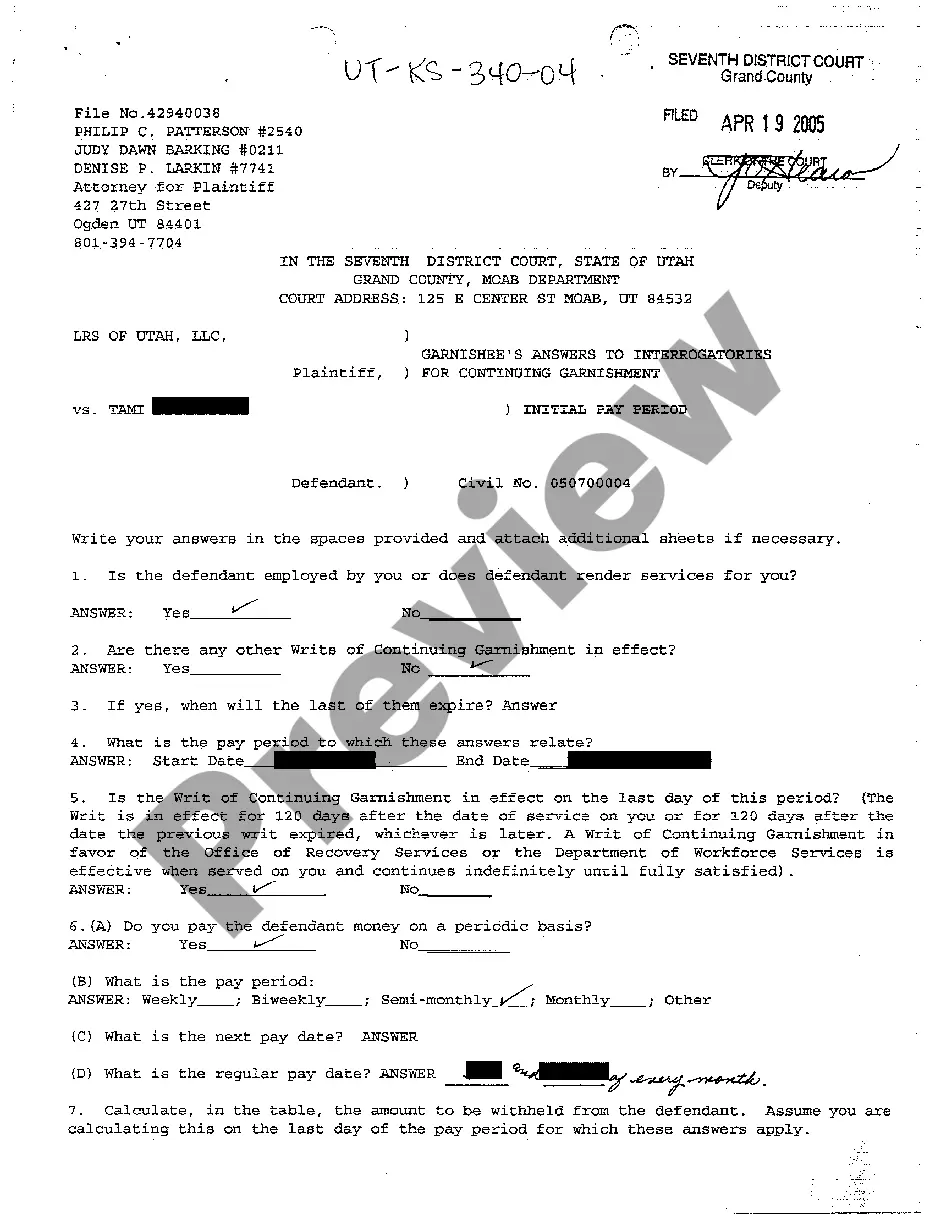

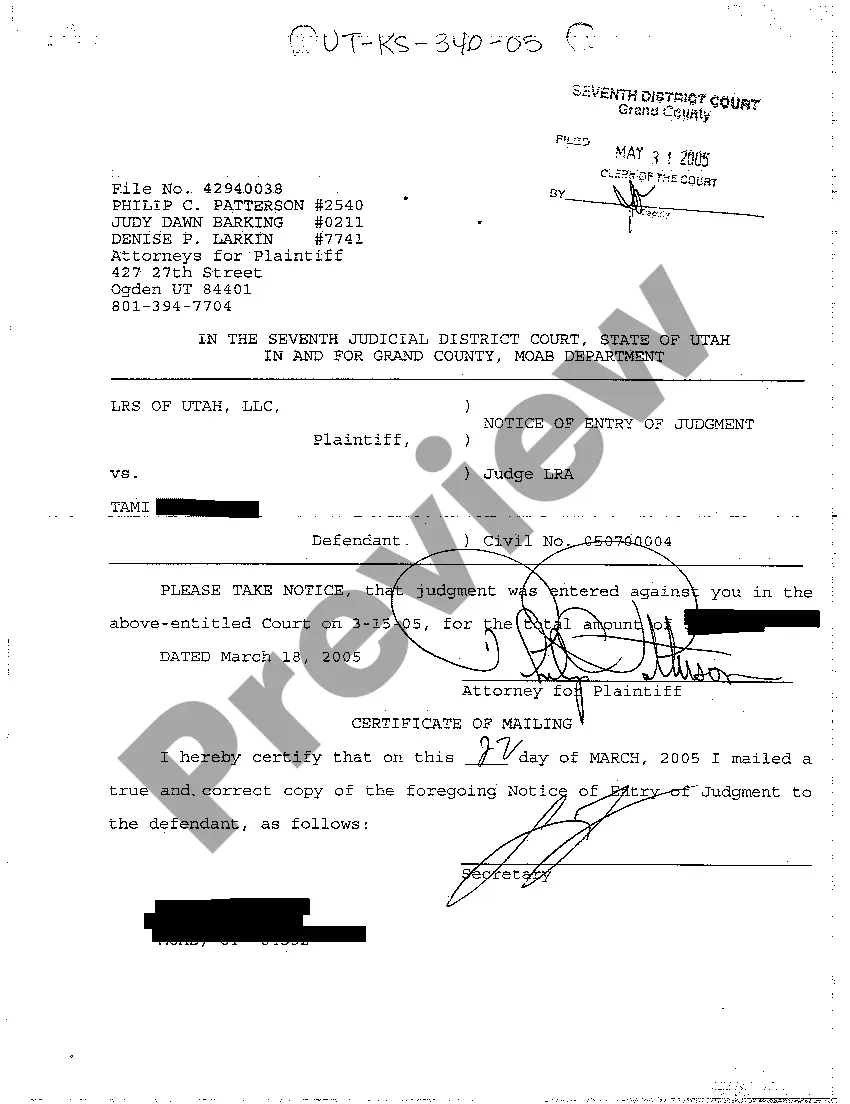

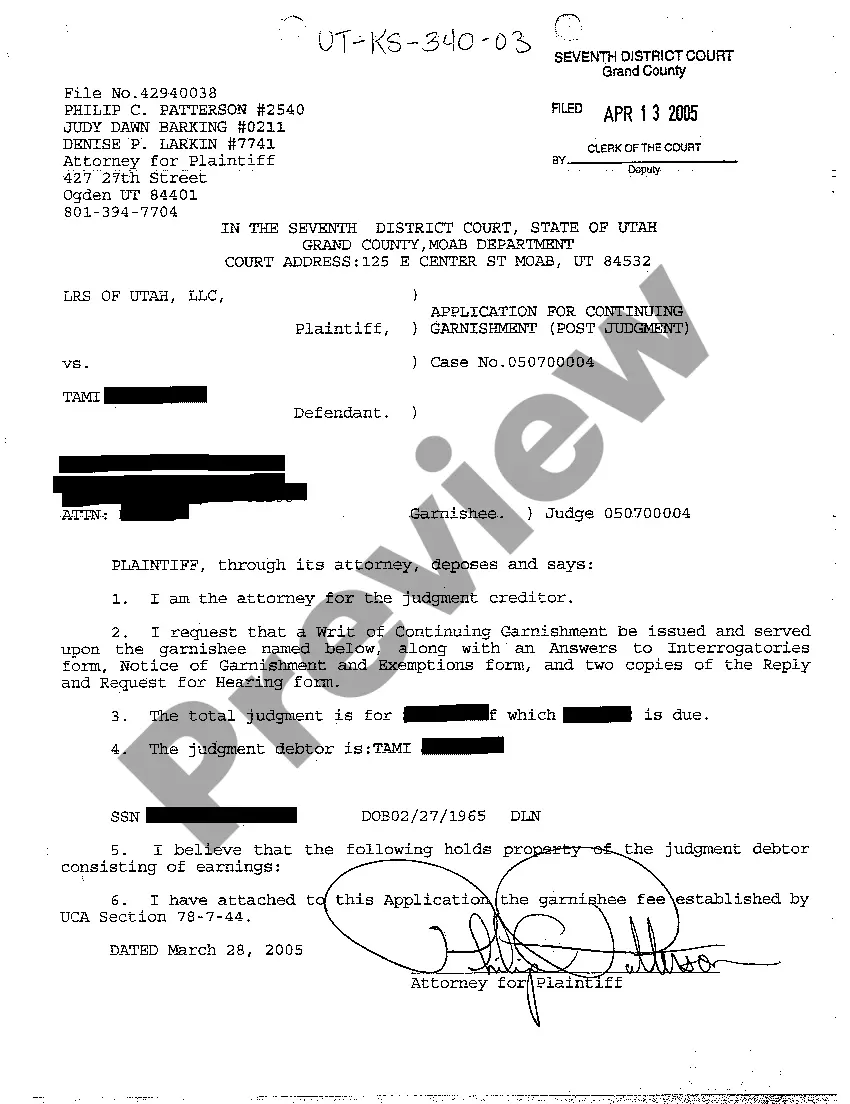

The Salt Lake Utah Application for Continuing Garnishment Post Judgment is a legal process that allows creditors to collect the owed money from a debtor's wages or bank accounts after obtaining a judgment against them. This post-judgment remedy is aimed at ensuring that the awarded amount is promptly paid, providing a mechanism for creditors to enforce their rights. Keywords: Salt Lake Utah, application for continuing garnishment, post-judgment, creditor, debtor, legal process, collect, owed money, wages, bank accounts, judgment, remedy, enforce. Types of Salt Lake Utah Application for Continuing Garnishment Post Judgment: 1. Wage Garnishment: This type of garnishment allows a creditor to collect a portion of the debtor's wages on an ongoing basis until the judgment debt is satisfied. The debtor's employer is served with a court order, instructing them to deduct a specific amount from the debtor's paycheck and send it directly to the creditor. 2. Bank Account Garnishment: In this case, the creditor can access the debtor's bank accounts and withdraw funds to fulfill the judgment debt. The bank is served with the appropriate legal documents, compelling them to freeze the debtor's account(s) and release the funds to the creditor. 3. Property Garnishment: If the debtor owns tangible assets such as a car, real estate, or valuable personal belongings, the creditor may apply for a property garnishment. This enables them to seize and sell these assets to satisfy the outstanding judgment debt. 4. Non-Wage Garnishment: This type of garnishment targets income sources other than wages. It can include garnishing income from rental properties, royalties, dividends, or any other regular form of income the debtor receives. 5. Federal Garnishment: Under certain circumstances, when the debtor owes money to the United States government, federal garnishment laws come into play. These laws provide guidelines for creditors seeking to collect debts owed to federal agencies and can bypass certain state restrictions. It is essential for creditors and debtors in Salt Lake Utah to be aware of the specific laws and guidelines regarding the Application for Continuing Garnishment Post Judgment. Consulting with a qualified attorney experienced in debt collection and garnishment processes can ensure compliance and a smooth resolution.

The Salt Lake Utah Application for Continuing Garnishment Post Judgment is a legal process that allows creditors to collect the owed money from a debtor's wages or bank accounts after obtaining a judgment against them. This post-judgment remedy is aimed at ensuring that the awarded amount is promptly paid, providing a mechanism for creditors to enforce their rights. Keywords: Salt Lake Utah, application for continuing garnishment, post-judgment, creditor, debtor, legal process, collect, owed money, wages, bank accounts, judgment, remedy, enforce. Types of Salt Lake Utah Application for Continuing Garnishment Post Judgment: 1. Wage Garnishment: This type of garnishment allows a creditor to collect a portion of the debtor's wages on an ongoing basis until the judgment debt is satisfied. The debtor's employer is served with a court order, instructing them to deduct a specific amount from the debtor's paycheck and send it directly to the creditor. 2. Bank Account Garnishment: In this case, the creditor can access the debtor's bank accounts and withdraw funds to fulfill the judgment debt. The bank is served with the appropriate legal documents, compelling them to freeze the debtor's account(s) and release the funds to the creditor. 3. Property Garnishment: If the debtor owns tangible assets such as a car, real estate, or valuable personal belongings, the creditor may apply for a property garnishment. This enables them to seize and sell these assets to satisfy the outstanding judgment debt. 4. Non-Wage Garnishment: This type of garnishment targets income sources other than wages. It can include garnishing income from rental properties, royalties, dividends, or any other regular form of income the debtor receives. 5. Federal Garnishment: Under certain circumstances, when the debtor owes money to the United States government, federal garnishment laws come into play. These laws provide guidelines for creditors seeking to collect debts owed to federal agencies and can bypass certain state restrictions. It is essential for creditors and debtors in Salt Lake Utah to be aware of the specific laws and guidelines regarding the Application for Continuing Garnishment Post Judgment. Consulting with a qualified attorney experienced in debt collection and garnishment processes can ensure compliance and a smooth resolution.