The Salt Lake Utah Schedule of Distribution Annexed to Verified Statement of Personal Representative Closing Estate serves as an important legal document in the probate process. This document outlines the detailed distribution plan for assets and properties related to a deceased individual's estate. The schedule of distribution is prepared by the personal representative, who is responsible for administering the estate and ensuring a fair and equitable distribution of assets among the beneficiaries. It is annexed to the verified statement of the personal representative, which is filed with the probate court to finalize the estate's closure. This comprehensive document includes various relevant keywords such as: 1. Estate assets: The schedule provides an inventory of all the assets included in the estate, which may include real estate properties, bank accounts, investments, stocks, vehicles, personal belongings, and other valuable items. 2. Beneficiaries: The names and contact information of all the individuals entitled to receive a share from the estate are listed in this document. Beneficiaries can be family members, friends, charitable organizations, or any designated individual/entity as stated in the deceased's will or the laws of intestacy if no will exists. 3. Distribution plan: The schedule of distribution outlines how the estate assets will be distributed among the beneficiaries. It specifies the percentage or specific amount each beneficiary will receive from the estate. 4. Debts and liabilities: Any outstanding debts or liabilities of the deceased are addressed in the distribution plan. Creditors have the opportunity to make claims against the estate, and the personal representative ensures that these obligations are properly settled before distributing assets to the beneficiaries. 5. Taxes and expenses: The document also includes information regarding any estate taxes, as well as administrative expenses and fees incurred during the probate process. These costs are typically deducted from the estate before distribution. Furthermore, depending on the specific circumstances, there might be different types of Salt Lake Utah Schedule of Distribution Annexed to Verified Statement of Personal Representative Closing Estate, such as: 1. Simple distribution schedule: This type of schedule is used when the estate consists of straightforward assets and the distribution plan is relatively uncomplicated. It may include mainly cash, a single property, or a limited number of assets. 2. Complex distribution schedule: In cases where the estate is extensive and includes various types of assets, multiple properties, business interests, or substantial financial investments, a more detailed and complex distribution schedule is necessary to ensure a fair and accurate distribution. 3. Contested distribution schedule: If there are disputes or disagreements among the beneficiaries regarding the distribution of assets, a contested distribution schedule may be required. This schedule provides a platform to address and resolve these conflicts, either through mediation, arbitration, or court proceedings. In conclusion, the Salt Lake Utah Schedule of Distribution Annexed to Verified Statement of Personal Representative Closing Estate is a vital legal document that outlines the distribution plan for an estate's assets. It provides comprehensive details regarding beneficiaries, assets, debts, expenses, and taxation. The specific type of distribution schedule will depend on the complexity of the estate and any associated disputes.

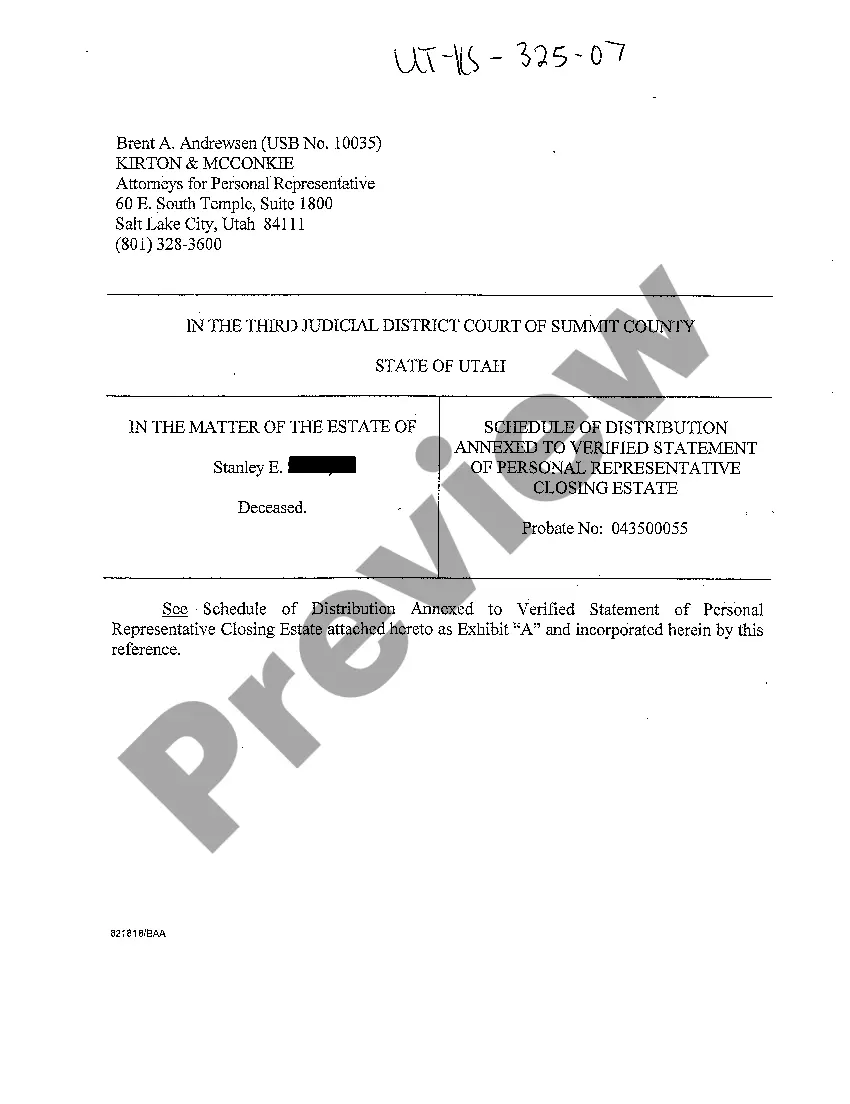

Salt Lake Utah Schedule of Distribution Annexed to Verified Statement of Personal Representative Closing Estate

Description

How to fill out Salt Lake Utah Schedule Of Distribution Annexed To Verified Statement Of Personal Representative Closing Estate?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Salt Lake Utah Schedule of Distribution Annexed to Verified Statement of Personal Representative Closing Estate becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Salt Lake Utah Schedule of Distribution Annexed to Verified Statement of Personal Representative Closing Estate takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve selected the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Salt Lake Utah Schedule of Distribution Annexed to Verified Statement of Personal Representative Closing Estate. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!