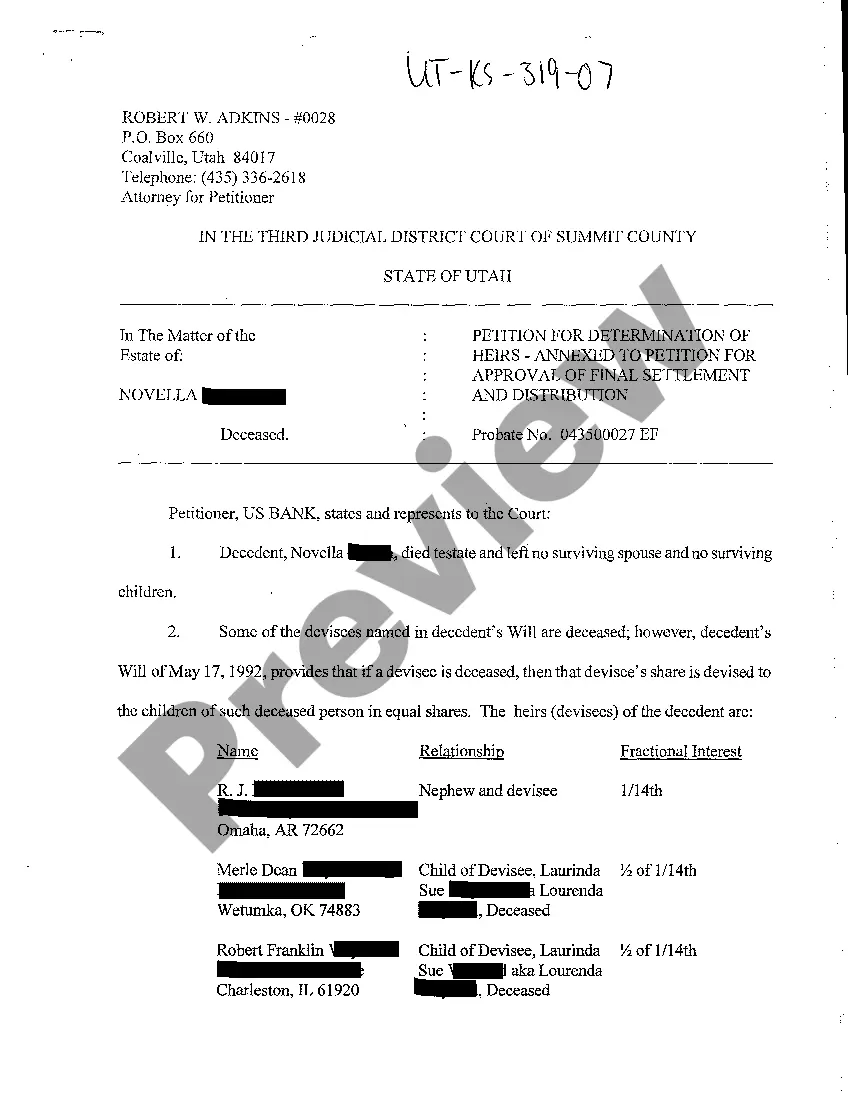

A West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution is a legal document filed in West Jordan, Utah, in situations where there is a need to determine the rightful heirs of a deceased individual's estate. The purpose of this petition is to obtain court approval for the final settlement and distribution of the deceased person's assets and properties to the rightful heirs. It is a crucial step in the probate process to ensure that the assets are distributed according to the law and the decedent's wishes. The West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution serves as a comprehensive summary of the decedent's estate, including their assets, debts, and liabilities. It also outlines the names and relationship details of potential heirs, along with supporting evidence such as birth certificates, marriage records, or other relevant documents to establish their status as rightful heirs. This petition will typically be filed by the executor or personal representative of the estate, who is responsible for managing the probate process. However, it can also be filed by any interested party who believes they may have a claim to the estate or wishes to challenge the status of the identified heirs. In West Jordan, Utah, there may be different variations or types of the Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution, depending on the specific circumstances of the case. Some possible variations or additional petitions may include: 1. Amended Petition: If new information or evidence comes to light after the initial petition is filed, an amended petition may be submitted to update or modify the information presented previously. 2. Contested Petition: If there is disagreement or dispute among potential heirs regarding their right to inherit from the estate, a contested petition may be filed to resolve these conflicts through the court's intervention. 3. Petition for Approval of Distribution Plan: In cases where a distribution plan has been developed to allocate the assets among the heirs, a separate petition may be filed to seek court approval for the proposed distribution plan. 4. Petition for Determination of Inheritance Tax: If there are potential inheritance tax obligations associated with the estate, a separate petition may be filed to determine the amount of tax owed and seek the court's approval for the payment plan. The West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution is a critical legal document that ensures the fair and lawful distribution of a deceased person's estate. It aims to protect the rights of potential heirs and provide a transparent process through court oversight and approval.

West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution

Description

How to fill out West Jordan Utah Petition For Determination Of Heirs Annexed To Petition For Approval Of Final Settlement And Distribution?

No matter the social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person with no law background to draft such paperwork cfrom the ground up, mostly due to the convoluted jargon and legal nuances they entail. This is where US Legal Forms can save the day. Our platform provides a huge catalog with more than 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you need the West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution in minutes employing our trustworthy platform. If you are presently a subscriber, you can proceed to log in to your account to get the appropriate form.

Nevertheless, if you are unfamiliar with our platform, make sure to follow these steps prior to downloading the West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution:

- Ensure the template you have found is good for your location because the regulations of one state or area do not work for another state or area.

- Preview the document and read a quick description (if provided) of scenarios the document can be used for.

- In case the form you selected doesn’t meet your requirements, you can start again and look for the necessary document.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your credentials or create one from scratch.

- Pick the payment gateway and proceed to download the West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution once the payment is done.

You’re good to go! Now you can proceed to print the document or complete it online. Should you have any problems locating your purchased forms, you can easily access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.

Form popularity

FAQ

Probate in Utah is typically triggered when a person passes away and leaves behind assets that are solely in their name. Additionally, having a will can initiate the probate process to ensure that wishes are honored. Understanding how probate works is important, and utilizing the West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution can help facilitate this process sooner.

To avoid probate in Utah, you can use various methods, such as establishing a trust or naming beneficiaries on accounts and assets. Joint ownership of property is another effective strategy. Each of these approaches can help ensure a smoother distribution process, particularly when considering the West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution.

Formal probate refers to the court-supervised process that oversees the distribution of assets, while informal probate is a more straightforward procedure without much court intervention. Generally, large or contested estates likely require formal probate. However, for simpler matters, your West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution may streamline the process effectively.

In Utah, the minimum value for probate depends primarily on the assets of the deceased person. Typically, if the total value of the estate exceeds $100,000, formal probate becomes necessary. However, if you need to manage a smaller estate, you may be able to use simpler methods. To secure a smooth process, consider the West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution.

When someone passes away without a will in Utah, their estate will undergo intestate probate, governed by Utah's intestacy laws. The court will identify the heirs based on relation and distribute assets accordingly. Filing a West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution becomes essential to formalize this process and clarify the distribution among heirs.

Formal probate involves court supervision throughout the entire process, which is necessary for larger or contested estates. Informal probate, on the other hand, is less rigid and allows for a faster resolution for straightforward estates. Knowing which option to choose is important when filing a West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution, as it affects the timeline and complexity of the estate settlement.

Utah Code 76 10 107 pertains to the offenses related to the fraudulent transfer of property. It indicates the legal consequences for those attempting to hide, misrepresent, or improperly distribute property. Understanding this code is essential when preparing a West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution, as any fraudulent activity can significantly impact the estate's administration.

An estate petition is a legal document filed in probate court to start the administration of a deceased person's estate. This process typically involves outlining the deceased's assets, liabilities, and the necessary steps to settle the estate. When submitting a West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution, this petition serves as a vital step in ensuring a smooth and lawful distribution of assets.

Code 75 1 107 in Utah outlines the statutory provisions about intestate succession. It explains how the estate of a person who passes away without a will is distributed among surviving heirs. This code is integral while filing a West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution to ensure the rightful heirs are identified and recognized.

Heirs in Utah are those individuals who inherit the estate of a deceased person, according to intestate succession laws. Typically, this includes the spouse, children, parents, and siblings, in that order. In some cases, more distant relatives may become heirs if direct family is absent. It's beneficial to file a West Jordan Utah Petition for Determination of Heirs Annexed to Petition for Approval of Final Settlement and Distribution to identify and confirm all heirs.