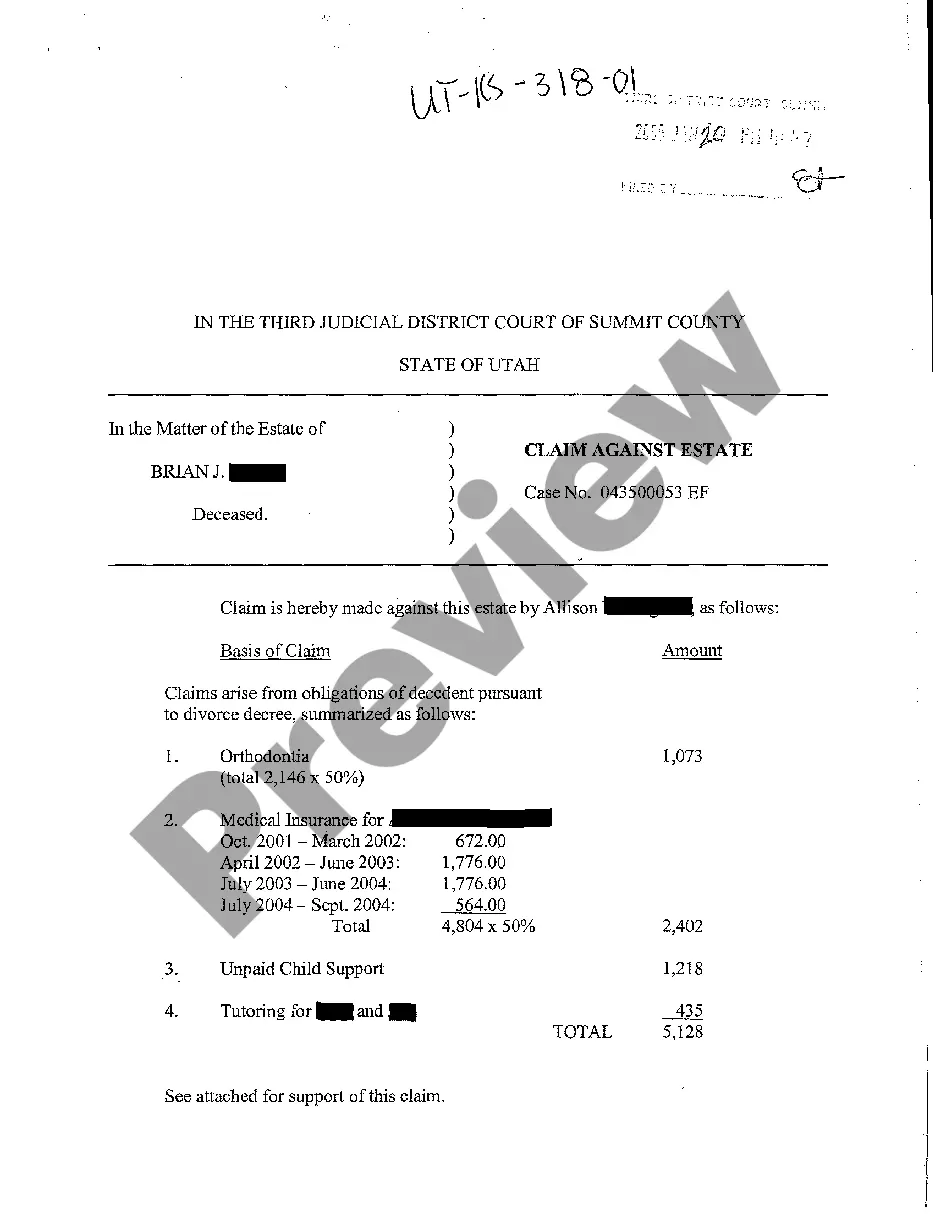

Title: Understanding West Jordan Utah Claim Against Estate: Types and Detailed Description Keywords: West Jordan Utah, claim against estate, estate creditors, probate process, legal proceedings, estate debts, estate assets, legitimate claims Introduction: In West Jordan, Utah, a claim against an estate refers to a legal action taken by individuals or entities asserting their right to collect debts owed to them by a deceased person. Such claims are an essential part of the probate process and are administered within Utah's legal framework. In this article, we will delve into the types of West Jordan Utah claims against an estate and provide a detailed description of their nature. 1. Creditor Claims: Creditor claims are the most common type of claim against an estate. These claims involve individuals or businesses that were owed money by the deceased at the time of their passing. Estate creditors are entitled to seek repayment for their outstanding debts from the assets of the estate. Examples of creditor claims may include unpaid medical bills, credit card debts, loans, mortgages, or outstanding utility bills. 2. Family Maintenance Act Claims: Under the West Jordan Utah Family Maintenance Act, certain individuals related to the deceased may make a claim against the estate if they can demonstrate a legitimate financial need that was not adequately addressed in the deceased's will or trust. Such claims typically involve close family members, such as surviving spouses or minor children, who were not provided with sufficient financial support. 3. Disputed Claims: Disputed claims arise when there are disagreements among parties involved regarding the validity or legitimacy of a claim against the estate. This may occur when a person challenges the creditor's claim or disputes the entitlement of a family member under the Family Maintenance Act. Disputed claims generally require additional legal proceedings to resolve the matter and may prolong the estate settlement process. 4. Tax Liabilities: When a deceased person has outstanding tax obligations, these claims are typically handled separately from other creditor claims. Both federal and state tax authorities may assert a claim against the estate to collect any unpaid tax liabilities, penalties, or interest accrued by the deceased. Resolving tax-related claims can require careful consideration and expert advice due to the complexity of tax laws. 5. Unforeseen Debts: Unforeseen debts are those that may surface during the estate administration process. These debts might not have been evident or known at the time of the deceased's passing. Examples of unforeseen debts may include unpaid bills, legal judgments, or outstanding financial obligations discovered during the probate process. Estate administrators must carefully review and address these claims to ensure that the estate can be properly settled. Conclusion: West Jordan Utah claims against estates encompass a range of legal actions brought forth by creditors, family members, and tax authorities seeking to collect outstanding debts, ensure adequate financial support, or resolve disputes related to the estate. Understanding the types of claims and their nature is crucial for estate administrators, heirs, and beneficiaries, as it enables them to navigate the probate process smoothly and ensure a fair distribution of the estate assets. It is always advisable to seek professional legal counsel to effectively address and resolve any claim against an estate in West Jordan, Utah.

West Jordan Utah Claim Against Estate

Description

How to fill out West Jordan Utah Claim Against Estate?

Do you need a reliable and inexpensive legal forms supplier to buy the West Jordan Utah Claim Against Estate? US Legal Forms is your go-to solution.

Whether you need a simple agreement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of particular state and county.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the West Jordan Utah Claim Against Estate conforms to the laws of your state and local area.

- Go through the form’s details (if available) to find out who and what the document is intended for.

- Restart the search if the template isn’t suitable for your legal scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the West Jordan Utah Claim Against Estate in any available file format. You can get back to the website at any time and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting hours learning about legal papers online for good.