Title: Understanding Salt Lake Utah Motion to Transfer Case to Tax Court Judge: A Detailed Overview Introduction: In Salt Lake City, Utah, individuals and businesses may seek to transfer their tax-related cases to the Tax Court Judge. This article provides an in-depth explanation of what a Salt Lake Utah Motion to Transfer Case to Tax Court Judge entails, including its purpose and possible types of motions. 1. What is Salt Lake Utah Motion to Transfer Case to Tax Court Judge? A Salt Lake Utah Motion to Transfer Case to Tax Court Judge refers to the legal procedure in which a party requests the relocation of their tax case from a lower court to the specialized Tax Court Judge, specifically established to handle tax-related matters. It is crucial to understand the reasons for seeking such a transfer and the potential benefits it may bring. 2. The Purpose and Benefits of Transferring a Case to Tax Court: a) Expertise and Specialization: The Tax Court Judge possesses extensive knowledge and expertise in tax laws, regulations, and their application. By transferring a case, the party gains access to a judge with specialized skills in resolving tax disputes. b) Tax-Specific Procedures: The Tax Court follows unique procedures and rules tailored to handle tax cases efficiently. These specialized procedures can streamline the litigation process, potentially leading to quicker resolutions. c) Venue Selection: The Tax Court allows parties to choose between various places, including Salt Lake City, Utah, ensuring accessibility for individuals or businesses in the area. d) Consistency: Transferring the case consolidates all relevant tax matters, minimizing the risk of different outcomes in separate courts and providing consistent rulings. 3. Types of Salt Lake Utah Motion to Transfer Case to Tax Court Judge: a) Motion for De Nova Review: This motion is filed when the taxpayer disagrees with the Internal Revenue Service's (IRS) determination and seeks a new hearing in the Tax Court. It aims to revise or challenge the IRS's decision through a fresh review. b) Motion to Remove Frivolous Issues: If the opposing party introduces baseless or trivial claims, a motion can be filed to request the removal of such issues from the case, streamlining the litigation process. c) Motion to Consolidate: When multiple tax-related cases involving the same or similar issues arise, parties may consider filing a motion to consolidate. Consolidation ensures efficiency, reduces redundancy, and allows the cases to be heard collectively by a Tax Court Judge. d) Motion for Change of Venue: Parties may request a change of venue to a specific geographic location, such as Salt Lake City, Utah. This motion is typically filed when the existing venue poses challenges or inconvenience to the parties involved. Conclusion: Salt Lake Utah Motion to Transfer Case to Tax Court Judge serves as a strategic legal maneuver for individuals and businesses seeking to resolve tax disputes efficiently and in a specialized tax-focused environment. By transferring a case, parties gain access to the expertise and unique procedures of the Tax Court, potentially yielding more favorable outcomes. Understanding the various types of motions related to Salt Lake Utah cases is essential for navigating the complex landscape of tax litigation.

Salt Lake Utah Motion To Transfer Case To Tax Court Judge

State:

Utah

County:

Salt Lake

Control #:

UT-KS-309-02

Format:

PDF

Instant download

This form is available by subscription

Description

A05 Motion To Transfer Case To Tax Court Judge

Title: Understanding Salt Lake Utah Motion to Transfer Case to Tax Court Judge: A Detailed Overview Introduction: In Salt Lake City, Utah, individuals and businesses may seek to transfer their tax-related cases to the Tax Court Judge. This article provides an in-depth explanation of what a Salt Lake Utah Motion to Transfer Case to Tax Court Judge entails, including its purpose and possible types of motions. 1. What is Salt Lake Utah Motion to Transfer Case to Tax Court Judge? A Salt Lake Utah Motion to Transfer Case to Tax Court Judge refers to the legal procedure in which a party requests the relocation of their tax case from a lower court to the specialized Tax Court Judge, specifically established to handle tax-related matters. It is crucial to understand the reasons for seeking such a transfer and the potential benefits it may bring. 2. The Purpose and Benefits of Transferring a Case to Tax Court: a) Expertise and Specialization: The Tax Court Judge possesses extensive knowledge and expertise in tax laws, regulations, and their application. By transferring a case, the party gains access to a judge with specialized skills in resolving tax disputes. b) Tax-Specific Procedures: The Tax Court follows unique procedures and rules tailored to handle tax cases efficiently. These specialized procedures can streamline the litigation process, potentially leading to quicker resolutions. c) Venue Selection: The Tax Court allows parties to choose between various places, including Salt Lake City, Utah, ensuring accessibility for individuals or businesses in the area. d) Consistency: Transferring the case consolidates all relevant tax matters, minimizing the risk of different outcomes in separate courts and providing consistent rulings. 3. Types of Salt Lake Utah Motion to Transfer Case to Tax Court Judge: a) Motion for De Nova Review: This motion is filed when the taxpayer disagrees with the Internal Revenue Service's (IRS) determination and seeks a new hearing in the Tax Court. It aims to revise or challenge the IRS's decision through a fresh review. b) Motion to Remove Frivolous Issues: If the opposing party introduces baseless or trivial claims, a motion can be filed to request the removal of such issues from the case, streamlining the litigation process. c) Motion to Consolidate: When multiple tax-related cases involving the same or similar issues arise, parties may consider filing a motion to consolidate. Consolidation ensures efficiency, reduces redundancy, and allows the cases to be heard collectively by a Tax Court Judge. d) Motion for Change of Venue: Parties may request a change of venue to a specific geographic location, such as Salt Lake City, Utah. This motion is typically filed when the existing venue poses challenges or inconvenience to the parties involved. Conclusion: Salt Lake Utah Motion to Transfer Case to Tax Court Judge serves as a strategic legal maneuver for individuals and businesses seeking to resolve tax disputes efficiently and in a specialized tax-focused environment. By transferring a case, parties gain access to the expertise and unique procedures of the Tax Court, potentially yielding more favorable outcomes. Understanding the various types of motions related to Salt Lake Utah cases is essential for navigating the complex landscape of tax litigation.

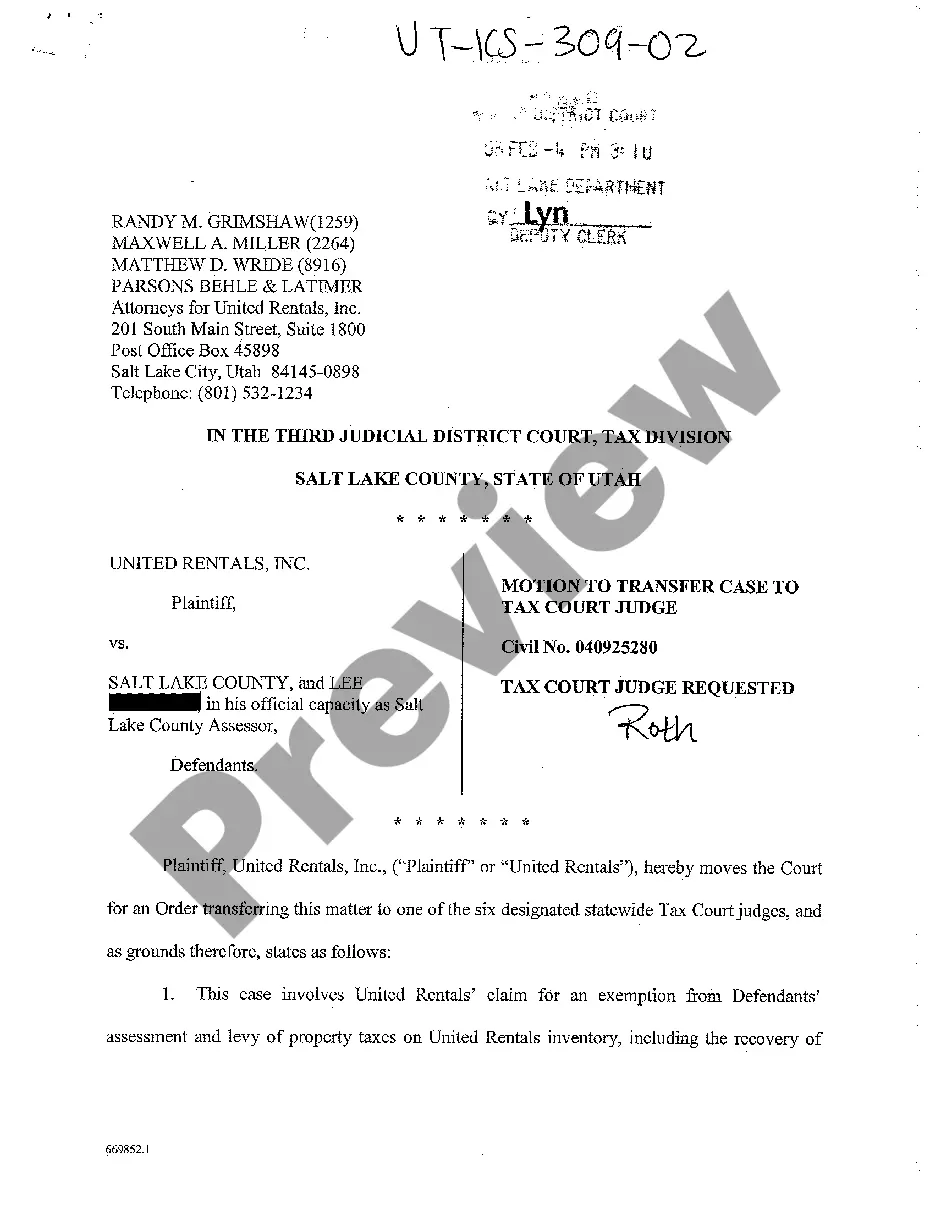

Free preview

How to fill out Salt Lake Utah Motion To Transfer Case To Tax Court Judge?

If you’ve already used our service before, log in to your account and save the Salt Lake Utah Motion To Transfer Case To Tax Court Judge on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Ensure you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Salt Lake Utah Motion To Transfer Case To Tax Court Judge. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!