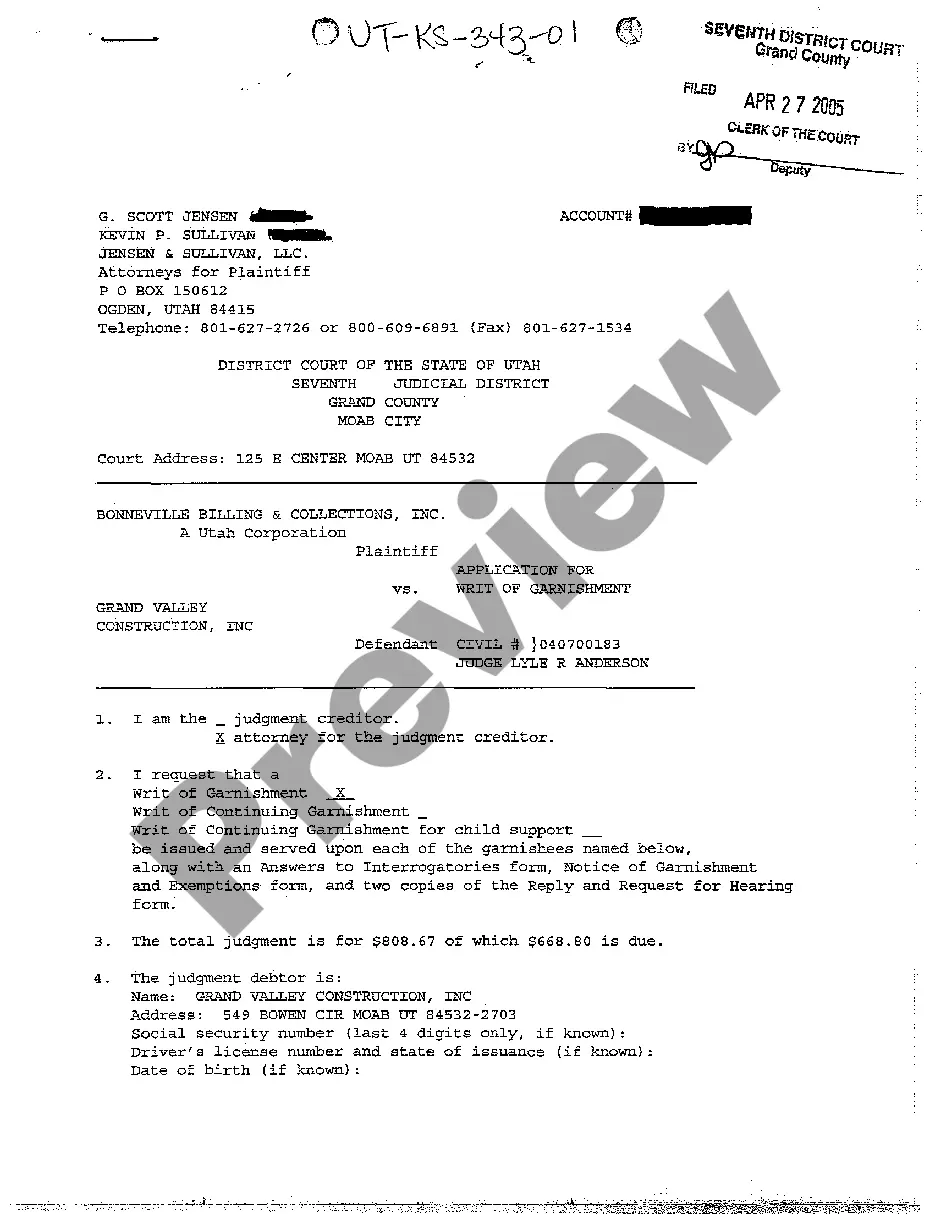

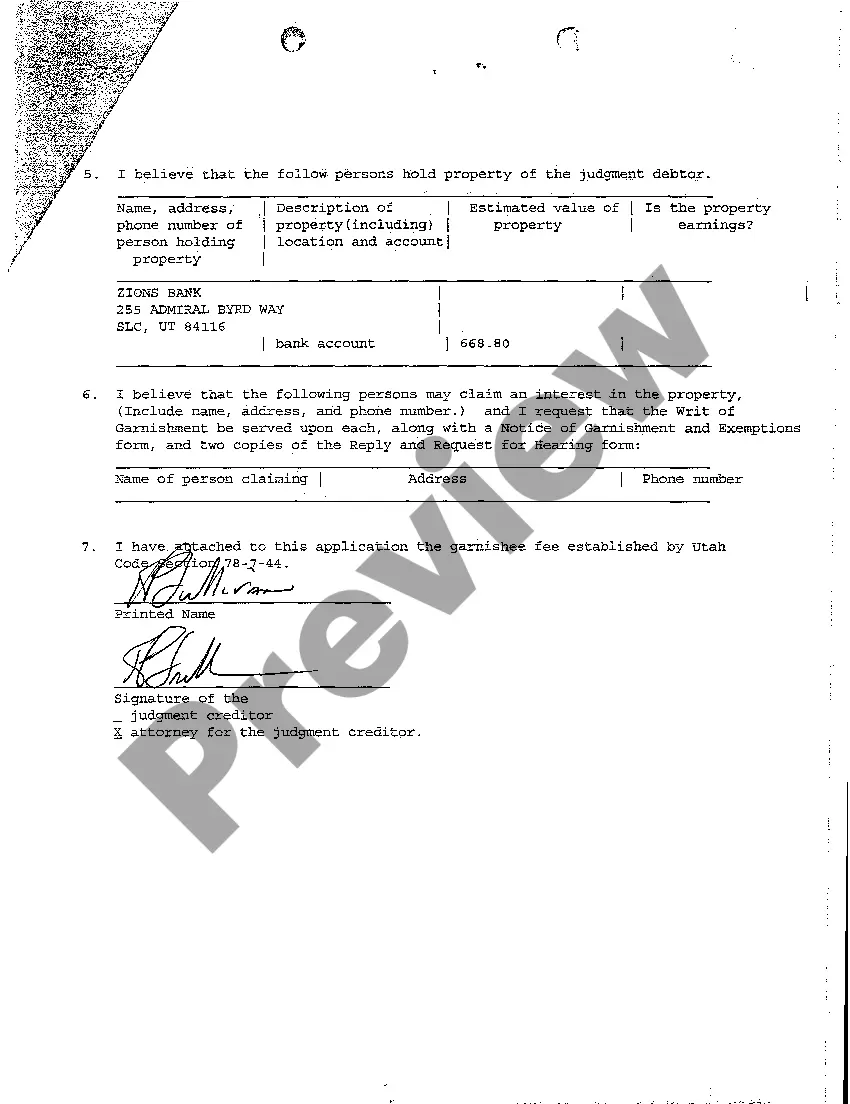

Salt Lake City, Utah Application for Writ of Garnishment is a legal process used to collect unpaid debts or judgments. This procedure allows a creditor to request the court to garnish or seize a portion of the debtor's wages, bank accounts, or other assets to satisfy the outstanding debt. There are several types of Salt Lake City, Utah Application for Writ of Garnishment that may be applicable depending on the specific circumstances of the case. These include: 1. Wage Garnishment: This is the most common type of garnishment where a creditor seeks to collect from a debtor's paycheck. The creditor submits an application to the court, detailing the debt owed and the amount to be garnished from the debtor's wages. The employer is then legally obligated to deduct the specified amount and send it directly to the creditor until the debt is satisfied. 2. Bank Account Garnishment: In this type of garnishment, the creditor applies for a writ to freeze the debtor's bank account and collect funds to satisfy the debt. Once the writ is granted, the bank is required to hold the funds in the account, and the creditor can then access the frozen amount to repay the debt owed. 3. Property or Asset Garnishment: If the debtor owns valuable assets such as real estate, vehicles, or valuable personal property, a creditor may seek a writ to garnish those assets. This type of garnishment involves the court granting permission for the creditor to seize and sell the debtor's tangible property to recover the amount owed. When filing a Salt Lake City, Utah Application for Writ of Garnishment, it is crucial to provide complete and accurate information about the debtor, the amount owed, and any supporting documentation necessary to establish the debt's validity. It is recommended to consult with an attorney familiar with Utah garnishment laws to ensure the application adheres to the required legal procedures and timelines. In conclusion, the Salt Lake City, Utah Application for Writ of Garnishment is a legal tool used by creditors to collect outstanding debts. Depending on the debtor's circumstances and available assets, a wage garnishment, bank account garnishment, or property garnishment may be pursued. Seeking professional guidance from an attorney can help navigate the complexities of the garnishment process and maximize the chances of successfully recovering the debt owed.

Salt Lake City Utah Application for Writ of Garnishment

Description

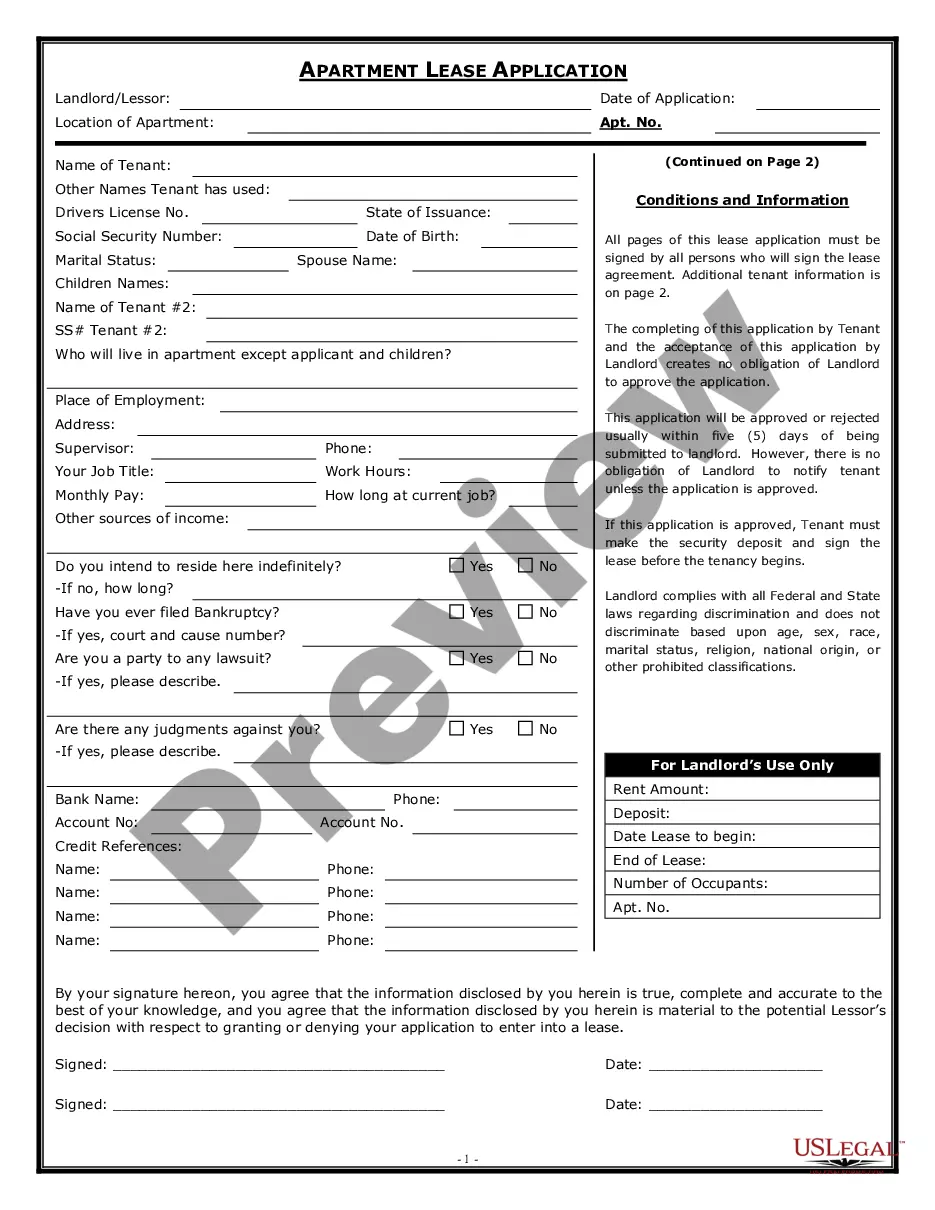

How to fill out Salt Lake City Utah Application For Writ Of Garnishment?

If you are looking for an authentic form, it’s challenging to select a superior platform than the US Legal Forms website – one of the most comprehensive online repositories.

With this repository, you can locate a vast array of templates for business and personal use categorized by types and locations, or search terms.

Utilizing our high-quality search tool, discovering the latest Salt Lake City Utah Application for Writ of Garnishment is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Acquire the template. Specify the format and download it to your device.

- Furthermore, the relevance of each document is confirmed by a team of professional attorneys who regularly assess the templates on our platform and update them according to the most recent state and county requirements.

- If you are already familiar with our platform and possess an account, all you need to obtain the Salt Lake City Utah Application for Writ of Garnishment is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have located the template you require. Review its details and utilize the Preview feature to examine its content. If it does not meet your requirements, utilize the Search box at the top of the page to find the suitable document.

- Verify your choice. Click the Buy now button. After that, select your desired pricing package and provide information to create an account.

Form popularity

FAQ

The IRS can garnish a significant part of your paycheck, up to 70%, depending on your situation, such as your filing status and number of dependents. It’s crucial to understand your rights and responsibilities when facing IRS garnishment. Consider utilizing resources like the Salt Lake City Utah Application for Writ of Garnishment for guidance and support in tackling these challenges.

In Utah, the law permits garnishment of wages up to 25% of your disposable earnings, but there are exceptions based on your specific financial obligations. This limit ensures your ability to cover basic living expenses while addressing your debt. If you're facing challenges related to garnishment, exploring the Salt Lake City Utah Application for Writ of Garnishment can be a beneficial step.

The maximum garnishment amount for an employee in Salt Lake City, Utah, is typically calculated based on their disposable earnings. Disposable earnings are the income remaining after mandatory deductions. Understanding these calculations is crucial if you are involved in a wage garnishment case or considering a Salt Lake City Utah Application for Writ of Garnishment.

In Salt Lake City, Utah, the amount a creditor can garnish depends on various factors. Generally, a creditor can garnish up to 25% of your disposable income after taxes. It’s important to review your financial situation carefully and consider legal options such as filing a Salt Lake City Utah Application for Writ of Garnishment if you are facing wage garnishment.

In the United States, creditors can garnish up to 25% of your disposable earnings, depending on the legal circumstances surrounding the debt. However, specific limits may change based on state laws, such as those governing the Salt Lake City Utah Application for Writ of Garnishment. It’s vital to understand these guidelines, as they can significantly impact your financial well-being.

To stop wage garnishment in New York, you need to schedule a hearing to challenge the garnishment order. This procedure can be complicated, but like the Salt Lake City Utah Application for Writ of Garnishment, it offers a chance to argue your situation before a judge. Utilizing legal resources can guide you through the necessary steps, ensuring your rights are protected during this process.

The quickest approach to halt a wage garnishment is to file an application for a Writ of Garnishment in Salt Lake City, Utah. This legal process allows you to contest the garnishment, granting you an opportunity to present your case. If you’re facing financial strain due to high deductions from your paycheck, seeking help from professionals can make the process smoother and faster.

In Salt Lake City, Utah, the maximum amount that can be garnished from your wages is determined by federal and state laws. Generally, the law allows creditors to garnish up to 25% of your disposable earnings, or the amount by which your weekly income exceeds 30 times the federal minimum wage. Understanding these limits is crucial when dealing with wage garnishment. For comprehensive information and assistance, consider using uslegalforms to ensure you know your rights and can respond appropriately.

To effectively stop a garnishment in Salt Lake City, Utah, you should consider filing an application for a writ of garnishment. This method attaches to your specific financial situation and allows you to challenge the garnishment order. Engaging with a service like uslegalforms can provide you with the necessary forms and guidance to present your case accurately. By following the correct legal steps, you can protect your income and regain control over your finances.

In Salt Lake City, Utah, the speed at which a garnishment can be stopped depends on how quickly you take action. If you file your Salt Lake City Utah Application for Writ of Garnishment and request a hearing, you may prevent further deductions almost immediately. It's essential to gather your documentation and submit everything promptly to expedite the process. Working through a reliable platform like uslegalforms can help ensure you meet your deadlines and navigate the court system effectively.