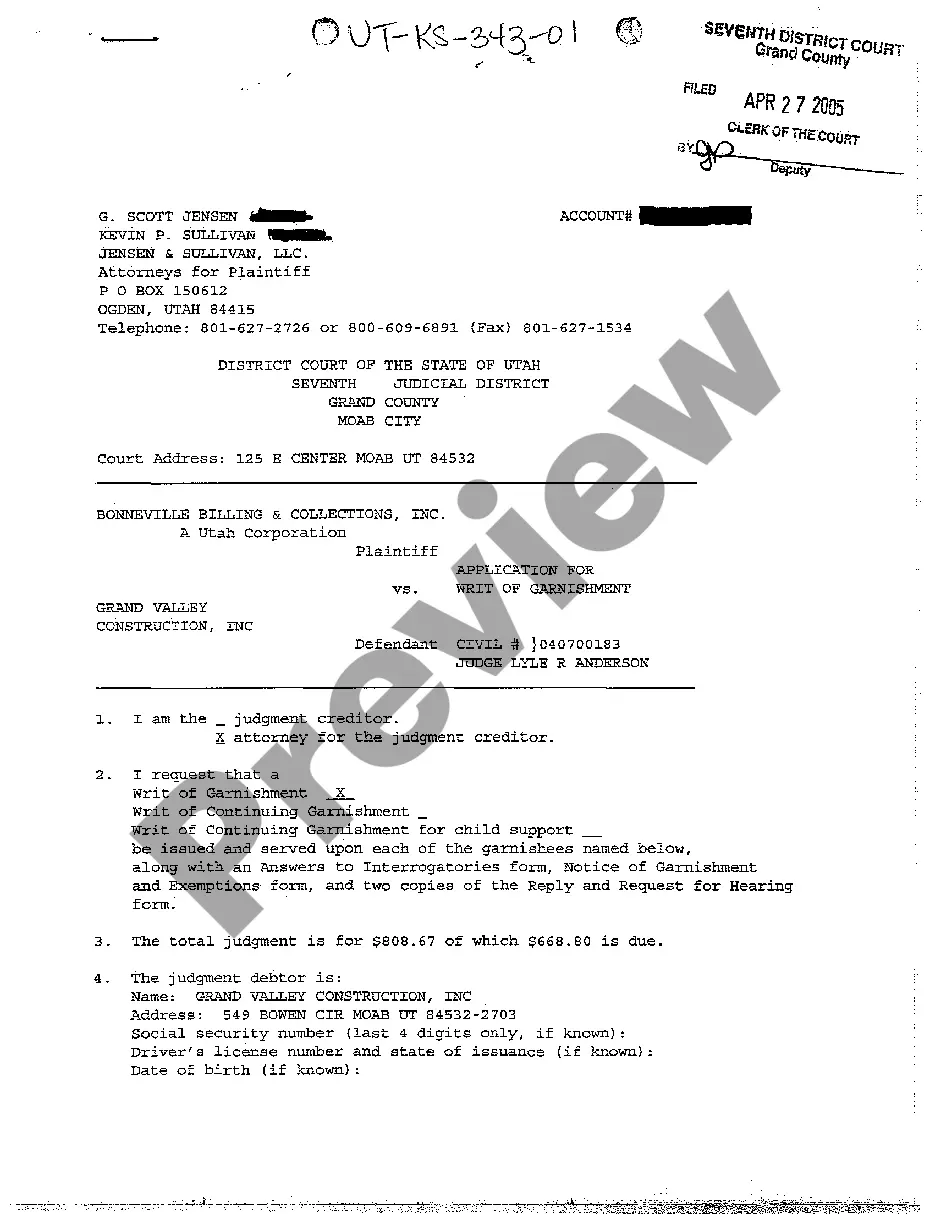

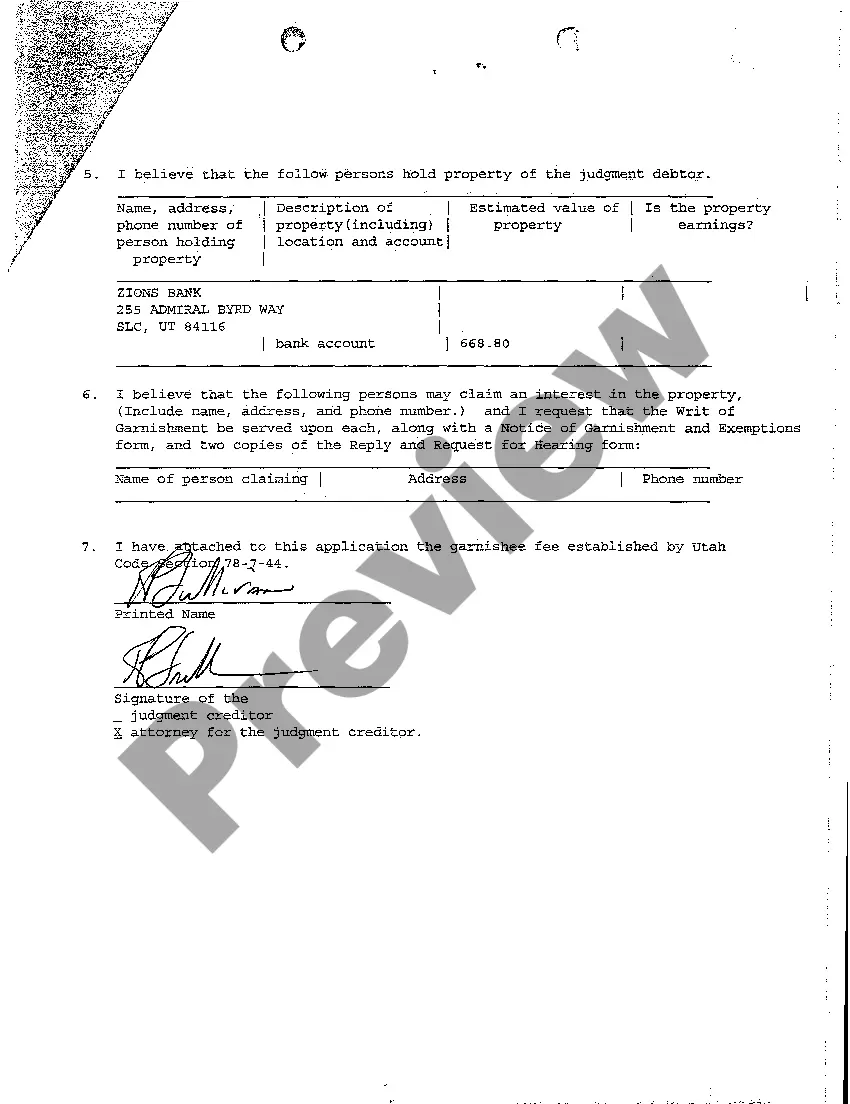

Title: Understanding Salt Lake Utah Application for Writ of Garnishment — Types and Procedures Introduction: Salt Lake City, Utah, follows a specific legal process known as an Application for Writ of Garnishment to enforce the collection of unpaid debts from a debtor. This detailed description will delve into the Salt Lake City Application for Writ of Garnishment, its significance, and the various types associated with it. 1. What is an Application for Writ of Garnishment? An Application for Writ of Garnishment is a legal document filed by a creditor to recover debts owed by a debtor. This process allows the creditor to collect a portion of the debtor's wages, bank accounts, or other assets, in compliance with Salt Lake City, Utah laws. 2. Types of Salt Lake Utah Application for Writ of Garnishment: a) Wage Garnishment: This type of garnishment involves the deduction of a portion of an employee's earnings to repay the debt. Salt Lake City law limits the amount that can be garnished from each paycheck, ensuring protection for the employee. b) Bank Account Garnishment: With this type of garnishment, funds owed to the debtor can be taken directly from their bank accounts. It is essential to note that certain exemptions protect a portion of the debtor's funds from being garnished. c) Property and Asset Garnishment: Under specific circumstances, a creditor may opt to garnish tangible assets owned by the debtor, such as vehicles, real estate, or other valuable possessions, to satisfy the outstanding debt. 3. Procedure for Filing an Application for Writ of Garnishment in Salt Lake City: a) Petition Filing: The creditor must first file a petition with the appropriate court in Salt Lake City using a specific form, supplying relevant details about the debt, the debtor, and any supporting documentation. b) Notice of Garnishment: Once the court approves the petition, the creditor serves a Notice of Garnishment to the debtor, informing them of the impending wage or asset garnishment and providing an opportunity to respond or dispute the debt. c) Response and Hearing: The debtor has a designated timeframe to respond, either by objecting to the garnishment or requesting a hearing to present their case. Failure to respond may result in a default judgment in favor of the creditor. d) Garnishment Order: If the court determines the debt is valid and the creditor's claim is substantiated, a Garnishment Order is issued, authorizing the appropriate entity to initiate wage or asset garnishment. e) Enforcement: The garnishment order is then sent to the debtor's employer (in the case of wage garnishment) or relevant financial institutions (for bank account garnishment). Deductions or freezing of assets commences to repay the outstanding debt. Conclusion: The Salt Lake City Application for Writ of Garnishment provides a legal framework for creditors to recover their owed debts in compliance with Utah laws. Understanding the types of garnishment available and following the proper procedural steps ensures a fair and just resolution for both debtors and creditors in Salt Lake City, Utah.

Salt Lake Utah Application for Writ of Garnishment

Description

How to fill out Salt Lake Utah Application For Writ Of Garnishment?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for a person without any legal education to create this sort of papers cfrom the ground up, mainly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service offers a massive catalog with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to save time using our DYI forms.

No matter if you require the Salt Lake Utah Application for Writ of Garnishment or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Salt Lake Utah Application for Writ of Garnishment quickly using our trustworthy service. In case you are already a subscriber, you can go ahead and log in to your account to download the needed form.

Nevertheless, in case you are a novice to our library, ensure that you follow these steps before obtaining the Salt Lake Utah Application for Writ of Garnishment:

- Be sure the form you have chosen is suitable for your area because the rules of one state or county do not work for another state or county.

- Preview the form and read a short description (if available) of cases the document can be used for.

- In case the form you chosen doesn’t meet your requirements, you can start over and look for the needed document.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Salt Lake Utah Application for Writ of Garnishment as soon as the payment is through.

You’re all set! Now you can go ahead and print out the form or fill it out online. In case you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.