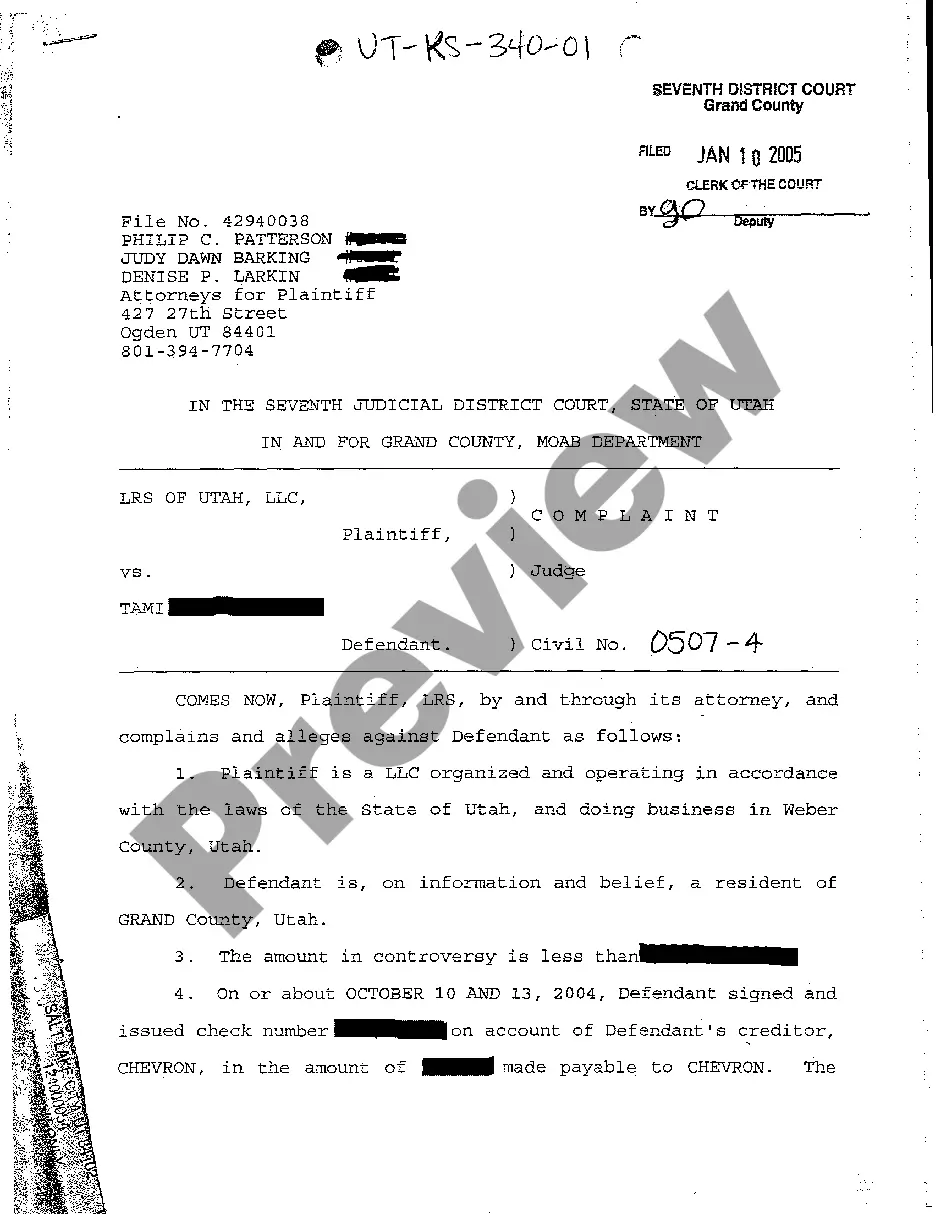

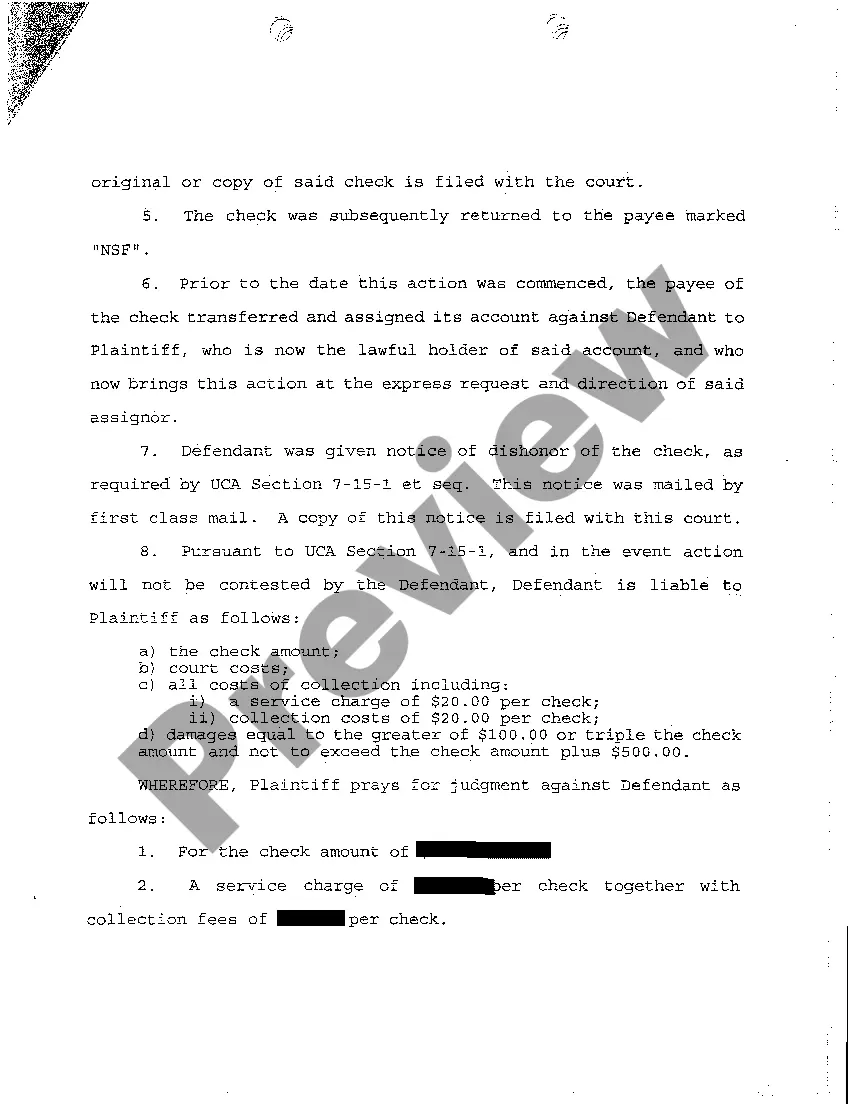

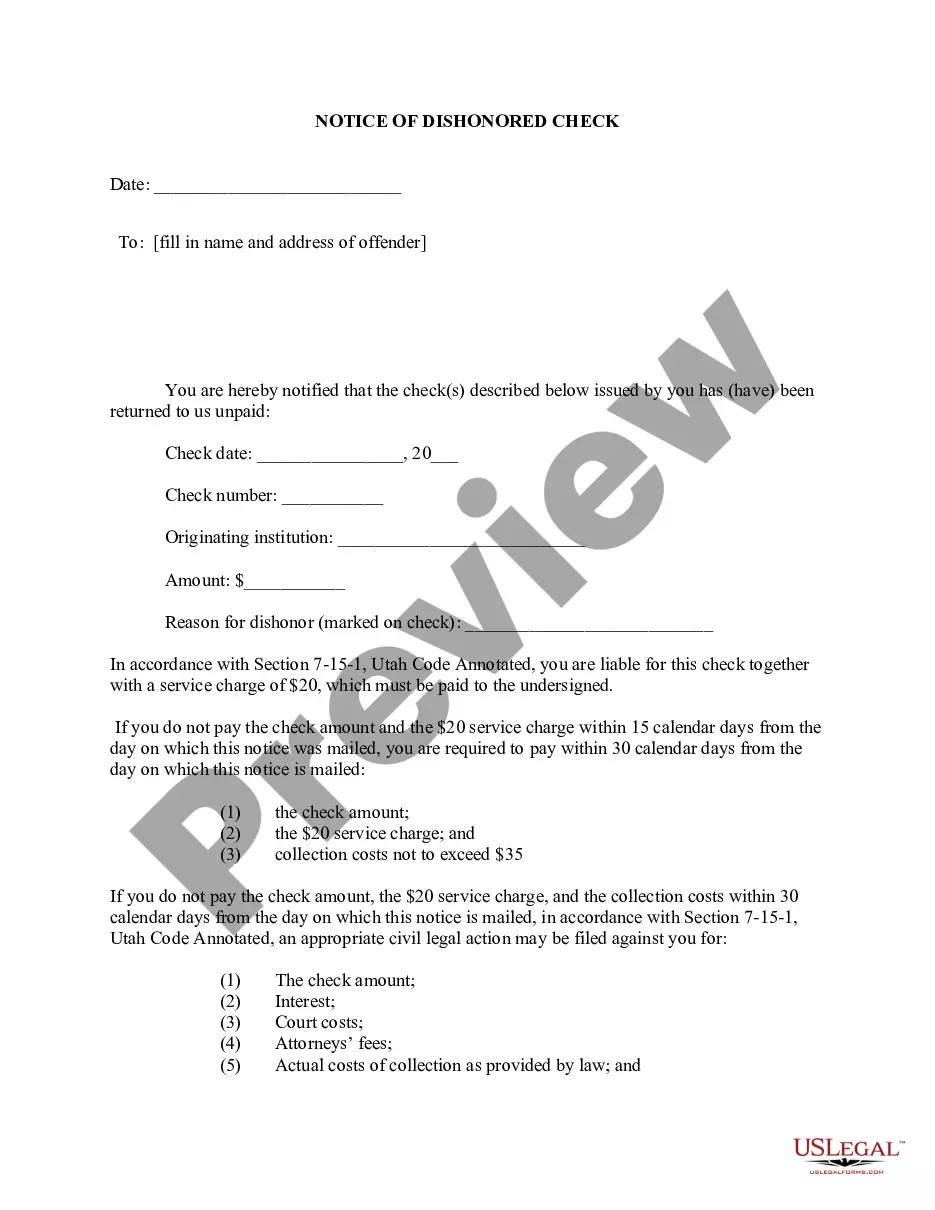

Salt Lake City Utah Complaint — Dishonored Check In Salt Lake City, Utah, there are certain legal provisions and regulations in place to address complaints related to dishonored checks. When a check is dishonored, it means that the bank or financial institution has refused to honor the payment due to insufficient funds, a closed account, or other reasons. This can lead to significant inconvenience, financial loss, and disruption of business transactions for the affected parties. Salt Lake City Utah Complaint — Dishonored Check Laws and Regulations: 1. Utah Code 7-15-1: This code governs the legal implications and penalties associated with dishonored checks in Utah. It specifies that intentionally issuing a check without sufficient funds is considered a criminal offense. 2. Utah Uniform Commercial Code (UCC) Article 3: The UCC provides guidelines for negotiable instruments, including checks, and outlines the rights and liabilities of the parties involved in the transaction. It offers protections to both payers and payees in case of dishonored checks. 3. Salt Lake City Municipal Code Chapter 3.48: This local ordinance may contain specific provisions related to dishonored checks within the city limits. It is essential to consult this code for any additional regulations or reporting requirements. Types of Dishonored Check Complaints in Salt Lake City, Utah: 1. Personal Dishonored Check Complaints: These involve individuals who have received a dishonored check from a personal acquaintance, client, or service provider, resulting in financial loss or inconvenience. 2. Business Dishonored Check Complaints: These pertain to dishonored checks issued by businesses to their vendors, suppliers, or employees, leading to disruptions in cash flow and potential legal repercussions. 3. Financial Institution Dishonored Check Complaints: These complaints may be directed towards banks, credit unions, or other financial institutions that fail to properly honor checks due to procedural errors or negligence, causing harm to their customers. 4. Criminal Dishonored Check Complaints: In cases where someone intentionally issues a dishonored check to defraud another party, a criminal complaint may be filed with the appropriate law enforcement agencies, such as the Salt Lake City Police Department. Filing a Complaint for Dishonored Checks in Salt Lake City, Utah: When facing a dishonored check situation, it is crucial to take appropriate steps to resolve the issue. Here is a general guideline for filing a complaint: 1. Gather Evidence: Collect all relevant documentation, including the dishonored check, bank statements, receipts, correspondence, and any other proof of the transaction. 2. Contact the Bank or Financial Institution: Inform the bank about the dishonored check and request their assistance in resolving the matter. If the issue persists, escalate the complaint to higher-level representatives or supervisors. 3. File a Complaint: If unable to reach a satisfactory resolution with the bank, consider filing a complaint with the appropriate regulatory authorities. This may involve contacting the Utah Department of Commerce — Division of Consumer Protection. 4. Legal Action: In severe cases, where significant financial loss or intentional fraud has occurred, consulting an attorney specializing in dishonored checks and pursuing legal action may be necessary. Navigating the complexities of a Salt Lake City Utah complaint regarding a dishonored check can be challenging. It is crucial to understand the applicable laws, seek professional advice when needed, and exhaust all available avenues for resolution. Prompt action and diligence can help ensure a swift and satisfactory resolution to such complaints.

Salt Lake City Utah Complaint - Dishonored Check

Description

How to fill out Salt Lake City Utah Complaint - Dishonored Check?

Are you looking for a reliable and affordable legal forms supplier to buy the Salt Lake City Utah Complaint - Dishonored Check? US Legal Forms is your go-to choice.

Whether you need a basic arrangement to set rules for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of specific state and county.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Salt Lake City Utah Complaint - Dishonored Check conforms to the laws of your state and local area.

- Read the form’s details (if available) to find out who and what the document is intended for.

- Restart the search if the template isn’t suitable for your specific situation.

Now you can register your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the Salt Lake City Utah Complaint - Dishonored Check in any available format. You can get back to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal papers online for good.