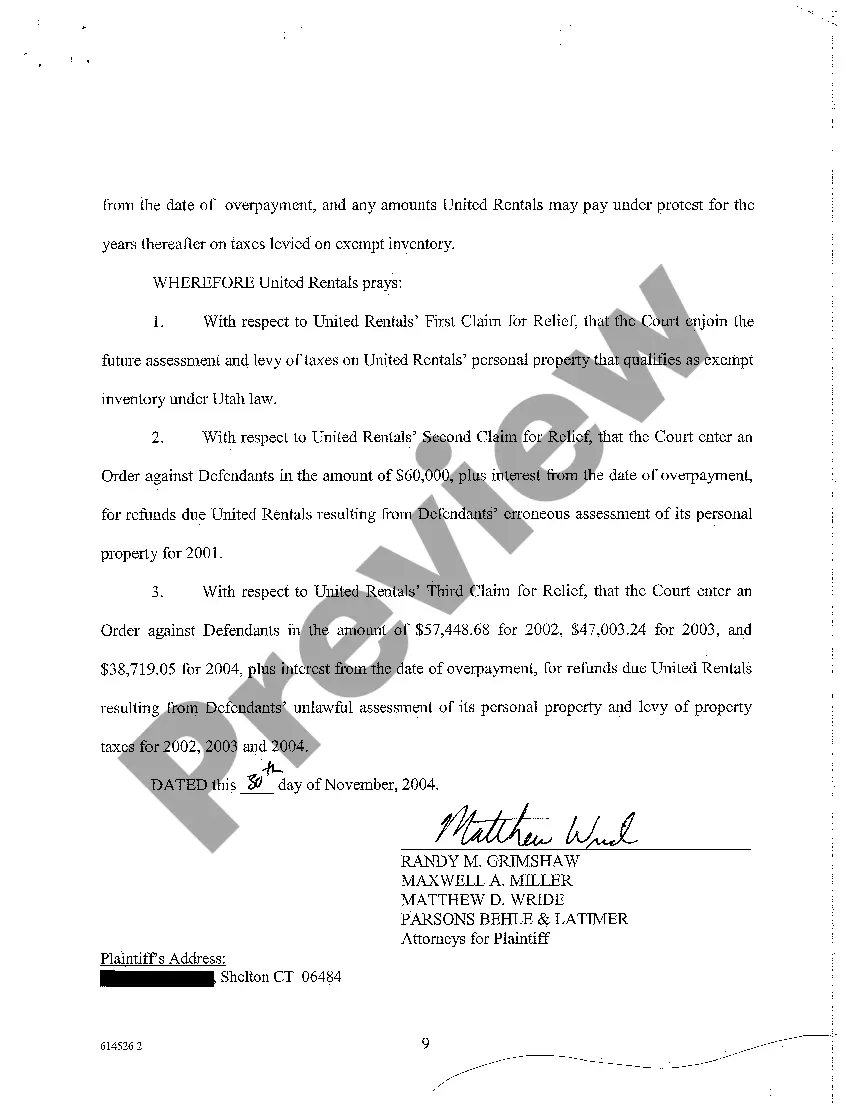

A West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes is a legal document filed by a taxpayer in West Jordan, Utah to seek relief and refund of taxes that have been assessed unlawfully. This specific type of complaint is designed to address situations where a taxpayer believes that they have been wrongly assessed taxes or charged excessive amounts by the local government. The complaint can cover various types of taxes, including property tax, income tax, sales tax, or any other tax imposed by the West Jordan municipality. The complaint typically alleges that the taxes assessed were in violation of the applicable laws, regulations, or constitutional provisions. In addition to claiming a refund of the illegally assessed taxes, a complainant can also seek declaratory and injunctive relief. Declaratory relief is a legal remedy that requests a court to make a declaration of the rights, duties, or legal status of the parties involved in the case. In this context, the complainant may request the court to declare that the assessed taxes were illegal or unconstitutional. Injunctive relief, on the other hand, seeks to prevent or halt certain actions or behaviors. In this case, the complainant may ask the court to issue an injunction to stop the local government from collecting or enforcing the disputed taxes until the matter is resolved. It is worth noting that there may be different types of West Jordan Utah Complaints For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes based on the specific tax types or circumstances involved. For instance, a complaint could be filed solely for property tax refund, or there could be separate complaints for different tax years. Each case will focus on the specific tax assessment and refund sought by the taxpayer. Overall, a West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes is a legal tool used by taxpayers in West Jordan, Utah to seek relief, reimbursement, and clarification on any wrongfully assessed taxes imposed by the local government.

West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes

Description

How to fill out West Jordan Utah Complaint For Declaratory And Injunctive Relief And For Refund Of Illegally Assessed Taxes?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person with no legal background to draft this sort of paperwork cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our platform offers a huge collection with over 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you need the West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes in minutes employing our trustworthy platform. In case you are already a subscriber, you can proceed to log in to your account to get the appropriate form.

Nevertheless, in case you are unfamiliar with our platform, make sure to follow these steps prior to downloading the West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes:

- Ensure the template you have chosen is specific to your area because the rules of one state or area do not work for another state or area.

- Review the document and read a short description (if provided) of cases the document can be used for.

- In case the one you picked doesn’t meet your needs, you can start over and look for the necessary document.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes as soon as the payment is done.

You’re good to go! Now you can proceed to print out the document or fill it out online. Should you have any issues getting your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

The SF City Attorney is the legal representative for the City and County of San Francisco, addressing legal matters and providing counsel for city government actions. While this position is distinct from the West Jordan City Attorney, both roles entail similar responsibilities, including navigating legal frameworks like the West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes. Collaboration between such offices ensures community interests are protected across jurisdictions.

A 10-day summons in Utah is a legal document that instructs the defendant to respond to a complaint within ten days. This type of summons is often used in civil cases, including those surrounding the West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes. The swift response necessary ensures that legal proceedings can commence promptly, upholding the rights of all parties involved.

The city attorney for West Jordan is tasked with providing legal guidance to the city government and representing the city's interests in court. This position is vital for handling issues like the West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes. The city attorney also helps to maintain the rule of law and protect the rights of residents through competent legal representation.

The judge of the West Jordan Court plays a crucial role in adjudicating cases, including those related to the West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes. They ensure due process is upheld and that legal matters are resolved fairly. A competent judiciary supports the community by interpreting laws and managing court proceedings efficiently.

The current mayor of West Jordan is responsible for overseeing city operations and representing the interests of the community. This role includes addressing issues like the West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes. The mayor works closely with various departments, including legal counsel, to ensure the city remains compliant and serves its residents effectively.

The City Attorney represents the City of West Jordan in legal matters, ensuring compliance with local, state, and federal laws. They advocate for the city's interests, particularly in cases involving the West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes. This position also involves providing legal counsel to city officials and departments, contributing to effective governance.

A complaint for injunctive relief outlines the request for the court to prevent certain actions or compel specific conduct. This legally binding document is essential when pursuing a West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes. It details the reasons for the injunction and the immediate need to protect the plaintiff's rights.

To obtain injunctive relief, a plaintiff typically must demonstrate a likelihood of success on the merits, the possibility of irreparable harm, and that the balance of hardships favors issuing the injunction. Particularly in a West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes, these factors help establish the need for immediate judicial intervention. Clear evidence is crucial for a favorable outcome.

An example of injunctive relief would be preventing a property owner from continuing construction that violates zoning laws. This might arise in a West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes. The court can issue an injunction to stop any actions causing immediate harm until the matter is resolved.

The two most common types of injunctions are temporary and permanent injunctions. A temporary injunction is usually granted to maintain the status quo while a case is ongoing, while a permanent injunction is issued as a final resolution of a legal dispute. In cases like a West Jordan Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes, the type of injunction sought can significantly affect the outcome.

More info

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.