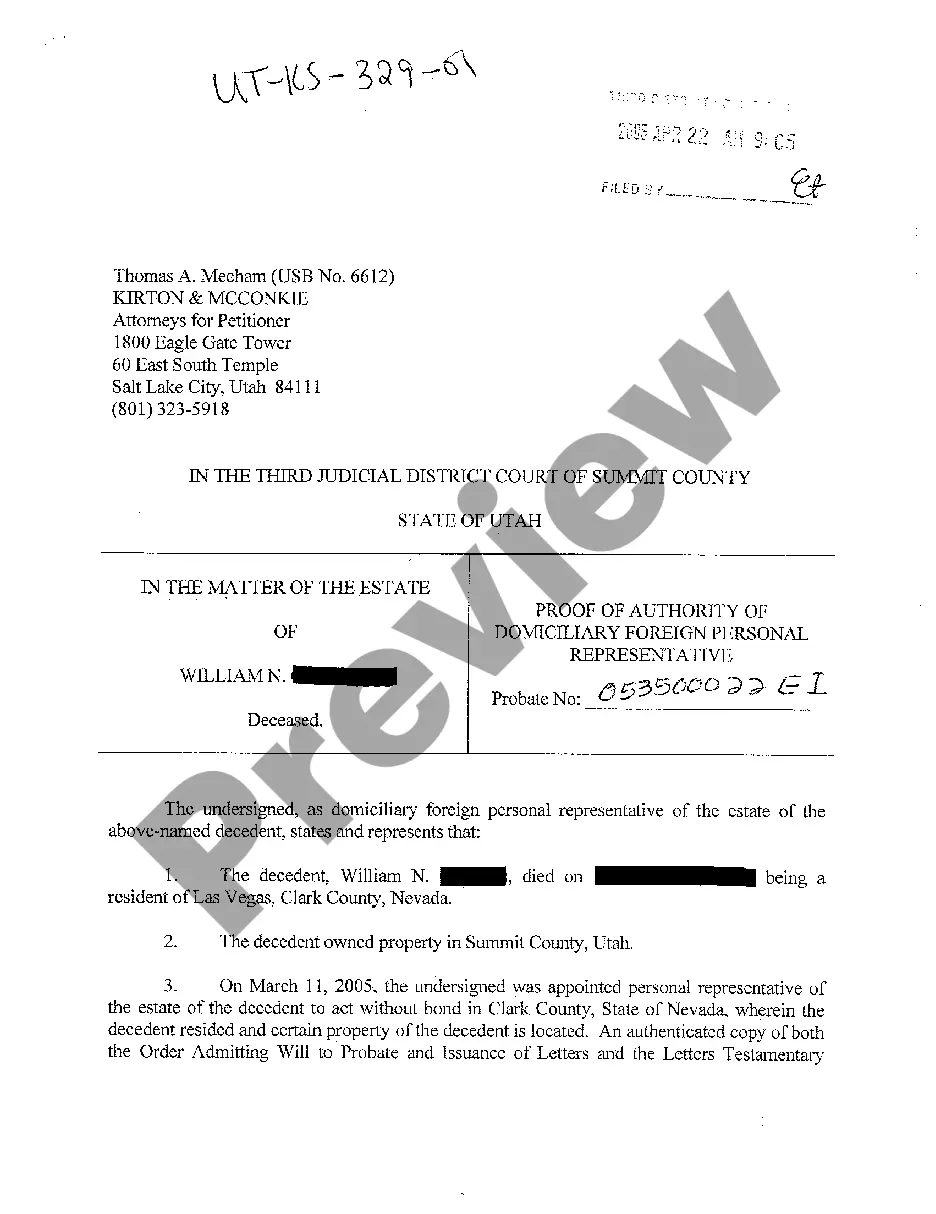

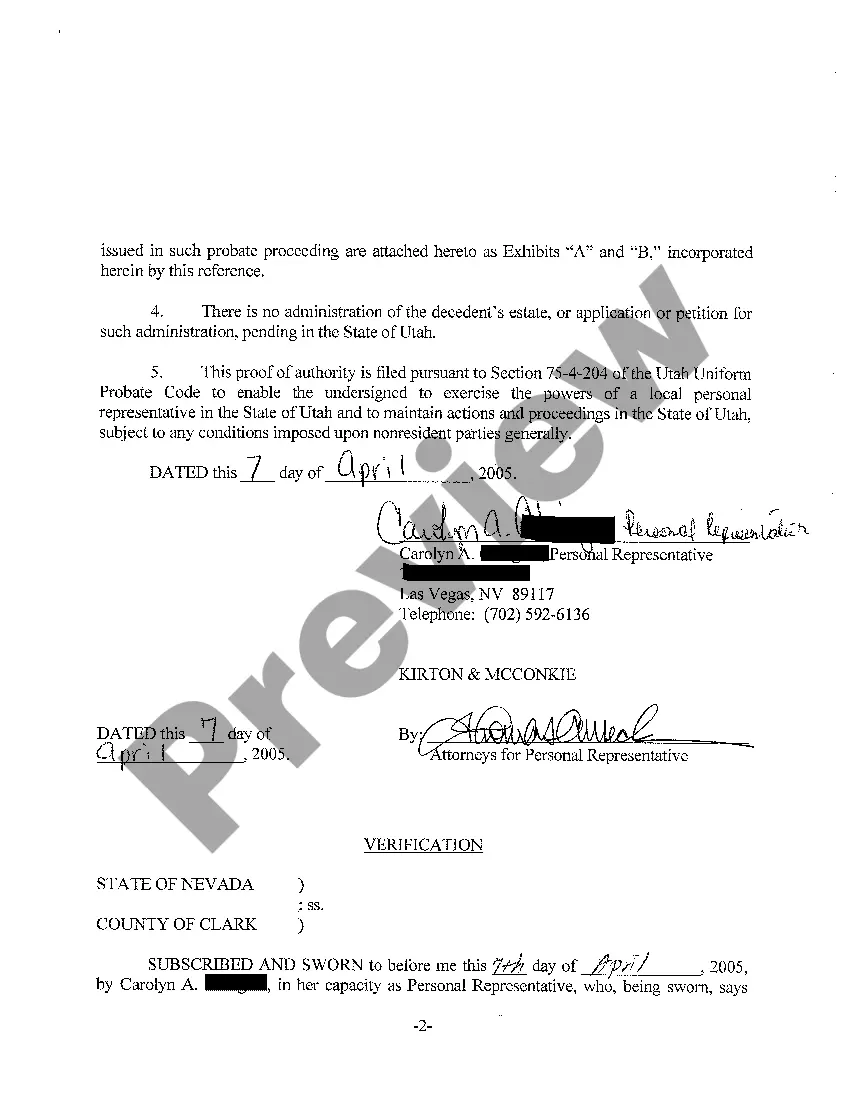

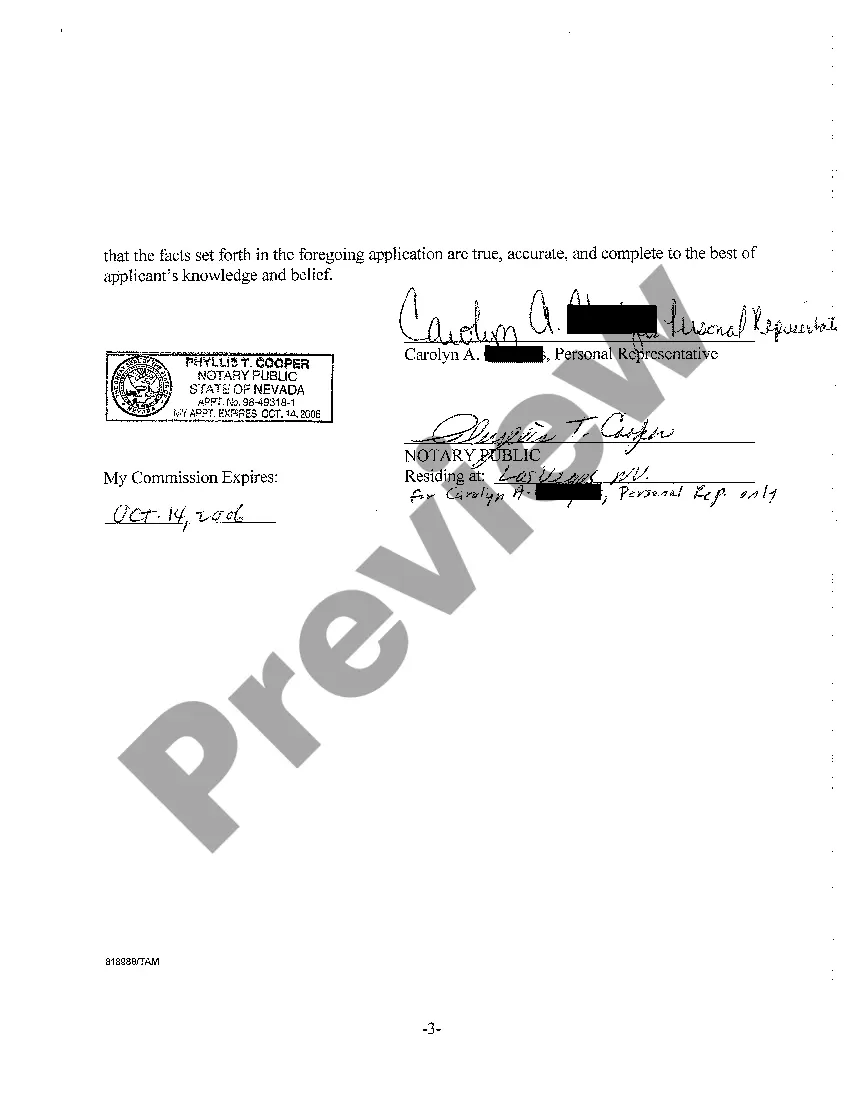

Salt Lake Utah Proof of Authority of Domiciliary Foreign Personal Representative is a legal document that establishes the authority and authenticity of a foreign personal representative to handle the affairs of a deceased individual's estate in Salt Lake City, Utah. This proof is required when a person from another jurisdiction is appointed to act as the personal representative in the Utah probate court. Keywords: Salt Lake Utah, Proof of Authority, Domiciliary Foreign Personal Representative, legal document, foreign personal representative, deceased individual's estate, Salt Lake City, Utah, jurisdiction, appointed, probate court. There are different types of Salt Lake Utah Proof of Authority of Domiciliary Foreign Personal Representative, which may vary depending on the specific circumstances. Some of these types include: 1. Standard Proof of Authority: This is the most common type of proof required to establish the authority of a domiciliary foreign personal representative. It includes details such as the representative's name, jurisdiction of appointment, relationship to the deceased, and the powers granted to them. 2. Limited Proof of Authority: In certain cases, a foreign personal representative may be granted limited authority to handle only specific aspects of the deceased individual's estate. This type of proof highlights the specific powers and limitations of the representative. 3. Emergency Proof of Authority: In urgent situations where immediate action is required, an emergency proof of authority may be issued. This grants the foreign personal representative immediate temporary authority to handle emergency matters until a standard proof of authority can be obtained. 4. Specialized Proof of Authority: In complex cases involving unique circumstances or specialized assets, a specialized proof of authority may be required. This type of proof ensures that the foreign personal representative has the necessary expertise and authority to handle the specific aspects of the estate. Regardless of the type, the Salt Lake Utah Proof of Authority of Domiciliary Foreign Personal Representative plays a crucial role in the legal process of administering an estate in Utah. It serves as a validation of the representative's authority and ensures that all actions taken in relation to the estate are legally binding and recognized by the Salt Lake City probate court. Please note: The above information is a general description and may not cover all variations or requirements of Salt Lake Utah Proof of Authority of Domiciliary Foreign Personal Representative. It is advisable to consult with a legal professional to understand the specific requirements and processes relevant to your situation.

Salt Lake Utah Proof of Authority of Domiciliary Foreign Personal Representative

Description

How to fill out Salt Lake Utah Proof Of Authority Of Domiciliary Foreign Personal Representative?

If you’ve already used our service before, log in to your account and download the Salt Lake Utah Proof of Authority of Domiciliary Foreign Personal Representative on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Salt Lake Utah Proof of Authority of Domiciliary Foreign Personal Representative. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!

Form popularity

FAQ

When someone dies without a will they are said to have died 'intestate' and no one has immediate authority to act as their personal representative. Instead, one of their relatives needs to apply to the Probate Registry for a grant of letters of administration.

Personal representative's other core duties Calculating the inheritance tax due (if any) and obtaining funds to pay the tax. Paying any private debts which may owed by the estate. Preparing the accounts, tax return and tax deductions for the beneficiaries. Distributing the assets to those entitled to them.

Living trusts In Utah, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Any individual who is at least 18 years old who is a resident of Florida at the time of the decedent's death, is qualified to act as the personal representative.

Over 18 years of age and ? The surviving spouse of the decedent, ? An adult child of the decedent, ? A parent of the decedent, ? A brother or sister of the decedent, ? A person entitled to property of the decedent, ? A person who was named as personal representative by will, or ? You are a creditor and 45 days have

What is the Utah Personal Representative Deed? A personal representative's deed is a fiduciary instrument used in probate proceedings. Probate is the process of settling and distributing a decedent's estate. The Utah Uniform Probate Code is codified at Title 75 of the Utah Code.

To be appointed the personal representative, an applicant must be at least 21 years old. See Utah Code 75-3-203. Although anyone may file a probate case, certain people have priority for being appointed the personal representative: Nominated in the will to be a personal representative.

Maryland offers a simplified probate procedure for smaller estates. The simplified procedure is available if the property subject to probate has a value of $50,000 or less. If the surviving spouse is the only beneficiary, the cap goes up to $100,000 or less.