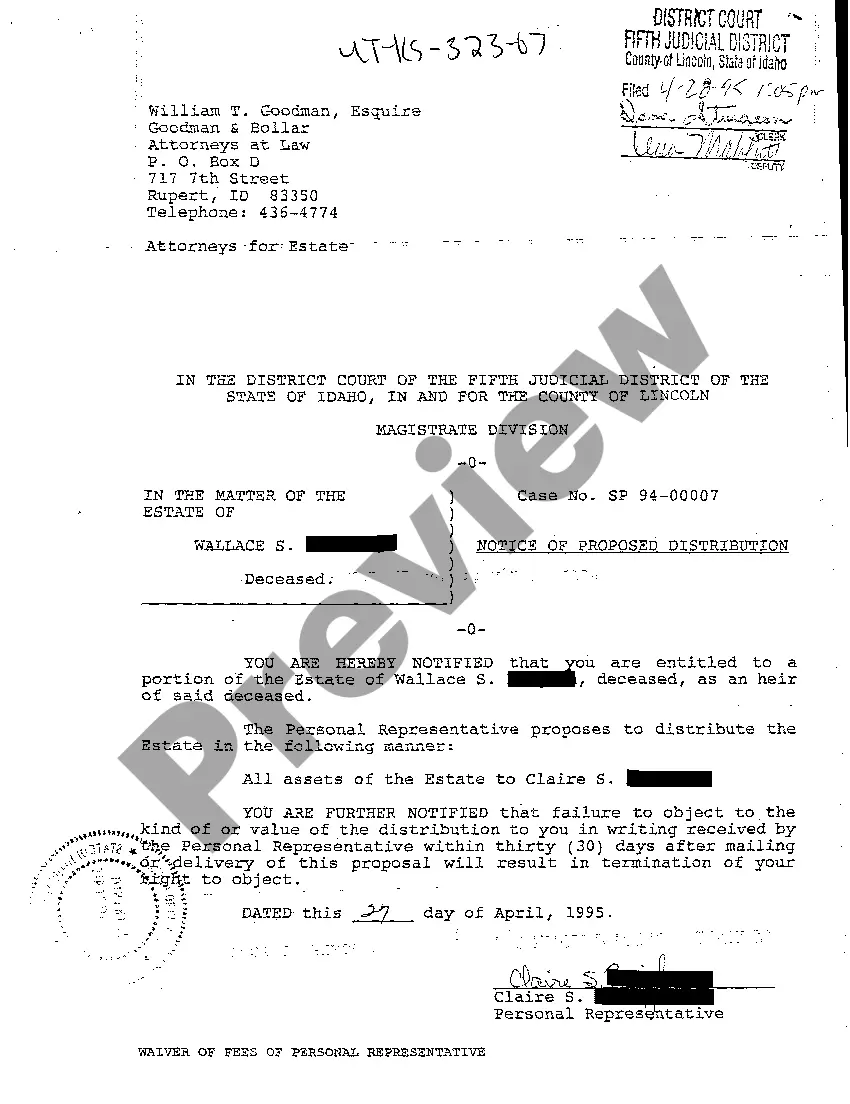

Salt Lake City Utah Notice of Proposed Distribution is a legal document that outlines the distribution plans for a certain estate or trust in Salt Lake City, Utah. This notice provides beneficiaries with important information regarding the assets and property of the estate or trust and details how they will be distributed. Key elements typically included in the Salt Lake City Utah Notice of Proposed Distribution are: 1. Estate or Trust Information: The notice will contain the name and relevant details of the particular estate or trust, such as the name of the deceased or granter, the date of death or creation, and any unique identifying numbers or references. 2. Executor or Trustee Details: It will mention the name, contact information, and qualifications of the appointed executor or trustee responsible for administering the estate or trust. 3. Beneficiary Information: The notice will identify all beneficiaries who are entitled to receive a distribution from the estate or trust. This will include their names, addresses, and the specific share or portion they will receive. 4. Asset Description: A detailed description of the assets, properties, or funds involved in the distribution, including their estimated values, will be provided. This may include real estate properties, bank accounts, investment portfolios, personal items, or any other valuable items that form part of the estate or trust. 5. Proposed Distribution Plan: The notice will outline the proposed distribution plan, indicating how the assets and properties will be divided among the beneficiaries. This plan may be based on the instructions provided in the decedent's will or trust document or determined by Utah state laws if there is no such document. 6. Objection Period: The notice will state the timeframe within which beneficiaries can raise objections to the proposed distribution plan. This allows any interested party to contest the plan if they believe it to be unfair or incorrect. 7. Hearing Information: If a hearing is required to address any objections or resolve disputes, the notice will provide details regarding the date, time, and location of the hearing. Additionally, it may specify the requirements for attending or filing objections, such as providing written notice in advance. It is important to note that the specific types of Salt Lake City Utah Notice of Proposed Distribution may vary based on the nature of the estate or trust. For instance, there could be different notice requirements for a probate estate, a living trust, or a testamentary trust. Each may have its own unique set of rules and regulations governing the distribution process. Overall, the Salt Lake City Utah Notice of Proposed Distribution is a significant legal document that ensures transparency and provides beneficiaries with an opportunity to understand and potentially challenge the proposed distribution plan for an estate or trust situated in Salt Lake City, Utah.

Salt Lake City Utah Notice of Proposed Distribution

Description

How to fill out Salt Lake City Utah Notice Of Proposed Distribution?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person without any legal education to draft this sort of paperwork from scratch, mainly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform offers a huge catalog with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you require the Salt Lake City Utah Notice of Proposed Distribution or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Salt Lake City Utah Notice of Proposed Distribution quickly employing our trusted platform. In case you are already an existing customer, you can proceed to log in to your account to download the needed form.

Nevertheless, in case you are new to our platform, make sure to follow these steps prior to downloading the Salt Lake City Utah Notice of Proposed Distribution:

- Be sure the template you have found is good for your area since the regulations of one state or area do not work for another state or area.

- Review the form and read a short outline (if available) of cases the document can be used for.

- If the form you selected doesn’t meet your needs, you can start over and search for the needed document.

- Click Buy now and pick the subscription option that suits you the best.

- Log in to your account credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Salt Lake City Utah Notice of Proposed Distribution as soon as the payment is through.

You’re good to go! Now you can proceed to print the form or complete it online. In case you have any issues getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.