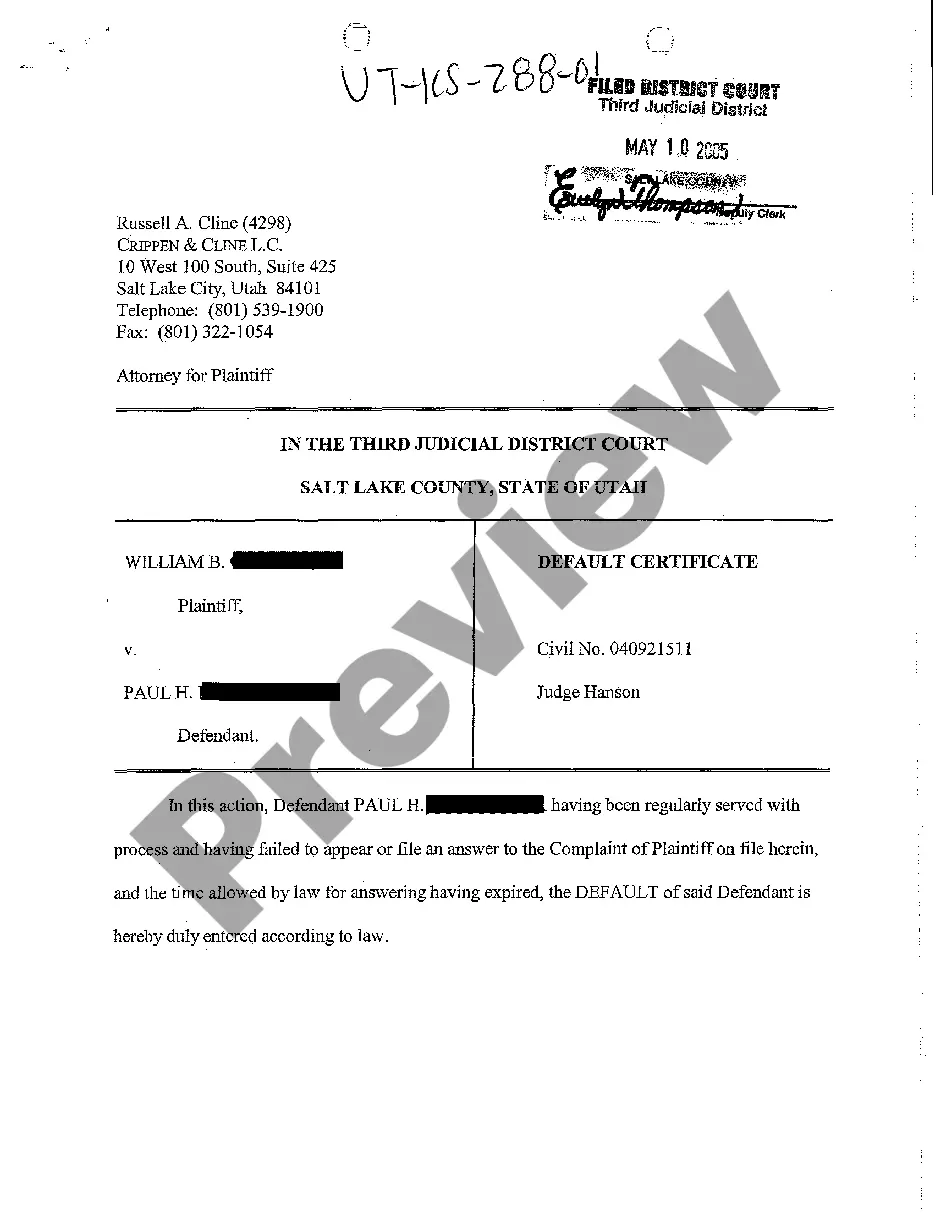

A Provo Utah Default Certificate is a legal document that certifies a defaulted loan or debt in the state of Utah. It serves as a formal notice to the debtor that they have failed to fulfill their financial obligations and have defaulted on their loan or debt agreement. This certificate is typically issued by the creditor or lender and outlines the specific details of the default, including the outstanding balance, interest charges, and any associated penalties. Keywords: Provo Utah, default certificate, defaulted loan, debt, financial obligations, creditor, lender, outstanding balance, interest charges, penalties. There can be different types of Provo Utah Default Certificates depending on the nature of the default. Some commonly encountered types include: 1. Mortgage Default Certificate: This type of certificate is issued when a borrower fails to make timely payments on their mortgage loan. It specifies the amount overdue, number of missed payments, and provides information on any foreclosure proceedings that may be initiated. 2. Student Loan Default Certificate: In the case of student loans, a default certificate can be issued when a borrower fails to make payments for an extended period. It verifies the defaulted status of the loan and outlines the consequences, such as wage garnishment or loss of eligibility for certain benefits. 3. Auto Loan Default Certificate: When a borrower fails to meet the payment schedule for an auto loan, a default certificate can be issued by the lender. It includes details on the outstanding balance, missed payments, and possible repossession of the vehicle. 4. Credit Card Default Certificate: This type of default certificate is issued by credit card companies when a cardholder fails to make minimum monthly payments for an extended period. It outlines the amount overdue, applicable interest charges, and possible actions like increased interest rates or collection efforts. 5. Personal Loan Default Certificate: In the case of personal loans, a default certificate can be issued when the borrower fails to make installment payments as agreed upon. It provides information on the outstanding balance, missed payments, and the potential legal actions that may be taken by the lender. These are just a few examples of Provo Utah Default Certificates, with each type tailored to the specific financial situation in which the default occurred. It is crucial for debtors to address default issues promptly to avoid further penalties and potential legal consequences.

Provo Utah Default Certificate

Description

How to fill out Provo Utah Default Certificate?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal services that, usually, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to a lawyer. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Provo Utah Default Certificate or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Provo Utah Default Certificate adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Provo Utah Default Certificate would work for your case, you can select the subscription option and proceed to payment.

- Then you can download the document in any available format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!