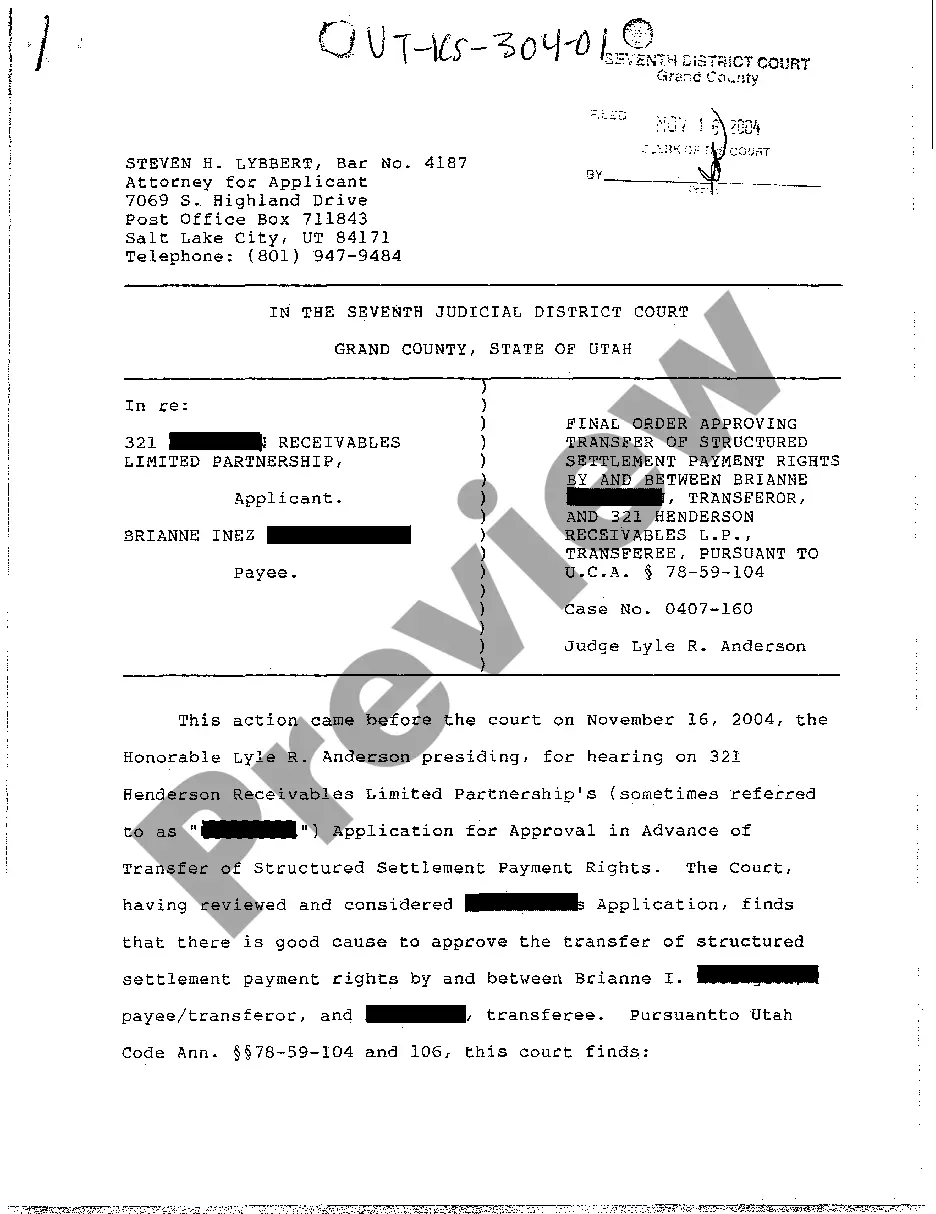

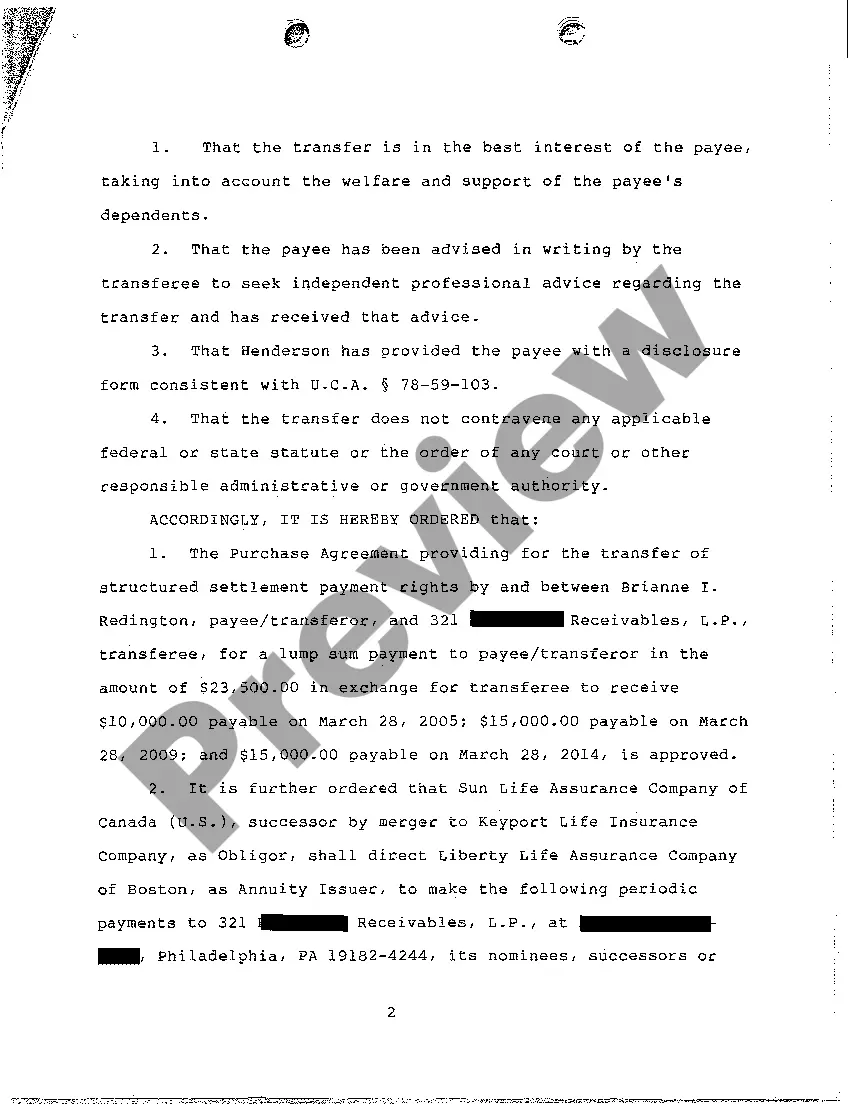

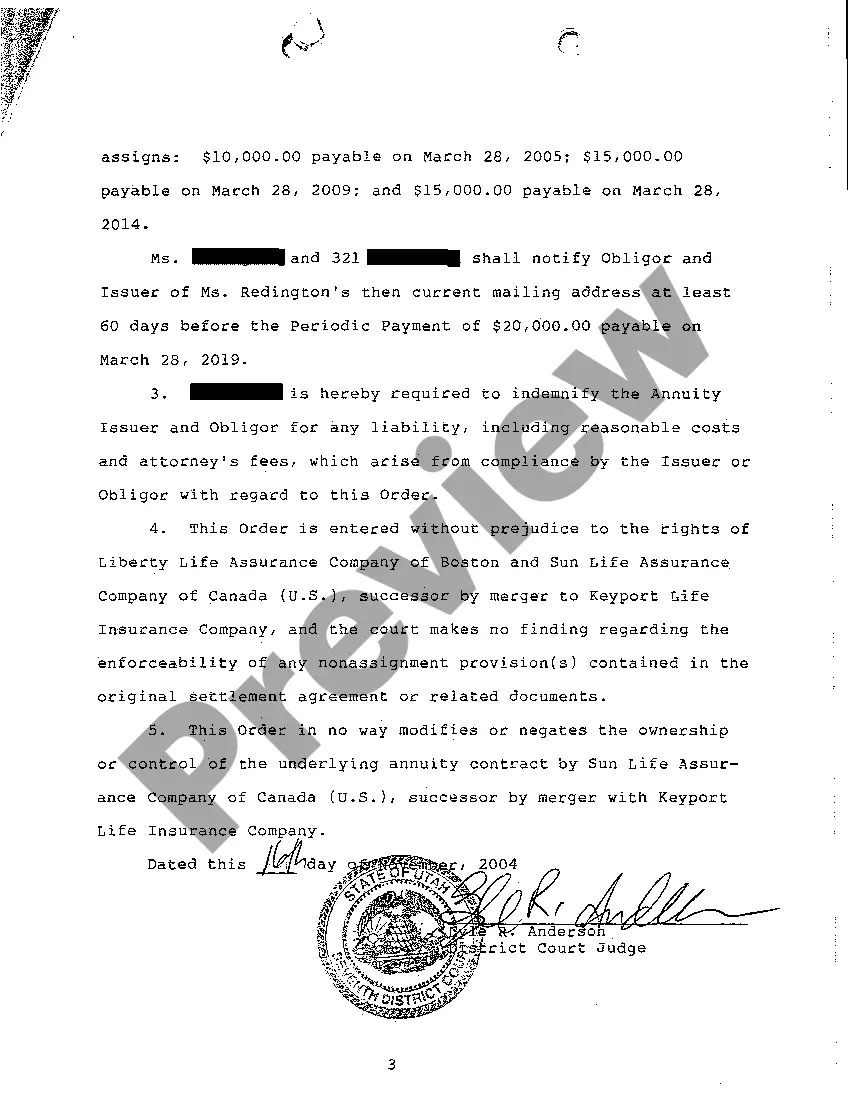

West Valley City Utah Final Order Approving Transfer of Structured Settlement Payment Rights is a legal document issued by a court in West Valley City, Utah, that authorizes the transfer of structured settlement payment rights from one party to another. This order is typically granted in cases where the recipient of the structured settlement wishes to sell their future payment stream for a lump sum of money. The Final Order Approving Transfer of Structured Settlement Payment Rights ensures that the transfer is executed in compliance with the relevant state and federal laws governing structured settlements. It ensures that the transaction is fair and equitable for all parties involved and provides legal protection for the parties involved in the transfer. There may be different types of West Valley City Utah Final Order Approving Transfer of Structured Settlement Payment Rights, depending on the specific circumstances of the case. Some possible variations include: 1. Minor's Release Order: If the structured settlement recipient is a minor, a separate order may be required to approve the transfer and release the funds. This order is issued to protect the minor's best interests and ensure that the funds are used for their benefit. 2. Assignment Order: This type of order may be used when the structured settlement payment rights are being transferred to a third party. It authorizes the assignment of the payment rights from the original payee to the new recipient. 3. Qualified Order: In cases where the transfer of structured settlement payment rights involves a qualified assignment under the Internal Revenue Code, a qualified order is necessary. This order confirms that the transfer meets the requirements set forth in the tax code and allows for the tax-free treatment of the transferred payments. In summary, West Valley City Utah Final Order Approving Transfer of Structured Settlement Payment Rights is a legal document that enables the transfer of structured settlement payment rights. The specific type of order may vary based on factors such as the age of the recipient or the tax implications of the transfer.

West Valley City Utah Final Order Approving Transfer of Structured Settlement Payment Rights

Description

How to fill out West Valley City Utah Final Order Approving Transfer Of Structured Settlement Payment Rights?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial affairs. To do so, we apply for legal solutions that, usually, are extremely expensive. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to legal counsel. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the West Valley City Utah Final Order Approving Transfer of Structured Settlement Payment Rights or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the West Valley City Utah Final Order Approving Transfer of Structured Settlement Payment Rights complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the West Valley City Utah Final Order Approving Transfer of Structured Settlement Payment Rights is proper for you, you can select the subscription plan and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!