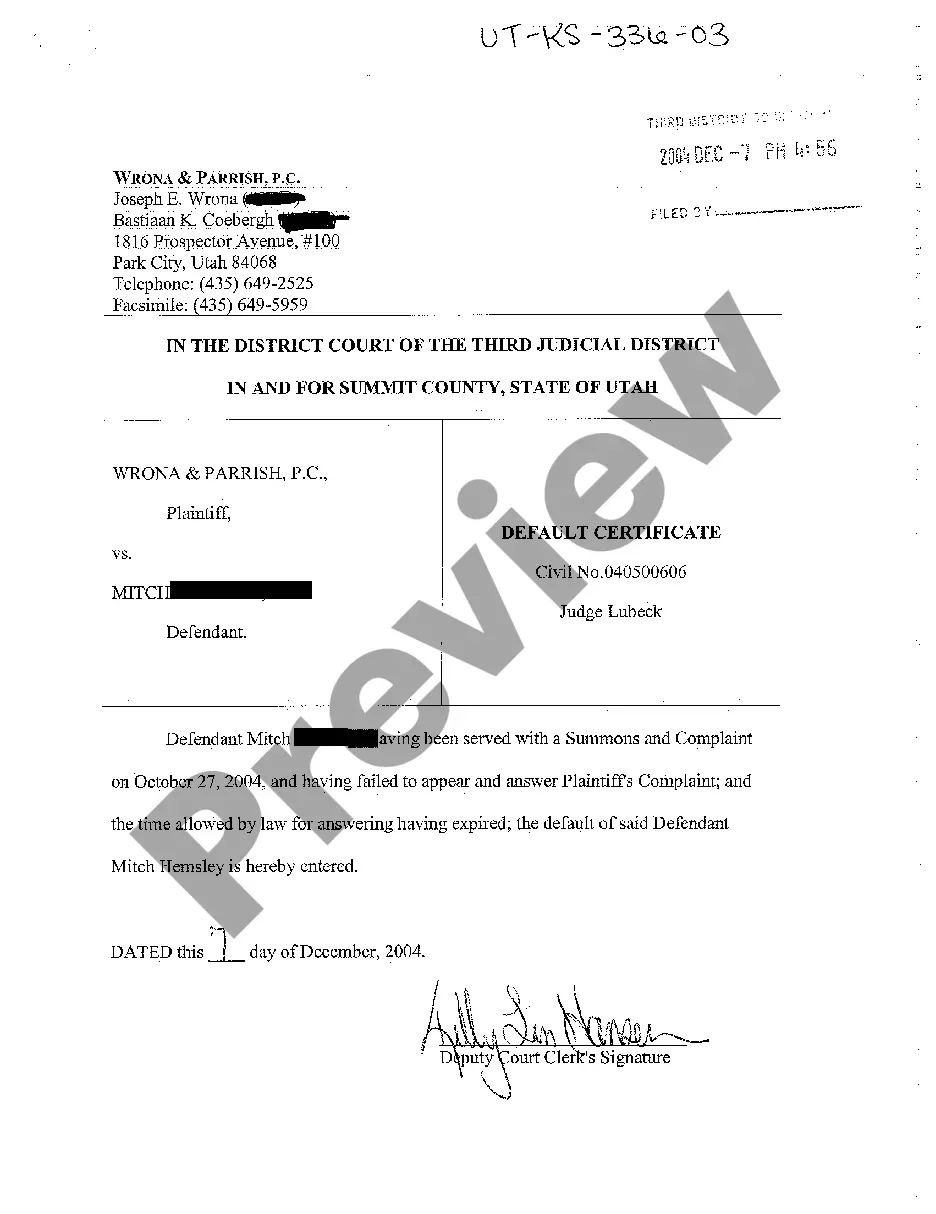

Salt Lake Utah Default Certificate refers to a legal document issued by the courts in Salt Lake City, Utah, declaring a person or entity to be in default of their financial obligations. The certificate is an official recognition that the individual or organization has failed to fulfill their contractual or legal duties, such as paying debts or meeting financial obligations. The Salt Lake Utah Default Certificate is typically issued following a legal process, which may involve a lawsuit filed by a creditor or lender seeking to recover the owed amount. Once a court determines that the debtor has indeed defaulted on their obligations, they issue a default certificate as evidence of the default. This certificate serves various purposes and may have different types depending on the specific legal situation. Some common types of Salt Lake Utah Default Certificates include: 1. Debt Default Certificate: This type of certificate is issued when an individual or business fails to repay borrowed money to a creditor or lending institution. It states the amount owed, the creditor's information, and the date of default. 2. Mortgage Default Certificate: In the case of a default on a mortgage loan, this certificate is issued to provide evidence of the borrower's failure to make timely payments on their home loan. It specifies the details of the mortgage, including the outstanding balance, interest rate, and the period of default. 3. Loan Default Certificate: This certificate is given to individuals or businesses who have defaulted on any type of loan, excluding mortgages. It can include personal loans, car loans, student loans, or business loans. 4. Judgment Default Certificate: If a person or entity fails to comply with a court-ordered judgment, a judgment default certificate may be issued. It indicates that the debtor has not followed the court's decision, which could involve paying damages, fines, or fulfilling certain obligations. 5. Tax Default Certificate: This type of certificate is specific to defaulting on tax obligations. It can be issued when an individual or business fails to pay their taxes owed to the local, state, or federal tax authorities. It includes details of the outstanding tax amount, the tax agency involved, and the period of default. Furthermore, it's important to note that these Salt Lake Utah Default Certificates have legal implications and may have severe consequences for the defaulting party. They serve as evidence of non-compliance with financial obligations and can lead to further legal actions by creditors, such as asset seizures, wage garnishments, or bankruptcy proceedings.

Salt Lake Utah Default Certificate

Description

How to fill out Salt Lake Utah Default Certificate?

If you are searching for a relevant form template, it’s extremely hard to choose a better platform than the US Legal Forms site – probably the most extensive online libraries. Here you can find thousands of templates for company and personal purposes by types and states, or key phrases. Using our high-quality search option, getting the most recent Salt Lake Utah Default Certificate is as easy as 1-2-3. In addition, the relevance of each document is verified by a group of expert attorneys that regularly review the templates on our website and revise them based on the most recent state and county laws.

If you already know about our platform and have an account, all you need to get the Salt Lake Utah Default Certificate is to log in to your user profile and click the Download button.

If you make use of US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have found the form you need. Look at its description and make use of the Preview feature to see its content. If it doesn’t meet your requirements, utilize the Search field near the top of the screen to discover the proper record.

- Confirm your choice. Select the Buy now button. Next, pick the preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Get the template. Select the file format and download it on your device.

- Make changes. Fill out, modify, print, and sign the received Salt Lake Utah Default Certificate.

Every template you add to your user profile does not have an expiry date and is yours permanently. You always have the ability to gain access to them using the My Forms menu, so if you want to have an extra duplicate for editing or printing, you may return and export it again at any moment.

Make use of the US Legal Forms professional library to gain access to the Salt Lake Utah Default Certificate you were seeking and thousands of other professional and state-specific templates on a single platform!

Form popularity

FAQ

The Rules define ?default? as when ?a party against whom a judgment for affirmative relief is sought has failed to plead or otherwise defend,? and define ?judgment? as ?a decree and any order from which an appeal lies.? Read together, a default judgment is simply any judgment that results from a default.

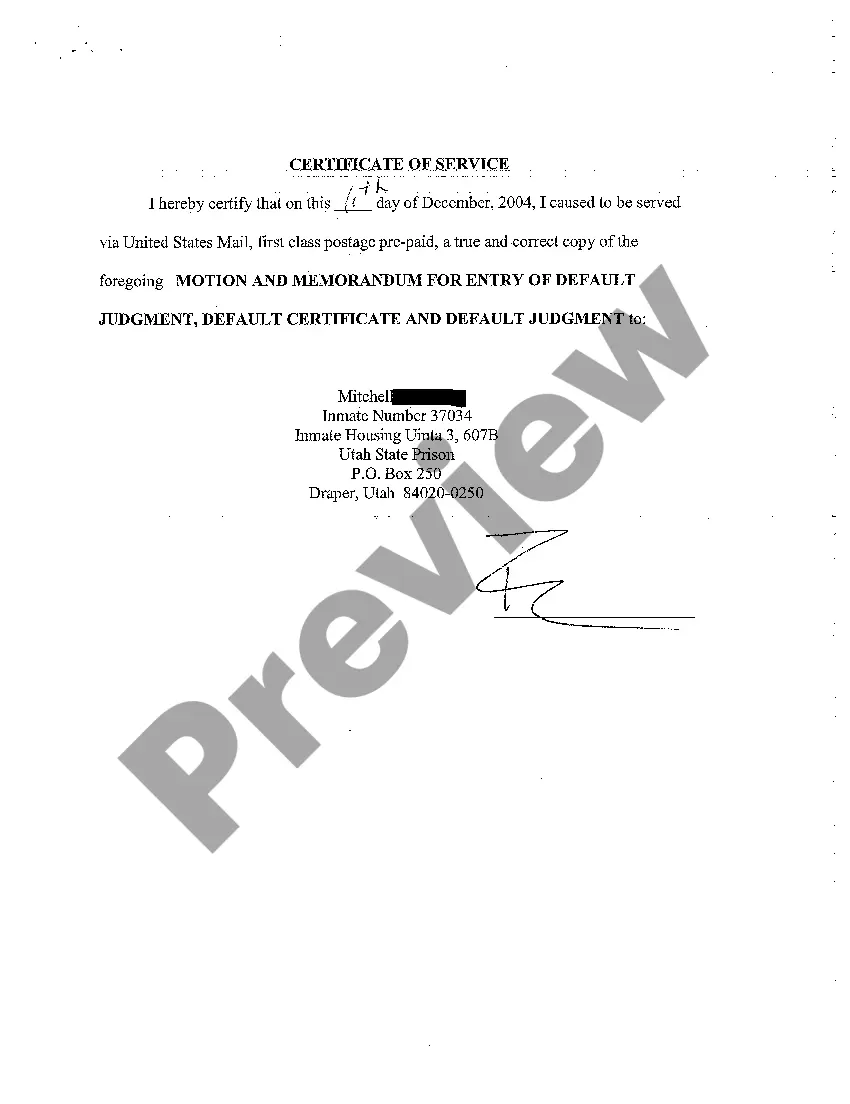

To get a judgment by default, you must serve the other party with the Summons and the Complaint/Petition, file proof of service with the court, and then wait at least 21 days (30 days if the other party was served outside Utah).

An uncontested divorce in Utah requires an average of 3 months to complete. A contentious divorce, on the other hand, might take 9 months or longer, depending on the complexity of marital assets.

A default judgment (also known as judgment by default) is a ruling granted by a judge or court in favor of a plaintiff in the event that the defendant in a legal case fails to respond to a court summons or does not appear in court.

Once the court has entered a judgment, your creditor can collect the judgment by garnishing you. This lets the creditor take the money directly from your bank account or paycheck. Your creditor might also legally seize your property.

To get a judgment by default, you must serve the other party with the Summons and the Complaint/Petition, file proof of service with the court, and then wait at least 21 days (30 days if the other party was served outside Utah).

An order of default is a court order saying that one party (usually the plaintiff) has won the case, and the defendant has lost, because the defendant did not participate in the case.

(h) Default judgment When a default is entered, the party who requested the entry of default must obtain a default judgment against the defaulting party within 45 days after the default was entered, unless the court has granted an extension of time.

?Final decision? or ?final judgment? refers to a court's decision that settles all of the parties' legal issues in controversy in the court. ?Decision on the merits? or ?judgment on the merits? is a judgment made based on facts and relevant substantive law of the case, rather than on technical or procedural grounds.

Primary tabs. A default judgment (also known as judgment by default) is a ruling granted by a judge or court in favor of a plaintiff in the event that the defendant in a legal case fails to respond to a court summons or does not appear in court.