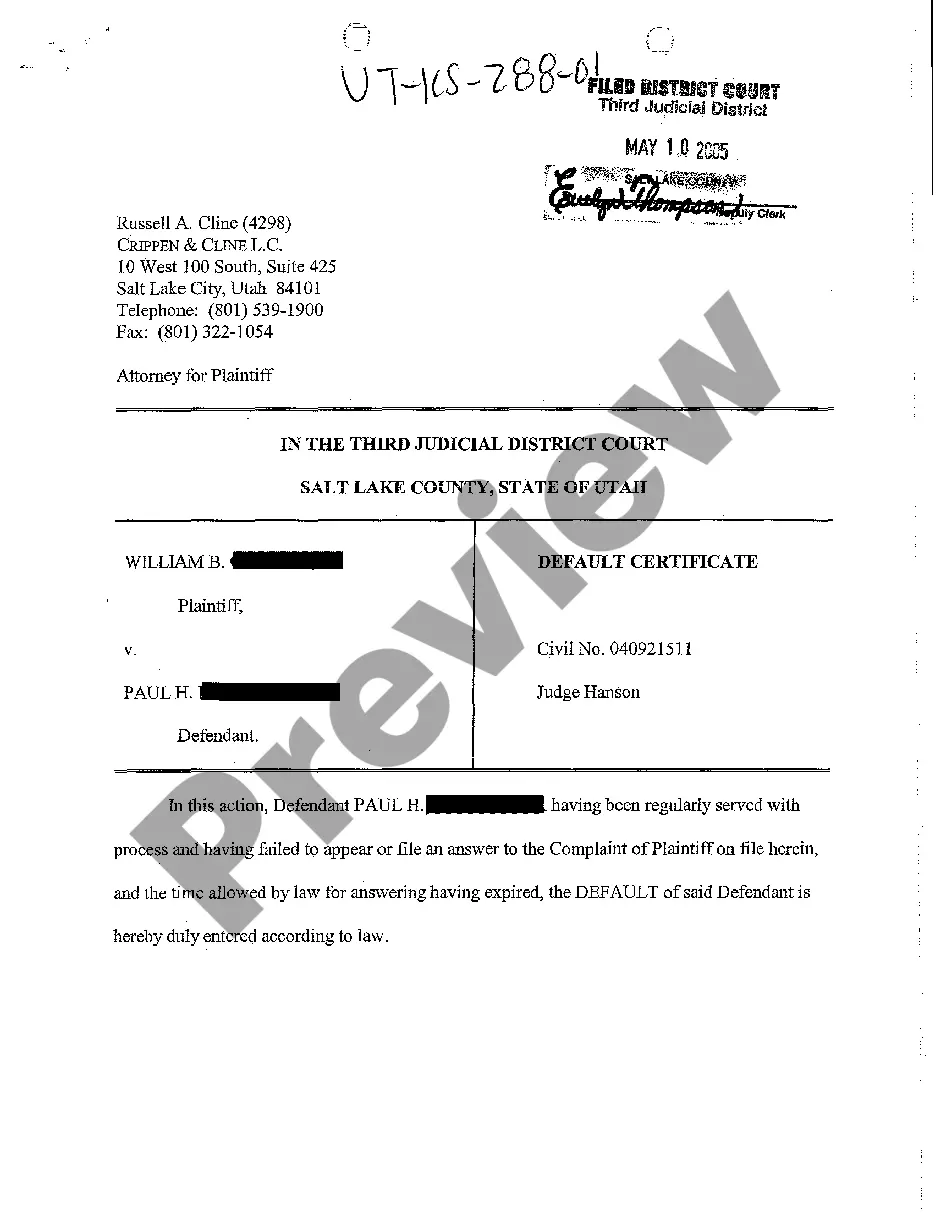

Salt Lake Utah Default Certificate is a legal document that serves as evidence of a default by a borrower on a loan or mortgage in Salt Lake City, Utah. It is issued by the lender or loan service and provides important information regarding the defaulted loan. Key features of the Salt Lake Utah Default Certificate include: 1. Definition and Details: The document includes a clear definition of default, outlining the specific actions or conditions that constitute default. It provides detailed information about the borrower, the lender, and the loan, such as loan amount, interest rate, terms, and repayment schedule. 2. Default Notice: The certificate includes a notice of default, which is a formal communication that informs the borrower about the default status. It outlines the reasons for default, such as missed payments, failure to maintain insurance or property taxes, or violation of loan covenants. 3. Cure Period: The certificate mentions the given cure period — a specific duration within which the borrower may rectify the default by making all outstanding payments, settling the arrears, or addressing the violation of loan terms. 4. Foreclosure Proceedings: If the borrower fails to cure the default within the designated period, the certificate may detail the lender's intention to initiate foreclosure proceedings. It may include information about the foreclosure process, including timelines, legal requirements, and potential consequences for the borrower. 5. Redemption Rights: In some cases, Salt Lake Utah Default Certificate may include information regarding the borrower's right to redeem the property even after foreclosure has been initiated. It may outline the conditions and timeframes within which the borrower can exercise their redemption rights, if applicable. Types of Salt Lake Utah Default Certificates: 1. Residential Mortgage Default Certificate: This type of certificate specifically pertains to default on residential mortgage loans in Salt Lake City, Utah. 2. Commercial Loan Default Certificate: This certificate is issued when a borrower defaults on a commercial loan, typically secured by a property used for commercial purposes in Salt Lake City, Utah. 3. Student Loan Default Certificate: Student loan lenders issue this certificate when a borrower fails to make timely payments or adhere to the terms and conditions of the student loan in Salt Lake City, Utah. In conclusion, the Salt Lake Utah Default Certificate is a vital legal document that outlines the details of a default on a loan or mortgage in Salt Lake City, Utah. It provides comprehensive information regarding the default, cure period, foreclosure proceedings, redemption rights, and other relevant details.

Salt Lake Utah Default Certificate

Description

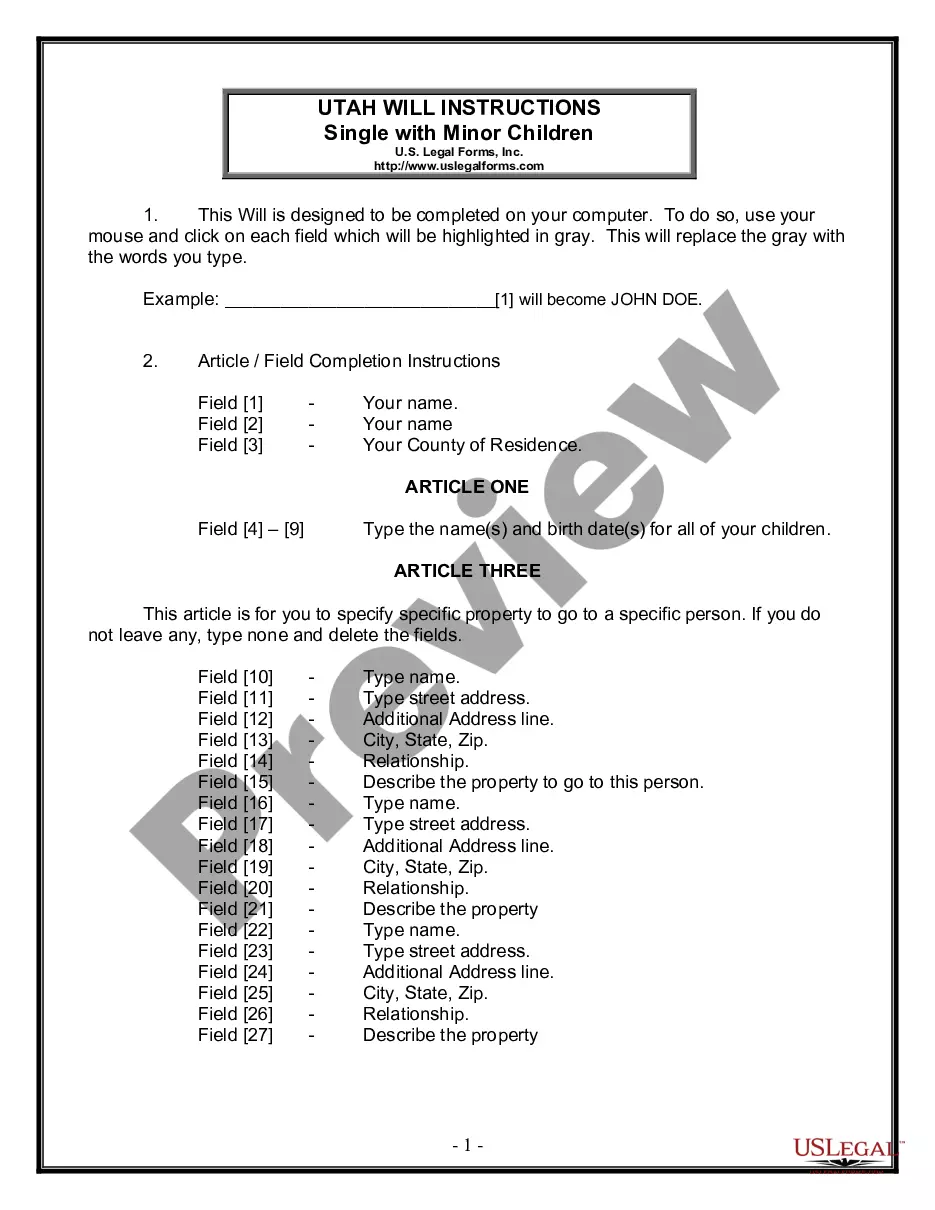

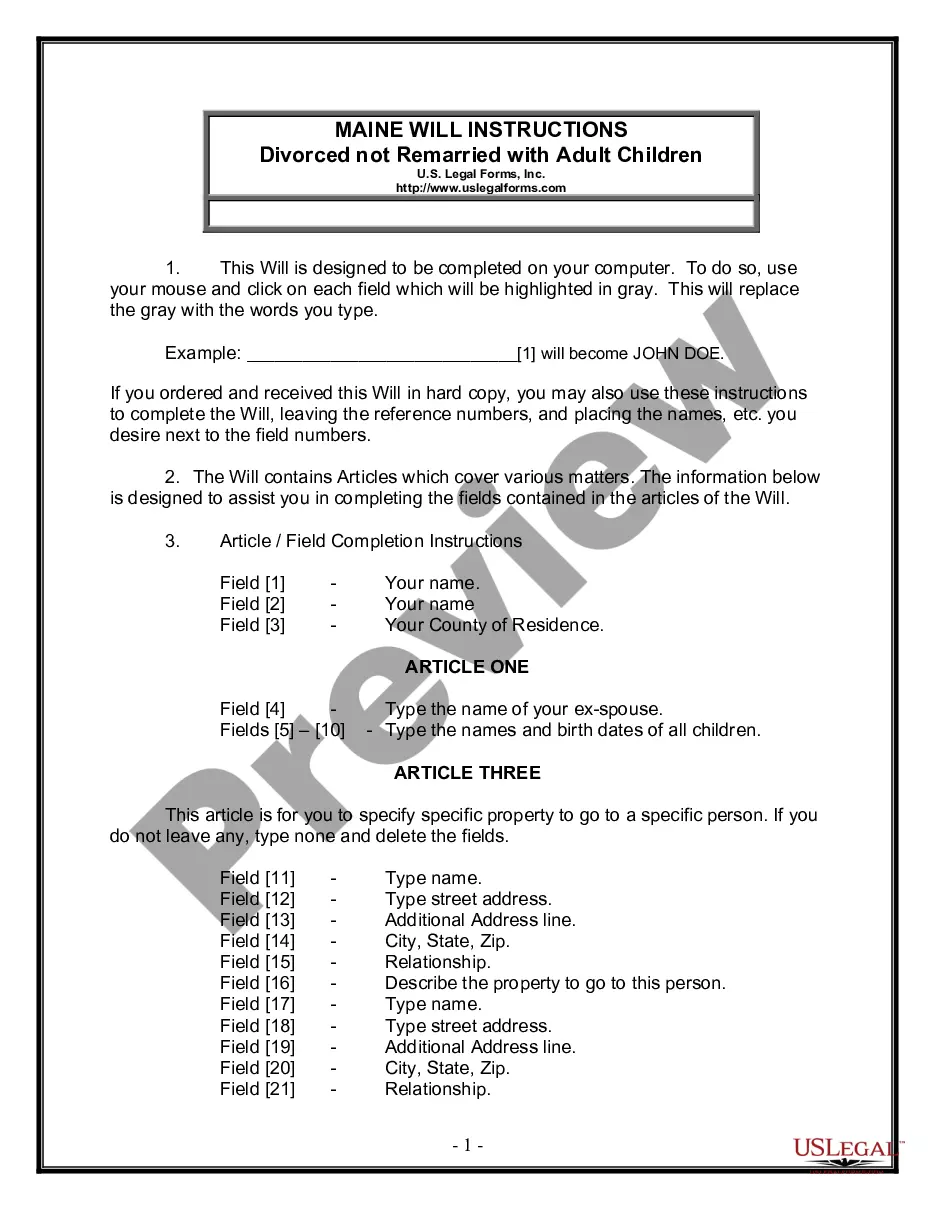

How to fill out Salt Lake Utah Default Certificate?

Take advantage of the US Legal Forms and have instant access to any form template you need. Our beneficial website with a huge number of templates allows you to find and obtain almost any document sample you require. You can export, complete, and certify the Salt Lake Utah Default Certificate in a few minutes instead of browsing the web for several hours trying to find an appropriate template.

Using our library is a superb way to raise the safety of your document filing. Our professional lawyers regularly check all the documents to ensure that the forms are appropriate for a particular state and compliant with new acts and regulations.

How do you get the Salt Lake Utah Default Certificate? If you already have a subscription, just log in to the account. The Download button will appear on all the documents you look at. Moreover, you can find all the earlier saved records in the My Forms menu.

If you haven’t registered an account yet, follow the tips below:

- Find the template you need. Ensure that it is the template you were hoping to find: examine its title and description, and take take advantage of the Preview option if it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the saving process. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Export the document. Indicate the format to obtain the Salt Lake Utah Default Certificate and modify and complete, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable document libraries on the internet. We are always happy to help you in any legal case, even if it is just downloading the Salt Lake Utah Default Certificate.

Feel free to take full advantage of our service and make your document experience as straightforward as possible!

Form popularity

FAQ

The Rules define ?default? as when ?a party against whom a judgment for affirmative relief is sought has failed to plead or otherwise defend,? and define ?judgment? as ?a decree and any order from which an appeal lies.? Read together, a default judgment is simply any judgment that results from a default.

To get a judgment by default, you must serve the other party with the Summons and the Complaint/Petition, file proof of service with the court, and then wait at least 21 days (30 days if the other party was served outside Utah).

An uncontested divorce in Utah requires an average of 3 months to complete. A contentious divorce, on the other hand, might take 9 months or longer, depending on the complexity of marital assets.

A default judgment (also known as judgment by default) is a ruling granted by a judge or court in favor of a plaintiff in the event that the defendant in a legal case fails to respond to a court summons or does not appear in court.

Once the court has entered a judgment, your creditor can collect the judgment by garnishing you. This lets the creditor take the money directly from your bank account or paycheck. Your creditor might also legally seize your property.

To get a judgment by default, you must serve the other party with the Summons and the Complaint/Petition, file proof of service with the court, and then wait at least 21 days (30 days if the other party was served outside Utah).

An order of default is a court order saying that one party (usually the plaintiff) has won the case, and the defendant has lost, because the defendant did not participate in the case.

(h) Default judgment When a default is entered, the party who requested the entry of default must obtain a default judgment against the defaulting party within 45 days after the default was entered, unless the court has granted an extension of time.

?Final decision? or ?final judgment? refers to a court's decision that settles all of the parties' legal issues in controversy in the court. ?Decision on the merits? or ?judgment on the merits? is a judgment made based on facts and relevant substantive law of the case, rather than on technical or procedural grounds.

Primary tabs. A default judgment (also known as judgment by default) is a ruling granted by a judge or court in favor of a plaintiff in the event that the defendant in a legal case fails to respond to a court summons or does not appear in court.