Salt Lake City Utah Motion to Transfer Case to Tax Court Judge is a legal process that allows individuals or entities involved in tax-related disputes to request the transfer of their case to the Tax Court Judge located in Salt Lake City, Utah. This motion serves as a means to ensure fair and impartial judgment by a specialized judge who has expertise in tax-related matters. It is important to note that there are various types of motions that can be filed in this context, such as: 1. Salt Lake City Utah Motion to Transfer Case to Tax Court Judge for Jurisdictional Reasons: This type of motion is filed when the case has originally been filed in a different court, and the party believes that the Tax Court Judge located in Salt Lake City, Utah, has proper jurisdiction to hear the case due to various reasons such as residence, property location, or other pertinent factors. 2. Salt Lake City Utah Motion to Transfer Case to Tax Court Judge for Expertise: If a tax case involves complex tax laws, regulations, or intricate financial matters, the party may file a motion to transfer the case to the Tax Court Judge in Salt Lake City, Utah, who possesses specialized knowledge and experience in tax-related disputes. This helps ensure that the case is handled by a judge who can comprehend and apply intricate tax laws accurately. 3. Salt Lake City Utah Motion to Transfer Case to Tax Court Judge for Convenience: Parties involved in a tax dispute may file a motion to transfer the case to the Tax Court Judge in Salt Lake City, Utah, for convenience purposes. This could occur if the location of the Tax Court in Salt Lake City offers logistical advantages to the parties involved, such as proximity to witnesses, evidence, or easier access to legal resources, thus making the proceedings more manageable for all parties. 4. Salt Lake City Utah Motion to Transfer Case to Tax Court Judge for Fairness: In specific circumstances, a party may request the transfer of their case to the Tax Court Judge located in Salt Lake City, Utah, for the purpose of ensuring a fair and impartial trial. This motion is typically filed when a party believes that the original court's judge may have a potential bias or conflict of interest that could impact the outcome of the case. Regardless of the specific type of motion filed, the Salt Lake City Utah Motion to Transfer Case to Tax Court Judge is an important legal document supporting the request for a case's relocation to the Tax Court Judge situated in Salt Lake City, Utah. The motion presents the reasons justifying the transfer and explains how the relocation will benefit the proceedings and the parties involved.

Salt Lake City Utah Motion To Transfer Case To Tax Court Judge

State:

Utah

City:

Salt Lake City

Control #:

UT-KS-309-02

Format:

PDF

Instant download

This form is available by subscription

Description

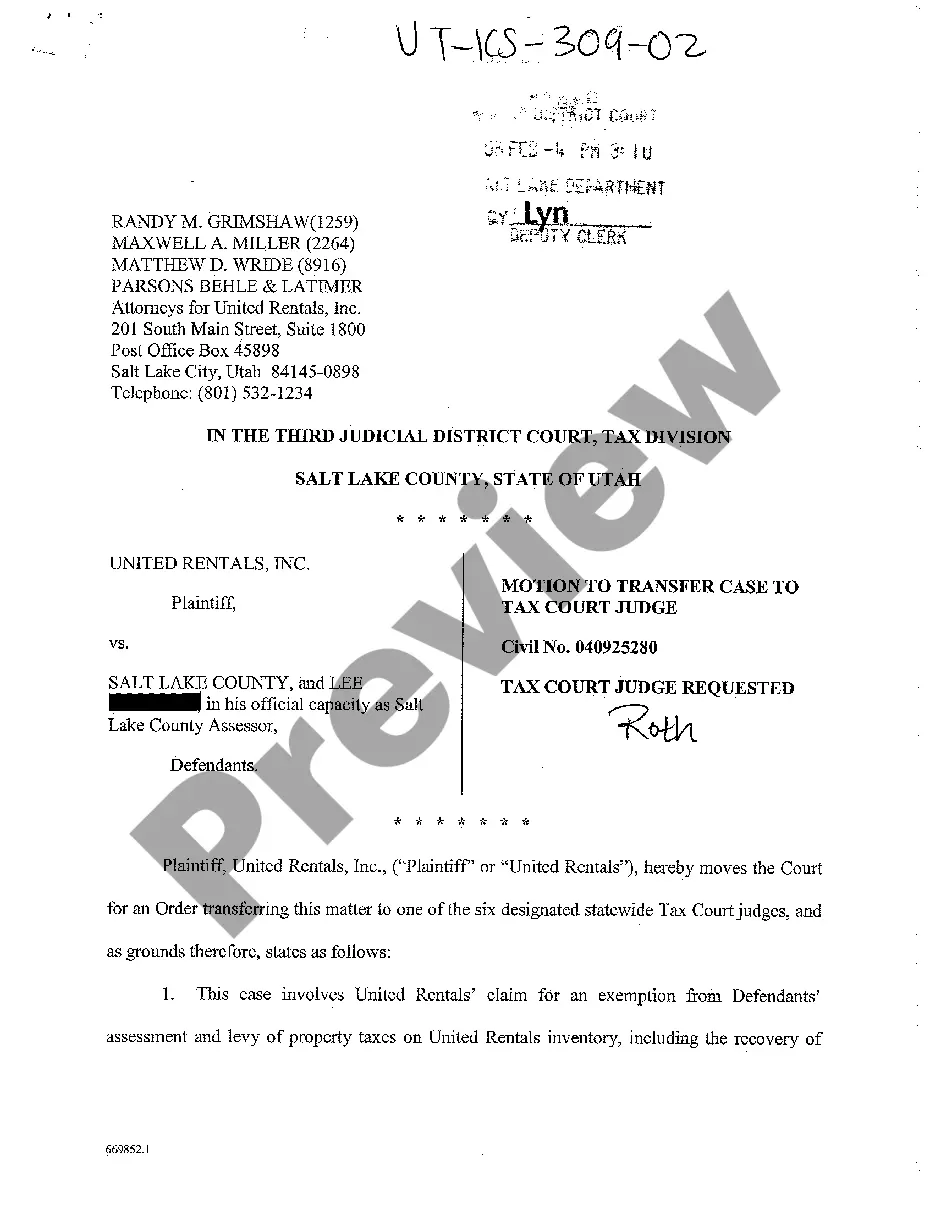

A05 Motion To Transfer Case To Tax Court Judge

Salt Lake City Utah Motion to Transfer Case to Tax Court Judge is a legal process that allows individuals or entities involved in tax-related disputes to request the transfer of their case to the Tax Court Judge located in Salt Lake City, Utah. This motion serves as a means to ensure fair and impartial judgment by a specialized judge who has expertise in tax-related matters. It is important to note that there are various types of motions that can be filed in this context, such as: 1. Salt Lake City Utah Motion to Transfer Case to Tax Court Judge for Jurisdictional Reasons: This type of motion is filed when the case has originally been filed in a different court, and the party believes that the Tax Court Judge located in Salt Lake City, Utah, has proper jurisdiction to hear the case due to various reasons such as residence, property location, or other pertinent factors. 2. Salt Lake City Utah Motion to Transfer Case to Tax Court Judge for Expertise: If a tax case involves complex tax laws, regulations, or intricate financial matters, the party may file a motion to transfer the case to the Tax Court Judge in Salt Lake City, Utah, who possesses specialized knowledge and experience in tax-related disputes. This helps ensure that the case is handled by a judge who can comprehend and apply intricate tax laws accurately. 3. Salt Lake City Utah Motion to Transfer Case to Tax Court Judge for Convenience: Parties involved in a tax dispute may file a motion to transfer the case to the Tax Court Judge in Salt Lake City, Utah, for convenience purposes. This could occur if the location of the Tax Court in Salt Lake City offers logistical advantages to the parties involved, such as proximity to witnesses, evidence, or easier access to legal resources, thus making the proceedings more manageable for all parties. 4. Salt Lake City Utah Motion to Transfer Case to Tax Court Judge for Fairness: In specific circumstances, a party may request the transfer of their case to the Tax Court Judge located in Salt Lake City, Utah, for the purpose of ensuring a fair and impartial trial. This motion is typically filed when a party believes that the original court's judge may have a potential bias or conflict of interest that could impact the outcome of the case. Regardless of the specific type of motion filed, the Salt Lake City Utah Motion to Transfer Case to Tax Court Judge is an important legal document supporting the request for a case's relocation to the Tax Court Judge situated in Salt Lake City, Utah. The motion presents the reasons justifying the transfer and explains how the relocation will benefit the proceedings and the parties involved.

Free preview

How to fill out Salt Lake City Utah Motion To Transfer Case To Tax Court Judge?

If you’ve already utilized our service before, log in to your account and download the Salt Lake City Utah Motion To Transfer Case To Tax Court Judge on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Salt Lake City Utah Motion To Transfer Case To Tax Court Judge. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!