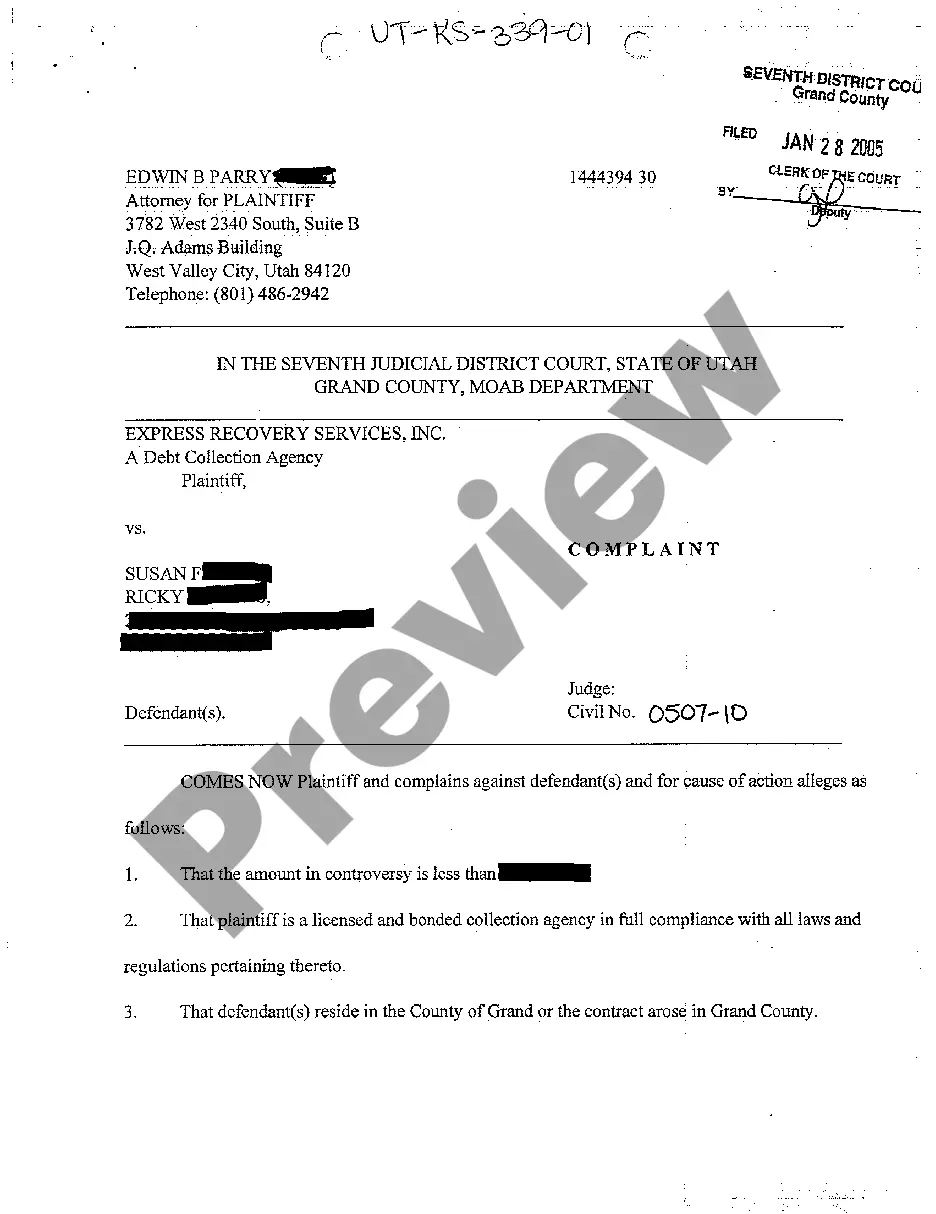

Provo Utah Complaint — Debt Collection by Collection Agency Provo, Utah residents who have faced issues with debt collection conducted by collection agencies can file a complaint to seek resolution. Debt collection complaints often arise when collection agencies use aggressive or unfair tactics to retrieve outstanding payments. It is crucial to understand the rights of debtors and the obligations of collection agencies under the Fair Debt Collection Practices Act (FD CPA). There are several types of Provo Utah Complaint — Debt Collection by Collection Agency, including: 1. Harassment Complaints: Some collection agencies resort to constant phone calls, threats, and abusive language while communicating with debtors. These tactics can cause significant emotional distress and are prohibited by the FD CPA. 2. False Representation Complaints: Collection agencies must provide accurate and truthful information regarding the debt and its collection. If a debtor receives misleading or false statements about their debt, the collection agency may be in violation of the FD CPA. 3. Unauthorized Actions Complaints: Collection agencies are limited in the actions they can take to collect a debt. Unlawful activities may include contacting third parties, revealing the debt details to unauthorized individuals, or attempting to collect a debt that isn't owed. Debtor complaints can be filed if any unauthorized actions occur during the collection process. 4. Disputed Debt Complaints: Debtors have the right to dispute a debt if they believe it's inaccurate or if they question its validity. If the collection agency fails to respond to a debtor’s dispute or continues collection efforts without proper validation, a complaint can be filed. To file a Provo Utah Complaint — Debt Collection by Collection Agency effectively, debtors can follow these steps: 1. Gather Documentation: Collect all relevant documents, including debt verification letters, correspondence with the collection agency, phone call logs, and any evidence of harassment or false representations. 2. Contact the Utah Division of Consumer Protection: Reach out to the Utah Division of Consumer Protection, either by phone, email, or visiting their office. Provide them with detailed information about the complaint, including the collection agency's name, contact information, and a thorough description of the issue. 3. Seek Legal Advice: If the debt collection practices continue to be problematic or if the debtor faces significant financial harm, consulting with an attorney specializing in debt collection can provide valuable guidance and support. It's important to note that debtors have legal rights and protections, and collection agencies have specific obligations and limitations when attempting to collect a debt. Understanding these rights and protections can help debtors navigate the complaint process and potentially seek resolution for their debt collection issues in Provo, Utah.

Provo Utah Complaint - Debt Collection by Collection Agency

Description

How to fill out Provo Utah Complaint - Debt Collection By Collection Agency?

We always want to minimize or prevent legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal services that, usually, are very expensive. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to legal counsel. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Provo Utah Complaint - Debt Collection by Collection Agency or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Provo Utah Complaint - Debt Collection by Collection Agency adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Provo Utah Complaint - Debt Collection by Collection Agency is suitable for you, you can pick the subscription option and proceed to payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!

Form popularity

FAQ

In general, a debt becomes uncollectible after a specific period, which can vary by state. In Utah, for example, unsecured debts may become uncollectible after six years, while other debts may have different timeframes. If you are dealing with a Provo Utah Complaint - Debt Collection by Collection Agency, it's essential to understand the statute of limitations on your debt. Knowing this can help you navigate your financial obligations and protect your rights.

The 777 rule refers to a guideline that helps protect consumers from aggressive debt collection practices. Under this rule, debt collectors must follow specific procedures when trying to collect a debt. If you receive a Provo Utah Complaint - Debt Collection by Collection Agency related to this rule, it's crucial to know your rights and seek proper advice. Understanding these protections can empower you to handle any unpleasant communications more effectively.

The 777 rule refers to the guideline that consumers should respond to debt collectors within seven days of receiving notice of a debt. This rule encourages individuals to take action quickly, either by disputing the debt or by making payment arrangements. Ignoring communications can lead to further complications. If you face issues with a debt collector in your Provo Utah Complaint - Debt Collection by Collection Agency, consider accessing the resources available on the US Legal Forms platform to better understand your rights and options.

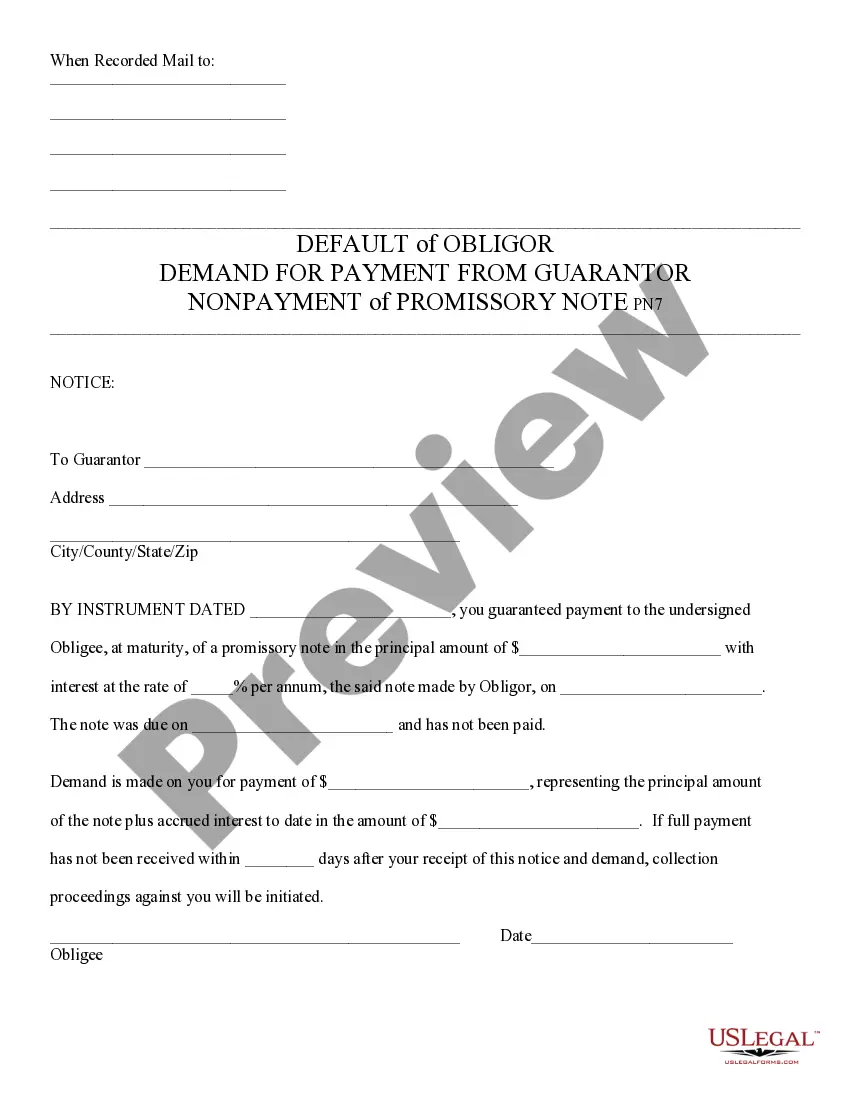

To write a dispute letter to a debt collection agency, start by clearly stating your intention to dispute the debt. Include your personal information, the account number, and the details about the dispute. Be sure to mention any errors or inaccuracies in the debt claim. You can find helpful templates and resources on the US Legal Forms platform that assist you in crafting a professional dispute letter specifically for your Provo Utah Complaint - Debt Collection by Collection Agency.

Disputing a collection can be worthwhile, especially if you believe the debt is incorrect or invalid. An accurate dispute process can help protect your credit score and ensure your financial records remain clean. Engaging with the US Legal Forms tools can streamline the process for handling your Provo Utah Complaint - Debt Collection by Collection Agency, giving you a clear path forward.

To dispute a collection agency debt, start by requesting validation of the debt from the agency. You have the right to receive proof that the debt is yours and that it is valid. Use the sample letters available on the US Legal Forms platform to create your dispute letter. By taking this step, you can effectively manage your Provo Utah Complaint - Debt Collection by Collection Agency.

To file a claim against a debt collector in Provo, Utah, you should first gather evidence of illegal practices or harassment. Then, you can file a complaint with the Federal Trade Commission (FTC) and the Utah Attorney General's office. If you are considering a lawsuit, legal forms and guides are available through US Legal Forms to facilitate the process. By taking these steps, you can hold collectors accountable in relation to Provo Utah Complaint - Debt Collection by Collection Agency.

In Utah, a debt typically becomes uncollectible after the statute of limitations expires, which is four years for most debts. Once this time has passed, creditors lose the legal right to sue you for unpaid debts. Understanding this can help you navigate your financial situation more effectively, especially in relation to Provo Utah Complaint - Debt Collection by Collection Agency. US Legal Forms can assist you in assessing your specific case and rights.

In Utah, debt collectors can pursue a debt for up to four years from the date of the last payment or acknowledgment of the debt. After this period, the debt becomes too old for creditors to file a lawsuit. This timeframe is important to understand when dealing with Provo Utah Complaint - Debt Collection by Collection Agency. Reach out to US Legal Forms for more information on your rights as a consumer during debt collection.

Yes, in Provo, Utah, a debt that is 10 years old can still be collected. While the original creditor may not be able to sue due to the statute of limitations, collection agencies can still attempt to recover the debt. It's important to be aware that paying on an old debt can sometimes reset the clock on the statute of limitations. For concerns regarding Provo Utah Complaint - Debt Collection by Collection Agency, consider reaching out to legal experts for guidance.