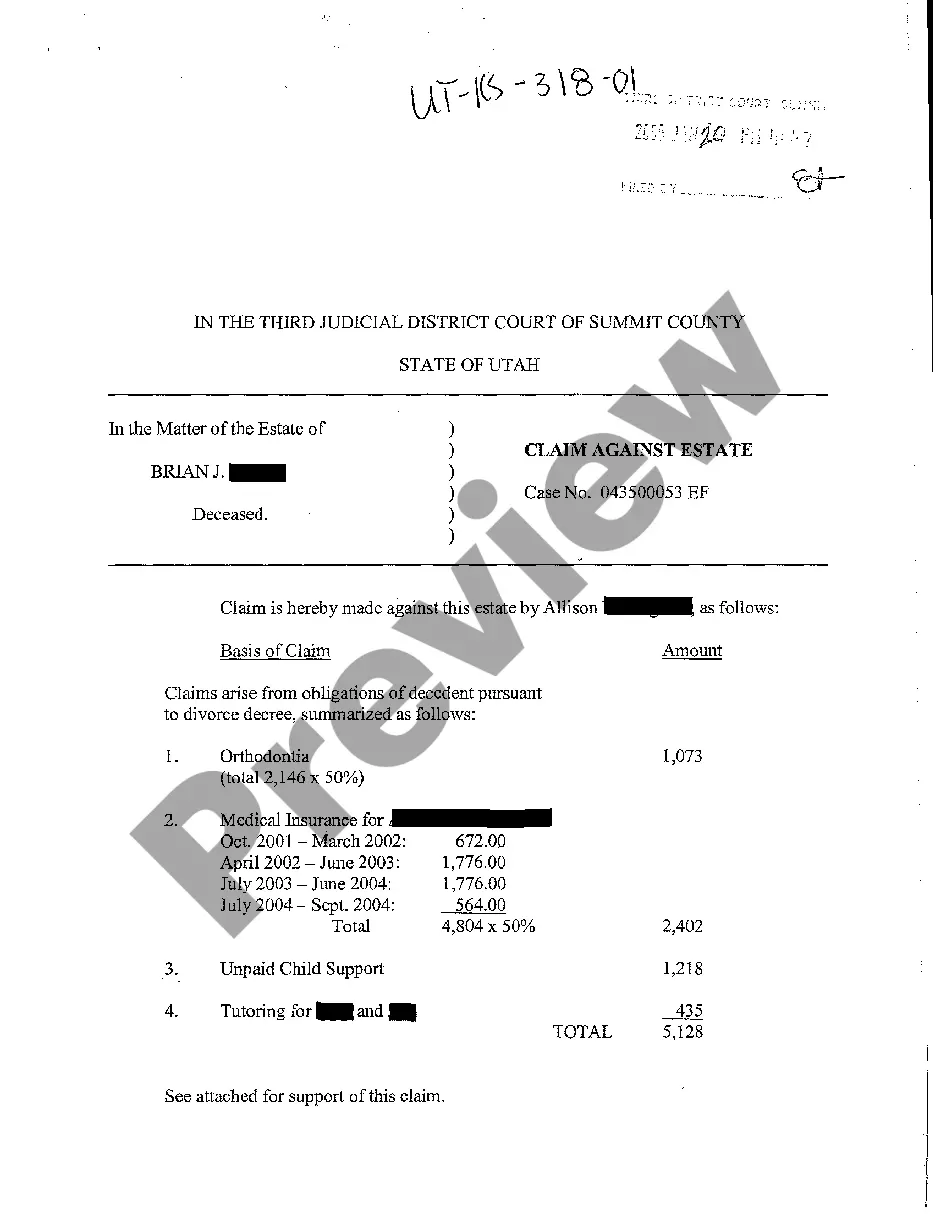

Salt Lake Utah Claim Against Estate refers to the legal process where someone makes a claim against the estate of a deceased individual in Salt Lake City, Utah. When a person passes away, their assets, known as an estate, are typically distributed among their heirs or beneficiaries according to their will or the state's laws of intestate succession. However, there are situations where certain individuals or entities believe they have a legal right to a portion of the deceased person's estate. In Salt Lake City, Utah, such claims can arise due to various reasons. Below are some common types of claims that can be made against an estate in Salt Lake City: 1. Creditor Claims: When someone owes a debt to a creditor, and they pass away, the creditor may file a claim against the estate to recover the amount owed. This can include credit card debt, medical bills, or outstanding loans. 2. Disinherited Family Members: If a family member believes they were intentionally excluded from the deceased person's will or believe they should have received a larger share of the estate, they may file a claim against the estate. They may argue that they were unjustly disinherited or that the deceased lacked the necessary mental capacity to make a valid will. 3. Spousal Rights: In Utah, a surviving spouse is entitled to a statutory share of the deceased spouse's estate, even if they were excluded from the will. If a surviving spouse believes they have not received their rightful share, they can file a claim against the estate. 4. Fraudulent Transfers: This type of claim is made when someone alleges that the deceased person made fraudulent transfers of assets before their death in an attempt to avoid creditors or disinherit certain individuals. These claims seek to recover the assets transferred back into the estate for proper distribution. 5. Will Contest: I will contest occurs when someone challenges the validity of the deceased person's will. This type of claim alleges that the will was forged, created under duress, or that the testator lacked the mental capacity to make a valid will. 6. Breach of Fiduciary Duty: If the executor or personal representative of the estate does not carry out their duties properly, they can be subject to a claim for breach of fiduciary duty. This claim can arise if the executor mismanages assets, fails to pay creditors, engages in self-dealing, or otherwise acts in a manner that harms the estate and its beneficiaries. In conclusion, Salt Lake Utah Claim Against Estate encompasses a range of legal claims that can be filed against the estate of a deceased person in Salt Lake City, Utah. Whether it is a creditor seeking payment, a disinherited family member disputing the will, or a surviving spouse asserting their rights, these claims must go through the appropriate legal channels to ensure a fair resolution for all involved parties.

Salt Lake Utah Claim Against Estate

Description

How to fill out Salt Lake Utah Claim Against Estate?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Salt Lake Utah Claim Against Estate becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Salt Lake Utah Claim Against Estate takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve selected the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Salt Lake Utah Claim Against Estate. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

Utah Code 75-3-307. The case must be filed within three years of the date of the decedent's death. If it has been more than three years since the decedent's death, parties will need to follow a different process for a determination of heirs, and should contact a probate attorney for help.

Living trusts In Utah, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

You cannot avoid probate with only a will because wills cannot transfer property. This means if you have assets you want to pass to loved ones, it isn't covered in the will and a probate matter still has to be opened.

Utah offers simplified probate procedures for smaller estates. Inheritors can skip probate completely if the value of the entire estate, after liens and encumbrances are subtracted, is worth $100,000 or less. All an heir has to do is prepare a short affidavit which states that they are entitled to a certain asset.

A small estate affidavit may be used if: the entire value of the estate is under $100,000, there is no real property, at least 30 days have passed since the death, and.

There is no federal inheritance tax?that is, a tax on the sum of assets an individual receives from a deceased person. However, a federal estate tax applies to estates larger than $11.7 million for 2021 and $12.06 million for 2022.

If only one parent is alive, the dead parent's children or grandchildren will inherit in the place of their parents. Only if the parent does not have children or grandchildren will the other parent inherit the entire estate. Where there are no parents, the deceased's estate will be inherited by his siblings equally.

Your spouse inherits all of your intestate property. If you die with descendants who are not the descendants of your surviving spouse -- in other words, you have children or grandchildren from a previous relationship. Your spouse inherits the first $75,000 of your intestate property, plus 1/2 of the balance.

Utah does not levy an inheritance tax. However, inheritance laws from other states may apply to you if someone from a state with an inheritance tax leaves you something. Pennsylvania, for instance, has inheritance laws that apply to out-of-state inheritors.

Under the Utah intestacy laws, all heirs must survive the decedent for at least 120 hours. Children born after the death of a parent may still inherit for as long as they also live for at least 120 hours. Legally-adopted children will hold the same right as biological children.