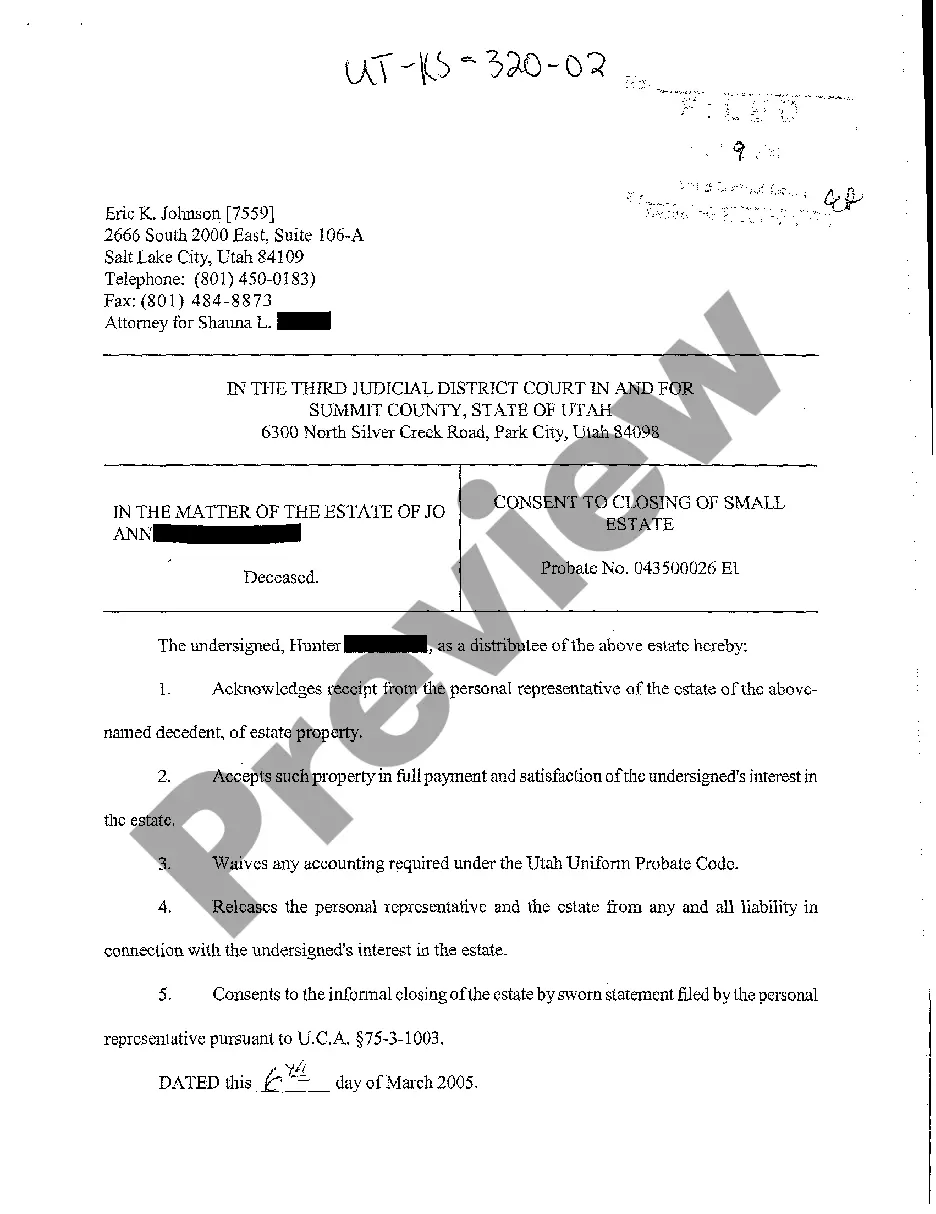

Title: Salt Lake Utah Consent to Closing of Small Estate: Detailed Description and Types Introduction: In Salt Lake City, Utah, the process of settling small estates can be simplified through the Consent to Closing of Small Estate. This legal document grants authority to an individual to distribute the assets of a deceased person without the need for a formal probate proceeding. This article provides a comprehensive description of what the Salt Lake Utah Consent to Closing of Small Estate entails, its advantages, and the different types available to residents. What is Salt Lake Utah Consent to Closing of Small Estate? The Salt Lake Utah Consent to Closing of Small Estate is a legal agreement that allows the personal representative or heirs of a small estate to settle the assets of a deceased person efficiently. It eliminates the requirement of going through a probate court process, helping save time and costs. Key Components: 1. Basic Information: The Consent to Closing of Small Estate includes details such as the estate's value, the deceased person's name and date of death, and the personal representative's contact information. 2. Appointment of Representative: This document designates a personal representative who will be responsible for distributing the assets of the small estate. 3. List of Assets and Debt: The Consent includes a list of the deceased person's assets, such as real estate, bank accounts, vehicles, and personal property, along with a list of any outstanding debts. 4. Compliance Declaration: The personal representative declares that they have provided proper notice to creditors and claimants and that all estate taxes, if any, have been paid or discharged. 5. Signatures and Notarization: The Consent must be signed by the personal representative, heirs, and any other relevant parties, and notarized to ensure its legal validity. Types of Salt Lake Utah Consent to Closing of Small Estate: 1. Consent to Closing of Small Estate — Real Property: This type specifically addresses estates where the main asset is real estate, guiding the process of transferring ownership. 2. Consent to Closing of Small Estate — Personal Property: This variant focuses on small estates where the primary assets are personal belongings, such as furniture, jewelry, and household items. 3. Consent to Closing of Small Estate — Mixed Assets: This type encompasses small estates that consist of a combination of real property, personal property, and other assets. It provides comprehensive guidelines for handling the distribution. Advantages of Salt Lake Utah Consent to Closing of Small Estate: 1. Time and cost-saving: The consent process avoids the need for probate and associated court fees, allowing for a faster resolution of the estate distribution. 2. Privacy: Probate proceedings are public, whereas the Consent to Closing of Small Estate maintains confidentiality. 3. Simplicity: The process is relatively straightforward, requiring less paperwork compared to formal probate. 4. Flexibility: The consent process offers more control to the personal representative and heirs, enabling them to distribute assets as efficiently as possible. Conclusion: The Salt Lake Utah Consent to Closing of Small Estate serves as a practical alternative to formal probate for settling small estates. By effectively outlining the distribution process and removing unnecessary complications, this legal document provides numerous benefits to the personal representative and heirs. Understanding the different types of Consents available assists residents in choosing the most suitable option for their specific estate circumstances.

Salt Lake Utah Consent to Closing of Small Estate

Description

How to fill out Salt Lake Utah Consent To Closing Of Small Estate?

Do you need a reliable and affordable legal forms provider to buy the Salt Lake Utah Consent to Closing of Small Estate? US Legal Forms is your go-to choice.

No matter if you need a basic agreement to set regulations for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked based on the requirements of separate state and area.

To download the form, you need to log in account, locate the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Salt Lake Utah Consent to Closing of Small Estate conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to find out who and what the form is intended for.

- Restart the search in case the template isn’t suitable for your specific situation.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the Salt Lake Utah Consent to Closing of Small Estate in any provided format. You can get back to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending hours learning about legal papers online for good.