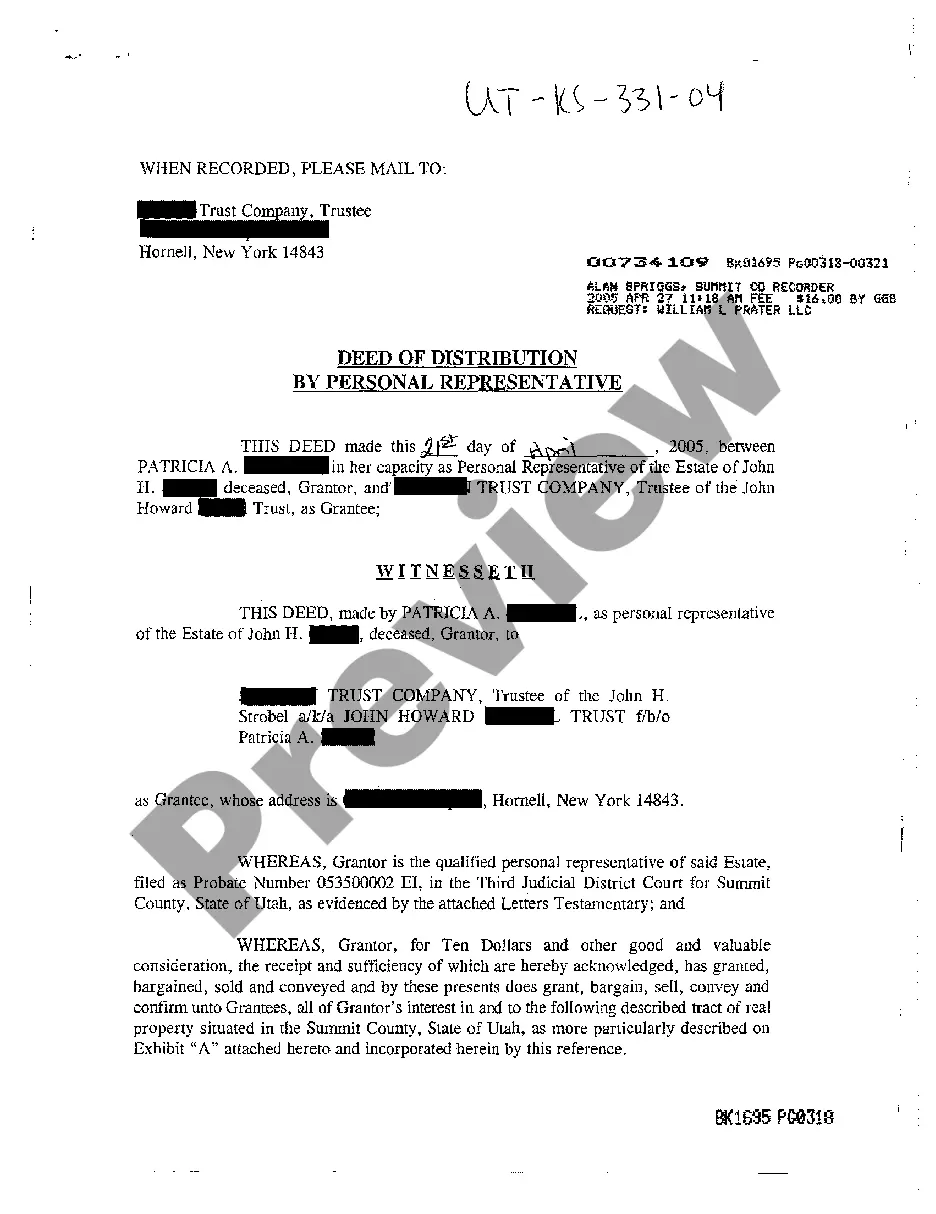

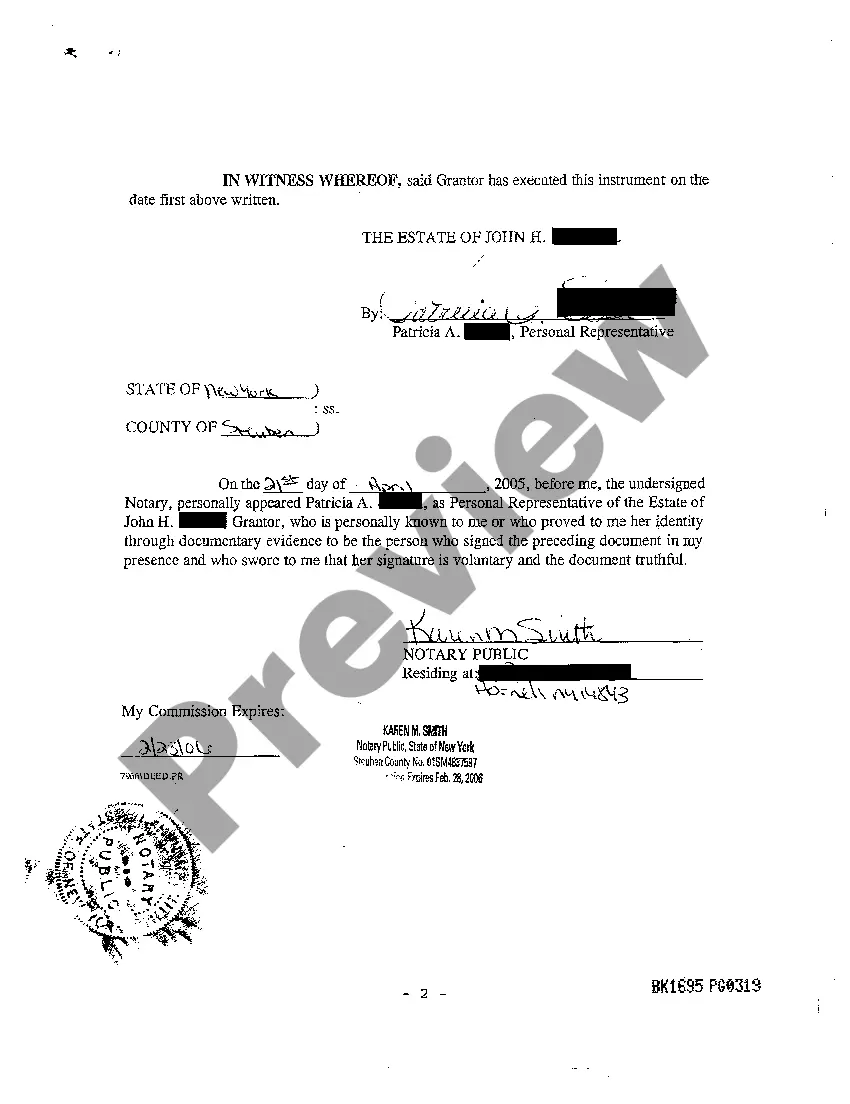

The Salt Lake City Utah Deed of Distribution by Personal Representative is a legally binding document that outlines the distribution of assets and properties of a deceased individual's estate. This deed is executed by the personal representative of the estate, who is responsible for managing and distributing the assets according to the decedent's wishes or the laws of intestate succession. Key Topics: 1. Purpose: The primary purpose of a Salt Lake City Utah Deed of Distribution by Personal Representative is to ensure the proper transfer of assets and properties from the estate to the rightful recipients. 2. Personal Representative: The personal representative, also known as an executor or administrator, is appointed by the court to handle the administration of the estate and carry out the distribution process. 3. Laws and Requirements: The deed must comply with the specific laws and requirements set forth by the state of Utah, including the Utah Uniform Probate Code and any additional regulations applicable to Salt Lake City. 4. Timing: The deed of distribution is typically prepared and executed after all debts, taxes, and expenses of the estate have been settled, and any required court approvals have been obtained. 5. Asset Distribution: The deed specifies how the assets will be distributed among the beneficiaries or heirs of the estate. This may include real estate, personal belongings, financial accounts, investments, and any other estate assets. 6. Warship Affidavit: In some cases, a warship affidavit may be required alongside the deed of distribution. This affidavit establishes the legal heirs of the deceased and their respective shares in the estate. 7. Types: While there may not be specific variations of the Salt Lake City Utah Deed of Distribution by Personal Representative, different scenarios can impact the distribution process. These scenarios include cases with or without a valid will, probate proceedings, trust administration, or when there are disputes among beneficiaries. 8. Legal Assistance: Due to the complexity of the probate process and the legal implications involved, it is highly recommended seeking the guidance of a qualified attorney to ensure compliance with state laws and make the distribution process smoother. In summary, the Salt Lake City Utah Deed of Distribution by Personal Representative is a crucial legal document that guides the correct distribution of a deceased individual's assets. It serves to protect the interests of all involved parties while ensuring adherence to the applicable laws and regulations in Salt Lake City, Utah.

Salt Lake City Utah Deed of Distribution by Personal Representative

State:

Utah

City:

Salt Lake City

Control #:

UT-KS-331-04

Format:

PDF

Instant download

This form is available by subscription

Description

A14 Deed of Distribution by Personal Representative

The Salt Lake City Utah Deed of Distribution by Personal Representative is a legally binding document that outlines the distribution of assets and properties of a deceased individual's estate. This deed is executed by the personal representative of the estate, who is responsible for managing and distributing the assets according to the decedent's wishes or the laws of intestate succession. Key Topics: 1. Purpose: The primary purpose of a Salt Lake City Utah Deed of Distribution by Personal Representative is to ensure the proper transfer of assets and properties from the estate to the rightful recipients. 2. Personal Representative: The personal representative, also known as an executor or administrator, is appointed by the court to handle the administration of the estate and carry out the distribution process. 3. Laws and Requirements: The deed must comply with the specific laws and requirements set forth by the state of Utah, including the Utah Uniform Probate Code and any additional regulations applicable to Salt Lake City. 4. Timing: The deed of distribution is typically prepared and executed after all debts, taxes, and expenses of the estate have been settled, and any required court approvals have been obtained. 5. Asset Distribution: The deed specifies how the assets will be distributed among the beneficiaries or heirs of the estate. This may include real estate, personal belongings, financial accounts, investments, and any other estate assets. 6. Warship Affidavit: In some cases, a warship affidavit may be required alongside the deed of distribution. This affidavit establishes the legal heirs of the deceased and their respective shares in the estate. 7. Types: While there may not be specific variations of the Salt Lake City Utah Deed of Distribution by Personal Representative, different scenarios can impact the distribution process. These scenarios include cases with or without a valid will, probate proceedings, trust administration, or when there are disputes among beneficiaries. 8. Legal Assistance: Due to the complexity of the probate process and the legal implications involved, it is highly recommended seeking the guidance of a qualified attorney to ensure compliance with state laws and make the distribution process smoother. In summary, the Salt Lake City Utah Deed of Distribution by Personal Representative is a crucial legal document that guides the correct distribution of a deceased individual's assets. It serves to protect the interests of all involved parties while ensuring adherence to the applicable laws and regulations in Salt Lake City, Utah.

Free preview

How to fill out Salt Lake City Utah Deed Of Distribution By Personal Representative?

If you’ve already used our service before, log in to your account and save the Salt Lake City Utah Deed of Distribution by Personal Representative on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Ensure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Salt Lake City Utah Deed of Distribution by Personal Representative. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!