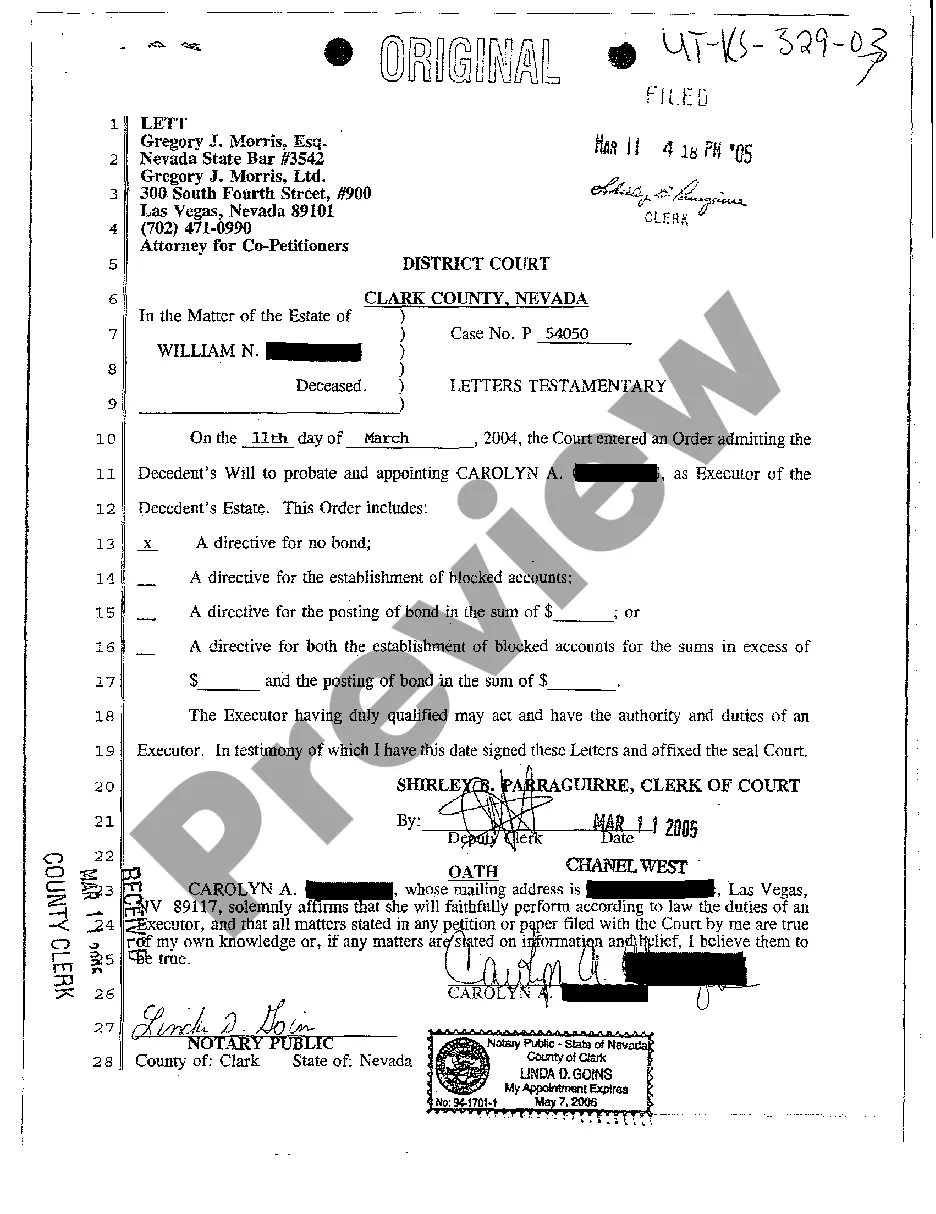

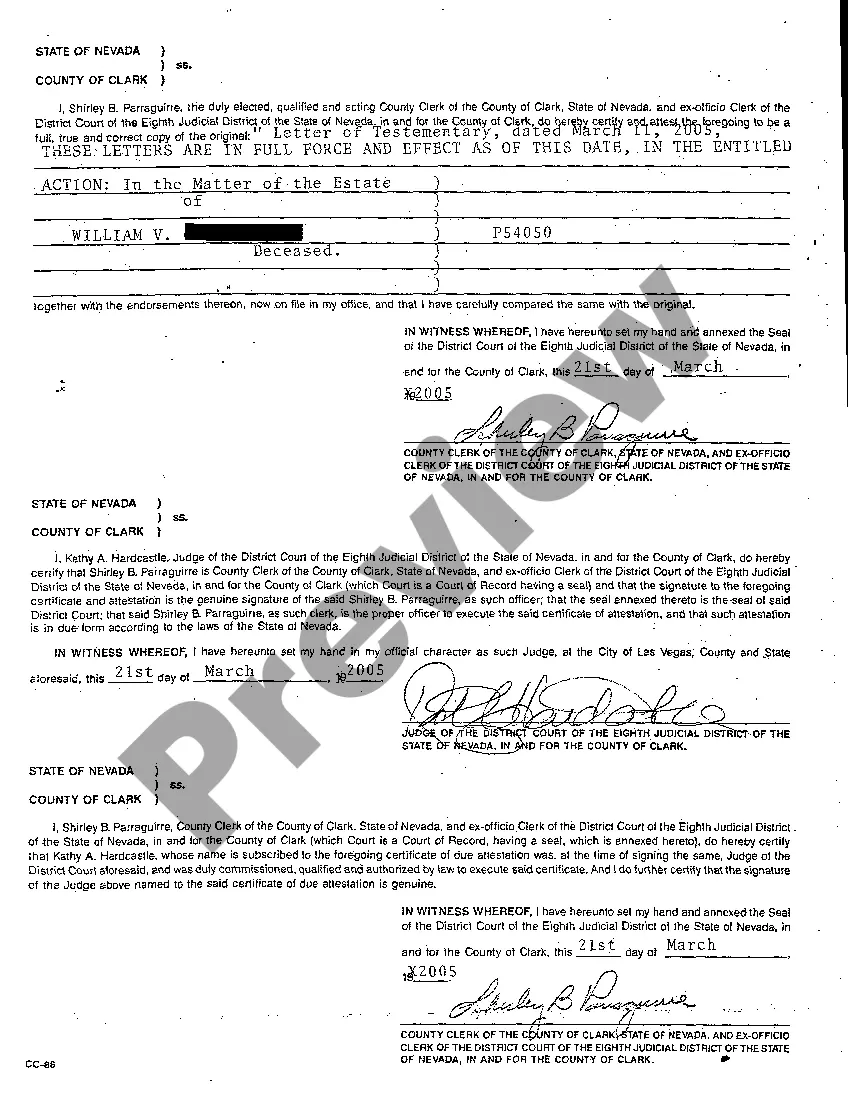

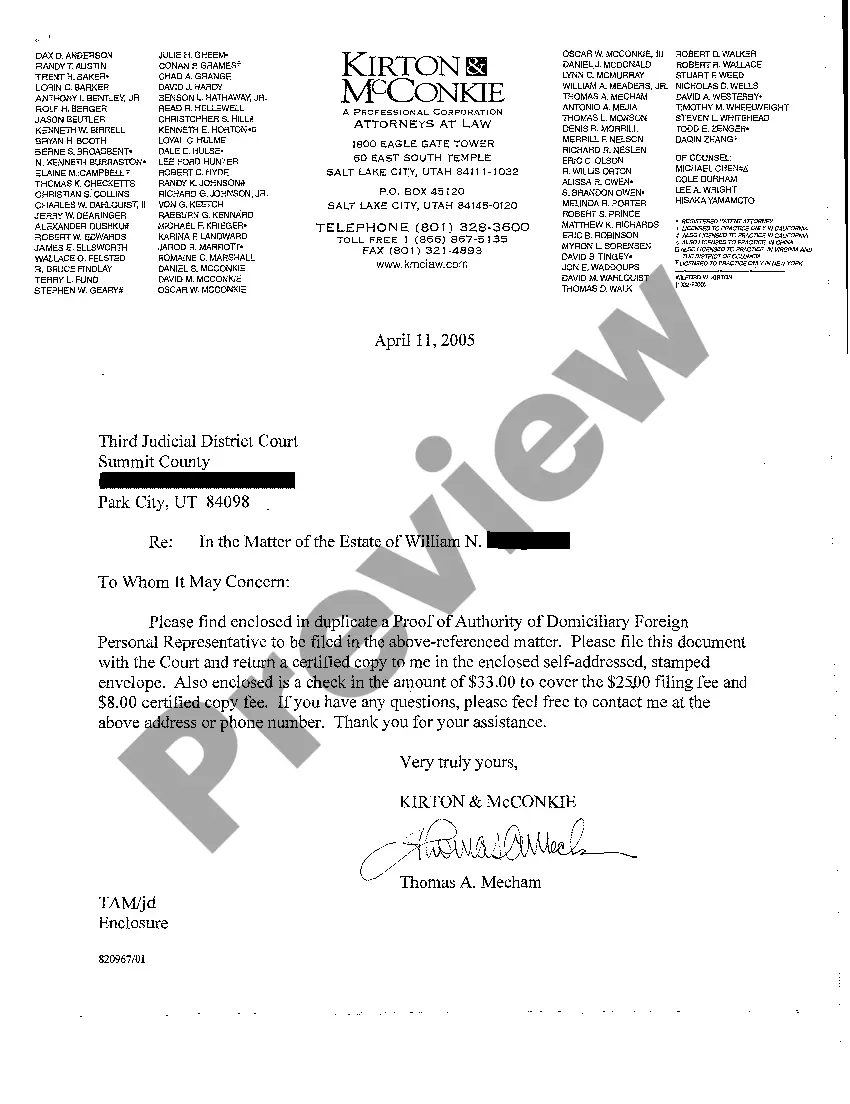

West Jordan Utah Letters Testamentary serve as legal documentation that grants authority to an appointed executor to administer the estate of a deceased individual located in West Jordan, Utah. These letters are issued by the court and provide the executor with the power and responsibility to settle any outstanding debts, distribute assets, and carry out the decedent's wishes as outlined in their will. Keywords: West Jordan Utah, Letters Testamentary, legal documentation, executor, estate, deceased individual, court, settle outstanding debts, distribute assets, decedent's wishes, will. Types of West Jordan Utah Letters Testamentary: 1. General Letters Testamentary: This is the most common type of letter granted by the court. It gives the executor full authority and responsibility to manage and distribute the assets of the deceased person's estate according to the terms of their will. 2. Limited Letters Testamentary: In certain cases, the court may grant limited letters testamentary, which restrict the power and authority of the executor. This can occur if the estate is complex, there are ongoing legal disputes, or if there are specific assets or tasks for which the executor requires additional permissions. 3. Special Letters Testamentary: Special letters testamentary are issued when the executor's duties are limited to a specific aspect of the estate. For example, if an estate includes a business, a person with expertise in that particular industry may be appointed as a special executor to handle business-related matters specifically. 4. Ancillary Letters Testamentary: Ancillary letters testamentary are necessary when there are assets in West Jordan, Utah, but the primary probate process is being conducted in another jurisdiction. These letters authorize an executor appointed in another state to handle the assets located in West Jordan, Utah. In summary, West Jordan Utah Letters Testamentary are legal documents that grant an executor the authority to administer an estate located in West Jordan, Utah. Different types of letters testamentary include general, limited, special, and ancillary, depending on the circumstances and requirements of the estate.

West Jordan Utah Letters Testamentary

Description

How to fill out West Jordan Utah Letters Testamentary?

If you’ve already used our service before, log in to your account and save the West Jordan Utah Letters Testamentary on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Ensure you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your West Jordan Utah Letters Testamentary. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!

Form popularity

FAQ

You can obtain a letter of testamentary through the probate court in your county after filing the necessary documents. This letter gives you the legal authority to administer the estate of the deceased. To streamline this process and ensure you meet all requirements, tools like the West Jordan Utah Letters Testamentary service can provide the guidance you need.

Not all wills necessarily have to go through probate in Utah. Small estates may qualify for simplified procedures that can expedite the distribution of assets without formal probate. However, it is essential to consult about the process since the requirement varies based on the estate's value and structure. Understanding West Jordan Utah Letters Testamentary can guide you through making informed decisions.

Probate in Utah is triggered when a person passes away and leaves behind assets that are solely in their name. Any property not designated to transfer via a trust or beneficiary designation usually falls into this category. This process validates the will and ensures proper distribution of assets. To navigate this process smoothly, you may want to review the procedures described in West Jordan Utah Letters Testamentary.

In Utah, a will does not automatically avoid probate. Instead, a will must be validated through the probate process for it to be effective. This validation ensures that your wishes are honored after your passing, directing how your assets should be distributed. The West Jordan Utah Letters Testamentary guide can help you understand this process better.

Certain assets do not require probate in Utah. For instance, assets held in a living trust, joint tenancy properties, and some retirement accounts can bypass the probate process. This means that you can maintain more control over your legacy without unnecessary delays. If you need more information about navigating these topics, consider the resources available through West Jordan Utah Letters Testamentary.

To file a Letter of Testamentary, first, gather necessary documents including the will and death certificate. Next, submit these papers to the probate court in your area; for West Jordan, Utah Letters Testamentary must be filed with the appropriate local court. Utilizing resources on the US Legal Forms platform can guide you through the required steps, ensuring compliance with local laws and easing the filing process.

Testamentary costs can vary significantly based on the size and complexity of the estate. Generally, you may encounter court fees, filing fees, attorney fees, and other related expenses when obtaining West Jordan Utah Letters Testamentary. It's important to expect these costs in your planning, and remember that using platforms like US Legal Forms can help streamline the process and reduce unexpected fees.

An alternative to a Letter of Testamentary is a Small Estate Affidavit, which is suitable when the estate's value falls below a certain threshold. This document allows heirs to claim assets without formal probate proceedings. In West Jordan, Utah Letters Testamentary serve a primary purpose in larger estates, but considering this alternative can speed up the process and reduce costs as necessary.

In Utah, an estate typically must be valued at over $100,000 to require probate. However, various factors can influence this requirement, so it's wise to consult local regulations or legal advice. If your estate is approaching this threshold, proper planning and understanding can help you decide the best course of action.

To prove testamentary intent, you need to demonstrate that the deceased genuinely intended to create a will or trust at the time of its execution. This often involves presenting the will itself, along with any supporting documents or witness testimonies. Understanding the nuances involved can be crucial in West Jordan, Utah, especially when dealing with West Jordan Utah Letters Testamentary.