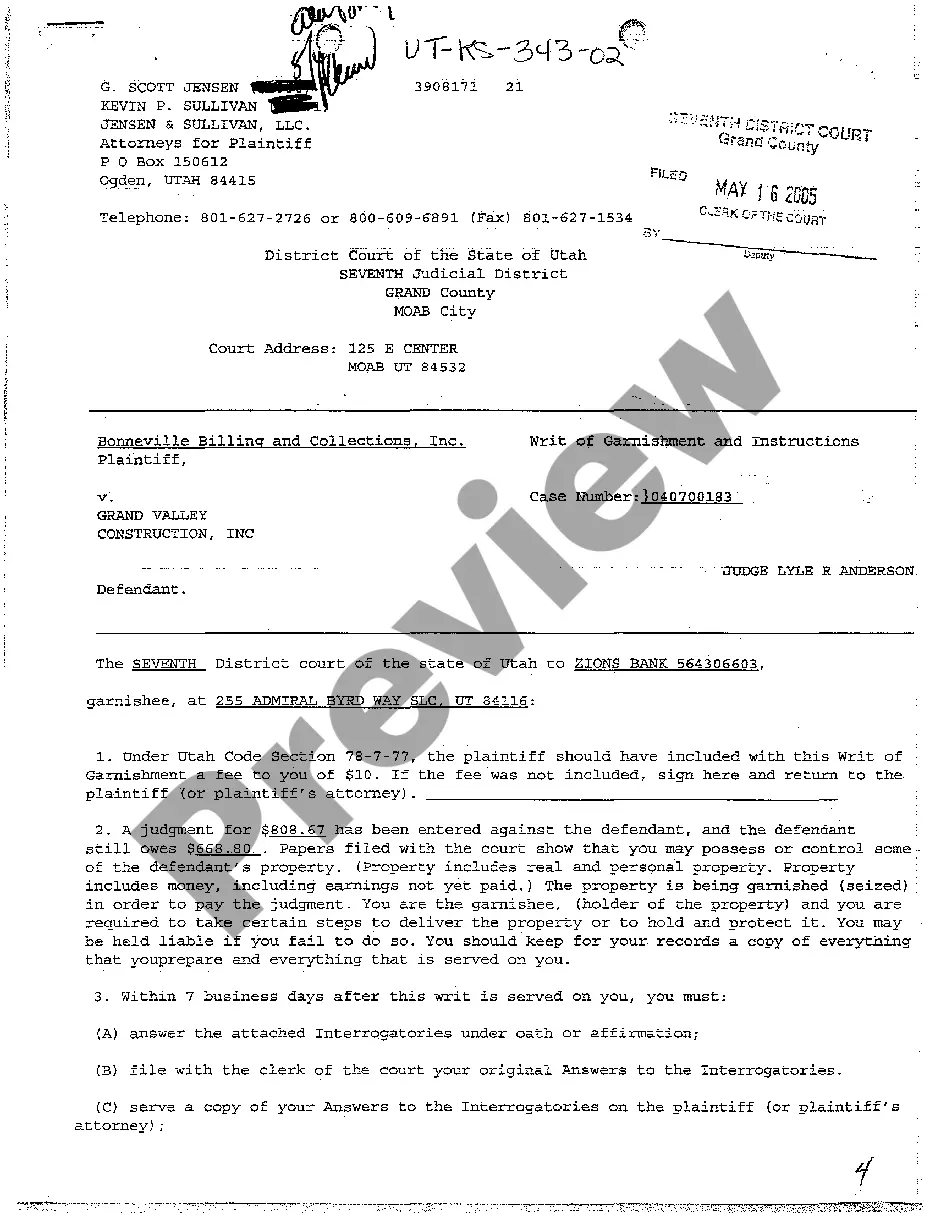

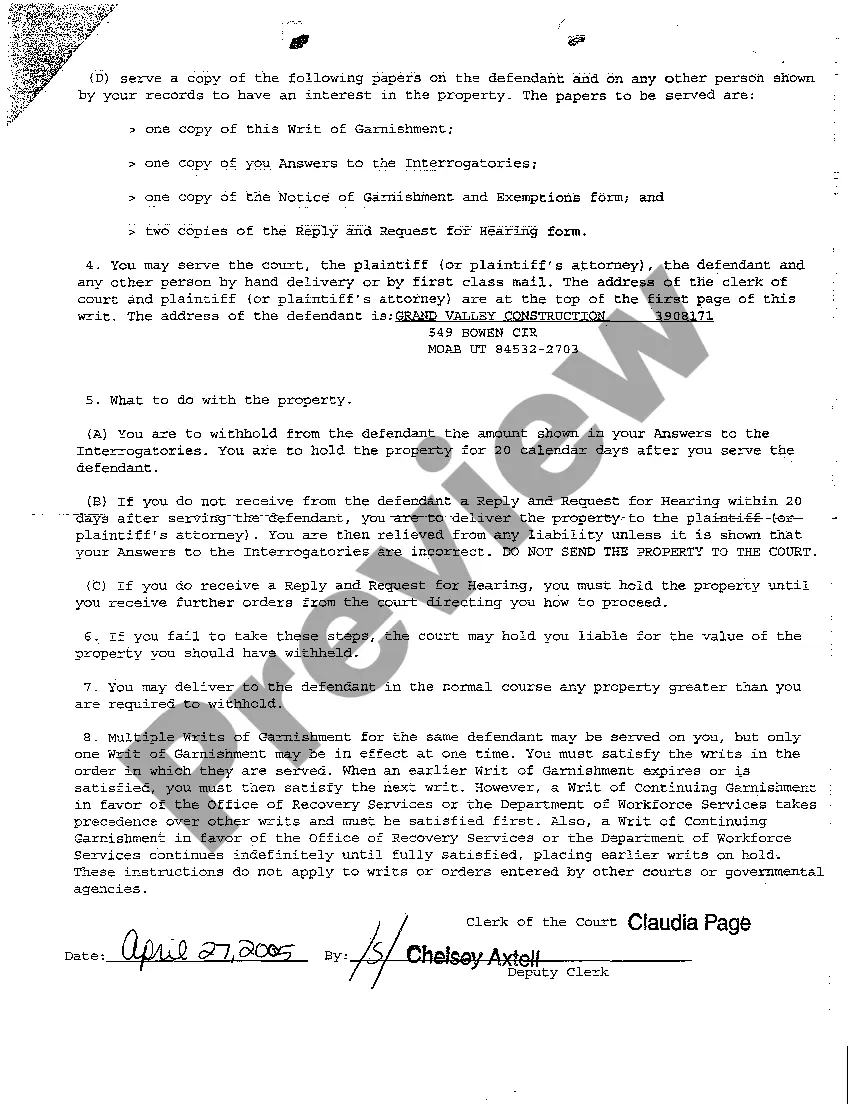

A Salt Lake Utah Writ of Garnishment is a legal document that allows a creditor to collect debts owed by a debtor through a process called garnishment. Garnishment involves the seizing of a portion of the debtor's wages or assets to satisfy the outstanding debt. The Salt Lake Utah Writ of Garnishment and Instructions is a specific type of document used in the state of Utah and more specifically, in Salt Lake County. It outlines the procedures and steps that need to be followed by the creditor when initiating the garnishment process. There are several types of Salt Lake Utah Writ of Garnishment and Instructions, each catering to different scenarios and types of debt. Some of these specific types include: 1. Wage Garnishment: This type of garnishment allows a creditor to collect a portion of the debtor's wages directly from their employer. The Salt Lake Utah Writ of Garnishment provides specific instructions on how to inform the employer of the garnishment order, calculate the amount to be withheld, and the duration of the garnishment. 2. Bank Account Garnishment: This type of garnishment enables a creditor to access funds held by a debtor in their bank accounts. The Salt Lake Utah Writ of Garnishment and Instructions provides details on the process of notifying the bank, freezing the account, and allowing the creditor to collect the owed amount. 3. Property or Asset Garnishment: In certain cases, a creditor may seek a Salt Lake Utah Writ of Garnishment to seize and sell the debtor's assets in order to satisfy the debt. This can include real estate, vehicles, or other valuable items. The document outlines the procedures for identifying, valuing, and selling these assets. The Salt Lake Utah Writ of Garnishment and Instructions is a crucial tool for creditors, providing them with a legal framework to collect outstanding debts. It ensures that the garnishment process is carried out in a fair and lawful manner, protecting the rights of both the creditor and the debtor.

Salt Lake Utah Writ of Garnishment and Instructions

Description

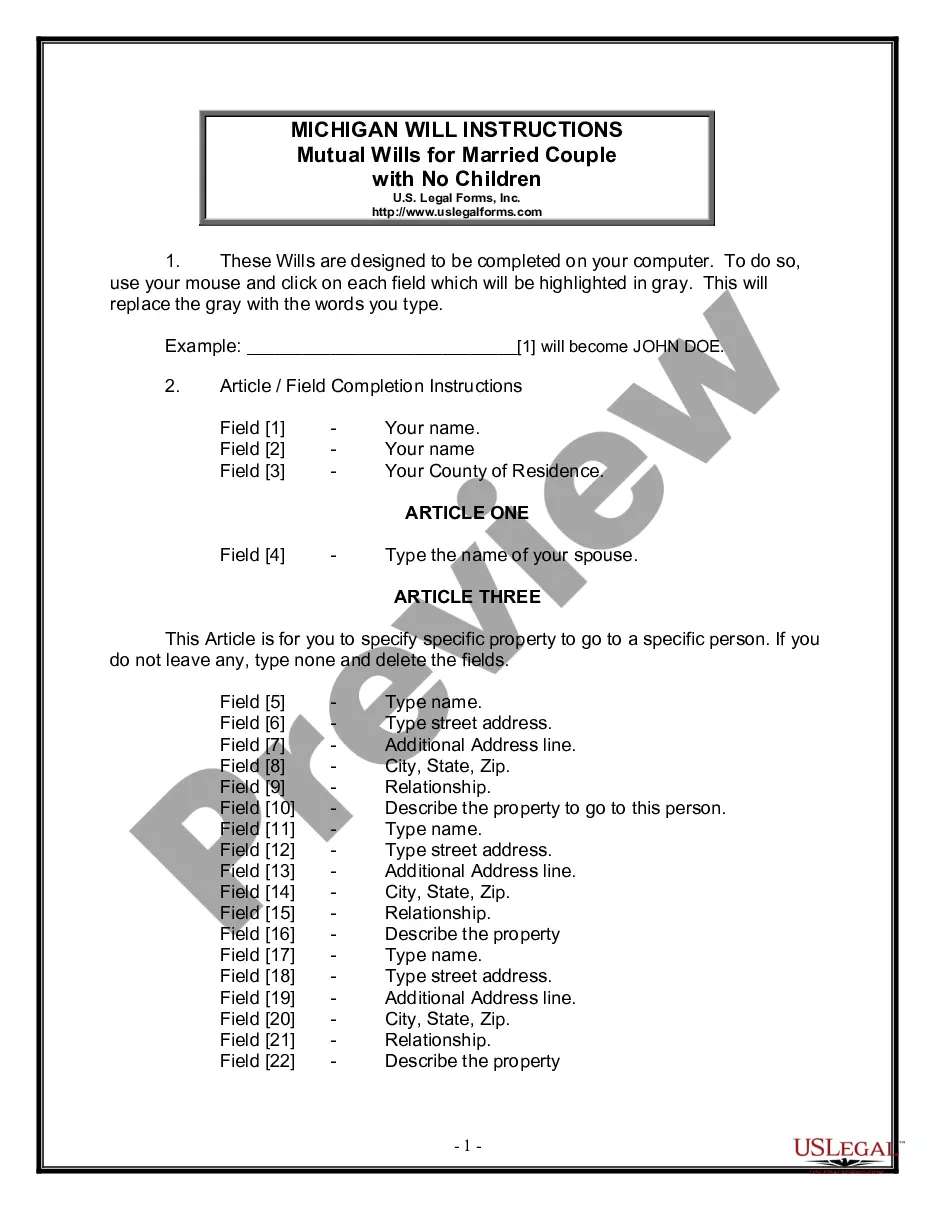

How to fill out Salt Lake Utah Writ Of Garnishment And Instructions?

If you’ve already used our service before, log in to your account and download the Salt Lake Utah Writ of Garnishment and Instructions on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Ensure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Salt Lake Utah Writ of Garnishment and Instructions. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!

Form popularity

FAQ

You can STOP the garnishment any time by paying the Clerk's Office what you owe. The Clerk will give you a receipt. Take the receipt to your employer right away. They should stop taking money from your pay as soon as they get the receipt.

Filing for bankruptcy can be an effective way to stop or prevent a wage garnishment. When your attorney files a Utah bankruptcy case, an automatic stay kicks in. The automatic stay acts like a court order that puts an immediate halt to garnishments and most other creditor collection actions.

How long can wages be garnished? Your wages can be garnished until the debt is paid. A writ of continuing garnishment is effective for one year after the date it was served, or for 120 calendar days if another writ of continuing garnishment is served.

Description. A writ of garnishment is a process by which the court orders the seizure or attachment of the property of a defendant or judgment debtor in the possession or control of a third party. The garnishee is the person or corporation in possession of the property of the defendant or judgment debtor.

Utah Wage Garnishment Limits They can be used based on wages or on other property, such as a bank account. Utah allows a creditor to take up to 25% of a given individual's disposable earnings. If the writ is to pay for child support specifically, this number goes up to 50%.

A Writ of Garnishment lets a creditor garnish all the money in a bank account that is available to pay the judgment. If there is money in the account that is exempt, that money should not be taken. You can file a Reply and Request for Hearing to protect that money.

After providing proof of identity, the sheriff will ask the debtor to meet the terms of the writ. If unable to do so, the debtor will be obliged to point out any moveable property that can be sold to meet the judgment debt and costs.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less.

Applying for the Writ of Garnishment. Choose Writ of Continuing Garnishment and Instructions form to garnish wages. Fill out the top part, including the garnishee's name and address and the case information - 2 copies. Choose Writ of Garnishment and Instructions form to garnish other property.

Even after a garnishment has started, you can still try and negotiate a resolution with the creditor, especially if your circumstances change.