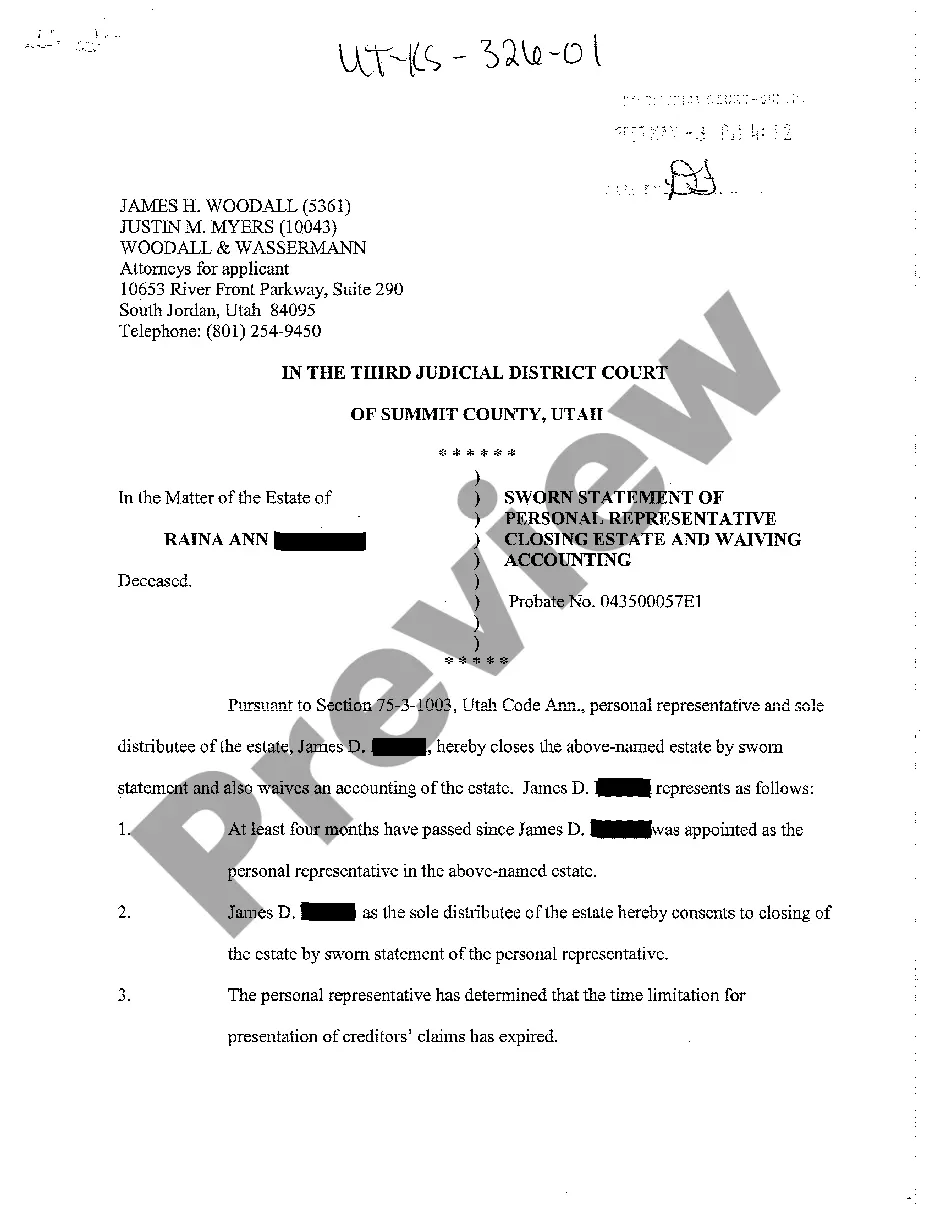

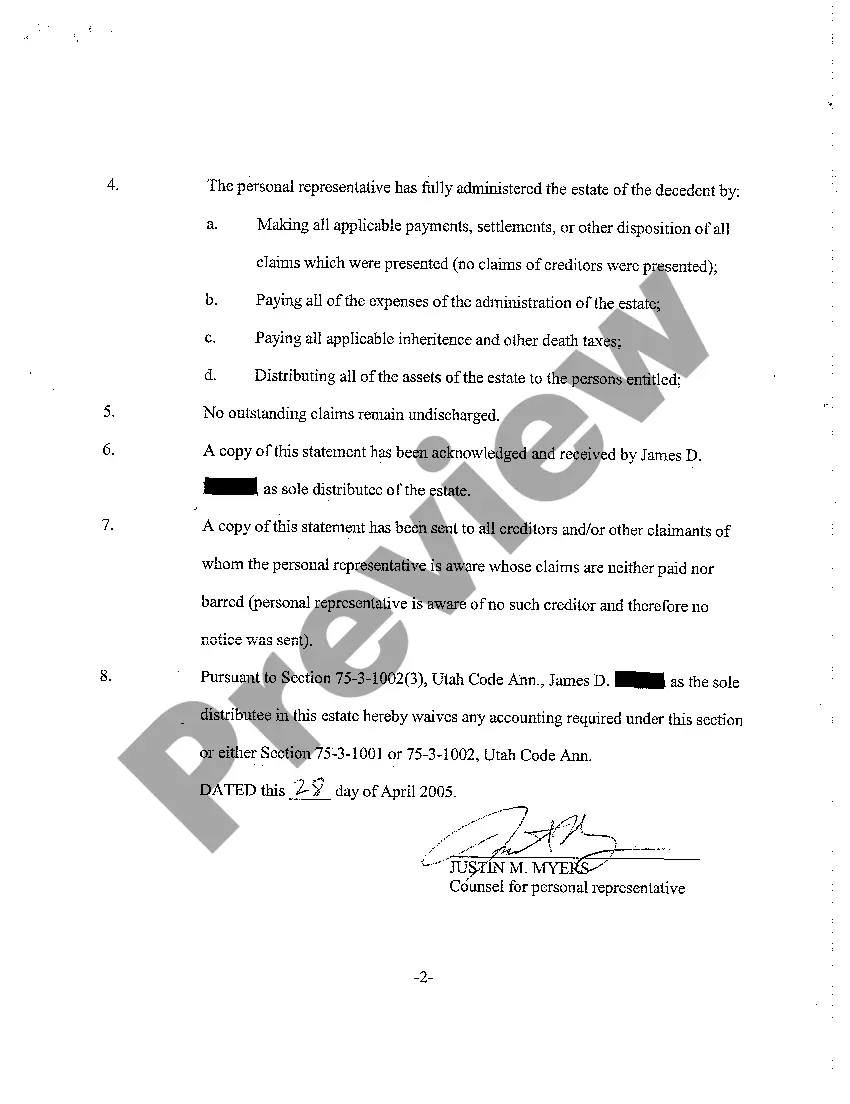

The Salt Lake Utah Sworn Statement of Personal Representative Closing Estate and Waving Accounting is a legal document that holds great significance in the process of finalizing an estate in Salt Lake City, Utah. This statement outlines the crucial steps taken by the personal representative to settle the affairs of the deceased individual's estate and ensures transparency in the distribution of assets. It is essential to understand the intricacies of this document, as it helps in safeguarding the rights of beneficiaries and ensures a smooth transfer of property. The Salt Lake Utah Sworn Statement of Personal Representative Closing Estate and Waving Accounting serves as an official record of the personal representative's fiduciary responsibilities and acts as an assurance that all necessary actions have been properly fulfilled. By submitting this statement, the personal representative declares his or her compliance with probate laws and regulations, guaranteeing that the estate's affairs have been handled with utmost precision and fidelity. This document encompasses various vital components that play a significant role in the closing of an estate. The personal representative is required to provide a comprehensive account of the estate's assets, debts, and liabilities, ensuring that all outstanding debts have been paid, and all necessary taxes have been settled. By waving accounting, it implies that the personal representative is attesting to the fact that all financial matters have been accurately recorded and can be waived from the requirement of preparing a formal accounting. In Salt Lake City, Utah, there may be different types of Salt Lake Utah Sworn Statement of Personal Representative Closing Estate and Waving Accounting, based on the specific circumstances of the estate and the preferences of the involved parties. Some of these variations may include: 1. Simplified Sworn Statement: This type of statement is used when the value of the estate falls below a certain threshold, usually determined by the local jurisdiction. It constitutes a more streamlined version of the regular statement, with fewer requirements and a simplified accounting process. 2. Formal Sworn Statement: This type of statement is utilized for estates that exceed the specified threshold for a simplified statement. It involves a more comprehensive declaration of assets, liabilities, and distributions made to beneficiaries, demonstrating compliance with all legal and financial obligations. 3. Small Estate Sworn Statement: In cases where the estate is relatively small and does not involve complex assets or disputes, a small estate sworn statement might be employed. This provides a simplified method for closing the estate, offering a quicker and less burdensome process for all parties involved. 4. Contested Estate Sworn Statement: In situations where there is a dispute or disagreement among the interested parties, a contested estate sworn statement might be necessary. This document would outline the ongoing legal proceedings and any unresolved matters related to the estate, providing a structured framework for reaching a resolution. It is crucial for personal representatives involved in closing an estate in Salt Lake City, Utah, to be well-versed in the specific requirements and variations of the Salt Lake Utah Sworn Statement of Personal Representative Closing Estate and Waving Accounting. Consulting with an experienced attorney specializing in probate law can provide invaluable guidance and ensure compliance with all legal obligations, ultimately facilitating a smooth and efficient estate settlement process.

Salt Lake Utah Sworn Statement of Personal Representative Closing Estate and Waving Accounting

Description

How to fill out Salt Lake Utah Sworn Statement Of Personal Representative Closing Estate And Waving Accounting?

Make use of the US Legal Forms and obtain immediate access to any form you require. Our helpful website with a large number of templates allows you to find and get almost any document sample you want. It is possible to export, fill, and sign the Salt Lake Utah Sworn Statement of Personal Representative Closing Estate and Waving Accounting in a matter of minutes instead of surfing the Net for hours looking for the right template.

Utilizing our collection is an excellent strategy to improve the safety of your document submissions. Our experienced attorneys regularly review all the records to ensure that the templates are appropriate for a particular region and compliant with new laws and regulations.

How can you get the Salt Lake Utah Sworn Statement of Personal Representative Closing Estate and Waving Accounting? If you already have a profile, just log in to the account. The Download option will appear on all the documents you view. Additionally, you can get all the earlier saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction below:

- Find the template you require. Make sure that it is the form you were looking for: verify its headline and description, and take take advantage of the Preview feature when it is available. Otherwise, use the Search field to look for the needed one.

- Launch the downloading procedure. Select Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the document. Pick the format to get the Salt Lake Utah Sworn Statement of Personal Representative Closing Estate and Waving Accounting and revise and fill, or sign it for your needs.

US Legal Forms is probably the most considerable and reliable document libraries on the web. We are always ready to help you in virtually any legal procedure, even if it is just downloading the Salt Lake Utah Sworn Statement of Personal Representative Closing Estate and Waving Accounting.

Feel free to make the most of our platform and make your document experience as efficient as possible!