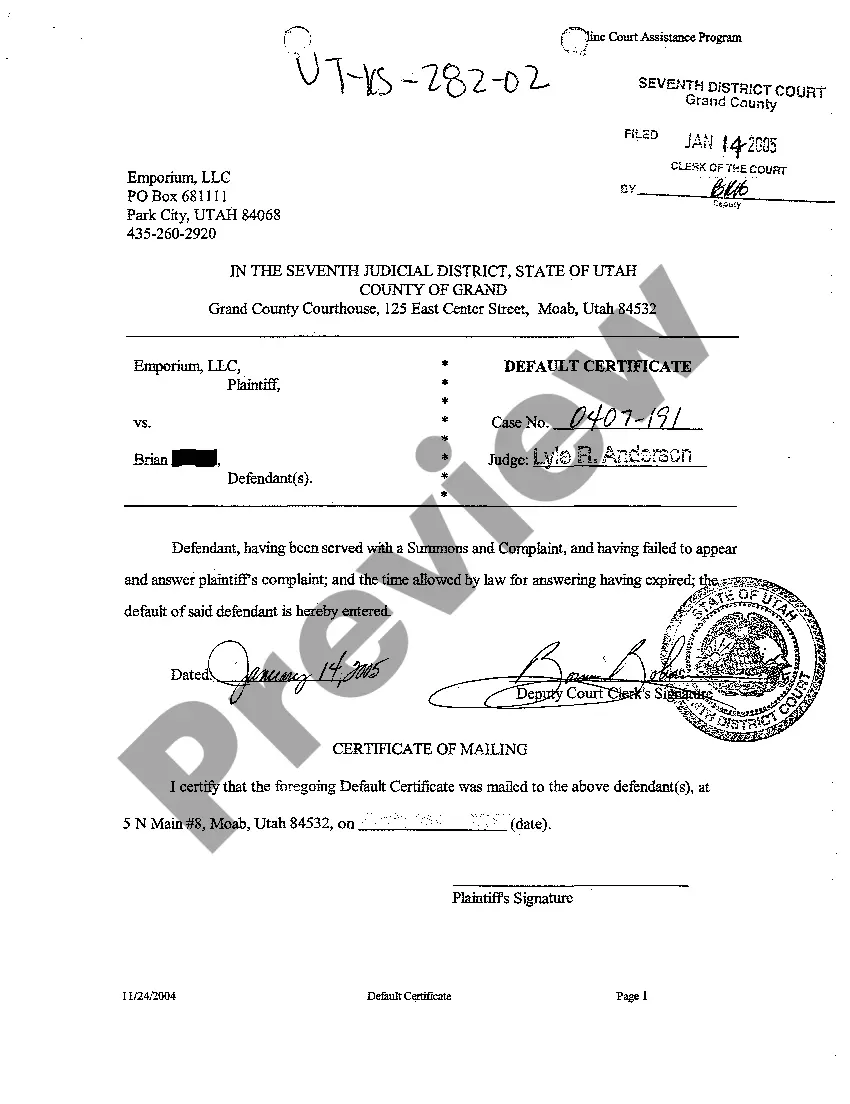

Salt Lake Utah Default Certificate is a legal document issued in Salt Lake City, Utah, that confirms a default on a financial obligation. This certificate serves as evidence that an individual or entity has failed to meet their payment obligations on a specific loan or contract. The Salt Lake Utah Default Certificate is typically issued by a creditor, such as a bank, financial institution, or loan service provider, after a debtor has defaulted on their payment for a specified period of time. It is an essential tool for creditors to protect their rights and interests and to enforce necessary legal actions to recover the outstanding debt. There are different types of Salt Lake Utah Default Certificates, each specific to the type of financial obligation or contract. Some common types include: 1. Salt Lake Utah Default Mortgage Certificate: This certificate is issued when a borrower defaults on their mortgage payments. It provides creditors with the necessary evidence to initiate foreclosure proceedings and potentially repossess the property. 2. Salt Lake Utah Default Student Loan Certificate: If a borrower fails to meet their repayment obligations on a student loan, a default certificate may be issued. This certificate allows the loan service provider to take legal action, such as wage garnishment or tax refund interception, to recover the outstanding amount. 3. Salt Lake Utah Default Auto Loan Certificate: When a borrower defaults on their car loan payments, a default certificate is issued, enabling the lender to repossess the vehicle as per the terms of the loan agreement. 4. Salt Lake Utah Default Credit Card Certificate: In the case of credit card debt, a default certificate may be issued if the cardholder fails to make minimum payments for a specified period. This certificate enables the credit card company to pursue legal actions to recoup the unpaid balance. It is important to note that the issuance of a Salt Lake Utah Default Certificate signifies a serious financial breach, potentially resulting in severe consequences for the debtor, such as damaged credit, legal action, or property repossession. Debtors should seek immediate professional advice to explore options for debt management, negotiation, or repayment plans to avoid the issuance of a default certificate.

Salt Lake Utah Default Certificate

State:

Utah

County:

Salt Lake

Control #:

UT-KS-282-02

Format:

PDF

Instant download

This form is available by subscription

Description

A02 Default Certificate

How to fill out Salt Lake Utah Default Certificate?

If you’ve already used our service before, log in to your account and save the Salt Lake Utah Default Certificate on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Salt Lake Utah Default Certificate. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!

Form popularity

Interesting Questions

More info

Salt Lake City, Utah 84103. Utah County Recorder's Office website.Call today to set up your consultation. The Chapter has over 500 members in various industries. Salt Lake City, UT 84114. For help with completing the form, visit our Utah Certificate of Organization guide. Western Renewable Energy Generation Information System. Airport.. . Utah. Salt.Lake.City.International.Airport. Utah State Tax Commission • 210 N 1950 W • Salt Lake City, UT 84137. Exemption Certificate.