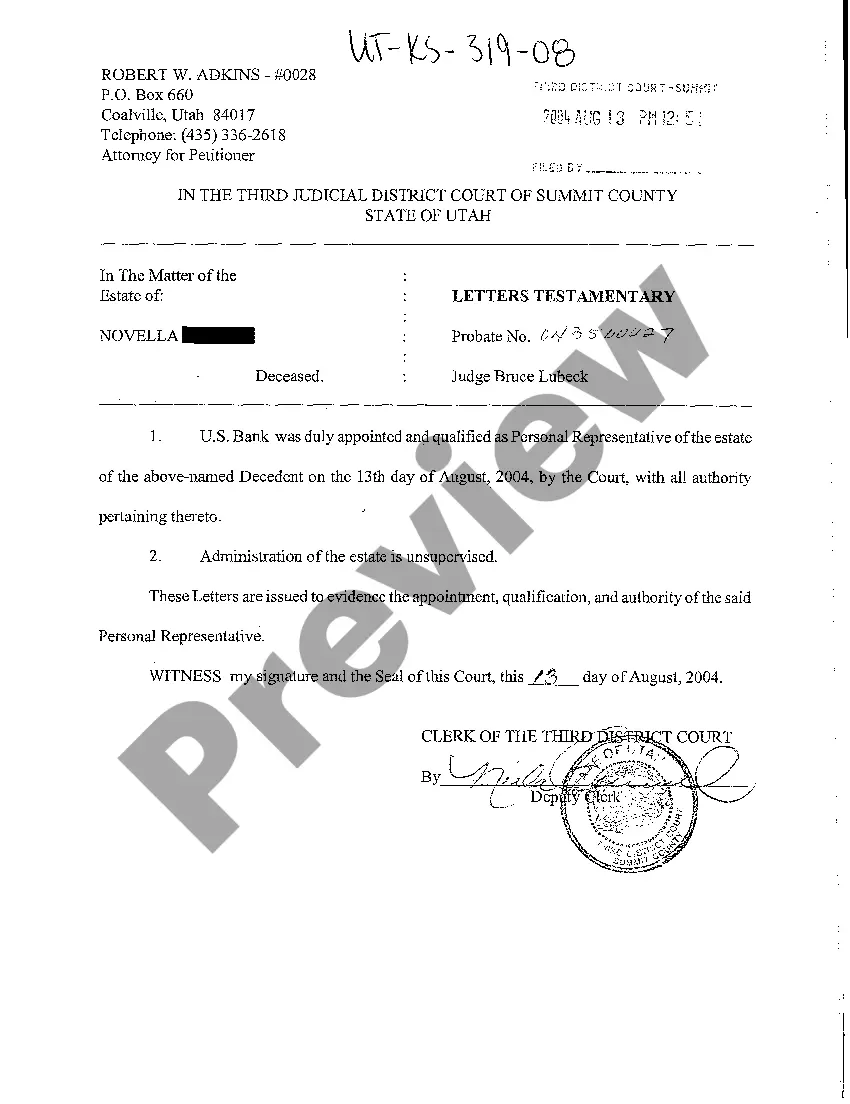

Salt Lake Utah Letters Testamentary, also known as Letters Testamentary in Salt Lake City, Utah, refer to a legal document granted by the court to the executor or personal representative of a deceased person's estate. This document authorizes and empowers the named individual to administer and manage the affairs and assets of the deceased individual. Keywords: Salt Lake Utah Letters Testamentary, Letters Testamentary, Salt Lake City, Utah, legal document, executor, personal representative, deceased person, estate, administer, manage, affairs, assets. There are different types of Salt Lake Utah Letters Testamentary, which are tailored based on the specific circumstances and complexities of the estate. These types include: 1. General Letters Testamentary: This is the most common type and is granted when an individual passes away with a valid will, designating an executor. The executor is responsible for carrying out the terms of the will and distributing the assets to beneficiaries accordingly. 2. Temporary Letters Testamentary: In situations where immediate actions need to be taken before the appointment of a permanent executor, temporary letters testamentary may be issued. This allows a designated individual to manage urgent matters, such as securing the estate's assets or notifying creditors. 3. Limited Letters Testamentary: In certain cases, the court may grant limited letters testamentary, which restrict the executor's authority to handle specific tasks or assets. This type is typically used when there are disputes or uncertain situations that require court supervision. 4. Ancillary Letters Testamentary: Ancillary letters testamentary come into play when the deceased person owned property or assets in Salt Lake City and another jurisdiction. These letters allow the executor to manage and distribute assets specifically located in Salt Lake City, while another executor handles assets in the primary jurisdiction. It is important to note that the process of obtaining Salt Lake Utah Letters Testamentary involves various legal steps, such as submitting an application to the probate court, providing necessary documentation, and potentially attending a court hearing. Additionally, the appointed executor has fiduciary responsibilities and must adhere to the laws and regulations governing estate administration in Utah. In summary, Salt Lake Utah Letters Testamentary are legal documents granted by the court to an executor or personal representative, empowering them to administer and manage the affairs and assets of a deceased person's estate in Salt Lake City. The types of letters testamentary may vary depending on the circumstances, including general, temporary, limited, and ancillary letters testamentary.

Salt Lake Utah Letters Testamentary

Description

How to fill out Salt Lake Utah Letters Testamentary?

Make use of the US Legal Forms and have immediate access to any form you require. Our beneficial website with thousands of templates allows you to find and obtain virtually any document sample you will need. You can export, complete, and certify the Salt Lake Utah Letters Testamentary in just a matter of minutes instead of surfing the Net for many hours seeking a proper template.

Using our collection is a great strategy to improve the safety of your form submissions. Our professional legal professionals on a regular basis review all the documents to make sure that the templates are appropriate for a particular state and compliant with new acts and polices.

How do you get the Salt Lake Utah Letters Testamentary? If you already have a profile, just log in to the account. The Download button will appear on all the documents you view. In addition, you can get all the previously saved documents in the My Forms menu.

If you don’t have an account yet, stick to the instructions listed below:

- Open the page with the template you need. Make certain that it is the form you were looking for: verify its title and description, and take take advantage of the Preview function when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the downloading procedure. Select Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Save the document. Select the format to obtain the Salt Lake Utah Letters Testamentary and change and complete, or sign it for your needs.

US Legal Forms is among the most extensive and trustworthy document libraries on the web. Our company is always happy to help you in any legal procedure, even if it is just downloading the Salt Lake Utah Letters Testamentary.

Feel free to take advantage of our platform and make your document experience as efficient as possible!

Form popularity

FAQ

Letters testamentary are documents that a probate court delivers to the executor of the deceased's estate to enforce the terms of the deceased person's will. A court can issue letters testamentary only to persons who are chosen as an executor in a will.

Living trusts In Utah, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Probate is required if: the estate includes real property (land, house, condominium, mineral rights) of any value, and/or. the estate has assets (other than land, and not including cars) whose net worth is more than $100,000.

You cannot avoid probate with only a will because wills cannot transfer property. This means if you have assets you want to pass to loved ones, it isn't covered in the will and a probate matter still has to be opened.

Your spouse inherits all of your intestate property. If you die with descendants who are not the descendants of your surviving spouse -- in other words, you have children or grandchildren from a previous relationship. Your spouse inherits the first $75,000 of your intestate property, plus 1/2 of the balance.

This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate. If you have been named in a will as an executor, you don't have to act if you don't want to.

There is not any legal timeframe for applying for probate, however much of the estate administration will not be possible until this is received, so it is generally one of the first things that is done. In the case of some small estates, probate may not be necessary. This will depend on the amount of assets held.

In the state of Utah, the entire probate process can take as little as four to five months. This assumes that the process proceeds quickly and there are no impediments to paying debts and dividing the remaining assets.

Letters Testamentary or Letters of Administration A certified copy of this document can be presented to third parties - such as banks and insurance companies - to show that the named person has been appointed by the court as personal representative of the decedent's estate.