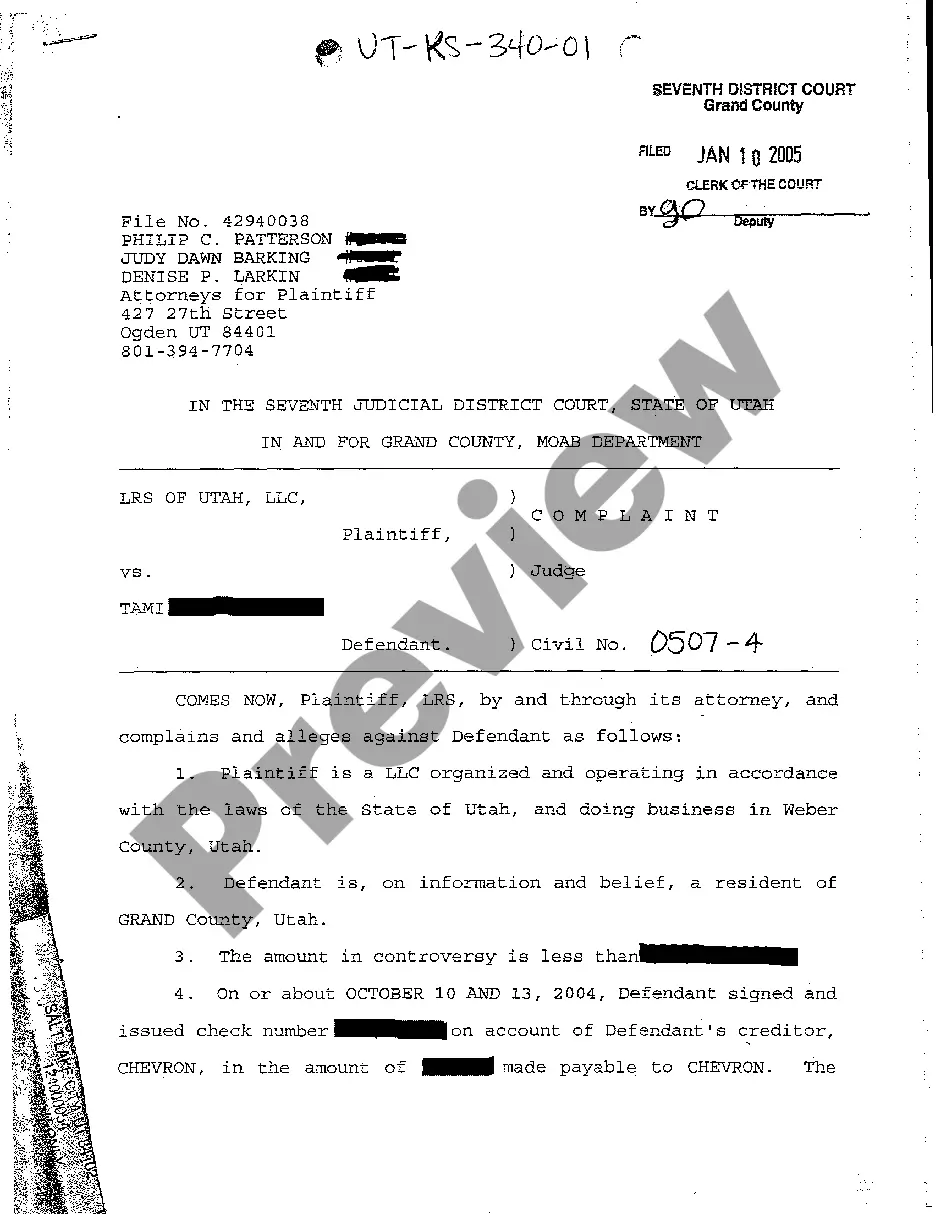

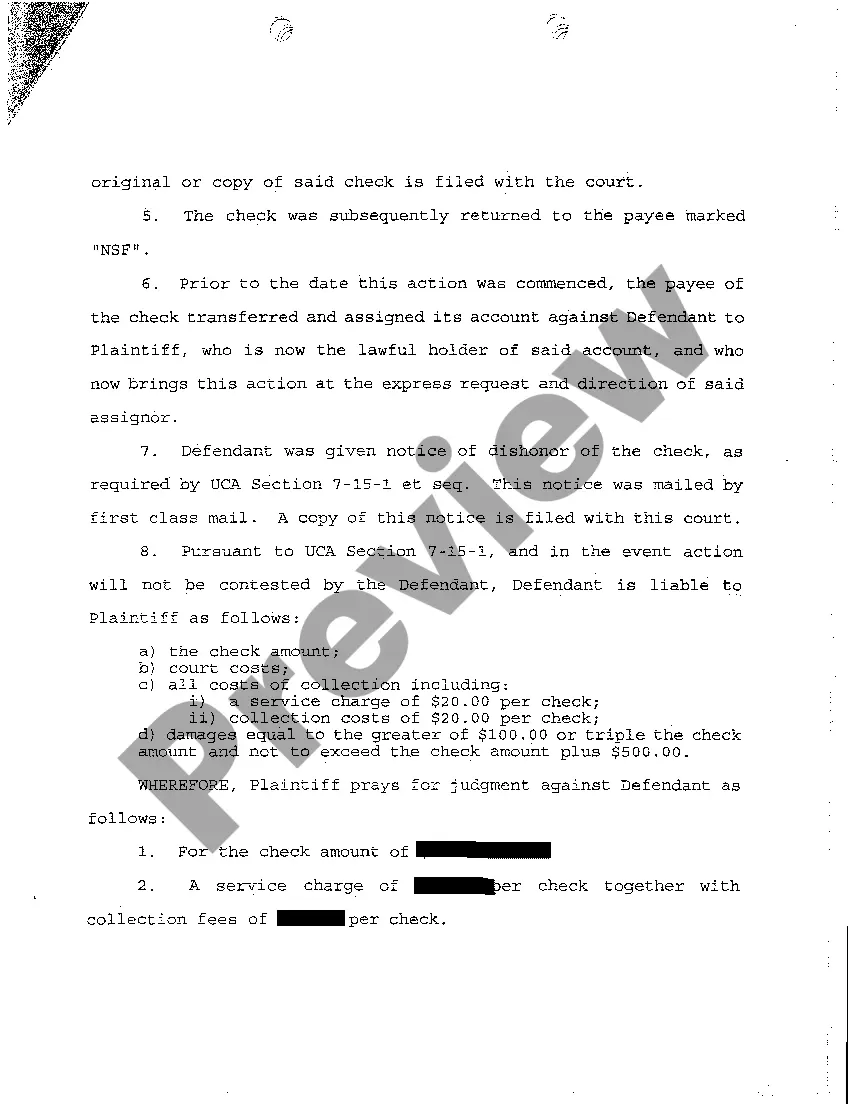

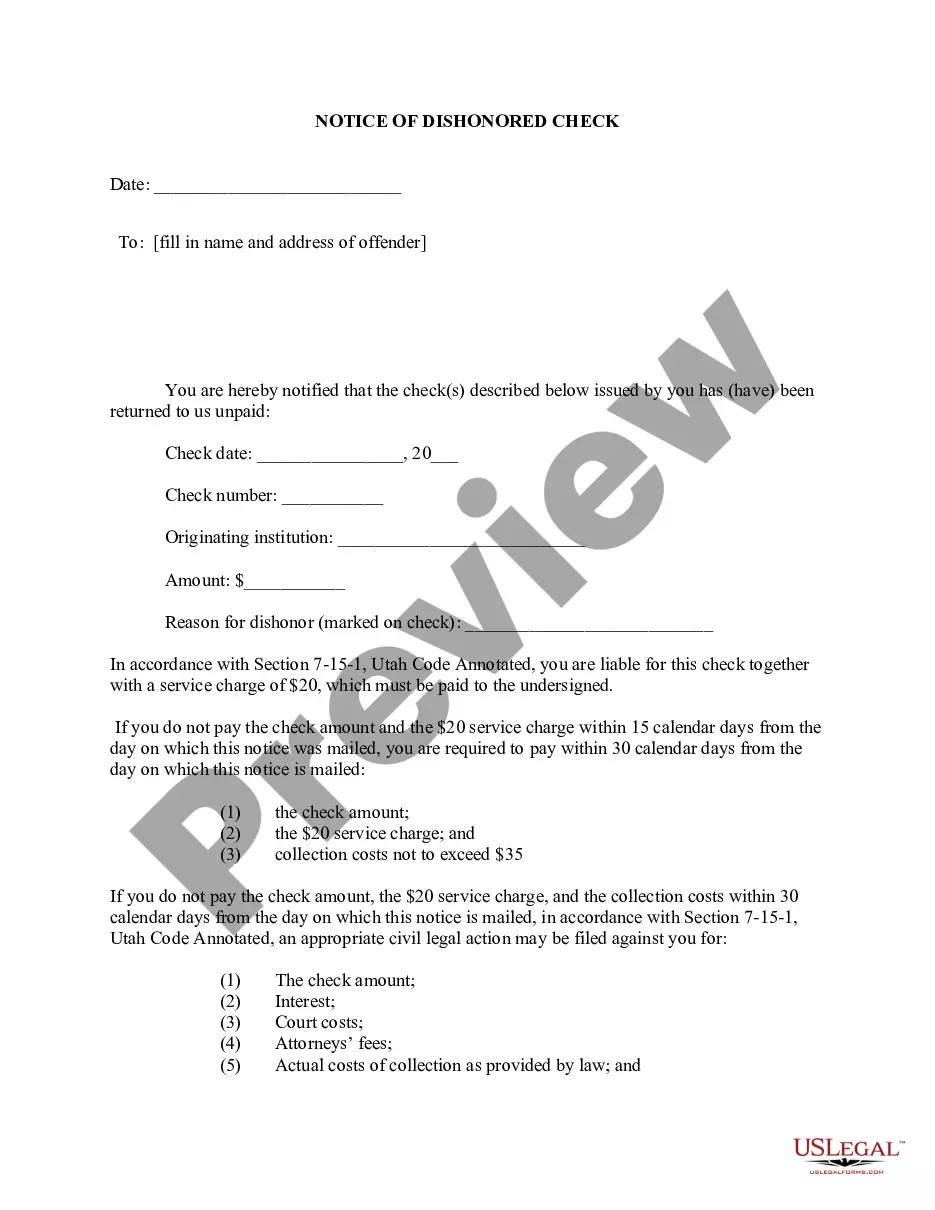

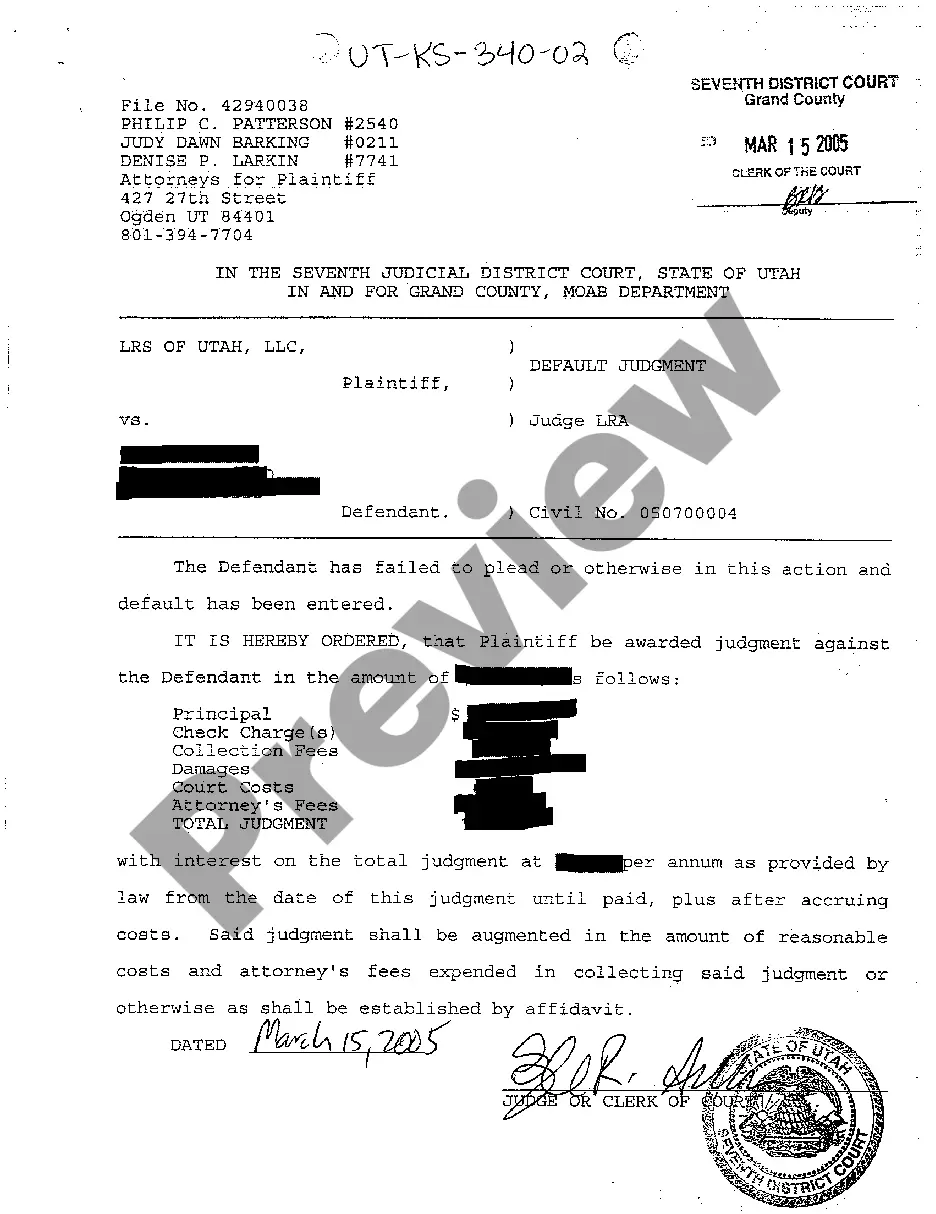

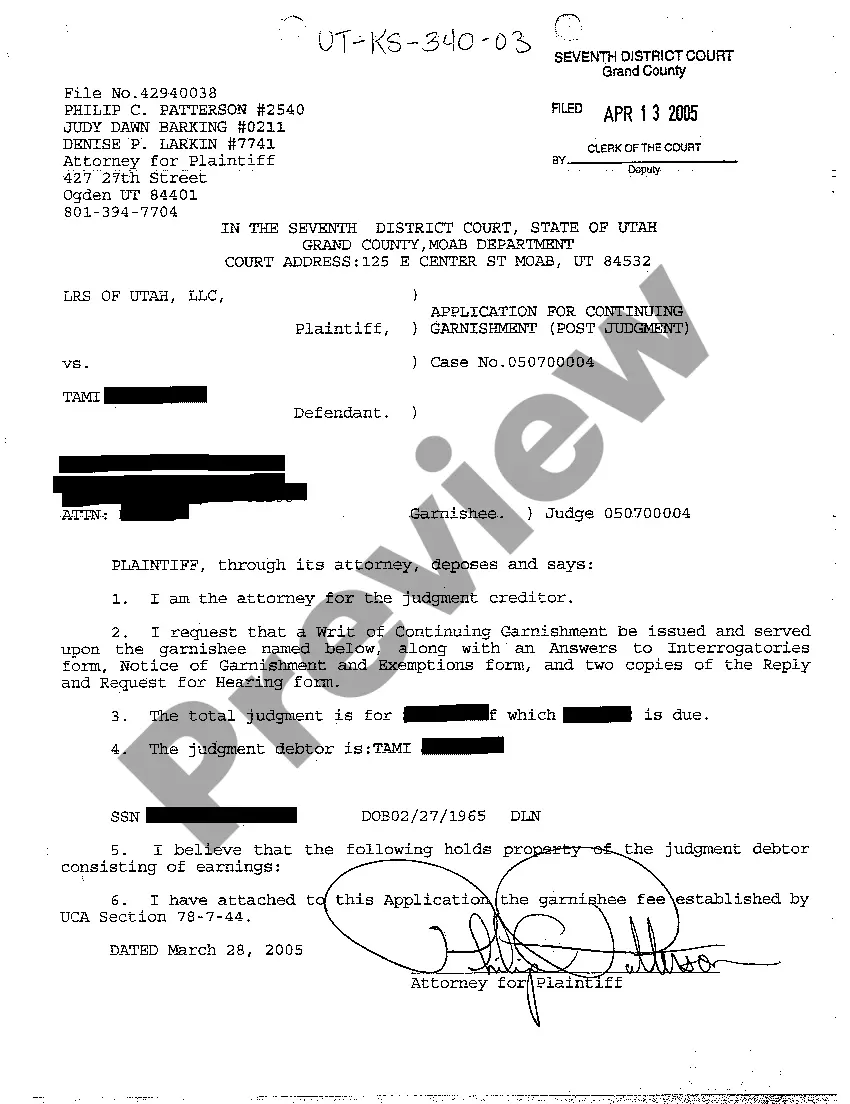

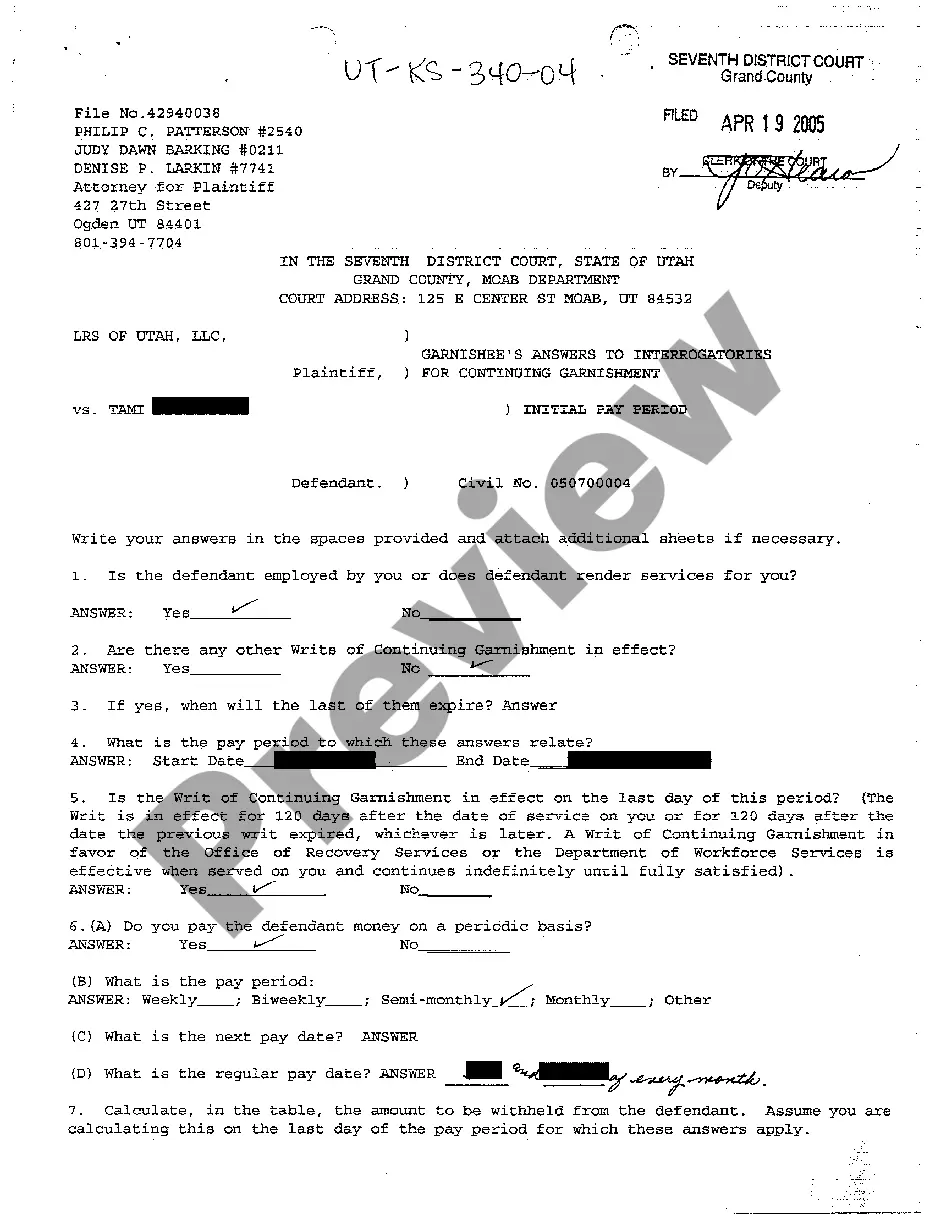

Provo Utah Complaint — Dishonored Check: Understanding the Legal Implications and Resolutions In Provo, Utah, the issue of dishonored checks is a serious matter with legal ramifications. When a check is dishonored, it means that the bank refuses to honor or cash the check due to insufficient funds, account closure, or other reasons. This situation can lead to financial losses and complications for the party expecting payment. Provo residents facing dishonored checks can file a complaint with the relevant authorities to ensure their rights are protected and seek a resolution. It's important to understand the different types of Provo Utah Complaint — Dishonored Check cases that may arise: 1. Individual-to-Individual Transactions: In cases where an individual writes a check to another person, such as for services rendered or goods purchased, a dishonored check can cause significant inconvenience and financial distress to the recipient. 2. Business Transaction Disputes: Dishonored checks arising from business transactions, whether it's payment for services, products, or loans, can have severe consequences for both parties involved. This often necessitates legal action to resolve the issue and recoup losses. 3. Fraudulent Activities: Dishonored checks can also be a result of fraudulent activities, such as forged signatures or stolen checkbooks. Victims of fraud must report the incident, gather evidence, and file complaints to avoid bearing the consequences of someone else's wrongdoing. When dealing with Provo Utah Complaints — Dishonored Check cases, it is vital to follow these recommended steps: 1. Contact the Bank: Start by reaching out to the bank to understand the reason behind the dishonored check. They can provide insights into the specific issue and advise on available options. 2. Communicate with the Obliged: If the dishonored check stems from an individual or business that owes you money, attempt to resolve the matter through direct communication. Inform them about the dishonor and discuss potential solutions or alternative payment methods. 3. Gather Documentation: Collect all relevant documents, including the dishonored check, bank statements, transaction records, invoices, and any other evidence supporting your claims. These records will be essential when filing a complaint or pursuing legal action. 4. File a Complaint: If initial attempts to resolve the issue fail, the next step is to file a complaint with the appropriate authorities. In Provo, this typically involves reporting to the local law enforcement agency or the Utah court system. 5. Seek Legal Assistance: Depending on the complexity of the case and the amount in question, it may become necessary to consult an attorney experienced in dishonored check disputes. They can guide you through the legal process, represent your interests, and help pursue a favorable resolution. 6. Mediation and Arbitration: In some cases, parties may opt for mediation or arbitration services to resolve the dispute without going to court. These alternative dispute resolution methods can be faster and more cost-effective compared to traditional litigation. To summarize, a Provo Utah Complaint — Dishonored Check refers to the legal dispute arising when a check is refused for payment by a bank due to insufficient funds or other reasons. By understanding the complexities of such cases and following the appropriate steps, individuals and businesses in Provo can seek resolution and protect their financial interests.

Provo Utah Complaint - Dishonored Check

Description

How to fill out Provo Utah Complaint - Dishonored Check?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Provo Utah Complaint - Dishonored Check gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Provo Utah Complaint - Dishonored Check takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Provo Utah Complaint - Dishonored Check. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

In Utah, you have 21 days to respond to divorce papers after being served personally, or 30 days if served by mail. Missing this deadline can result in a default judgment against you, which could affect your rights regarding property and custody. It’s crucial to act promptly, especially if financial issues related to a Provo Utah Complaint - Dishonored Check are involved.

If one party does not want a divorce, the other can still proceed with filing for divorce in Utah. The court will generally grant the divorce even if one person is reluctant, provided that certain requirements are met. Thus, addressing financial matters, including those dealing with a Provo Utah Complaint - Dishonored Check, becomes essential in negotiations and court decisions.

Responding to a divorce petition in Utah involves filing a response within 21 days if you received the petition in person, or 30 days if served by mail. Your response should include your stance on custody, property, and any other claims made in the petition. It's important to handle this matter clearly, especially in cases involving financial disputes, such as those related to a Provo Utah Complaint - Dishonored Check.

To write a response to a petition, begin by clearly stating your objections or agreements to the claims made. You should format your document properly, using an organized structure to address each point raised in the original petition. This is crucial in cases related to a Provo Utah Complaint - Dishonored Check, as a well-crafted response can significantly impact the outcome.

In Utah, the maximum amount you can claim in small claims court is $11,000. This limit applies specifically to cases that include disputes such as Provo Utah Complaint - Dishonored Check. If your damages exceed this amount, you may need to consider filing your case in a higher court, which can lead to more legal complexities.

The timeframe to answer a complaint in Utah is typically 21 days from the date of service for most cases, including a Provo Utah Complaint - Dishonored Check. Meeting this deadline is crucial to avoid legal repercussions. Always consider drafting your response promptly and accurately. Utilizing platforms like US Legal Forms can simplify the process with templates and legal guidance tailored for your needs.

To contact Provo City regarding a Provo Utah Complaint - Dishonored Check, you can visit their official website for phone numbers and email addresses. They provide resources for residents and help address various legal concerns. You can also contact the city clerk's office for further inquiries. Make sure to have any relevant information ready to facilitate the process.

In Utah, you generally have 21 days to file an answer to a Provo Utah Complaint - Dishonored Check after being served. This timeline is important, as missing it may result in default judgment. Therefore, it is recommended to review the complaint thoroughly and respond within the set time frame. Consulting with an attorney can provide clarity and assistance during this stage.

In a Provo Utah Complaint - Dishonored Check case, the plaintiff typically has 20 days to respond to an answer filed by the defendant. Timely responses are crucial, as failing to reply may affect the proceedings. It is advisable to prepare a proper response with the help of a legal expert. This ensures your rights are protected during the process.

If you do not respond to a Provo Utah Complaint - Dishonored Check, the court may issue a default judgment against you. This means you may lose your case automatically without a chance to present your side. It is essential to address complaints promptly to avoid unfavorable outcomes. Seeking legal assistance can help you navigate this situation effectively.