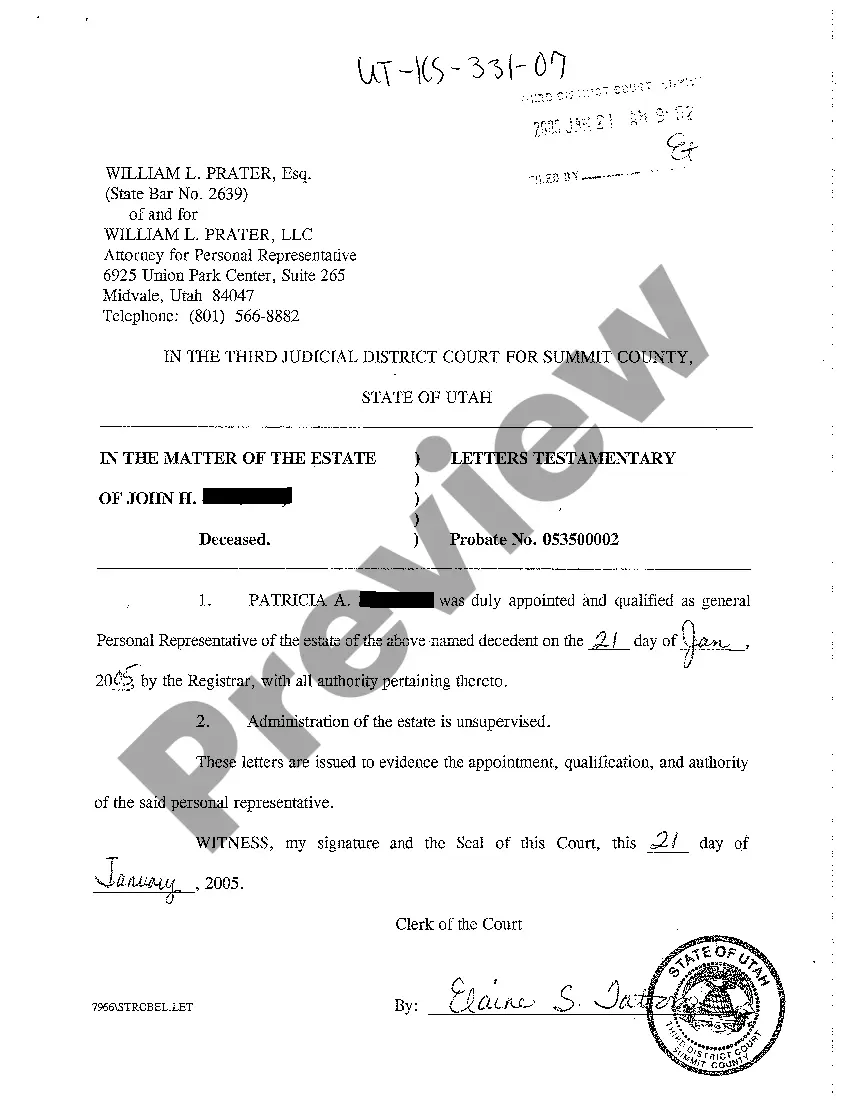

Salt Lake Utah Letters Testamentary is a legal document granting authority to an executor or administrator to settle the affairs of a deceased person's estate in the state of Utah. It is issued by the probate court in Salt Lake County, Utah, and provides the appointed individual with the legal power and responsibility to manage and distribute the assets and properties of the deceased according to their will or the state's intestacy laws. The Letters Testamentary serve as official evidence of the executor's or administrator's authority, allowing them to act on behalf of the estate. This includes gathering and inventorying assets, paying off debts and taxes, and distributing the remaining assets to the beneficiaries or heirs. The process ensures that the deceased person's affairs are properly settled, providing a smooth transition of assets and minimizing disputes among potential claimants. There are different types of Letters Testamentary that can be issued in Salt Lake County, Utah, depending on the circumstances of the estate: 1. Letters Testamentary with a Will: If the deceased person left a valid will, the appointed executor is granted Letters Testamentary with a Will. This document outlines the executor's authority to carry out the wishes of the deceased as stated in their will. 2. Letters Testamentary without a Will: In case the deceased person did not leave a will or if it is deemed invalid, the court may appoint an administrator to manage the estate. The administrator is issued Letters Testamentary without a Will, providing them with the legal authority to settle the estate according to Utah's intestacy laws. It is essential to note that obtaining Letters Testamentary requires a legal process, typically through probate court. The appointed person should file the necessary paperwork, present the death certificate, and provide proof of their eligibility to serve as the executor or administrator. Once the court validates the application and approves the issuance of Letters Testamentary, the appointed individual can begin the estate administration proceedings. In summary, Salt Lake Utah Letters Testamentary is a legal document granting authority to manage the affairs of a deceased person's estate. It establishes the executor's or administrator's power to handle assets, pay off debts, and distribute the remaining estate to beneficiaries or heirs. This process ensures the proper settlement of the deceased's affairs, providing clarity and transparency in estate administration.

Salt Lake Utah Letters Testamentary

Description

How to fill out Salt Lake Utah Letters Testamentary?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person without any legal education to create this sort of paperwork from scratch, mainly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms can save the day. Our platform provides a huge collection with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI forms.

Whether you require the Salt Lake Utah Letters Testamentary or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Salt Lake Utah Letters Testamentary in minutes employing our trusted platform. If you are already a subscriber, you can go on and log in to your account to download the needed form.

However, in case you are unfamiliar with our platform, make sure to follow these steps before obtaining the Salt Lake Utah Letters Testamentary:

- Be sure the template you have chosen is specific to your location since the rules of one state or county do not work for another state or county.

- Preview the document and go through a quick description (if provided) of scenarios the document can be used for.

- If the form you selected doesn’t suit your needs, you can start again and look for the necessary document.

- Click Buy now and choose the subscription plan you prefer the best.

- with your credentials or register for one from scratch.

- Pick the payment method and proceed to download the Salt Lake Utah Letters Testamentary once the payment is completed.

You’re good to go! Now you can go on and print the document or complete it online. Should you have any issues getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.

Form popularity

FAQ

Letters testamentary are documents that a probate court delivers to the executor of the deceased's estate to enforce the terms of the deceased person's will. A court can issue letters testamentary only to persons who are chosen as an executor in a will.

Living trusts In Utah, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Probate is required if: the estate includes real property (land, house, condominium, mineral rights) of any value, and/or. the estate has assets (other than land, and not including cars) whose net worth is more than $100,000.

You cannot avoid probate with only a will because wills cannot transfer property. This means if you have assets you want to pass to loved ones, it isn't covered in the will and a probate matter still has to be opened.

Your spouse inherits all of your intestate property. If you die with descendants who are not the descendants of your surviving spouse -- in other words, you have children or grandchildren from a previous relationship. Your spouse inherits the first $75,000 of your intestate property, plus 1/2 of the balance.

This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate. If you have been named in a will as an executor, you don't have to act if you don't want to.

There is not any legal timeframe for applying for probate, however much of the estate administration will not be possible until this is received, so it is generally one of the first things that is done. In the case of some small estates, probate may not be necessary. This will depend on the amount of assets held.

In the state of Utah, the entire probate process can take as little as four to five months. This assumes that the process proceeds quickly and there are no impediments to paying debts and dividing the remaining assets.

Letters Testamentary or Letters of Administration A certified copy of this document can be presented to third parties - such as banks and insurance companies - to show that the named person has been appointed by the court as personal representative of the decedent's estate.