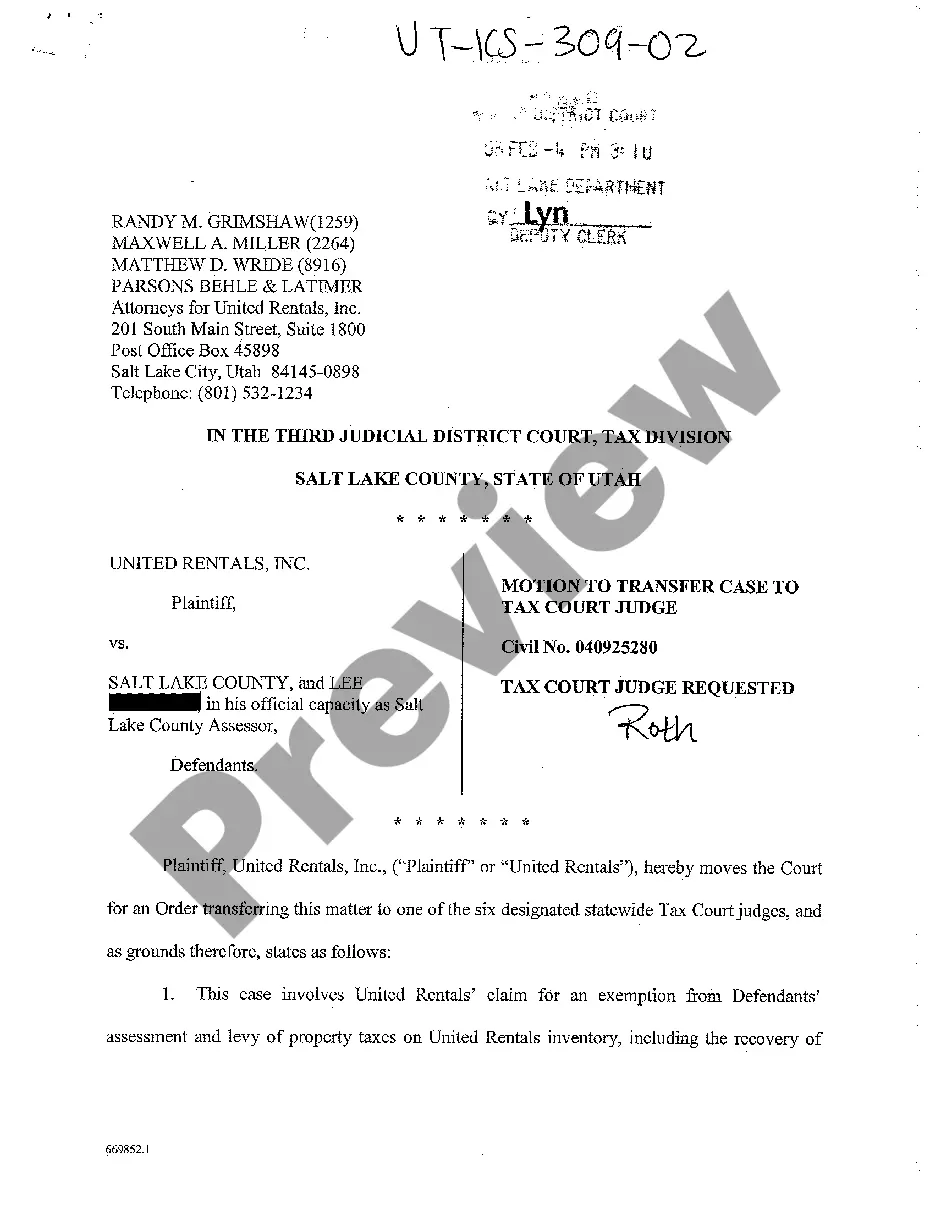

Title: Provo Utah Motion to Transfer Case to Tax Court Judge: A Comprehensive Overview Keywords: Provo Utah, Motion to Transfer Case, Tax Court Judge, legal process, tax disputes, types of Provo Utah Motion to Transfer Cases, tax-related cases, benefits of transferring case to Tax Court Judge Introduction: A Provo Utah Motion to Transfer Case to Tax Court Judge is a legal procedure used to request the transfer of a tax-related case from a traditional court to the Tax Court Judge. This detailed description explores the process, types of cases involved, and the advantages of transferring a case to a Tax Court Judge in Provo Utah. 1. Understanding the Motion to Transfer Case: The Motion to Transfer Case allows individuals or entities involved in tax disputes to request the relocation of their case from a regular court to the specialized Tax Court. The Tax Court Judge possesses specialized knowledge and experience to handle complex tax-related matters efficiently. 2. Types of Provo Utah Motion to Transfer Cases: a) Income Tax Disputes: Taxpayers dealing with income tax disputes, such as disputes over deductions, exemptions, or tax liabilities, can file a Motion to Transfer Case for their disputes to be heard by a Tax Court Judge. b) Estate and Gift Tax Disputes: Cases related to estate and gift tax, including valuation disputes or disagreements on tax liabilities, can be transferred to the Tax Court. c) Employment Tax Disputes: Businesses facing disputes over employment tax, such as worker classification or payroll tax matters, may opt to move their case to the Tax Court Judge. 3. Procedure to File a Motion to Transfer Case: To transfer a case to a Tax Court Judge in Provo Utah, the following steps need to be followed: a) Consultation with tax attorney or legal expert. b) Prepare the Motion to Transfer Case, including a succinct explanation justifying why the transfer is necessary for the resolution of the tax dispute. c) File the Motion with the appropriate court, adhering to the specific procedural requirements and timeline. d) Prepare supporting documents and evidence to strengthen the Motion to Transfer Case. e) Attend the hearing where the judge will evaluate the motion and decide whether to grant or deny the request for transfer. 4. Benefits of transferring a case to a Tax Court Judge: a) Expertise: Tax Court Judges possess in-depth knowledge and experience in resolving complex tax-related matters, ensuring a fair and informed judgment. b) Efficiency: The Tax Court operates under a streamlined process, reducing the time and resources required for case resolution. c) Specialized Tax Focus: Unlike regular courts, Tax Court Judges solely deal with tax-related cases, ensuring a better understanding of the intricate laws and regulations governing taxation matters. d) Confidentiality: Unlike regular courts, Tax Court proceedings are generally not open to the public, offering a greater level of privacy and confidentiality for sensitive tax matters. In conclusion, a Provo Utah Motion to Transfer Case to Tax Court Judge is an avenue to transfer tax-related disputes to a specialized Tax Court, ensuring a fair and knowledgeable resolution. Understanding the process and benefits of such cases can aid individuals and businesses in effectively navigating tax disputes in Provo, Utah.

Provo Utah Motion To Transfer Case To Tax Court Judge

Description

How to fill out Provo Utah Motion To Transfer Case To Tax Court Judge?

Do you need a reliable and inexpensive legal forms supplier to buy the Provo Utah Motion To Transfer Case To Tax Court Judge? US Legal Forms is your go-to option.

No matter if you require a basic agreement to set regulations for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked based on the requirements of specific state and area.

To download the document, you need to log in account, locate the required template, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Provo Utah Motion To Transfer Case To Tax Court Judge conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is intended for.

- Restart the search in case the template isn’t good for your specific situation.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is completed, download the Provo Utah Motion To Transfer Case To Tax Court Judge in any provided file format. You can get back to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending hours researching legal paperwork online once and for all.